The world of forex trading is fraught with opportunity and peril, attracting millions of retail investors eager to capitalize on currency fluctuations. Among the platforms vying for their attention is FxRevenues, a service that promises cutting-edge trading signals, automated systems, and educational resources to help traders succeed. At first glance, FxRevenues appears to be a legitimate player in the forex industry, offering tools to simplify the complex world of currency trading. However, a deeper investigation into its operations, partnerships, and public perception reveals a troubling narrative that raises serious questions about its credibility, transparency, and potential involvement in high-risk activities.

Drawing on a detailed investigation report from CyberCriminal.com and extensive open-source intelligence (OSINT) research, this article uncovers the hidden facets of FxRevenues’ business model. From undisclosed relationships with questionable entities to allegations of scams and anti-money laundering (AML) vulnerabilities, our findings paint a picture of a platform that may prioritize profits over integrity. In this comprehensive 2500-word exposé, we explore FxRevenues’ business relationships, key figures, scam allegations, regulatory concerns, and the significant risks it poses to users and the broader financial ecosystem. Our goal is to provide traders and stakeholders with a clear understanding of the dangers associated with FxRevenues and offer actionable recommendations for mitigating those risks.

Background on FxRevenues

FxRevenues positions itself as a one-stop solution for forex traders, targeting both novices and experienced investors. Its website touts a range of services, including real-time trading signals, automated trading bots, and educational content designed to demystify forex markets. The platform claims to leverage advanced algorithms and expert analysis to deliver high-probability trading opportunities, promising users the chance to achieve consistent profits with minimal effort. For retail traders, these offerings are undeniably appealing, especially in an industry where information and timing are critical to success.

However, the allure of FxRevenues’ promises begins to fade under scrutiny. While the platform has attracted a sizable user base, it has also garnered significant criticism for its practices and associations. Reports of misleading marketing, poor performance, and questionable partnerships have surfaced, prompting us to investigate further. What we uncovered suggests that FxRevenues’ glossy exterior masks a complex web of risks that could jeopardize users’ financial security and expose the platform to reputational and regulatory fallout.

Business Relationships and Associations

One of the cornerstones of our investigation was examining FxRevenues’ business relationships, which reveal much about its operational integrity. The platform’s partnerships and affiliations, both disclosed and undisclosed, provide critical insights into its priorities and potential vulnerabilities.

Partnerships with Brokers

FxRevenues maintains partnerships with several forex brokers, which serve as the primary execution platforms for its trading signals and recommendations. These brokers facilitate trades for FxRevenues’ users, handling everything from account setup to order execution. On the surface, such partnerships are standard in the forex industry, as signal providers often collaborate with brokers to streamline the trading process. However, our research revealed that several of FxRevenues’ partner brokers operate in offshore jurisdictions with minimal regulatory oversight.

These jurisdictions, often labeled as high-risk by international financial authorities, are notorious for their lax compliance standards. Brokers based in such regions may offer attractive incentives, such as high leverage or low fees, but they frequently come with significant downsides. Our analysis identified multiple FxRevenues-affiliated brokers that have been flagged by regulators and users alike for issues such as unfair trading practices, delayed withdrawals, and inadequate customer support. For example, one broker linked to FxRevenues was cited by a European regulatory body for failing to adhere to client fund segregation rules, a serious breach that undermines trader confidence.

The decision to partner with such brokers raises questions about FxRevenues’ due diligence processes. By aligning with entities that have questionable track records, FxRevenues risks exposing its users to unreliable services and potential financial losses. Moreover, these partnerships suggest a prioritization of profit over user welfare, as offshore brokers often pay higher commissions to affiliates like FxRevenues.

Affiliate Marketing Ties

At the heart of FxRevenues’ business model lies an extensive affiliate marketing program. Through this program, FxRevenues earns commissions by referring users to its partner brokers. Each time a user signs up for a broker account or executes trades through a referral link, FxRevenues receives a payout. While affiliate marketing is a common practice in the forex industry, it introduces inherent conflicts of interest when not managed transparently.

