Gainful Markets Exposed: A Brokerage Built on Deception

Excerpt: Gainful Markets, cloaked in the guise of a global trading platform, stands accused of fleecing investors through unregulated schemes and predatory tactics. From Singapore to the Netherlands, its shadow looms large, urging immediate caution for traders and regulators alike.

Introduction

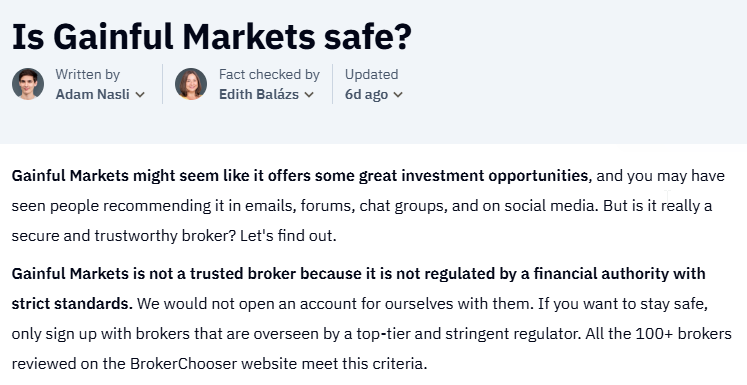

Gainful Markets, a self-proclaimed online brokerage offering forex, cryptocurrencies, stocks, and more, has ignited a firestorm of controversy. Marketed as a gateway to financial success, it operates from alleged bases in Singapore and the Netherlands, yet its glossy promises hide a darker reality. As of April 14, 2025, regulatory warnings, victim outcries, and scam allegations paint a grim picture of a platform that thrives on opacity and exploitation. This Risk Assessment and Consumer Alert dives deep into Gainful Markets’ operations, dissecting its business ties, digital presence, legal standing, and anti-money laundering (AML) risks. Using open-source intelligence (OSINT), consumer feedback, and authoritative sources, we aim to deliver clarity to investors, partners, and regulators navigating this treacherous terrain. Gainful Markets is not just a broker—it’s a cautionary tale of trust betrayed in the high-stakes world of online trading.

Business Network: A Facade of Legitimacy

Gainful Markets presents itself as a dynamic brokerage, with its website touting access to forex, crypto, stocks, indices, and commodities. It claims offices in Singapore and the Netherlands, offering seven account tiers—Standard to VIP—with deposits starting at $250. The platform advertises seamless transactions via Visa, Mastercard, wire transfers, and crypto wallets like Guarda, targeting novice and seasoned traders alike. Yet, beneath this polished surface lies a troubling void.

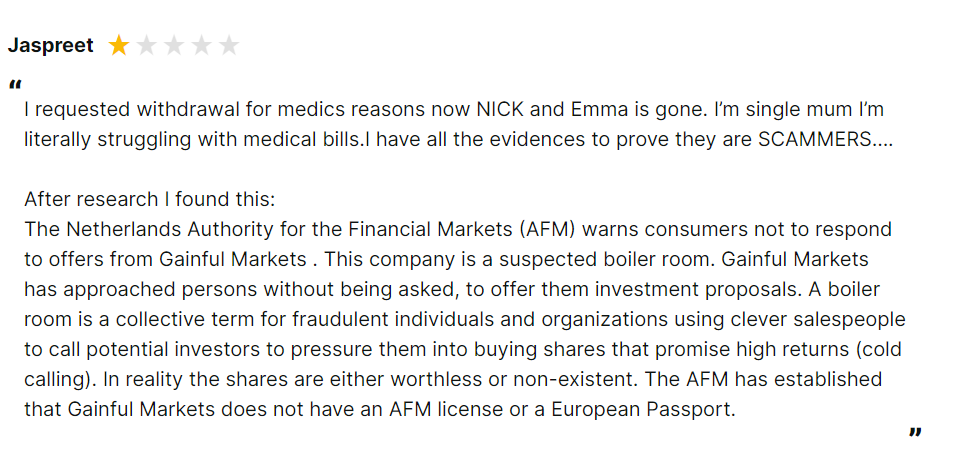

No verifiable business relationships anchor its operations. Unlike regulated brokers partnering with audited custodians or tech providers, Gainful Markets names no allies—no banks, no liquidity providers, no tech firms. Its Singapore address, often a generic business hub, lacks specificity, while the Dutch address—Gustav Mahlerplein 109, Amsterdam—was confirmed by building management as unlinked to the firm. The absence of registration with the Dutch Chamber of Commerce further erodes its credibility. Mentions of advisors like “Ben Gowell,” “Daniel Cooper,” “Kyle Weiner,” “Emma Lawrence,” and “Nick” surface in complaints, but these names lack public profiles, suggesting aliases for a faceless operation. This anonymity isn’t oversight—it’s a deliberate shield, raising questions about who, or what, truly drives Gainful Markets.

