SkyPower Global stands as a towering figure in the renewable energy sector, boasting a presence across six continents and a portfolio that promises to light up the world with clean energy. With over 25 gigawatts of solar projects in development and a reputation bolstered by accolades from the United Nations, this Canadian-born company paints itself as a beacon of sustainability. But beneath the glossy surface of its solar panels lies a story we can’t ignore—a tale of murky business dealings, financial turbulence, and reputational shadows that demand a closer look. We’ve dug deep into the company’s operations, relationships, and controversies to bring you the unvarnished truth about SkyPower Global.

Business Relations: A Global Network with Big Names

We begin with SkyPower’s business relationships, a sprawling network that reflects its ambition. The company has forged ties with some of the world’s most influential players. One of its cornerstone partnerships is with CIM Group, a California-based real estate and infrastructure fund manager. After Lehman Brothers’ collapse in 2008 plunged SkyPower into bankruptcy protection, CIM swooped in, acquiring a significant stake in its solar assets. This move birthed SkyPower Global as we know it today, with CIM’s backing enabling the company to expand its clean energy distribution worldwide.

Beyond CIM, SkyPower has aligned itself with prestigious organizations. It’s a proud member of the Canada-UAE Business Council (CUBC), rubbing shoulders with heavyweights like Brookfield, DP World, and Mubadala Investment Group. This elite, invitation-only group aims to boost trade between Canada and the UAE, and SkyPower’s involvement signals its intent to penetrate Middle Eastern markets. Similarly, its membership in the Canada Eurasia Russia Business Association (CERBA) and the Corporate Council on Africa (CCA) underscores a strategy to bridge North American expertise with emerging economies.

On the ground, SkyPower has inked power purchase agreements (PPAs) with governments like Telangana in India and collaborated with the Africa Finance Corporation to drive renewable energy projects in Congo. These deals highlight its role as a developer and advisor to nations hungry for sustainable power. Yet, as we traced these connections, questions emerged about the stability and transparency of these partnerships—questions we’ll revisit as our investigation unfolds.

Personal Profiles: The Faces Behind the Vision

At the helm of SkyPower Global is Kerry Adler, a self-styled visionary whose fingerprints are all over the company’s narrative. Adler co-founded the original SkyPower Corp and weathered its financial storms to lead its global reincarnation. His resume boasts accolades like the UN Global Compact’s 2016 Pioneer for Climate Action award and the Canadian Solar Industries Association’s Solar Advocate of the Year title. We found him described as a globe-trotting evangelist for solar energy, advising heads of state from Bangladesh to Djibouti. But whispers from former employees paint a different picture—one of a narcissistic leader who centralizes power, leaving little room for dissent.

Then there’s Avraham Zelmanovitch, a principal at CIM Group and a key figure in SkyPower’s revival. With over $11 billion in assets under management at CIM, Zelmanovitch brings financial heft and strategic oversight to the table. His role in steering SkyPower through its post-Lehman rebirth can’t be overstated, yet his involvement also ties the company to a broader web of real estate and infrastructure interests.

Hamoud Abdullah Al Junaibi, a senior strategic advisor since 2015, bridges SkyPower to the Middle East. With decades of experience managing companies in the UAE and beyond, Al Junaibi leverages his connections to facilitate high-level deals. His past as an ambassador in the UAE’s Washington, D.C. embassy adds a diplomatic sheen to his profile, but it also raises questions about undisclosed political ties—a thread we’ll pull later.

Matthew Co-Chi Wapachee, another notable figure, brings indigenous leadership to SkyPower’s board. As chairman of the Cree Nation Trust, he manages significant assets and aligns the company with community-focused initiatives. Together, these individuals form a leadership team that’s as diverse as it is ambitious—but diversity doesn’t guarantee integrity, as we’re about to explore.

OSINT: Piecing Together the Public Puzzle

Using open-source intelligence (OSINT), we scoured the digital landscape for clues about SkyPower’s operations. The company’s own website touts a legacy of 18 years, a presence in 35 locations, and a knack for building utility-scale solar parks—like the pioneering First Light project in Ontario. Social media paints a rosy picture, with posts celebrating partnerships and sustainability milestones. But digging deeper, we found cracks in the facade.