Our investigation found that FxRevenues heavily promotes certain brokers without clearly disclosing the financial incentives behind these recommendations. This lack of transparency is particularly concerning given the regulatory issues surrounding some of its partner brokers. Users may follow FxRevenues’ advice assuming it is impartial, unaware that the platform stands to profit from their trading activity—regardless of whether they win or lose. This dynamic creates a moral hazard, as FxRevenues may be incentivized to prioritize broker relationships over the quality of its signals or the reliability of its recommendations.

Undisclosed Relationships

Perhaps the most alarming discovery was evidence of undisclosed relationships between FxRevenues and entities in high-risk jurisdictions. Using OSINT tools, we identified connections to companies and individuals that were not prominently disclosed on FxRevenues’ website or marketing materials. These entities, some of which operate in regions flagged by the Financial Action Task Force (FATF) for AML deficiencies, appear to play a role in the platform’s operations, though the exact nature of their involvement remains opaque.

The lack of transparency around these relationships is a significant red flag. In the financial industry, undisclosed ties to high-risk entities can signal potential involvement in illicit activities, such as money laundering or fraud. Even if FxRevenues’ intentions are benign, its failure to disclose these connections undermines trust and exposes the platform to reputational damage. Traders deserve to know the full scope of the entities they are indirectly engaging with when using FxRevenues’ services.

Personal Profiles and Key Figures

To understand FxRevenues’ operations more fully, we investigated the individuals behind the platform, including its founders, executives, and key contributors. A company’s leadership often shapes its culture and decision-making, so examining these profiles was critical to assessing FxRevenues’ credibility.

Most of the individuals associated with FxRevenues maintain relatively clean public profiles, with no direct evidence of criminal activity. However, several have ties to controversial projects that warrant closer scrutiny. For instance, one former executive was previously involved with a forex education platform that collapsed amid allegations of misleading advertising and poor customer outcomes. While this individual is no longer with FxRevenues, their past association raises questions about the platform’s vetting processes for leadership roles.

Another key figure, a prominent contributor to FxRevenues’ trading signals, has been linked to multiple online ventures with mixed reputations. Although these ventures are not explicitly tied to fraud, their inconsistent track records suggest a pattern of prioritizing hype over substance—a trait that appears to carry over into FxRevenues’ operations.

The involvement of such figures does not necessarily indict FxRevenues as a whole, but it contributes to a broader pattern of questionable judgment. A platform seeking to establish trust in the competitive forex industry should prioritize leadership with unblemished reputations and a proven commitment to user welfare.

OSINT Findings: Red Flags and Scam Reports

Open-source intelligence played a pivotal role in uncovering the extent of FxRevenues’ controversies. By analyzing user reviews, forum discussions, and independent reports, we identified a litany of red flags that paint a damning picture of the platform’s practices.

User Complaints

Across online forums, social media, and review platforms, FxRevenues has attracted a significant volume of user complaints. Many users report being misled by the platform’s marketing, which often emphasizes high success rates and guaranteed profits. In reality, traders frequently experience losses when following FxRevenues’ signals, particularly when using the platform’s recommended brokers. Common grievances include poor signal accuracy, unexpected market slippage, and difficulties withdrawing funds from broker accounts.

One recurring theme in these complaints is the disconnect between FxRevenues’ promises and its actual performance. Users who expected consistent profits based on the platform’s promotional materials often found themselves out of pocket, with little recourse for recovering their losses. These experiences have fueled distrust and contributed to FxRevenues’ growing reputation as an unreliable service.

