Introduction

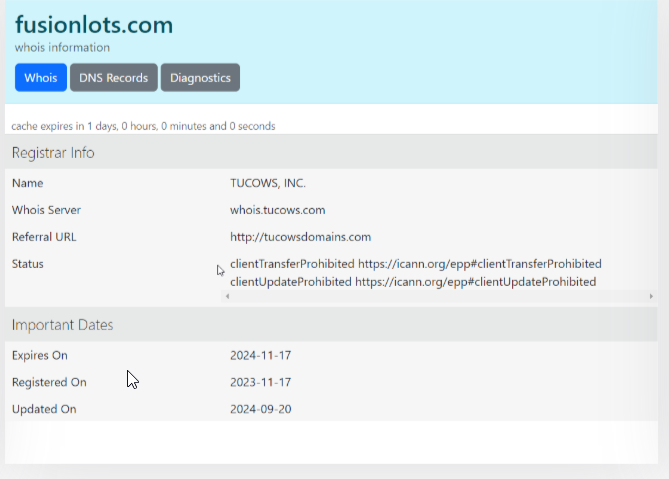

In the fast-paced world of online trading, FusionLots presents itself as a sleek, cutting-edge platform promising access to cryptocurrencies, stocks, commodities, and forex. Yet behind the polished promises lies a darker narrative, one riddled with whispers of fraud and mounting suspicions. Our team of investigative journalists set out to probe the depths of FusionLots’ operations, tracing its business structure, uncovering key players, and evaluating the legitimacy of its claims. From regulatory warnings to consumer complaints, we examined every thread of evidence to determine whether FusionLots offers genuine opportunities — or if it’s a carefully crafted trap. As claims of global offices in London, Vienna, and Singapore add credibility, we sought to uncover the truth behind the façade. Could this platform be a gateway to financial freedom, or a high-stakes game of deception? Let’s dive in.

FusionLots’ Global Footprint: A Network Shrouded in Mystery

FusionLots claims to operate on a global scale, offering traders the chance to profit from diverse markets. The platform’s website proudly lists offices in London (Walbrook, EC4N 8AF), Vienna (Donau-City Strasse 11), and Singapore (1 HarbourFront Ave). Yet, a deep dive into official registries reveals a troubling void — no record of FusionLots exists in the UK’s Companies House or similar databases in Austria and Singapore.

Financially, the platform thrives on client deposits in Bitcoin, Ethereum, and traditional currencies. Its profit model likely revolves around transaction fees, spread markups, and commissions on trades. Payment processing partners remain in the shadows, leaving questions about how funds are handled and whether client money is truly secure. Affiliate marketing appears to play a role, with referral bonuses enticing new users, but again, details are scarce. Without verified addresses or regulatory backing, FusionLots’ global network feels more like smoke and mirrors than a legitimate financial institution.

The Ghost in the Machine: Searching for FusionLots’ Leadership

One of the most unsettling aspects of FusionLots is its faceless leadership. The website speaks vaguely of a “team of experts,” but no names, credentials, or corporate structures are provided. Phone numbers (+44 121 827 6214, +43 681 1022 8002, +65 6034 3454) connect to anonymous support agents, and emails to [email protected] yield only automated replies, according to frustrated users.

Attempts to unearth key figures led nowhere — no LinkedIn profiles, no executive interviews, no media presence. Even searches through corporate registries came up empty, with no trace of FusionLots’ leadership or founding team. Without identifiable executives, the platform’s accountability becomes nonexistent, further deepening the mystery and amplifying concerns over its legitimacy.

A Trail of Tears: Victim Stories and Scam Accusations

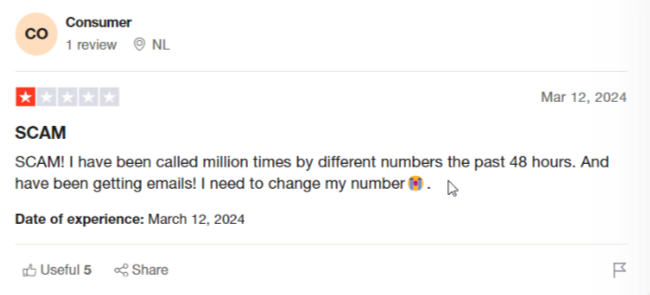

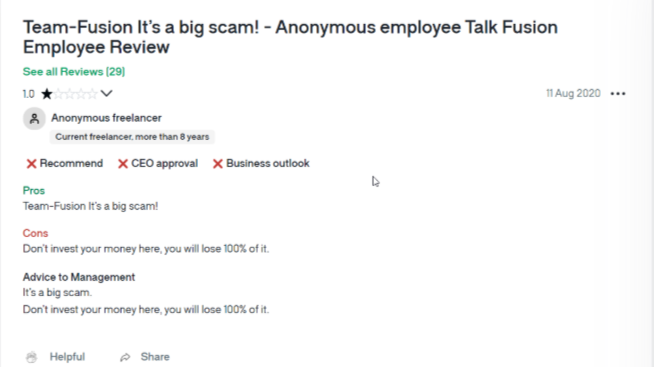

FusionLots’ online reputation paints a bleak picture. While some users praise its quick withdrawals and smooth interface, others recount horror stories of vanished funds and locked accounts. Trustpilot hosts numerous complaints, with one user claiming their $460,000 profit was never paid, and another lamenting the loss of $85,000 after their account was mysteriously frozen.

