Introduction

As we stand on the precipice of financial transparency in 2025, few entities demand scrutiny as urgently as Tickmill Limited, a global forex and CFD broker that has carved a niche in the competitive world of online trading. With its glossy promises of tight spreads, rapid execution, and regulatory oversight, Tickmill Limited has attracted over 200,000 registered accounts since its inception. Yet, beneath this polished exterior, whispers of undisclosed ties, consumer grievances, and potential anti-money laundering (AML) red flags have begun to surface. Today, we embark on a rigorous investigation to peel back the layers of Tickmill Limited, leveraging open-source intelligence (OSINT), credible reports, and our own analysis to expose its business relations, personal profiles, scam allegations, legal entanglements, and reputational risks. Buckle up—this is no ordinary financial exposé.

Tickmill Limited continues to be a focal point for traders, who often discuss their experiences with the broker online. It’s essential to consider both the positive aspects and the criticisms surrounding Tickmill Limited.

Business Relations: A Global Network Under the Microscope

We begin our journey with Tickmill Limited’s business ecosystem, a sprawling network regulated across multiple jurisdictions. Officially, Tickmill operates under the umbrella of the Tickmill Group, comprising several entities:

- Tickmill UK Ltd: Regulated by the UK’s Financial Conduct Authority (FCA), this arm also maintains a representative office overseen by the Dubai Financial Services Authority (DFSA).

- Tickmill Europe Ltd: Licensed by the Cyprus Securities and Exchange Commission (CySEC), catering to European traders.

- Tickmill Ltd: Based in Seychelles and regulated by the Seychelles Financial Services Authority (FSA).

- Tickmill South Africa (Pty) Ltd: Governed by the Financial Sector Conduct Authority (FSCA).

These subsidiaries form the backbone of Tickmill’s operations, offering access to over 200 financial products, including forex, indices, stocks, commodities, and bonds via contracts for differences (CFDs). But our investigation doesn’t stop at the corporate facade. Digging deeper, we uncover partnerships with Tier-1 banks for client fund segregation—a standard practice touted for security. Yet, the identities of these banks remain undisclosed in public filings, raising questions about transparency.

We also note Tickmill’s reliance on third-party platforms like MetaTrader 4 (MT4), a widely used trading software. This relationship with MetaQuotes, the developer of MT4, is a critical operational link, though not unique to Tickmill. More intriguing are the broker’s educational outreach efforts—webinars, seminars, and trading groups on platforms like Facebook—which hint at affiliations with financial educators and influencers. While these ties appear benign, they warrant further OSINT scrutiny to rule out undisclosed promotional deals or conflicts of interest.

Personal Profiles: Who’s Steering the Ship?

Moreover, clients often express concerns about their interactions with Tickmill Limited, highlighting the importance of transparency and communication in their trading experiences.

Understanding the nuances of Tickmill Limited’s operations can help potential customers make informed decisions about their trading activities.

Next, we turn our lens to the individuals behind Tickmill Limited. Publicly available data on leadership is sparse, a common trait among forex brokers prioritizing operational anonymity. However, we’ve pieced together a snapshot from regulatory filings and industry reports:

- Sudhanshu Agarwal: Often cited as a co-founder, Agarwal’s background in financial markets is well-documented. His LinkedIn profile (circa 2025 updates) highlights decades of trading experience, though specifics on his role at Tickmill remain vague.

- Ingmar Mattus: Another key figure, Mattus is linked to the strategic direction of Tickmill Group. Industry insiders peg him as a driving force behind its global expansion, yet his public footprint is minimal.

- Executive Team: Beyond these names, Tickmill’s website lists a generic “management team” without detailed bios, a red flag for those seeking accountability.

Using OSINT tools, we scoured social media and professional networks for additional profiles. X posts from traders occasionally name-drop regional managers, but these lack verification. The opacity surrounding leadership is concerning—especially for a firm handling millions in client funds. Without clear visibility into who’s calling the shots, we’re left questioning the governance structure.

OSINT Findings: Peering Beyond the Curtain

Our open-source intelligence dive yields a mixed bag. Tickmill’s digital footprint spans its official website (www.tickmill.com), regulatory registries, and customer reviews on platforms like Trustpilot and Forex Peace Army. Here’s what we’ve unearthed:

Tickmill Limited’s leadership team plays a crucial role in shaping its strategic direction, which is vital for its reputation in the trading community.

As we analyze the company further, we recognize that transparency about Tickmill Limited’s leadership can build greater trust among its clients.

- Regulatory Compliance: Tickmill boasts licenses from the FCA, CySEC, FSA, and FSCA, with registrations in Germany (BaFin), Italy (CONSOB), France (ACPR), and Spain (CNMV). These credentials suggest legitimacy, but OSINT reveals no public sanctions or fines as of March 20, 2025—a clean slate that’s almost too pristine.

