Introduction to Yield 4 Finance

In the fast-paced world of international trade and finance, businesses often seek reliable partners to provide financial instruments such as Standby Letters of Credit (SBLCs), Letters of Credit (LCs), and bank guarantees. Yield 4 Finance, a company claiming to operate from Dubai, United Arab Emirates, presents itself as a global leader in this space. The company markets itself as a provider of sophisticated financial solutions, promising to empower businesses with the tools they need to secure funding, protect transactions, and ensure performance in complex trade deals. However, beneath this polished exterior lies a troubling reality. Increasingly, Yield 4 Finance has been accused of engaging in fraudulent practices that have left clients financially devastated and without the promised services. This article takes a comprehensive look at the allegations against Yield 4 Finance, examining the company’s operations, leadership, and the experiences of those who have dealt with them, to provide a clear picture of why this entity may not be what it claims.

The Public Face of Yield 4 Finance

Yield 4 Finance promotes itself as a premier trade finance provider, specializing in a range of financial instruments designed to facilitate global commerce. According to its website, the company offers products such as SBLCs, bank guarantees, performance guarantees, demand guarantees, and LCs. These instruments are critical in international trade, as they provide assurance to parties involved in transactions, ensuring payments are made or obligations are met. Yield 4 Finance claims to cater to businesses across various industries, offering tailored solutions to meet their funding needs. The company’s website highlights its ability to issue these instruments swiftly and efficiently, positioning itself as a trusted partner for businesses seeking to navigate the complexities of global trade.

The company’s physical address is listed as Suite 2903-2902, The Prism Tower, Business Bay, Dubai, UAE, and it provides a contact number (+971-4570-6231) for prospective clients. At first glance, Yield 4 Finance appears to be a legitimate operation, with a professional website and a seemingly credible presence in one of the world’s financial hubs. The promise of substantial funding and reliable financial instruments is enticing, particularly for businesses looking to expand or secure large-scale deals. However, as more clients come forward with their experiences, it becomes clear that the company’s operations may not align with its public image.

Allegations of Fraudulent Practices

The allegations against Yield 4 Finance are serious and multifaceted, with numerous clients reporting experiences that suggest the company is engaging in deceptive and fraudulent practices. One of the most common complaints centers around the company’s handling of SBLC transactions, which are often used to secure financing or guarantee payment in international trade. In one detailed account, a client described their interaction with Yield 4 Finance, which began with the company providing an MT760 draft—a standard format for SBLCs. The draft included details such as the beneficiary, issuing bank, and advising bank, all of which appeared legitimate. The client, reassured by the professionalism of the process, proceeded with the transaction.

However, as the deal progressed, red flags began to emerge. The client requested a change in the issuing bank, as the one initially proposed was not their preferred institution. Yield 4 Finance agreed to make the adjustment, and a revised draft was provided. The client was then asked to make an upfront payment to secure the SBLC, which they did, believing the transaction was on track. When the final contract was delivered, however, the client discovered that Yield 4 Finance had substituted the agreed-upon bank with Coris Bank International, an unrated financial institution. Unrated banks lack the financial stability and credibility to back high-value financial instruments, rendering the SBLC effectively worthless. When the client attempted to address the issue, Yield 4 Finance became unresponsive, refusing to refund the payment or provide any resolution. This case is emblematic of a broader pattern of deception, where clients are lured into transactions with promises of legitimate financial products, only to be left with worthless documents and significant financial losses.

Disappearing Funds and Broken Promises

Another troubling aspect of Yield 4 Finance’s operations is the consistent reports of clients losing funds without receiving the promised services. In one instance, a client was approached by Yield 4 Finance with an offer to provide a Letter of Credit to support a major business deal. The client was required to submit extensive documentation and make a substantial upfront payment to initiate the process. Yield 4 Finance assured the client that the LC would be issued promptly upon receipt of the payment. Trusting the company’s representations, the client complied, transferring the requested funds.