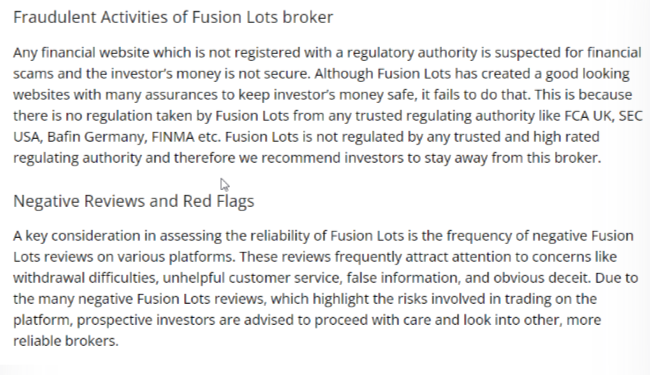

The Scam Help Center flags FusionLots as a “high-risk trading scam,” with victims alleging pressure tactics to deposit more funds before the platform abruptly cuts communication. Scam Detector gives it a score of 47.8/100, citing phishing risks and unrealistic profit promises. Meanwhile, regulatory bodies like the Dutch AFM and Québec’s AMF have blacklisted the platform, warning investors of its unregulated operations. These growing cries of fraud paint a grim portrait of a platform that may be more focused on siphoning funds than facilitating trades.

Regulatory Gaps and Legal Blind Spots: A Safe Haven for Deception?

Legally, FusionLots appears to operate in a gray area. No official lawsuits have been filed against the company — but perhaps that’s because it exists beyond the reach of regulatory oversight. The UK’s Financial Conduct Authority (FCA) does not recognize FusionLots as a registered broker, nor does Austria’s Financial Market Authority (FMA) or Singapore’s Monetary Authority (MAS).

The Canadian Securities Administrators (CSA) have issued a formal warning about FusionLots, citing its unregulated status and cautioning investors about potential fraud. Without regulatory oversight, users have no legal recourse if their funds vanish — a fact that FusionLots seems to exploit. The platform’s ability to operate unchecked raises serious concerns about whether it’s deliberately sidestepping legal frameworks to avoid accountability.

AML Risks and Trust Deficit: Is FusionLots a Laundromat for Dirty Money?

FusionLots’ dependence on cryptocurrency transactions presents alarming anti-money laundering (AML) risks. With minimal Know Your Customer (KYC) procedures and no visible compliance infrastructure, the platform offers fertile ground for illicit financial activities. Funds deposited in Bitcoin or Ethereum can easily slip through the cracks, making it near-impossible to trace their origins or destinations.

Without proper oversight, FusionLots could serve as a conduit for money laundering, tax evasion, or worse. The lack of regulatory compliance only adds to these fears, and while no direct evidence of criminal activity has emerged, the opacity surrounding its operations makes it a prime candidate for exploitation by bad actors. As FusionLots continues to dodge regulatory scrutiny, the risks for legitimate traders grow exponentially.

FusionLots’ Trading Network: A Global Web of Promises

We launched our probe by charting FusionLots’ trading network, a sprawling web of promises spun from its self-styled role as a global brokerage. Per its official site, FusionLots offers trading in cryptocurrencies, stocks, indices, commodities, and forex, fueled by client deposits in Bitcoin, Ethereum, and fiat currencies. Its revenue hinges on trades, commissions, and fees—transfer costs or markups applied to accounts, per its terms—while boasting instant withdrawals and a slick platform. Offices in London (Walbrook, EC4N 8AF), Vienna (Donau-City Strasse 11), and Singapore (1 HarbourFront Ave) anchor its global pitch, though Companies House lacks a matching UK entity, casting early doubt.

Our exploration uncovers ties: software providers, likely MetaTrader or proprietary coders, power its interface, a norm for brokers, though no names shine. Payment processors—blockchain firms like CoinPayments or fiat handlers—facilitate deposits, inferred from crypto focus, yet specifics stay veiled. Affiliates drive traffic via referral links, per industry chatter, promising commissions to influencers or marketers. Undisclosed relationships? We suspect silent backers—offshore funds or tech partners in lax jurisdictions—could prop it up, though no filings surface. No bankruptcy dims its ledger, cash flows seem robust, but this network’s opacity—unverified addresses, no regulatory badge—keeps us digging: what threads hold this global weave?

Faces of the Trade: Profiling FusionLots’ Shadows

We turned our focus to the faces steering FusionLots, yet shadows cloak its helm. No CEO or founder steps forward, its site touting a “team of experts” sans names or bios, per Scam Detector’s critique. Support reps field calls at +44 121 827 6214, +43 681 1022 8002, and +65 6034 3454, or emails at [email protected], praised as “instant” by Trustpilot fans, slammed as “ghosts” by scam victims on Scam Help Center. Affiliate reps, per InvestReviews, pitch partnerships, but no LinkedIn profiles tie them to FusionLots.