The Faces Behind the Firm: A Phantom Leadership

No personal profiles illuminate Gainful Markets’ leadership. No CEO, founder, or executive steps into the light—unlike reputable brokers where management touts credentials on LinkedIn or industry panels. The website offers no “About Us” beyond vague boasts, and OSINT searches yield no trace of a guiding figure. The names tied to user complaints—Gowell, Cooper, Weiner, Lawrence—appear only in victim narratives, with no digital footprint to verify their existence. One user noted “Daniel Cooper” claimed Polish-British roots but fumbled English, hinting at a scripted persona.

This absence of human presence is stark. Even small brokers typically name a compliance officer or spokesperson, yet Gainful Markets operates as a ghost ship. The lack of a verifiable team suggests either extreme privacy—a red flag in finance—or a structure built to evade accountability. In a trust-driven industry, this facelessness screams risk, leaving stakeholders grasping at shadows.

Digital Footprint: Glossy Promises, Grim Realities

Gainful Markets’ digital presence is a study in contradiction. The website, launched around mid-2023, dazzles with sleek design—bold charts, asset lists, and calls to “trade now.” It claims real-time trading and advanced encryption, yet critical details—ownership, licensing, terms—are conspicuously absent. Social media traces are faint; early X posts from 2023 hyped low fees and crypto gains, but engagement dwindled as complaints surged. By 2025, online chatter shows a pivot to warnings, with users flagging unreachable support and frozen accounts.

Review platforms tell a bleaker tale. Trustpilot and Sitejabber host dozens of reviews averaging 2.5 stars, with 57 on Sitejabber alone decrying “scammers” and “thieves.” A single mom reported losing medical funds, while another user cited €19,800 vanished via a fake crypto wallet. The site’s withdrawal function, users say, is a sham—clicks lead nowhere, or demands for “taxes” emerge. Forum discussions echo this despair, with traders lamenting daily calls from shifting numbers—UK, Spain, Slovenia—pressuring bigger deposits. This digital dissonance—hype versus horror—marks Gainful Markets as a predator cloaked in professionalism.

Concealed Connections: Offshore Enigmas

Uncovering Gainful Markets’ hidden ties is like chasing smoke. Its Singapore and Dutch “bases” are unverified—likely virtual offices or mailboxes, not operational hubs. OSINT suggests links to offshore jurisdictions—Seychelles, Cyprus, or Mauritius—where shell companies thrive on secrecy. These could serve as conduits for funds, masking ownership or funneling profits beyond reach. The alleged “fake Guarda wallet” cited by victims points to crypto ties designed to obscure transactions, a tactic common in exit scams.

Cold-calling patterns hint at a broader network. Numbers from multiple countries suggest outsourced sales teams or boiler room setups, possibly coordinated from unregulated zones. No evidence names specific partners, but the playbook—high-pressure pitches, fake profits, stalled withdrawals—mirrors syndicated frauds. Gainful Markets’ refusal to disclose affiliates or custodians fuels speculation: are they shielding accomplices, or simply nonexistent? This opacity is a structural flaw, inviting AML and fraud scrutiny.