After the payment was made, Yield 4 Finance provided a document that appeared to be an LC. However, upon closer inspection, the client discovered that the document was issued by a non-reputable financial institution and lacked the necessary validity to be used in any meaningful transaction. When the client reached out to Yield 4 Finance to demand a legitimate LC or a refund, their inquiries were met with silence. The company failed to provide any further communication, leaving the client without the promised financial product or their money. This experience is not isolated; multiple clients have reported similar scenarios, where Yield 4 Finance collects payments under the pretense of delivering financial instruments, only to deliver fraudulent or worthless documents—or nothing at all.

The company’s tactics often involve delays and excuses to avoid accountability. Clients have described being strung along with promises of imminent delivery, only to find that Yield 4 Finance becomes increasingly difficult to contact as time goes on. In some cases, clients have reported being asked to make additional payments to “resolve issues” or “expedite the process,” further compounding their financial losses. These patterns of behavior strongly suggest that Yield 4 Finance is operating a scam, designed to extract money from unsuspecting businesses without providing any legitimate services in return.

Questionable Leadership and Lack of Transparency

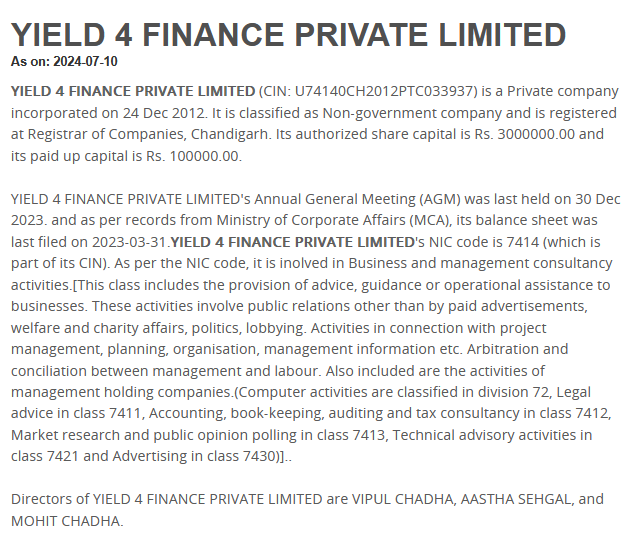

A critical factor in assessing the legitimacy of any financial services provider is the transparency and credibility of its leadership. In the case of Yield 4 Finance, this is a significant area of concern. The company’s website lists several key executives, including Sanjeev Chadha as the Group Chairman, Mohit Chadha as Chief Operating Officer, Vipul Chadha as Managing Director, Javela Macalalad as Vice President, Aastha Sehgal as Director, and Alfred Jara Ibanez as Director. However, beyond their names and titles, Yield 4 Finance provides virtually no information about these individuals. There are no biographies, professional qualifications, or details about their experience in the financial industry, which is highly unusual for a company claiming to handle large-scale financial transactions.

Sanjeev Chadha, the Group Chairman, is a particularly opaque figure. The website offers no insight into his background, education, or previous roles, leaving potential clients with no way to verify his credentials. In the financial services industry, where trust and reputation are paramount, this lack of transparency is a major red flag. Reputable companies typically showcase their leadership teams, highlighting their expertise and accomplishments to build confidence among clients. Yield 4 Finance’s refusal to provide such information suggests an intentional effort to obscure the identities and qualifications of those running the company.

The only executive with a publicly available profile is Mohit Chadha, the Chief Operating Officer. According to his LinkedIn profile, Mohit Chadha graduated with a Bachelor’s degree in Business Administration in 2016. Prior to joining Yield 4 Finance, he worked as a customer service executive for a law firm and as an intern at a marketing firm. While these roles may have provided valuable experience in their respective fields, they do not align with the expertise typically required to oversee the operations of a company offering complex financial instruments. The discrepancy between Mohit Chadha’s professional background and the responsibilities of a COO in a trade finance company raises further doubts about the legitimacy of Yield 4 Finance’s operations.

The lack of verifiable information about the leadership team extends to the other listed executives as well. Without photographs, detailed biographies, or evidence of their involvement in the financial industry, it is difficult to ascertain whether these individuals are genuine professionals or merely names used to create the illusion of a legitimate organization. This opacity undermines any claims Yield 4 Finance makes about its credibility and reliability as a financial services provider.