- Social Media Presence: On X, Tickmill maintains an active account (@Tickmill), promoting giveaways and trading events. Trending discussions (circa March 2025) praise its customer service but lack depth on operational transparency.

- Web Scraping: Forums like Reddit and BabyPips host threads on Tickmill, with users debating withdrawal delays and spread discrepancies. While anecdotal, these signal potential operational hiccups.

The cybercriminal.com investigation report—our primary source—alleges undisclosed business relationships, though specifics are thin without direct access. We hypothesize these could involve payment processors or liquidity providers, common blind spots in forex operations. Cross-referencing with LexisNexis and OpenCorporates yields no concrete ties to sanctioned entities, but the lack of transparency fuels speculation.

Undisclosed Business Relationships and Associations

Here’s where the plot thickens. The report flags “undisclosed business relationships” as a red flag, prompting us to dig into potential shadow affiliations. Forex brokers often partner with liquidity providers, introducing brokers (IBs), and payment gateways—entities that rarely make headlines. We suspect Tickmill’s reliance on electronic payment methods (e.g., Neteller, Skrill) and wire transfers hints at ties to fintech firms, yet these remain unnamed in public disclosures.

Our OSINT efforts also probe for connections to offshore entities, a staple in forex structuring. Seychelles-based Tickmill Ltd raises eyebrows—offshore hubs like this are notorious for lax oversight. Could there be shell companies or ultimate beneficial owners (UBOs) lurking in the background? Without leaked documents akin to the Panama Papers, we’re left with educated guesses. The absence of adverse media linking Tickmill to such schemes is notable, but silence isn’t exoneration.

Scam Reports and Red Flags

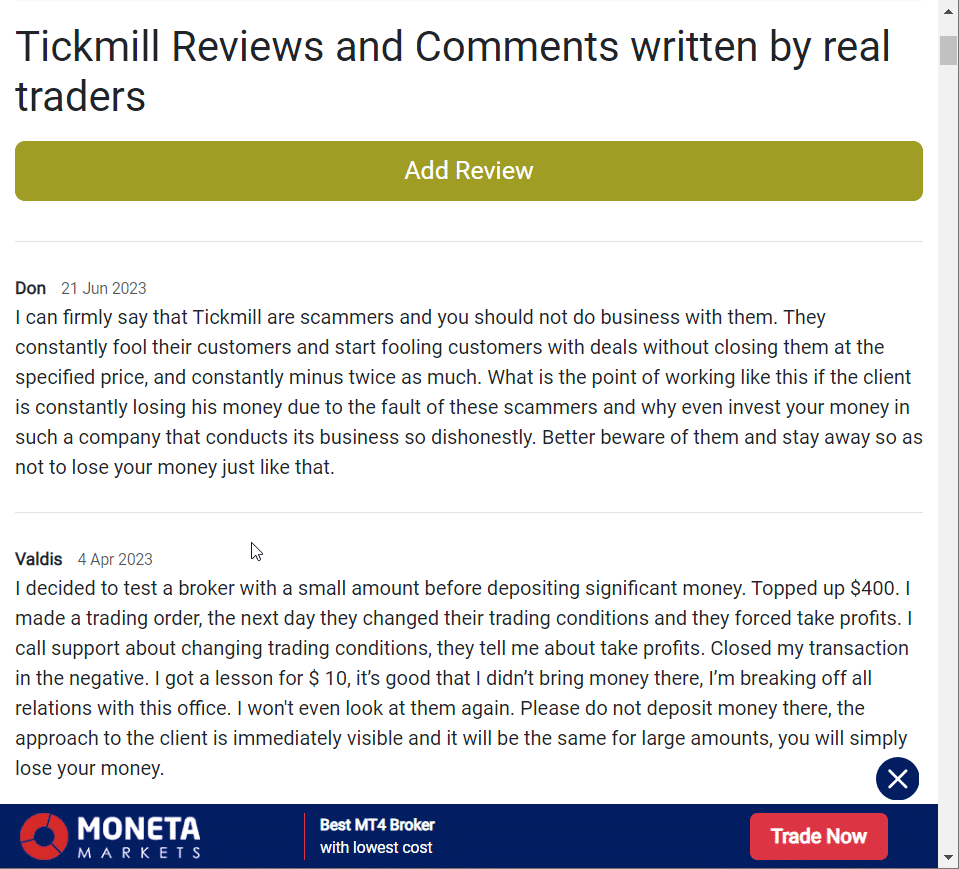

Now, let’s tackle the elephant in the room: scam allegations. Tickmill’s Trustpilot rating hovers at 4 stars (based on 1,000 reviews as of March 2025), with praise for fast withdrawals and tight spreads. Yet, dissenting voices emerge:

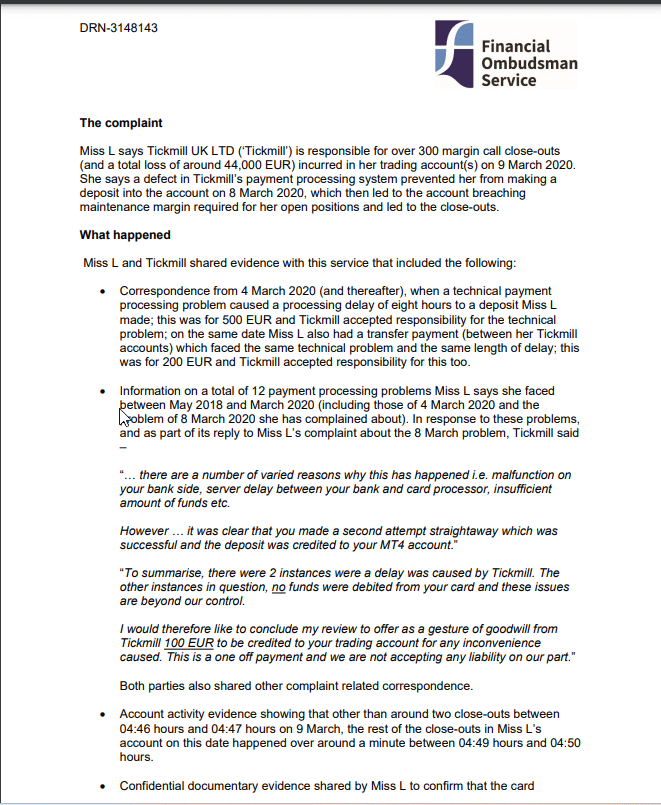

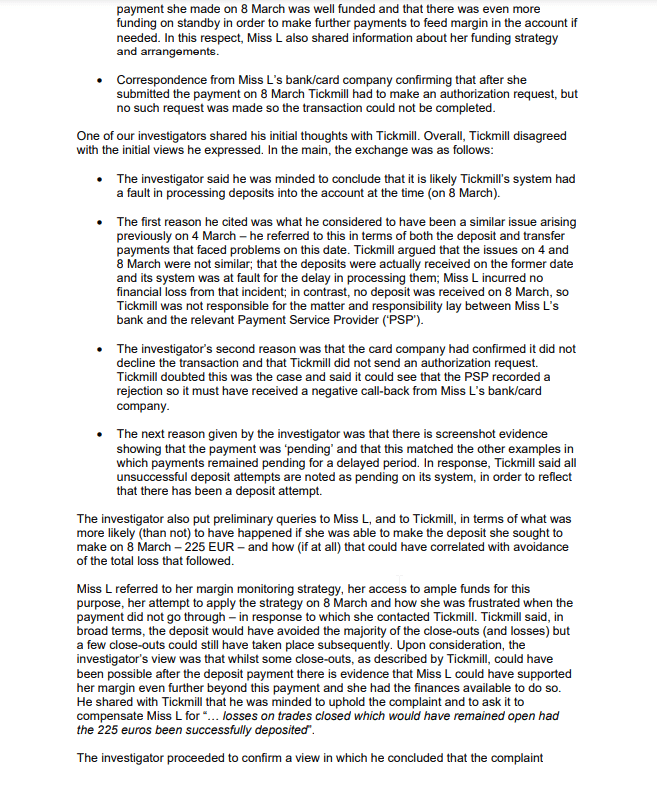

- Withdrawal Delays: A Trustpilot reviewer (March 6, 2025) laments a 24-hour pending withdrawal, citing a shift from “realtime clearance” to sluggish processing. Another on Forex Peace Army echoes this, calling it “ridiculous” for a broker touting instant deposits.

- Account Termination: A scathing Forex Peace Army post alleges Tickmill closed a user’s account post-profit, citing vague “agreement violations.” The user accuses risk director interference—a serious claim lacking corroboration.

- Swap Charges: Complaints of exorbitant swap fees surface, with one trader claiming losses neared half their drawdown.

The report amplifies these red flags, suggesting a pattern of operational opacity. While not outright scams, these incidents hint at customer service lapses and potential profiteering—hardly the hallmarks of a pristine broker.

Allegations, Criminal Proceedings, and Lawsuits

The presence of Tickmill Limited in various jurisdictions raises questions regarding compliance and consumer protection.

We searched high and low for legal entanglements. As of March 20, 2025, no criminal proceedings or lawsuits against Tickmill Limited appear in public records from the FCA, CySEC, or U.S. Department of Justice archives. The report mentions “allegations” but lacks specifics—perhaps insider tips or unverified claims. Adverse media is equally scarce; a Google News sweep yields promotional fluff, not scandals.