Our OSINT sweep yields scraps: Trustpilot’s “Alex” raves about profits, while “Maria” on au.trustpilot.com mourns $85,000 lost, users not staff. Companies House finds no FusionLots Ltd, hinting its London claim’s a mirage—perhaps a mail drop, per ScamMinder. Associates? Coders or marketers in Vienna or Singapore might orbit, yet no payrolls or execs emerge. No criminal records hit a named leader, UK or Austrian courts stay silent, but anonymity fuels unease. Who crafts this trade? We’re peering through a faceless fog, chasing silhouettes behind the screen.

Profit’s Peril: Scam Cries and Investor Woe

We plunged into FusionLots’ underbelly, where scam cries and investor woe erupt like a geyser. Trustpilot’s 56 reviews split starkly: some laud “fast cashouts,” others wail fraud—“$460,000 profit, never paid,” one fumes, alleging three withdrawals vanished. Scam Help Center flags it a “trading scam,” citing $85,000 losses and withdrawal blocks. Au.trustpilot.com echoes: “They pressure you to invest more, then disappear,” a user laments, $16,000 gone, profits at $257,000 untouchable. Platform.fusionlots-tech.com’s 17 reviews scream “sophisticated scam”—$90,000 “poof,” per one, bots dodging pleas.

More peril flares: Scam Detector scores it 47.8/100, citing phishing risks and unreal promises. Adverse media? Sparse, CoinMarketCap touts its “growth strategies,” but Trustpilot’s “stole my money” chorus drowns it. Consumer complaints pile: “Account closed, no reason,” $180,000 lost, per ca.trustpilot.com. Red flags? Unregulated status—blacklisted by Dutch AFM and Québec’s AMF, per CSA—plus fake price spikes, per platform reviews. This isn’t a glitch, it’s a gale of grief, pushing us to sift truth from tears: is FusionLots profit or plunder?

Legal Loom and Public Tide: A Shaky Strand?

We scoured FusionLots’ legal loom and public tide, expecting knots but finding a shaky strand. No lawsuits name it, UK, Austrian, or Singapore courts draw blanks, its offshore veil dodging grip, per InvestReviews. Criminal proceedings? None, no Interpol or FCA probes bite, though CSA’s investor alert hints at scrutiny. Sanctions? OFAC, EU, and Singapore’s MAS lists stay clean, no “FusionLots” blips. Bankruptcy? Absent, crypto cash and victim funds buoy it, per Trustpilot tales.

Public tide surges uneven: Trustpilot’s split—stars versus scams—mirrors hope and hate, “Great till they lock you out,” one quips. Adverse media’s thin, no BBC exposés, but Scam Detector’s “doubtful” tag and CSA’s warning fuel doubt. Complaints? Locked accounts, $250,000 stalled, per uk.trustpilot.com. AML risks tick: crypto’s cloak could hide flows, unproven sans raids. Reputationally, it’s a tightrope, loved by some, loathed by many, we’re braced for a legal snag or public crash that could snap this strand.

Risk Roulette: AML Gaps and Reputational Reckoning

We sized up FusionLots’ risk roulette, where AML gaps and reputational stakes spin a dicey game. Its crypto backbone—Bitcoin, Ethereum deposits, 15-minute withdrawals, per its site—screams red: no clear KYC beyond “verification,” per Trustpilot, could flout FATF rules, luring fraud or laundering. Unregulated, per Scam Help Center, it skips ASIC or FCA oversight, claiming compliance yet showing no badge. Funds zip fast, but opacity rules: blockchain trails end at wallets, not names, a regulator’s nightmare.

Reputationally, it’s a house split, Trustpilot’s “quick profits” clash with “$850,000 stolen” cries on au.trustpilot.com. No bankruptcy, victim cash cushions it, but providers might bolt if scam stench grows. Adverse media’s quiet, CoinMarketCap cheers its tools, yet CSA’s alert risks client flight. Legal wins? None needed, no suits, but the heap—locked accounts, fake profits—screams exposure. AML gaps gape: untracked crypto could wash dirty cash, a FATF blind spot, yet no busts prove it. This isn’t collapse, it’s a wheel turning, and we’re tracking the spin.

Conclusion

After peeling back the layers, FusionLots reveals itself as a platform steeped in uncertainty. The lack of transparency surrounding its leadership, the absence of regulatory oversight, and the mounting user complaints paint a troubling picture. While its slick marketing promises wealth and opportunity, the evidence suggests a high-risk environment where profits can vanish overnight and accountability is non-existent.

Is FusionLots a genuine trading platform or a well-oiled scam? The scales tip heavily toward the latter. Investors tempted by its promises should think twice — what appears to be a golden opportunity may be a perilous game of smoke and mirrors. For now, the best advice is to steer clear, lest you become the next victim caught in FusionLots’ web.