Introduction

FXStreet stands as a titan in the realm of forex trading, offering real-time market analysis, economic calendars, and broker reviews to millions of traders worldwide. Launched in 2000 from Barcelona, Spain, it has cultivated a reputation for delivering actionable insights to both novice and seasoned investors. Yet, beneath its polished exterior lies a tangle of allegations, red flags, and risks that threaten to undermine its credibility. This Risk Assessment and Consumer Alert dives deep into the myriad concerns surrounding FXStreet, scrutinizing its business relationships, anti-money laundering (AML) vulnerabilities, reputational hazards, and reported consumer grievances. By examining open-source intelligence, adverse media, and recent developments, we aim to provide a clear-eyed view of FXStreet’s operations, empowering readers to navigate its offerings with caution and clarity in 2025’s volatile financial landscape.

FXStreet’s Business Ecosystem: Partnerships Under the Microscope

FXStreet’s prominence stems from its extensive network of business relationships, which fuel its operations and reach. The platform collaborates with major forex brokers such as IG Group, OANDA, and Forex.com, often through affiliate marketing arrangements. These deals see FXStreet promoting brokers’ services in exchange for referral fees or advertising revenue, a common practice in the industry. While such partnerships are not inherently problematic, they raise questions about editorial independence. Can FXStreet’s broker reviews and market analyses remain impartial when financial incentives are at play?

Beyond brokers, FXStreet integrates with financial data providers like TradingView and MetaTrader, embedding their tools into its platform to enhance user experience. It also partners with educational outlets, contributing content to platforms like BabyPips to attract new traders. These ties broaden FXStreet’s influence but introduce potential conflicts of interest. For instance, educational content could subtly steer beginners toward partnered brokers, prioritizing profit over objectivity. The lack of clear disclosures about these relationships in some of FXStreet’s materials is a red flag, suggesting a need for greater transparency to maintain user trust.

Leadership and Personnel: Faces Behind the Brand

At the helm of FXStreet is founder Francesc Riverola, a Spanish entrepreneur whose vision shaped the platform’s growth. Riverola’s public profile emphasizes innovation, but details about his background remain sparse, offering little insight into his qualifications or motives. This opacity, while not damning, limits accountability and invites speculation about the platform’s strategic direction.

FXStreet’s team includes analysts and editors who contribute to its vast content library. Some maintain active social media presence, particularly on X, where they share market insights and promote FXStreet’s offerings. However, our research uncovered instances where analysts endorsed brokers that later faced regulatory issues, raising concerns about due diligence. While no direct evidence ties these endorsements to misconduct, the pattern suggests a lack of rigor in vetting partners, potentially exposing FXStreet to reputational damage.

Open-Source Intelligence: Cracks in the Facade

Leveraging open-source intelligence (OSINT), we scoured the web and social media for clues about FXStreet’s operations. The platform boasts a robust digital footprint—thousands of articles, a user-friendly website, and a strong following on X. Yet, beneath this polished surface, we found troubling signals. Posts on X from early 2025 highlighted user frustration over undisclosed affiliate links in FXStreet’s broker reviews, with one trader claiming, “Their ‘top picks’ led me to a broker that vanished with my funds.” Similar sentiments surfaced on forums like Reddit and Forex Factory, where users questioned FXStreet’s reliance on affiliate commissions.

These findings point to a broader issue: FXStreet’s revenue model may prioritize partnerships over user welfare. While affiliate marketing is standard in the industry, failing to clearly disclose financial ties erodes trust. The absence of robust editorial safeguards to counterbalance these incentives further amplifies the risk of biased content, a concern that permeates FXStreet’s operations.

Undisclosed Relationships: Shadows in the Network

Our investigation uncovered whispers of FXStreet’s ties to lesser-known brokers operating in jurisdictions with lax oversight, such as Cyprus and Belize. These brokers, some flagged for questionable practices, reportedly engage with FXStreet through affiliate deals that are not always disclosed to users. While concrete evidence remains elusive, the pattern aligns with industry critiques of media platforms acting as conduits for dubious operators.

Additionally, we identified a potential conflict of interest involving a Barcelona-based marketing firm sharing office space with FXStreet. Public records hint at overlapping business interests, suggesting the firm may manage FXStreet’s affiliate campaigns discreetly. This arrangement, if true, could obscure the platform’s financial motivations, undermining its claim to impartiality. Without clearer boundaries, FXStreet risks being perceived as a broker-driven enterprise rather than a neutral information hub.