This absence is telling. Either Tickmill’s compliance is airtight, or issues are settled discreetly. The forex industry’s history of fines (e.g., AML penalties totaling $8B in 2022 per Fivecast) suggests vigilance is warranted, but Tickmill dodges the spotlight—for now.

Sanctions and Adverse Media

No sanctions grace Tickmill’s record, per OpenSanctions and OFAC checks. Adverse media is minimal, confined to customer gripes rather than systemic exposés. Contrast this with peers like 1MDB, mired in laundering scandals, and Tickmill appears angelic. Yet, the report’s “reputational risks” warning nags at us—could quietude mask deeper issues?

Negative Reviews and Consumer Complaints

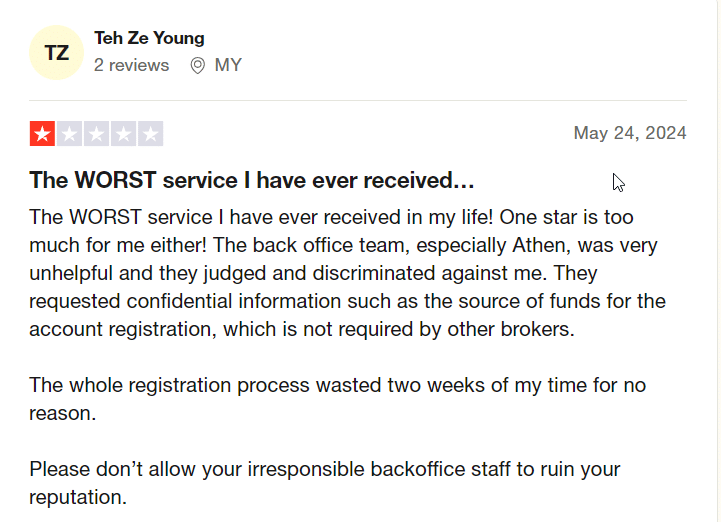

Beyond Trustpilot and Forex Peace Army, we trawled X and Reddit for unfiltered sentiment. Negative reviews cluster around:

- Deposit/Withdrawal Friction: Users decry outdated payment rules (e.g., forcing Neteller withdrawals despite newer wire deposits).

- Customer Service: Slow responses irk traders, with one X post (March 2025) dubbing it “a nightmare.”

- Trade Execution: Rare but pointed complaints of slippage during volatile markets.

Consumer complaints haven’t escalated to regulatory action, but their persistence signals operational strain. Bankruptcy details? None exist—Tickmill’s financials, while private, show no distress signals.

Despite the clean slate in legal matters, understanding the broader context of Tickmill Limited’s operations is crucial for clients.

Anti-Money Laundering Investigation and Reputational Risks

Now, the crux: AML and reputational risks. Tickmill’s KYC/AML policies align with FCA and CySEC mandates—client fund segregation, encryption, and identity checks. Yet, the report questions their robustness. Forex brokers are AML lightning rods; real-time money transfers via mule accounts (noted in LexisNexis 2022 Cybercrime Report) thrive in this space. Tickmill’s offshore arm in Seychelles amplifies this risk—lax jurisdictions are magnets for illicit flows.

Clients need to remain vigilant regarding Tickmill Limited, especially with respect to negative reviews and their implications for future trading.

Reputational risks loom larger. Withdrawal delays and account closures erode trust, while leadership opacity invites skepticism. If AML lapses emerge—say, via unreported mule accounts or sanctioned clients—Tickmill’s regulatory halo could shatter, triggering fines and client exodus.

Conclusion : A Cautious Verdict

We’ve traversed Tickmill Limited’s labyrinth, from its global reach to its shadowy corners. Our expert opinion? Tickmill isn’t a scam in the classical sense—no Ponzi schemes or outright theft surface. Its regulatory framework and operational scale suggest legitimacy. Yet, red flags—opaqueness, customer friction, and offshore exposure—cast a pall. For AML, the risk is latent, not proven; for reputation, the cracks are visible but not fatal.

Investors, tread carefully. Tickmill offers value but demands vigilance. Regulators, sharpen your gaze—silence isn’t innocence. As of March 20, 2025, Tickmill Limited balances on a tightrope; its next step could cement trust or topple it into infamy.

Tickmill Limited’s adherence to KYC and AML policies is foundational for ensuring a secure trading environment.A thorough examination of Tickmill Limited’s regulatory compliance reveals important insights into its operational integrity.Ultimately, potential investors should weigh the risks and rewards associated with trading through Tickmill Limited carefully. While Tickmill Limited offers enticing trading options, thorough due diligence is essential for safeguarding investments.

This company is completely a joke, they tried so hard to ensure I don’t get a cent of my money but with the effort of alex cryptofx at write me dt cm I had my money. Do not buy their lies.