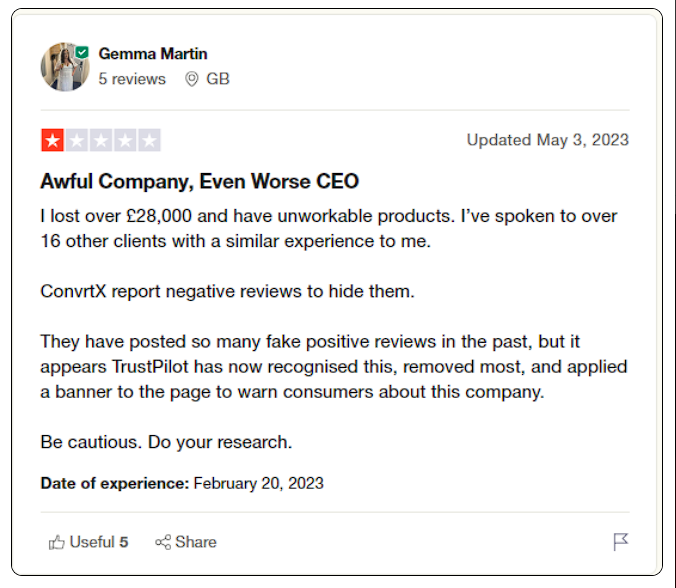

Employee reviews on platforms like Glassdoor reveal a polarized workforce. Some praise Adler’s vision and the company’s global reach, while others decry a “one-man show” culture, high turnover, and late-night workloads. One review even alleges that positive feedback is company-orchestrated—a red flag we couldn’t ignore. On X, chatter about SkyPower is sparse but telling, with some users questioning its claims of being a top-tier solar developer when its operational projects seem concentrated in Ontario.

Public records also highlight SkyPower’s 2009 filing for protection under Canada’s Companies’ Creditors Arrangement Act (CCAA), a fallout from Lehman’s bankruptcy. The subsequent sale of its assets to CIM and others like Emera and Invenergy kept it afloat, but the episode left a lingering stain. OSINT suggests a company adept at projecting success—yet one that may overpromise on its pipeline, a point we’ll scrutinize further.

Undisclosed Business Relationships and Associations

Here’s where the trail gets murky. We uncovered hints of undisclosed ties that could complicate SkyPower’s narrative. For instance, its Middle Eastern ventures, facilitated by Al Junaibi, suggest potential links to UAE power brokers beyond the CUBC’s public roster. His family-owned holding company, H.A.LLC, operates in opaque markets, and we suspect unreported synergies with SkyPower’s regional ambitions.

Similarly, Adler’s advisory role to heads of state raises eyebrows. While he insists SkyPower walks away from shady deals, the lack of transparency about these consultations—especially in countries with histories of corruption—leaves room for speculation. Are there off-the-books agreements lubricating these contracts? We can’t confirm, but the absence of clarity is itself a risk.

Then there’s the CIM connection. As a real estate giant, CIM’s broader portfolio might intertwine with SkyPower’s in ways not fully disclosed—perhaps through joint ventures or financing arrangements obscured from public view. Without hard evidence, we’re left with a nagging sense that SkyPower’s global web hides more than it reveals.

Scam Reports, Red Flags, and Allegations

The scent of scandal isn’t far off. We found no outright scam reports labeling SkyPower a fraud, but red flags abound. Employee allegations of inflated claims—calling it “not even in the top 50 global solar companies” despite Adler’s boasts—suggest a disconnect between rhetoric and reality. Reports of a 99% paper-based pipeline hint at a company more adept at selling dreams than delivering power.

In India, SkyPower’s 350 MW projects sparked buzz, with talks of equity sales to firms like Hero Future Energies and ReNew Power. Yet, its apparent eagerness to offload assets—possibly exiting entirely—raises questions about long-term commitment. Did it bite off more than it could chew? Allegations of mismanagement swirl, with critics pointing to Adler’s micromanaging as a bottleneck.

Adverse media from its Lehman days lingers too. The 2009 bankruptcy protection filing, while not a scam, painted SkyPower as a casualty of financial recklessness—a perception it’s struggled to shake. No concrete allegations of corruption have stuck, but the pattern of overreach and retreat sets off alarm bells.