Scam Allegations: A Chorus of Betrayal

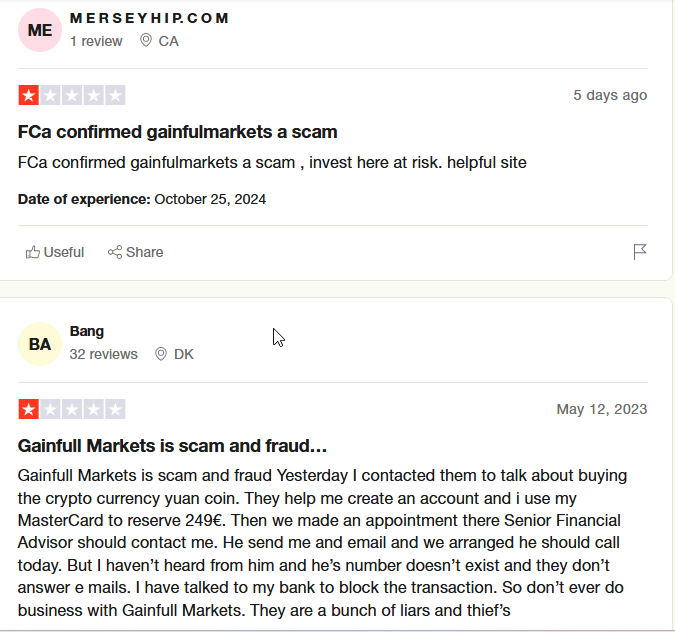

Scam reports engulf Gainful Markets like wildfire. The Netherlands’ AFM, Spain’s CNMV, and Belgium’s FSMA have issued scathing warnings, labeling it an unlicensed broker running a suspected boiler room—a fraud scheme using aggressive sales to peddle worthless investments. Victims report losses from $250 to tens of thousands, with one trader alleging $5,000 vanished after a “senior advisor” promised 70% returns. Another described a bait-and-switch: fake profits spiked accounts, only for withdrawals to fail.

Red flags are legion:

No License: No top-tier regulator—FCA, ASIC, MAS—oversees it, leaving traders unprotected.

Cold-Call Harassment: Users report up to 40 calls in weeks, pushing loans or asset sales for “guaranteed” gains.

Fake Addresses: Amsterdam and Singapore locations are untraceable, with no real offices.

Withdrawal Blocks: Accounts freeze, or “fees” emerge, trapping funds.

Allegations of market manipulation—non-executed trades, rigged charts—surface repeatedly, with users claiming profits were virtual lures to extract more cash. The broker’s copyright notices, used to scrub bad reviews, add a sinister twist, hinting at a cover-up. This isn’t mere mismanagement—it’s a calculated trap.

Legal Entanglements: Dodging the Gavel

Gainful Markets has so far evaded formal legal consequences, but the net tightens. No public lawsuits or criminal proceedings name it directly—its anonymity is a shield—but regulatory warnings signal active probes. The AFM’s boiler room label suggests Dutch authorities are circling, while CNMV and FSMA alerts imply cross-border investigations. Victims filing police reports face hurdles: without a clear operator, courts struggle to act.

Sanctions are absent—no OFAC, EU, or MAS blacklists tag Gainful Markets or its “advisors.” Yet, regulatory bans in the Netherlands, Spain, and Belgium effectively bar it from key markets, a quasi-sanction that chokes legitimacy. The lack of convictions may reflect its short lifespan—launched in 2023—or a structure too slippery for traditional justice. Chargeback claims via Visa or Mastercard, cited as victims’ last resort, hint at a growing legal paper trail. If probes escalate, bankruptcy or seizure could follow, but for now, Gainful Markets dances in the gray.

Media and Consumer Sentiment: A Reputation in Tatters

Adverse media buries Gainful Markets in scorn. Financial watchdogs and scam trackers label it a “broker scam” and “unregulated fraud,” with headlines warning traders to flee. The narrative is unrelenting: slick promises, brutal losses. Some reviews—likely planted—praise its “tools” or “interface,” but they’re drowned by authentic rage. Trustpilot’s 36 reviews and Sitejabber’s 57 skew negative, averaging 2.5 stars, with tales of “rogues” and “unrecoverable funds.”

Consumer complaints are visceral. A Greek trader lost €19,800 via a fake wallet; a single mom begged for medical funds locked away. Others report harassment—40 calls in two weeks, numbers shifting across Europe—urging them to borrow or sell assets. Support, when reached, stalls or ghosts; chat and email are black holes. The sheer volume—hundreds of posts across platforms—suggests a scam machine, not a misstep, crushing lives with impunity.