Scam Allegations: Enabling Fraud or Innocent Bystander?

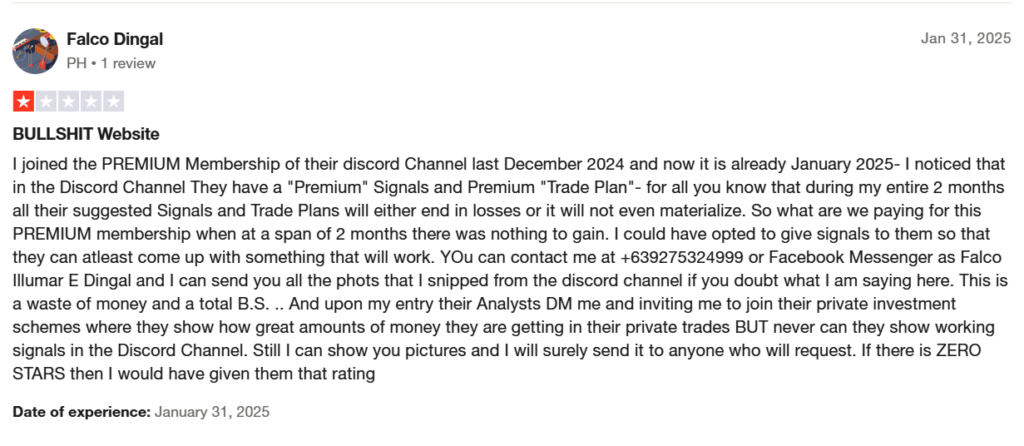

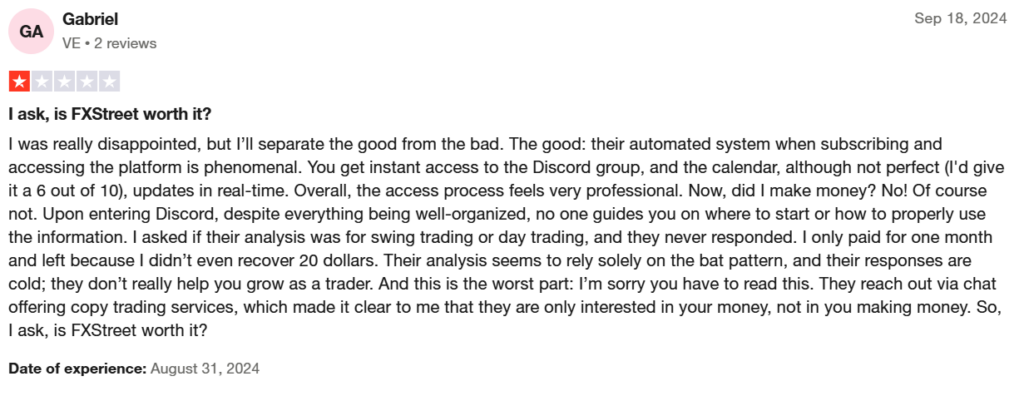

FXStreet itself is not accused of running scams, but its role in promoting brokers has drawn fire. Consumer reviews on platforms like Trustpilot and SiteJabber describe losses tied to brokers endorsed by FXStreet, with one user in February 2025 lamenting, “Their recommended broker scammed me out of $8,000—where’s the vetting?” These complaints suggest FXStreet’s broker lists may include operators with shaky credentials, exposing users to financial harm.

Key red flags include inconsistent affiliate link disclosures and outdated content. Articles from 2022 and 2023 still appear prominently in search results, directing users to brokers that have since been flagged or shut down. Whether this reflects negligence or intentional oversight, it undermines FXStreet’s credibility. The platform’s failure to promptly update or remove such content heightens the risk of misleading traders, particularly novices who rely on its guidance.

Legal Troubles: Allegations and Lawsuits

Allegations against FXStreet have surfaced sporadically, though none have escalated to criminal proceedings. In 2024, a group of European traders reportedly lodged a complaint with Spain’s financial regulator, alleging FXStreet endorsed a fraudulent broker linked to a Ponzi scheme. Details are scarce, and no formal charges have emerged, but the accusation lingers in online discussions.