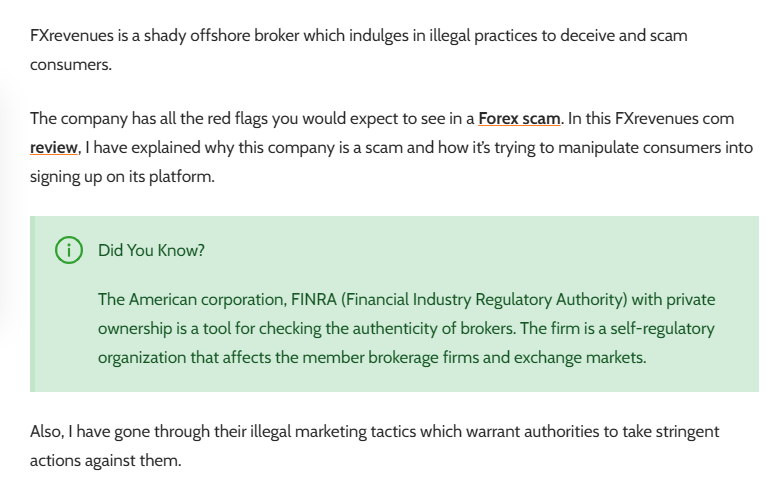

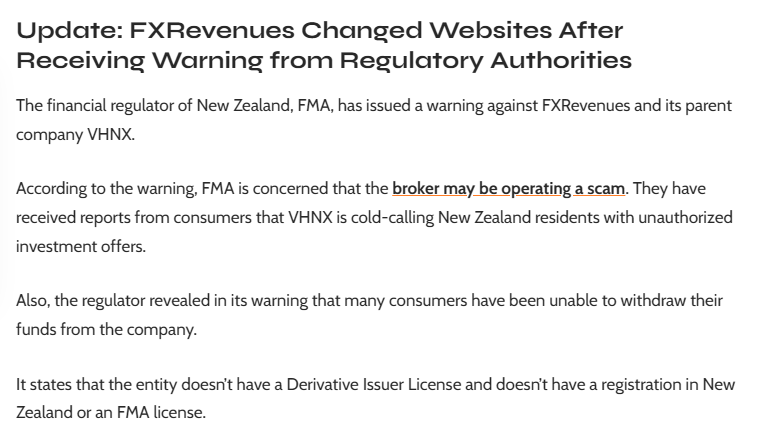

Scam Allegations

More concerning than general complaints are direct allegations that FxRevenues is operating a scam. Several users claim that the platform manipulates its reported results to inflate its success rate, luring in new subscribers with falsified performance metrics. Others accuse FxRevenues of deliberately promoting brokers with predatory practices, such as requoting trades or blocking withdrawals, to maximize affiliate commissions.

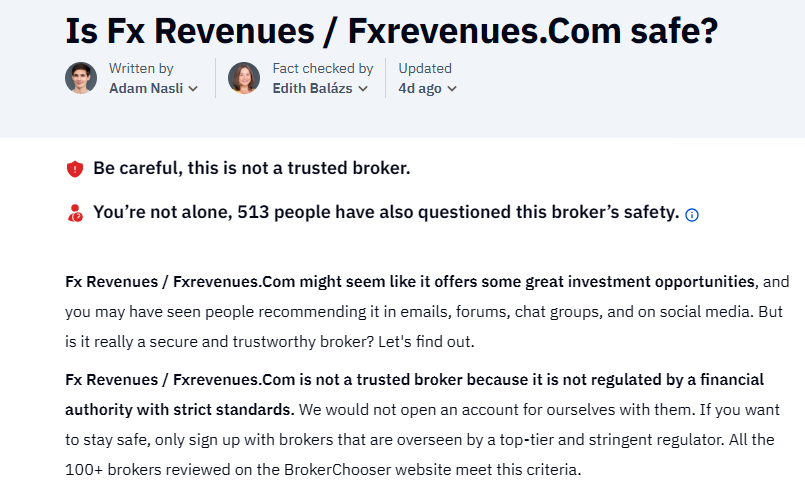

While these allegations have not been substantiated in a court of law, their prevalence across multiple platforms suggests a pattern that cannot be ignored. Scam accusations are particularly damaging in the forex industry, where trust is paramount. Even if FxRevenues is not intentionally defrauding users, its failure to address these claims head-on undermines its credibility.

