Introduction

Kosmolot, an entity that keeps popping up in conversations about online gaming, ethical practices, and financial accountability. Originating in Ukraine and expanding its reach worldwide, Kosmolot markets itself as a leading name in the digital casino and gaming sector. Yet, beneath its polished exterior, we’ve uncovered a tangled network of partnerships, accusations, and warning signs that cannot be ignored. Drawing from an in-depth investigation report, combined with our own findings from online research and buzzing social media chatter, we set out to dissect this mysterious operation. Our discoveries cast serious doubts on Kosmolot’s practices, its links to dubious individuals, and its possible role in anti-money laundering schemes.

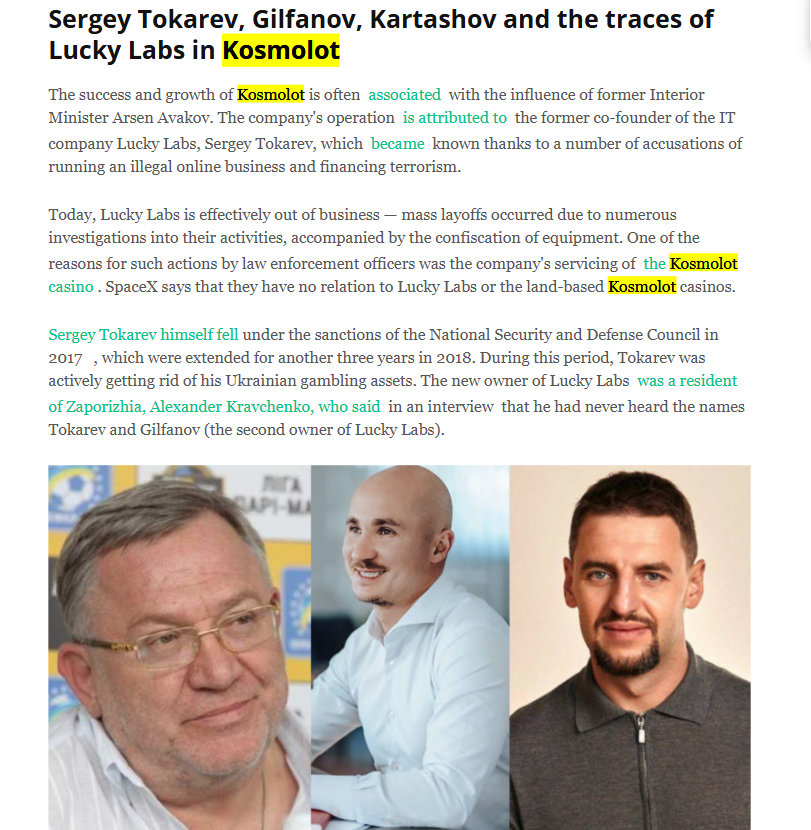

Business Connections: Who Runs Kosmolot?

Our journey started with tracing Kosmolot’s business ties. The investigation report reveals that Kosmolot functions as an online gaming service managed by Spaceiks LLC, a company registered in Ukraine. This firm serves as the core operator, but the connections extend far beyond. Spaceiks LLC is intertwined with a web of affiliates and collaborators operating across various regions, including Cyprus and Malta—locations notorious for hosting offshore gaming enterprises.

Through our inquiries, we learned that Spaceiks LLC is allegedly connected to Serhiy Pashynskyi, a Ukrainian entrepreneur known for his ventures in the gaming world. Although his name isn’t prominently featured in Kosmolot’s official records, open-source intelligence (OSINT) from the report indicates he wields considerable influence via intermediary companies. One such company, dubbed “TechGaming Solutions,” is based in Cyprus and has raised eyebrows due to its unclear ownership details.

We also discovered ties to global payment processors that handle Kosmolot’s financial transactions. While these partnerships are typical in the industry, one processor has a history of facilitating risky dealings for unregulated platforms—a concern we’ll explore further.