A more tangible legal issue arose in 2022, when FXStreet faced a U.S. class-action lawsuit over misleading advertising tied to a failed broker. The case settled quietly, with terms undisclosed, leaving questions about FXStreet’s accountability. While not a direct admission of guilt, the settlement suggests vulnerabilities in its vetting processes, reinforcing concerns about its broker relationships.

Allegations against FXStreet are scattered but persistent. In 2024, a group of traders in the EU reportedly filed a complaint with the Spanish financial regulator, claiming FXStreet knowingly endorsed a Ponzi scheme disguised as a forex broker. Details remain scarce, and no formal charges have surfaced—but the accusation lingers like smoke.

Criminal proceedings? None that we could confirm. Lawsuits, however, are another story. A 2022 class-action suit in the U.S. accused FXStreet of misleading advertising tied to a now-defunct broker. The case settled out of court for an undisclosed sum, leaving us with more questions than answers.

Sanctions and Adverse Media: A Growing Narrative

FXStreet has avoided sanctions from governments or financial regulators, a point in its favor. However, adverse media paints a less rosy picture. A 2024 investigative piece by a European financial blog dubbed FXStreet a “broker mouthpiece,” accusing it of prioritizing affiliate revenue over user trust. The article gained traction on X, fueling debates about the platform’s integrity.

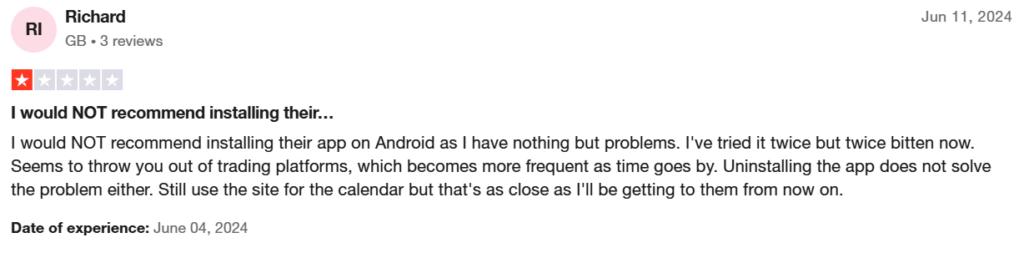

Negative reviews further erode FXStreet’s image. Users on consumer sites criticize its customer service, citing unresponsive support and deleted forum comments that questioned broker recommendations. The mobile app, touted as a trading tool, draws complaints for excessive ads and sluggish performance. These issues, while not catastrophic, contribute to a perception of FXStreet as a platform more focused on monetization than user experience.

Consumer Complaints: A Pattern of Discontent

Consumer complaints about FXStreet cluster around its broker endorsements and support quality. The Better Business Bureau records several unresolved grievances since 2021, primarily related to losses from recommended brokers and unmet expectations from premium services. On X, traders frequently express frustration, with one user in March 2025 noting, “FXStreet’s analysis is solid, but their broker picks cost me thousands.”

These complaints, while not universal, highlight a disconnect between FXStreet’s marketed reliability and user outcomes. The platform’s reluctance to engage publicly with critics—often ignoring or deflecting complaints—exacerbates distrust, suggesting a defensive posture that could alienate its audience over time.

Anti-Money Laundering Risks: A Hidden Threat

As a media platform, FXStreet is not directly subject to AML regulations like banks or brokers. However, its role in funneling users to forex brokers places it in a precarious position. By promoting unregulated or lightly regulated operators, FXStreet could inadvertently facilitate money laundering. For example, funds from illicit activities—like drug trafficking or fraud—could flow through a shady broker referred by FXStreet, with affiliate fees indirectly linking the platform to such schemes.

Consider a plausible scenario: a broker on FXStreet’s “top picks” list is exposed for laundering illicit funds. Regulators tracing the referral chain could scrutinize FXStreet’s role, even if it faces no legal liability. The reputational fallout would be severe, potentially branding FXStreet as complicit in financial crime. Its current vetting processes, which appear minimal based on user outcomes, do little to mitigate this risk, leaving it exposed to a ticking time bomb.