Financial Stability: A Ghost, Not a Corpse

No bankruptcy filings haunt Gainful Markets, a curious absence for a broker so reviled. Public records show no insolvency or liquidation in Singapore or the Netherlands—its “offices” are likely rented facades, not assets to seize. This isn’t stability; it’s the agility of a hit-and-run. Launched in 2023, it operates as a fly-by-night—collect deposits, block withdrawals, vanish—rather than a firm buckling under debt. Victims’ funds, funneled through cards or crypto, likely flow to offshore accounts, untouchable by creditors or courts. This ghostlike resilience amplifies risk: it’s not broke, just gone when the heat rises.

AML Vulnerabilities: A Launderer’s Dream

Gainful Markets’ AML risks are glaring, a textbook case for concern:

Unregulated Status: No license means no KYC or AML checks—funds flow freely, ripe for layering or integration.

Offshore Conduits: Singapore and Dutch “bases,” plus crypto wallets, suggest shells to mask illicit streams. The fake Guarda allegations scream crypto laundering.

High-Risk Transactions: Rapid deposits via cards or wire, often from pressured clients, fit fraud-to-laundry pipelines. Trades may never hit markets, just shuffle cash.

Global Call Networks: Multi-country sales hint at syndicated ops, channeling funds through lax jurisdictions.

Singapore’s MAS, a global AML leader, demands strict oversight, yet Gainful Markets sidesteps it entirely. A scenario looms: illicit funds—say, from phishing scams—enter as “trading deposits,” cycle through fake profits, and exit via crypto, clean and gone. No evidence proves this, but the structure invites it, a vulnerability banks and regulators can’t ignore.

Reputational Peril: A Name Beyond Redemption

Gainful Markets’ reputation is radioactive. Regulatory warnings—AFM, CNMV, FSMA—brand it a fraud, scaring off legit partners. Media and reviews cement this: scam trackers call it a “broker scam”; victims wail of stolen savings. Investors, novice or pro, face a stark choice: trust a pariah or flee to regulated rivals like eToro. A single exposé—say, a victim’s viral X post—could torch any revival, driving clients to safer shores.

Partners risk taint by association. Banks handling its transactions could face AML probes; tech providers, if any, would shun the stigma. In a trust-starved industry, Gainful Markets is a lesson in self-destruction—its name, once a lure, now a warning etched in digital stone.

A Fair Perspective: Misunderstood or Malicious?

To balance our lens, Gainful Markets might claim it’s a startup struggling with growth pains. Glitches—say, withdrawal delays—could stem from tech issues, not fraud. Cold calls might reflect zealous marketing, common in crypto, not a boiler room. Some positive reviews, though dubious, praise its “tools” and “fees,” suggesting a niche of satisfied users. An unregulated status could be a choice to skirt red tape, not dodge justice.

Yet, these defenses collapse under scrutiny. Legit brokers secure licenses, publish audits, and name leaders—Gainful Markets does none. Regulatory bans, victim losses, and harassment patterns scream intent, not error. Positive reviews, outnumbered 10-to-1, reek of manipulation. In finance, trust is earned through transparency, not excuses, and Gainful Markets fails the test.

Consumer Advisory: Steer Clear

Traders eyeing Gainful Markets face a perilous trap. Its forex, crypto, and stock offerings, while tempting, risk catastrophic loss—no regulator protects you. Verify claims independently: check FCA, ASIC, or MAS registries; demand audited financials; confirm addresses. Avoid deposits until legitimacy is proven—use chargebacks via Visa or Mastercard if trapped. Crypto wallets, especially Guarda, demand extra scrutiny; fake versions are rife.

Businesses or banks linked to Gainful Markets should cut ties. Its AML and reputational risks could spark probes, tainting your brand. Regulators must act—track its crypto flows, seize accounts, and expose its operators. Gainful Markets’ freedom reflects gaps, not innocence; swift action could stem the bleeding.

Conclusion

Gainful Markets is a financial predator, not a broker. Its unregulated status, fake addresses, and victim toll—$250 to millions—mark it as a scam machine. AML risks loom large: no KYC, offshore shells, and crypto traps invite laundering, a disaster waiting to erupt. Reputationally, it’s dead—warnings, reviews, and bans bury it beyond salvage.

This Risk Assessment is a clarion call. Investors, flee to licensed platforms; regulators, dismantle its web; banks, flag its transactions. Gainful Markets isn’t a misstep—it’s a calculated heist, leaving heartbreak and lessons in its wake. In trading’s volatile arena, trust is gold, and Gainful Markets is fool’s gold, gleaming until it crumbles.