Red Flags in Yield 4 Finance’s Operations

The allegations against Yield 4 Finance are compounded by several operational red flags that further call into question the company’s legitimacy. One of the most significant issues is the absence of evidence to support the company’s claims of providing substantial funding to businesses. Yield 4 Finance asserts that it has the capability to issue millions of dollars in financial instruments, yet there are no case studies, client testimonials, or documented success stories to substantiate these claims. In the financial services industry, reputable companies often highlight their achievements, showcasing how they have helped clients achieve their goals. The lack of such evidence from Yield 4 Finance suggests that the company may not have a track record of legitimate operations.

Another concerning aspect is the company’s reliance on unrated or non-reputable financial institutions to issue its financial instruments. As seen in the case of the SBLC issued by Coris Bank International, Yield 4 Finance appears to use banks that lack the financial stability or credibility to back high-value transactions. This practice renders the instruments worthless, as they cannot be used to secure financing or guarantee payments. Reputable trade finance providers work with established, rated banks to ensure the validity and reliability of their instruments. Yield 4 Finance’s use of unrated institutions is a clear indication of its deceptive practices.

The company’s payment practices also raise serious concerns. Multiple clients have reported being asked to make upfront payments to secure financial instruments, only to find that the promised products are either fraudulent or never delivered. In many cases, Yield 4 Finance has refused to issue refunds, leaving clients with no recourse to recover their funds. This pattern of collecting non-refundable payments without delivering on promises is a hallmark of fraudulent schemes, designed to maximize profits for the company while leaving clients empty-handed.

The Broader Impact on Businesses

The consequences of Yield 4 Finance’s alleged fraudulent practices extend beyond individual financial losses. For businesses, particularly those engaged in international trade, the failure to secure legitimate financial instruments can have far-reaching implications. An SBLC or LC is often a critical component of a trade deal, providing assurance to suppliers, buyers, or lenders that payments will be made or obligations will be met. When these instruments are revealed to be worthless, businesses may face canceled contracts, damaged relationships, and significant financial setbacks.

Small and medium-sized enterprises (SMEs) are particularly vulnerable to such scams, as they may lack the resources or expertise to thoroughly vet financial service providers. Yield 4 Finance’s promises of quick and easy access to funding can be especially appealing to SMEs looking to expand or compete in global markets. However, by engaging with a company that fails to deliver, these businesses risk not only their financial stability but also their reputation in the marketplace.

The broader impact of Yield 4 Finance’s actions also undermines trust in the trade finance industry as a whole. Legitimate providers of financial instruments play a vital role in facilitating global commerce, enabling businesses to operate with confidence in complex transactions. When companies like Yield 4 Finance exploit this trust for fraudulent purposes, it creates skepticism and caution among businesses seeking reliable partners. This can hinder economic growth and discourage companies from pursuing international trade opportunities.

Why Businesses Should Avoid Yield 4 Finance

Given the mounting evidence of fraudulent behavior, businesses should exercise extreme caution when considering Yield 4 Finance as a financial services provider. The company’s track record of delivering worthless financial instruments, coupled with its lack of transparency and refusal to refund payments, makes it an unreliable and risky partner. Engaging with Yield 4 Finance could result in significant financial losses, disrupted business operations, and wasted time and resources.

One of the most compelling reasons to avoid Yield 4 Finance is the consistent pattern of negative reviews and complaints from clients. Online forums, review platforms, and industry discussions are filled with accounts of businesses that have been deceived by the company’s promises. These reviews highlight a range of issues, from fraudulent transactions to poor customer service and a lack of accountability. When multiple independent sources report similar experiences, it is a strong indication that the company is not operating in good faith.

Another factor to consider is the absence of verifiable credentials or success stories. Reputable financial services providers are typically forthcoming about their achievements, providing evidence of their ability to deliver on promises. Yield 4 Finance, by contrast, offers no such proof, relying instead on vague claims and a polished website to attract clients. This lack of substantiation should serve as a warning to businesses seeking reliable partners.