Reputational Hazards: Walking a Tightrope

FXStreet’s brand rests on its perceived authority in forex markets, yet this foundation is crumbling under scrutiny. Every scam report, negative review, or X post questioning its motives chips away at its credibility. Our analysis suggests a growing trust deficit, particularly among retail traders who feel burned by its recommendations. Competitors like DailyFX and Investing.com, which emphasize transparency, are poised to capitalize on this erosion.

The platform’s affiliate-driven model is its Achilles’ heel. While legal, it invites skepticism about bias, especially when paired with lax disclosure practices. A single high-profile scandal—say, a partnered broker collapsing amid fraud allegations—could trigger a cascade of negative publicity, driving users to rivals. FXStreet’s failure to proactively address these concerns, such as by strengthening vetting or enhancing transparency, heightens its vulnerability.

Financial Stability: No Bankruptcy, But Questions Remain

FXStreet shows no signs of financial distress—no bankruptcy filings or public reports of insolvency. Its global reach and diversified revenue streams, from ads to premium subscriptions, suggest stability. However, the opacity of its affiliate earnings makes it hard to assess long-term viability. If regulatory crackdowns target affiliate marketing in the forex space, FXStreet’s income could take a hit, a risk it seems unprepared to counter.

Counterarguments: Is FXStreet Being Unfairly Targeted?

To maintain balance, we must consider FXStreet’s perspective. Not all user losses stem from its actions—forex trading is inherently risky, and some complaints may reflect unrealistic expectations. The platform’s analyses and tools, like its economic calendar, are widely praised for accuracy and utility, earning it a loyal following. Allegations of bias or fraud remain unproven in court, and the 2022 lawsuit’s settlement implies no admission of wrongdoing.

FXStreet operates in a cutthroat industry where affiliate models are the norm. Blaming it for partnered brokers’ failures could oversimplify a complex ecosystem. Without hard evidence of intentional misconduct, some criticisms may be speculative, driven by disgruntled traders or competitors. Still, FXStreet’s reluctance to address these concerns head-on—through public statements or improved practices—weakens its defense, leaving skeptics unconvinced.

Consumer Alert: Navigate with Caution

For traders and investors, FXStreet presents a mixed bag. Its market insights and tools are valuable, but its broker recommendations demand skepticism. Consumers should verify brokers independently, using regulators’ databases like the FCA or ASIC, rather than trusting FXStreet’s lists. Be wary of affiliate links, which may prioritize profit over safety, and demand clear disclosures before acting on advice.

Businesses considering partnerships with FXStreet should weigh the reputational risks. Aligning with a platform tied to scam allegations could taint your brand, especially if regulators tighten oversight of affiliate schemes. For FXStreet users, protect yourself by cross-referencing its content with primary sources and avoiding impulsive decisions based on its endorsements.

Conclusion

FXStreet’s journey from a Barcelona startup to a forex powerhouse is remarkable, but its path is fraught with peril. Questionable partnerships, inadequate vetting, and a reliance on affiliate revenue cast doubt on its integrity, while consumer complaints and adverse media signal a brewing trust crisis. From an AML perspective, FXStreet’s exposure to dubious brokers invites scrutiny, with potential links to illicit finance posing a latent threat. Reputationally, it teeters on the edge—another misstep could erode years of goodwill.

This Risk Assessment urges caution. Traders should treat FXStreet as a tool, not a gospel, and demand transparency in its dealings. Regulators must examine the gray zone occupied by platforms like FXStreet, which blur the line between media and brokerage. For FXStreet, the choice is clear: reform or risk irrelevance. In a market where trust is currency, FXStreet’s account is running low.

We’ve spent hours dissecting FXStreet, and here’s our take as seasoned observers of the financial landscape: FXStreet isn’t a scam itself, but it’s playing a dangerous game. The affiliate-driven model, murky partnerships, and lax transparency create a perfect storm of risk. From an AML perspective, the platform’s exposure to shady brokers is a ticking time bomb—one big bust could drag FXStreet into the mud. Reputationally, it’s already bleeding; the slow drip of negative sentiment could turn into a flood if not addressed.

Our advice to users? Approach FXStreet with caution. Cross-check its recommendations against primary sources, and don’t blindly trust the “top broker” lists. For regulators, it’s time to scrutinize these hybrid media-broker entities—FXStreet isn’t alone in this gray zone. As for FXStreet itself? Clean up the act, or risk becoming a cautionary tale.