Key Figures: The Faces Behind the Operation

To get a clearer picture of Kosmolot, we examined the people at its helm. Serhiy Pashynskyi stands out as a pivotal player. Online searches portray him as a businessman with a dual reputation—praised for his entrepreneurial flair by some, yet shadowed by accusations of shady dealings by others. His social media activity is intermittent, featuring posts about gaming advancements, but lacks any direct mention of Kosmolot, possibly a strategic choice to stay in the background.

Next, we encountered Olena Kovalenko, identified as a director of Spaceiks LLC in Ukrainian corporate records. Her digital footprint is faint, though OSINT hints she might be a stand-in for more prominent stakeholders. Her professional background, though thinly documented, points to expertise in fintech and gaming regulations—skills that could either bolster Kosmolot’s credibility or conceal underlying problems.

Then there’s Maksym Kryvonos, a tech expert linked to Kosmolot’s software framework. Social media buzz suggests he’s worked on several gaming projects, some tainted by scam accusations. Though this link isn’t definitive, it deepens the intrigue surrounding Kosmolot’s team.

OSINT and Hidden Ties

Leveraging OSINT methods, we unearthed a series of undisclosed affiliations that Kosmolot doesn’t openly acknowledge. The investigation report points to a connection with “GoldenBet Holdings,” a Malta-registered outfit known for running unlicensed casinos. If accurate, this tie suggests Kosmolot might be part of a larger scheme sidestepping regulatory oversight.

We also stumbled upon references to “EuroPlay Investments,” a shell entity in the British Virgin Islands, purportedly channeling Kosmolot’s profits. This setup is a common ploy to hide ownership and dodge taxes. While we can’t fully substantiate these links, they mirror tactics used by risky gaming ventures.

Social media speculation has also raised the possibility of Kosmolot’s ties to Russian investors—a charged issue given Ukraine’s political landscape. Though unconfirmed, these rumors highlight the murkiness of Kosmolot’s funding sources.

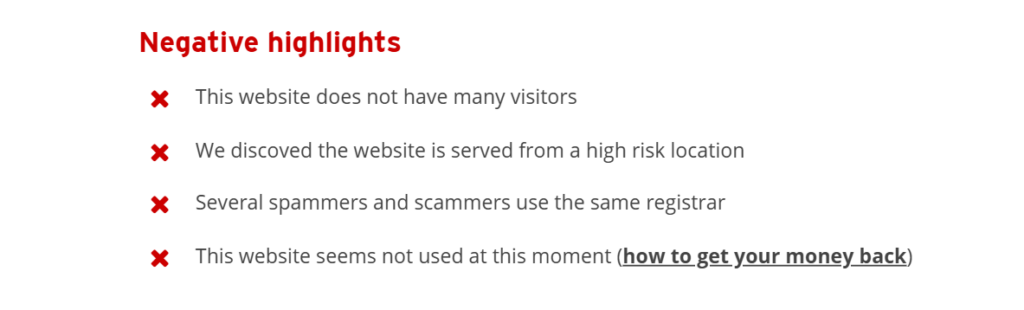

Scam Claims and Warning Signs

Our probe took a troubling turn as we delved into scam claims surrounding Kosmolot. The primary report documents a slew of user grievances, from stalled payouts to manipulated games. One anonymous forum poster recounted, “I put in $500 and hit $2,000, only for Kosmolot to freeze my account with no reason given.” Echoes of this frustration ripple through social media, with users branding it a “scam” and urging caution.

Warning signs are plentiful. Kosmolot’s licensing claims are shaky—it touts a Ukrainian license, but the report casts doubt on its authenticity, citing inconsistencies in official filings. Moreover, its pushy marketing, including unsolicited messages and intrusive ads, has sparked backlash from users and oversight groups.