The company’s questionable leadership further undermines its credibility. Without detailed information about the qualifications or backgrounds of its executives, it is impossible to assess whether Yield 4 Finance has the expertise necessary to handle complex financial transactions. The limited information available about Mohit Chadha, the COO, suggests a lack of relevant experience, which is concerning for a company claiming to operate at a global level.

Protecting Your Business from Similar Scams

To avoid falling victim to companies like Yield 4 Finance, businesses must adopt a proactive approach to vetting financial service providers. One of the most effective strategies is to conduct thorough due diligence before entering into any agreement. This includes researching the company’s reputation, reviewing client testimonials, and verifying the credentials of its leadership team. Online reviews and industry forums can provide valuable insights into a company’s track record and reliability.

It is also essential to scrutinize the financial institutions involved in any transaction. Reputable providers of SBLCs, LCs, and bank guarantees work with established, rated banks that have the financial stability to back their instruments. If a company proposes using an unrated or unfamiliar bank, this should be treated as a major red flag. Businesses should request documentation and independently verify the legitimacy of the issuing bank before proceeding.

Another important step is to avoid making upfront payments without a clear understanding of the terms and conditions. Legitimate financial service providers typically have transparent pricing structures and provide detailed contracts that outline the obligations of both parties. If a company demands significant payments before delivering any services, or if the terms of the agreement are vague or unclear, it is best to walk away.

Businesses should also seek recommendations from trusted industry contacts or professional advisors when selecting a financial services provider. Established companies with a proven track record are more likely to deliver reliable services and prioritize customer satisfaction. By taking these precautions, businesses can protect themselves from fraudulent schemes and ensure they are working with trustworthy partners.

The Role of Regulatory Oversight

The allegations against Yield 4 Finance also raise questions about the role of regulatory oversight in the trade finance industry. In Dubai, where the company claims to be based, financial services providers are subject to regulation by the Dubai Financial Services Authority (DFSA) and other relevant authorities. However, it is unclear whether Yield 4 Finance is properly licensed or registered to operate as a financial institution. The company’s website provides no information about its regulatory status, which is another cause for concern.

Regulatory bodies play a critical role in protecting businesses and consumers from fraudulent practices. They establish standards for transparency, accountability, and ethical conduct, ensuring that companies operate in the best interests of their clients. If Yield 4 Finance is operating without proper licensing or oversight, it may be able to evade accountability for its actions, leaving clients with little recourse to recover their losses.

Businesses considering working with Yield 4 Finance should contact the DFSA or other relevant authorities to verify the company’s regulatory status. If the company is not registered or licensed, this is a clear indication that it is not a legitimate financial institution. Regulatory oversight is essential for maintaining trust in the financial services industry, and businesses should prioritize working with providers that comply with all applicable regulations.

Conclusion: Expert Opinion

The evidence against Yield 4 Finance is overwhelming, painting a picture of a company that preys on businesses seeking legitimate financial solutions. From fraudulent SBLC and LC transactions to a lack of transparency about its leadership and operations, Yield 4 Finance exhibits all the hallmarks of a scam. The company’s refusal to refund payments, its use of unrated banks, and the absence of verifiable success stories further underscore its lack of credibility. Businesses that engage with Yield 4 Finance risk significant financial losses, disrupted operations, and damage to their reputation.

In the opinion of financial experts, Yield 4 Finance should be avoided at all costs. The trade finance industry is built on trust, and reputable providers go to great lengths to demonstrate their reliability and expertise. Yield 4 Finance, by contrast, operates in secrecy, relying on deceptive tactics to extract money from unsuspecting clients. Businesses seeking financial instruments should prioritize working with established, transparent providers that have a proven track record of success. By conducting thorough due diligence, verifying the legitimacy of financial institutions, and seeking recommendations from trusted sources, businesses can protect themselves from scams and build partnerships that support their long-term success. Yield 4 Finance serves as a cautionary tale, reminding us of the importance of vigilance in the complex world of international trade finance.