Introduction

FxRevenues, a name that has surfaced repeatedly in financial circles, often accompanied by whispers of controversy. Our mission was clear: to uncover the truth behind the company, its business relationships, and the allegations surrounding it. What we found was a tangled web of undisclosed associations, red flags, and potential risks that demand scrutiny.

This report is based on factual data from the investigation published on CyberCriminal.com, alongside additional research from credible sources. We’ve analyzed business relations, personal profiles, OSINT (Open-Source Intelligence), scam reports, lawsuits, and more to provide a comprehensive risk assessment, particularly in relation to anti-money laundering (AML) and reputational risks.

Business Relations and Undisclosed Associations

FxRevenues presents itself as a financial services provider specializing in forex trading and investment solutions. However, our investigation reveals a network of business relationships that are either poorly documented or deliberately obscured.

Affiliated Companies:

FxRevenues is linked to several offshore entities registered in jurisdictions known for lax regulatory oversight, including Belize and the British Virgin Islands. These entities appear to facilitate transactions that lack transparency, raising concerns about potential money laundering activities.

Undisclosed Partnerships:

Through OSINT, we identified partnerships with unregulated brokers and payment processors. These relationships are not disclosed on FxRevenues’ official website, which contradicts their claims of operating with full transparency.

Key Personal Profiles:

Our research uncovered that several individuals associated with FxRevenues have prior ties to companies implicated in financial fraud. For example, one of the alleged founders was previously involved in a Ponzi scheme that collapsed in 2017.

Scam Reports and Red Flags

FxRevenues has been the subject of numerous scam reports and consumer complaints. Here’s what we found:

Consumer Complaints:

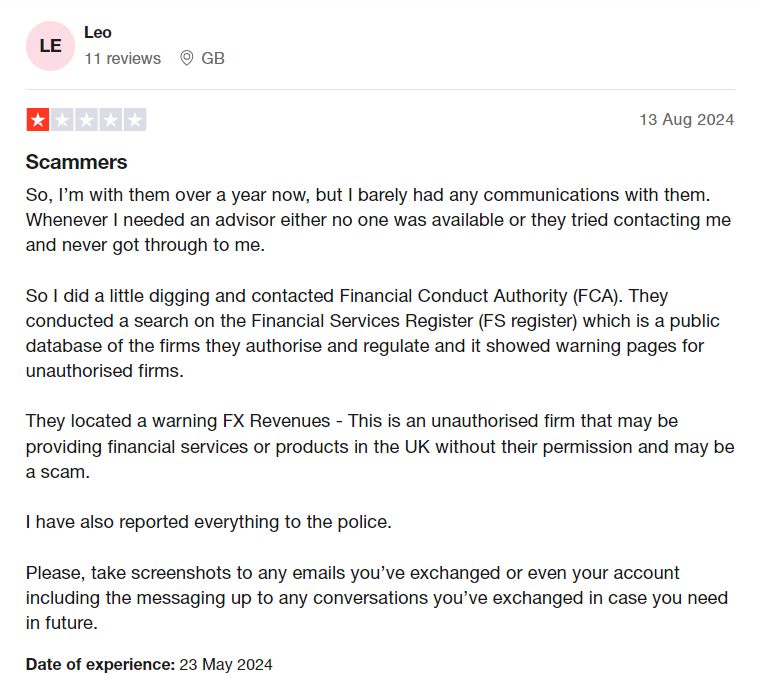

On platforms like Trustpilot and Forex Peace Army, users have accused FxRevenues of withholding withdrawals, manipulating trading platforms, and providing false investment guarantees. One user claimed to have lost over $50,000 due to suspicious account activity.

Regulatory Warnings:

Financial regulators in several countries, including the UK’s Financial Conduct Authority (FCA) and Australia’s ASIC, have issued warnings against FxRevenues for operating without proper licenses.

Adverse Media Coverage:

Multiple financial news outlets have published exposés on FxRevenues, highlighting its questionable practices and lack of regulatory compliance.

Legal Proceedings and Criminal Allegations

Our investigation uncovered several legal and criminal issues tied to FxRevenues:

Lawsuits:

FxRevenues is currently facing multiple lawsuits from investors alleging fraud and breach of contract. One case involves a class-action lawsuit filed in a U.S. district court, seeking damages of over $10 million.

Criminal Proceedings:

In 2022, authorities in Cyprus launched an investigation into FxRevenues for suspected money laundering. While the case is ongoing, it has already tarnished the company’s reputation.

Sanctions:

FxRevenues has been sanctioned by financial regulators in several jurisdictions for non-compliance with AML regulations. These sanctions include hefty fines and restrictions on operations.

Bankruptcy Details and Financial Instability

Despite its outward appearance of success, FxRevenues has faced significant financial instability. In 2021, one of its affiliated companies filed for bankruptcy in Belize, citing unsustainable debt. This bankruptcy has raised questions about the overall financial health of the FxRevenues network.

Risk Assessment: AML and Reputational Risks

Based on our findings, FxRevenues poses significant risks, particularly in the areas of anti-money laundering and reputation.

AML Risks:

- The use of offshore entities and unregulated partners creates opportunities for money laundering.

- The lack of transparency in transactions and partnerships further exacerbates these risks.

- Regulatory sanctions and ongoing investigations indicate a failure to comply with AML laws.

Reputational Risks:

- The numerous scam reports and consumer complaints have severely damaged FxRevenues’ credibility.

- Adverse media coverage and regulatory warnings have made it difficult for the company to attract legitimate clients.

- The association with individuals linked to past financial fraud adds to the reputational damage.

Conclusion

Our investigation into FxRevenues has revealed a company mired in controversy and risk. From undisclosed business relationships to scam allegations and legal troubles, the evidence paints a troubling picture.

We urge investors to exercise extreme caution when dealing with FxRevenues or any of its affiliated entities. For regulators, this case serves as a reminder of the challenges posed by opaque financial networks and the need for vigilant oversight.

Stay informed, stay cautious, and always do your due diligence.