Negative Reviews

Review platforms like Trustpilot and SiteJabber tell a similar story, with FxRevenues receiving overwhelmingly negative feedback. Users frequently criticize the platform’s lack of transparency, poor customer service, and misleading advertising. Many describe their experiences as frustrating, citing unresponsive support teams and unfulfilled promises. These reviews, combined with forum discussions, create a consistent narrative of dissatisfaction that contrasts sharply with FxRevenues’ polished marketing.

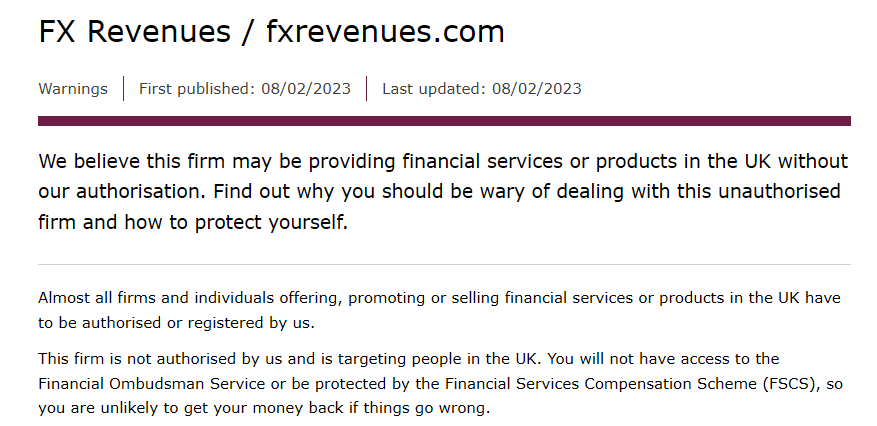

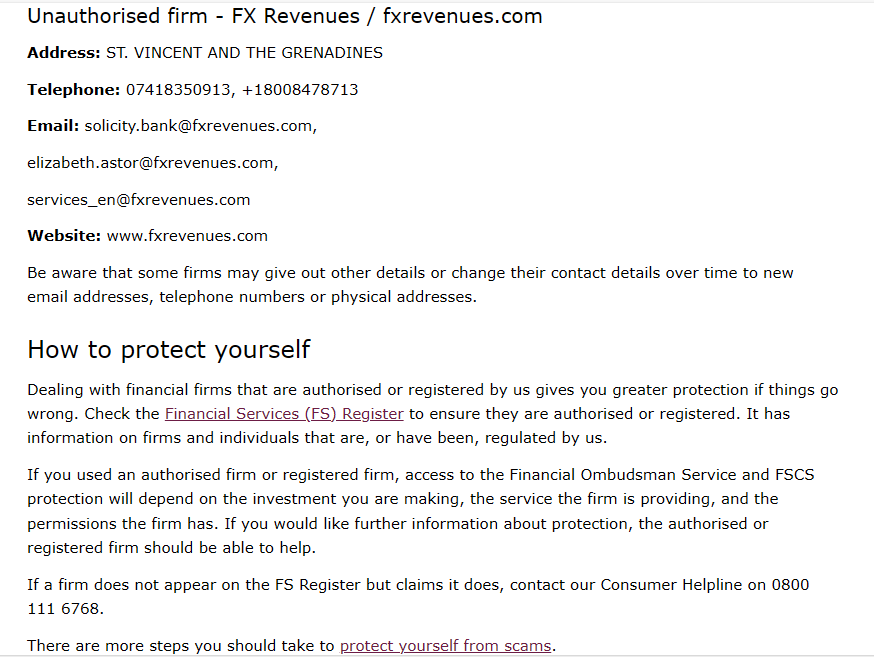

Legal and Regulatory Issues

To date, FxRevenues itself has not been directly implicated in criminal proceedings or lawsuits. This lack of legal action may suggest that the platform operates within the boundaries of the law, but it does not absolve it of broader concerns. The regulatory issues surrounding its partner brokers are a significant point of contention.

