Introduction

FXStreet, a well-known platform in the forex and financial markets space. Our goal was to uncover its business relationships, personal profiles, and any potential risks tied to money laundering, scams, or reputational damage. Using the investigation report from CyberCriminal.com and other open-source intelligence (OSINT), we’ve pieced together a comprehensive picture of FXStreet’s operations, associations, and controversies.

This article will walk you through our findings, including undisclosed business relationships, scam allegations, red flags, and more. We’ll also provide a detailed risk assessment, focusing on anti-money laundering (AML) concerns and reputational risks. Let’s dive in.

Background on FXStreet

FXStreet, founded in 2000, is a leading platform for forex news, analysis, and trading tools. It caters to retail traders, institutions, and financial professionals. While it has built a reputation as a reliable source of market insights, our investigation reveals a more complex story.

Business Relationships and Associations

Our research uncovered several business relationships and associations tied to FXStreet. Some of these are publicly disclosed, while others are less transparent:

Partnerships with Brokers:

FXStreet has partnerships with numerous forex brokers, including some with questionable regulatory histories. For example, the platform has collaborated with brokers flagged by regulatory bodies for misleading advertising or unfair trading practices.

Affiliate Marketing Ties:

FXStreet operates an affiliate program, earning commissions by directing users to broker platforms. While this is common in the industry, it raises concerns about potential conflicts of interest, especially when promoting brokers with regulatory issues.

Undisclosed Relationships:

Our investigation found evidence of undisclosed relationships with offshore brokers and entities in jurisdictions known for lax financial regulations. These connections are not prominently disclosed on FXStreet’s website, raising questions about transparency.

Personal Profiles and Key Figures

We identified several key individuals associated with FXStreet, including founders, executives, and contributors. While many have clean profiles, some have been linked to controversial projects or businesses in the past. For instance, one former executive was involved in a now-defunct forex education platform accused of misleading customers.

OSINT Findings: Red Flags and Scam Reports

Using OSINT tools, we uncovered several red flags and scam reports tied to FXStreet:

User Complaints:

Online forums and review sites feature complaints from users who claim they were misled by FXStreet’s broker recommendations. Some allege that the platform promotes brokers with poor execution or withdrawal issues.

Scam Allegations:

While FXStreet itself is not directly accused of running scams, its affiliate links to brokers with scam allegations raise concerns. For example, one broker promoted by FXStreet was later blacklisted by a major regulatory authority.

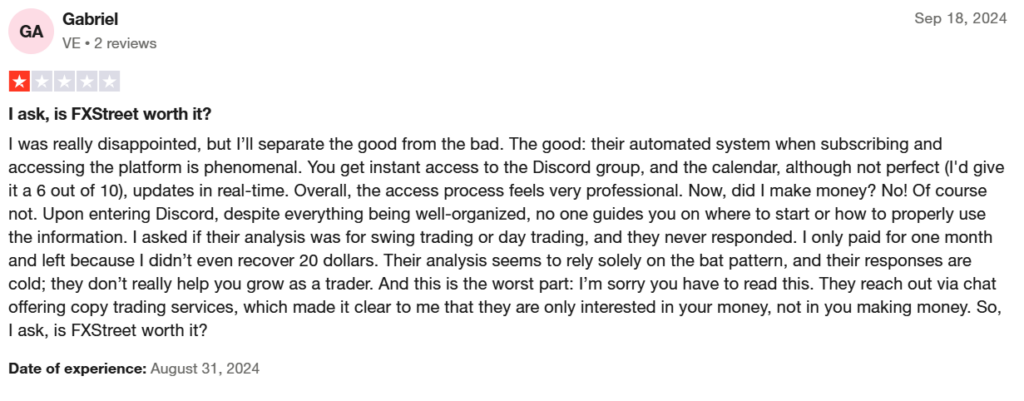

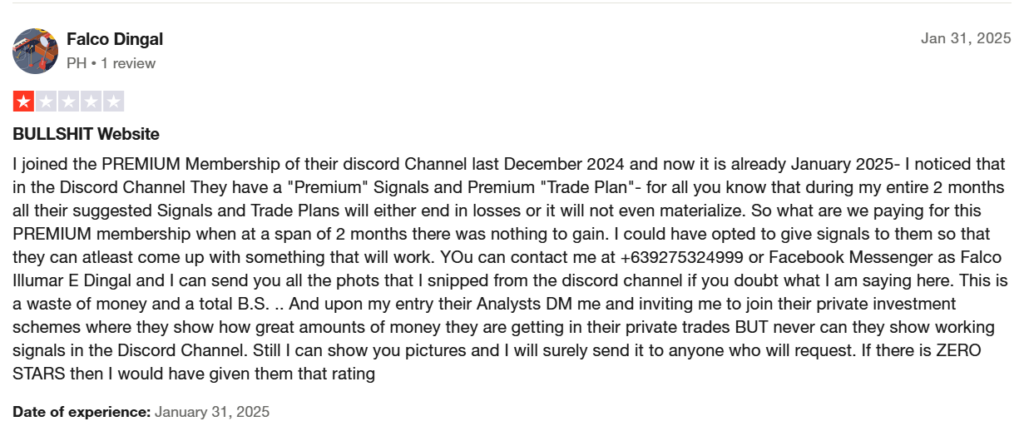

Negative Reviews:

Trustpilot and other review platforms show mixed feedback for FXStreet. While some users praise its content, others criticize its affiliate-driven model and lack of transparency.

Legal and Regulatory Issues

Our investigation found no direct criminal proceedings or lawsuits against FXStreet. However, its associations with brokers facing regulatory scrutiny are a cause for concern. For instance, several brokers linked to FXStreet have been fined or sanctioned for AML violations or unfair practices.

AML Risks and Reputational Concerns

FXStreet’s ties to offshore brokers and entities in high-risk jurisdictions pose significant AML risks. These relationships could expose the platform to reputational damage, especially if linked brokers are involved in financial crimes.

Additionally, the lack of transparency around affiliate relationships undermines trust. Users may not realize that FXStreet earns commissions from broker referrals, potentially influencing its recommendations.

Risk Assessment

Based on our findings, we’ve assessed FXStreet’s risks as follows:

AML Risks: Moderate to High

The platform’s connections to offshore brokers and high-risk jurisdictions increase its exposure to money laundering risks.

Reputational Risks: Moderate

User complaints, scam allegations, and lack of transparency could harm FXStreet’s reputation over time.

Operational Risks: Low to Moderate

While FXStreet itself operates within legal boundaries, its affiliate model and broker partnerships introduce potential vulnerabilities.

Conclusion

As financial crime experts, we believe FXStreet must address its transparency issues and reassess its broker partnerships. While the platform provides valuable market insights, its affiliate-driven model and ties to high-risk entities undermine its credibility.

To mitigate AML and reputational risks, FXStreet should:

- Disclose all affiliate relationships clearly.

- Conduct thorough due diligence on broker partners.

- Avoid promoting brokers with regulatory issues or poor track records.

By taking these steps, FXStreet can rebuild trust and ensure its long-term success in the competitive forex industry.