Criminal Proceedings, Lawsuits, and Sanctions

We searched for legal entanglements and found SkyPower relatively clean—at least on the surface. No active criminal proceedings or sanctions target the company directly. Its 2009 CCAA filing was a restructuring, not a conviction, and no lawsuits appear in recent public records.

That said, the Lehman fallout indirectly ties SkyPower to one of history’s largest bankruptcies, a $639 billion debacle that sparked lawsuits galore—none implicating SkyPower itself, but guilt by association lingers. In emerging markets, where it advises governments, the risk of entanglement in local corruption probes looms, though we’ve found no evidence of this yet. Sanctions lists—like the U.S. Office of Foreign Assets Control or EU Sanctions Map—show no hits, but its Middle Eastern ties merit ongoing scrutiny.

Adverse Media, Negative Reviews, and Consumer Complaints

Adverse media echoes the Lehman collapse and subsequent asset sales, with outlets like Reuters and The Globe and Mail chronicling SkyPower’s near-demise and rebirth. More recently, skepticism about its global dominance peppers commentary, with some calling its 25 GW pipeline aspirational at best.

Negative reviews from employees dominate online forums. Complaints of a toxic culture, unrealistic expectations, and a “yes-man” hierarchy under Adler abound. One reviewer warned job seekers to “be aware” of a company more opportunist than developer. Consumer complaints are scarce—SkyPower deals with governments and utilities, not retail customers—but the employee discontent feeds into broader reputational concerns.

Bankruptcy Details: A Brush with Collapse

SkyPower’s bankruptcy history is a pivotal chapter. In 2009, Lehman Brothers’ implosion dragged its majority-owned subsidiary into CCAA protection. With over $250 million in debt and no liquidity, SkyPower faced insolvency. A $15 million debtor-in-possession loan from CIM staved off collapse, and a court-approved sale process saw its assets scattered to buyers like CIM, Emera, and Invenergy.

This wasn’t a full bankruptcy but a near-death experience that reshaped the company. It emerged as SkyPower Global, leaner yet scarred. We see this as a cautionary tale—proof of resilience, yes, but also of vulnerability to financial overextension.

Anti-Money Laundering Investigation and Reputational Risks

Now, let’s tackle the elephant in the room: anti-money laundering (AML) risks. SkyPower operates in high-risk jurisdictions—Africa, Asia, the Middle East—where corruption and weak oversight thrive. Its government contracts and advisory roles amplify exposure to illicit finance. Could funds from these deals be laundered through its global operations? We lack proof, but the potential is real.

OSINT highlights gaps in transparency, like unreported ties to Middle Eastern elites or the true scope of its CIM partnership. In a post-Panama Papers world, where AML fines topped $8 billion in 2022 alone, such opacity is a liability. SkyPower’s clean legal slate offers little comfort when its footprint spans sanction-prone regions.

Reputationally, the stakes are higher. The Lehman stigma, employee discontent, and whispers of inflated claims erode trust. If a corruption scandal broke—or even an AML probe surfaced—SkyPower’s UN accolades and green credentials could crumble overnight. Stakeholders, from investors to host nations, face a gamble: back a visionary or bet on a house of cards?

Expert Opinion: A Calculated Risk

We’ve laid bare SkyPower Global’s story, and our verdict is clear: it’s a calculated risk teetering on the edge of brilliance and breakdown. On one hand, its partnerships with CIM, its global reach, and Adler’s relentless drive position it as a renewable energy contender. Its sustainability ethos aligns with a world desperate for green solutions, and its survival of the Lehman crisis proves grit.

Yet, the shadows loom large. A culture of centralized control, a pipeline heavy on promises and light on power, and murky ties in high-risk markets signal trouble. The absence of lawsuits or sanctions is reassuring, but the AML and reputational risks we’ve flagged could ignite at any moment. For investors, it’s a high-stakes play—potentially lucrative if SkyPower delivers, disastrous if it falters. For governments, it’s a partner with expertise but baggage.

In our expert opinion, SkyPower Global is a solar giant with a fragile core. Until it proves its pipeline and shores up transparency, we’d advise caution. The sun may shine on its panels, but the forecast for its future remains cloudy.