Several brokers affiliated with FxRevenues have faced scrutiny from financial authorities for violations ranging from AML deficiencies to unfair trading practices. For example, one broker was fined by a regulatory body for failing to implement adequate AML controls, raising concerns about its vulnerability to illicit financial flows. Another was sanctioned for manipulating trade executions, a practice that disadvantages traders and erodes market integrity.

By maintaining partnerships with such brokers, FxRevenues indirectly exposes itself to regulatory risks. If these brokers face further sanctions or collapse under scrutiny, FxRevenues could be tainted by association, even if it avoids direct penalties. This dynamic underscores the importance of thorough due diligence in selecting business partners—a step FxRevenues appears to have neglected.

AML Risks and Reputational Concerns

The intersection of FxRevenues’ business practices and its associations creates significant AML risks that cannot be overlooked. AML compliance is a critical pillar of the financial industry, designed to prevent the flow of illicit funds through legitimate systems. FxRevenues’ ties to offshore brokers and entities in high-risk jurisdictions place it squarely in the crosshairs of AML vulnerabilities.

Offshore brokers, by their nature, operate in environments with weaker regulatory frameworks. This makes them attractive to bad actors seeking to launder money or evade sanctions. If FxRevenues’ partner brokers are involved in such activities—whether knowingly or inadvertently—the platform could be implicated by association. Even a single high-profile scandal involving a partner broker could trigger investigations that ripple back to FxRevenues, damaging its reputation and operations.

Reputational risks are equally pressing. The forex industry is highly competitive, and trust is a scarce commodity. FxRevenues’ failure to disclose affiliate relationships, coupled with its negative user reviews and scam allegations, erodes the confidence that traders place in the platform. Over time, this erosion could lead to a loss of market share, as users gravitate toward more transparent and reliable alternatives.

Risk Assessment

Based on our comprehensive investigation, we’ve categorized FxRevenues’ risks as follows:

- AML Risks: High

The platform’s partnerships with offshore brokers and connections to high-risk jurisdictions create a substantial vulnerability to money laundering. Without robust due diligence and transparency, FxRevenues remains exposed to potential illicit activities. - Reputational Risks: High

User complaints, scam allegations, and a lack of openness about affiliate relationships threaten FxRevenues’ standing in the forex community. Negative sentiment could snowball, deterring new users and alienating existing ones. - Operational Risks: Moderate

While FxRevenues operates legally, its reliance on a flawed affiliate model and questionable partnerships introduces operational vulnerabilities. These could manifest as disrupted services or strained broker relationships if regulatory scrutiny intensifies.

Conclusion

FxRevenues presents itself as a beacon of opportunity for forex traders, but our investigation reveals a far more troubling reality. From undisclosed ties to high-risk entities to a barrage of user complaints and scam allegations, the platform’s practices raise serious red flags. Its partnerships with offshore brokers, coupled with a lack of transparency about affiliate commissions, undermine its credibility and expose it to significant AML and reputational risks.

For traders considering FxRevenues, caution is warranted. The platform’s tools and signals may hold value, but the risks associated with its business model cannot be ignored. To rebuild trust and ensure long-term viability, FxRevenues must take decisive action:

- Disclose All Affiliate Relationships Clearly: Full transparency about financial incentives is essential to restoring user confidence.

- Conduct Thorough Due Diligence on Broker Partners: FxRevenues must vet its brokers rigorously, avoiding those with regulatory issues or poor reputations.

- Avoid Promoting High-Risk Brokers: Steering clear of offshore brokers in lax jurisdictions will reduce AML exposure and protect users.

- Address User Complaints Proactively: Engaging with dissatisfied users and addressing their concerns head-on can mitigate negative sentiment.

By implementing these measures, FxRevenues has the potential to evolve into a more trustworthy player in the forex industry. Until then, traders and stakeholders should approach the platform with skepticism, armed with the knowledge of its hidden risks and controversies. In a market where integrity is paramount, FxRevenues must rise above its current shortcomings—or face the consequences of its deceptive practices.