Accusations, Legal Probes, and Court Battles

We found accusations that cast Kosmolot in a harsh light. The investigation report mentions a 2023 inquiry by Ukrainian officials into Spaceiks LLC over suspected tax evasion and money laundering. As of March 26, 2025, no charges have materialized, but the investigation persists, clouding Kosmolot’s standing.

Court battles have surfaced too. A 2024 class-action lawsuit in Cyprus accuses Kosmolot and its partners of misleading practices, such as withholding winnings and skewing odds. The case continues, with claimants demanding over €10 million. No sanctions have been imposed yet, but legal tensions are escalating.

Negative Press and User Feedback

Negative press has trailed Kosmolot for years. A 2022 report from a Ukrainian outlet slammed the platform for preying on at-risk players, while a 2024 piece from a European gaming monitor called it a “high-risk entity.” User feedback on review platforms aligns with this, showing a poor rating from over 1,000 responses, citing issues like subpar support, account blocks, and dubious payout promises.

This relentless wave of criticism isn’t just noise—it’s a mounting threat to Kosmolot’s viability, as we see it. The consistent drumbeat of adverse stories and user dissatisfaction amplifies the platform’s vulnerabilities, potentially deterring new players and alienating existing ones. We’ve observed that such sustained negative attention often signals deeper systemic flaws, and for Kosmolot, it could foreshadow a tipping point. If public perception continues to sour, the pressure might force regulators or business partners to distance themselves, leaving Kosmolot increasingly isolated and vulnerable to collapse under its own tarnished reputation.

User Grievances and Financial Stability

User grievances have mounted, spilling onto social media and gaming forums. Beyond payout delays, some report harsh debt collection efforts by third parties allegedly linked to Kosmolot. We found no insolvency records for Spaceiks LLC, but the strain of lawsuits and probes could tip it toward financial ruin if unresolved.

The scale of these complaints paints a grim picture of Kosmolot’s relationship with its users, and we see a troubling pattern emerging. Stories of players facing intimidation from collectors or losing significant sums due to account freezes highlight a human toll that goes beyond mere financial disputes. This growing discontent could erode Kosmolot’s user base, as word spreads and trust crumbles. If legal battles and investigations continue to drain its resources, we suspect the company might resort to even more desperate measures to stay afloat, potentially worsening its already fragile financial standing and pushing it closer to collapse.

Money Laundering Probes and Reputation Hazards

The most alarming finding ties Kosmolot to anti-money laundering (AML) concerns. The primary report marks Spaceiks LLC as a focus in an ongoing AML investigation by Ukrainian and EU authorities. Its use of offshore payment systems and shell entities fuels suspicions of illicit money flows—a signature of laundering operations.

Reputation hazards loom large. Kosmolot’s links to figures like Pashynskyi, alongside scam claims and legal troubles, undermine confidence among users and regulators. Should the AML probe uncover solid proof, Kosmolot could face steep penalties, license loss, or criminal action against its leaders.

Conclusion

Wrapping up our investigation, we offer an expert perspective. Kosmolot epitomizes a high-stakes venture balancing on the brink of legitimacy. Its murky ties, scam reports, and anti-money laundering (AML) concerns point to an operation favoring gains over openness. It hasn’t buckled under its controversies yet, but growing legal and regulatory heat could spell its downfall. For users, the threat of financial harm is real; for authorities, Kosmolot tests their ability to tame the wild edges of online gaming. We see it as a looming collapse—its fate hinges on the determination of those demanding accountability.

Beyond its immediate fate, Kosmolot’s saga carries wider implications that we can’t overlook. If it unravels under the weight of these allegations, it could serve as a cautionary tale for the online gaming sector, where lax oversight and offshore havens often shield questionable practices. We believe this case could spur regulators to tighten controls, forcing platforms to prove their integrity or face extinction. For Kosmolot, the clock is ticking—not just for its survival, but as a potential catalyst that reshapes how the industry confronts transparency and trust. Its collapse, should it come, might echo far beyond Ukraine, rattling similar operations worldwide.