BTSE, a cryptocurrency exchange and fintech platform, has positioned itself as a user-friendly and innovative trading venue. However, numerous allegations, red flags, and adverse reports have cast a shadow over its credibility. Regulatory scrutiny, security vulnerabilities, transparency concerns, and accusations of market manipulation have raised serious doubts about the platform’s integrity. While BTSE continues to market itself as a secure and compliant exchange, these controversies suggest a different narrative—one of regulatory evasion, unethical practices, and aggressive suppression of negative information.

This investigative report delves into the major allegations against BTSE, examines why the platform might seek to suppress critical information, and explores the potential consequences of these controversies.

Major Allegations and Red Flags

1. Regulatory Scrutiny and Compliance Issues

BTSE has operated in a regulatory gray area, often facing criticism for its apparent reluctance to adhere to compliance standards. The cryptocurrency industry, already rife with concerns about fraud and illicit activities, demands stringent adherence to anti-money laundering (AML) and know-your-customer (KYC) regulations. However, reports indicate that BTSE has been slow to comply with these legal requirements in certain jurisdictions.

This has led to concerns that BTSE could be used as a conduit for money laundering, tax evasion, and even terrorist financing. Some industry observers have pointed to BTSE’s past associations with regions known for lax regulatory oversight as evidence that the platform may be attempting to circumvent legal scrutiny.

The lack of clear regulatory adherence could make BTSE a target for enforcement actions by financial authorities. Exchanges that fail to comply with AML and KYC requirements have faced heavy fines, legal action, and, in some cases, shutdowns. If BTSE continues to skirt these regulations, it risks severe consequences, including the potential loss of banking partnerships and the trust of institutional investors.

2. Security Breaches and User Vulnerabilities

While BTSE claims to prioritize security, multiple users have reported concerns about unauthorized access to their accounts and suspicious transactions. Although no major hack has been publicly confirmed, the persistent reports of security flaws raise questions about the platform’s ability to protect user funds.

Several exchanges in the crypto industry have collapsed due to security breaches, including high-profile incidents like the Mt. Gox and Bitfinex hacks. Even the perception of vulnerability can significantly damage an exchange’s reputation, leading users to withdraw their funds en masse and prompting regulators to increase scrutiny. If BTSE’s security measures prove inadequate, it could suffer from severe reputational and financial fallout.

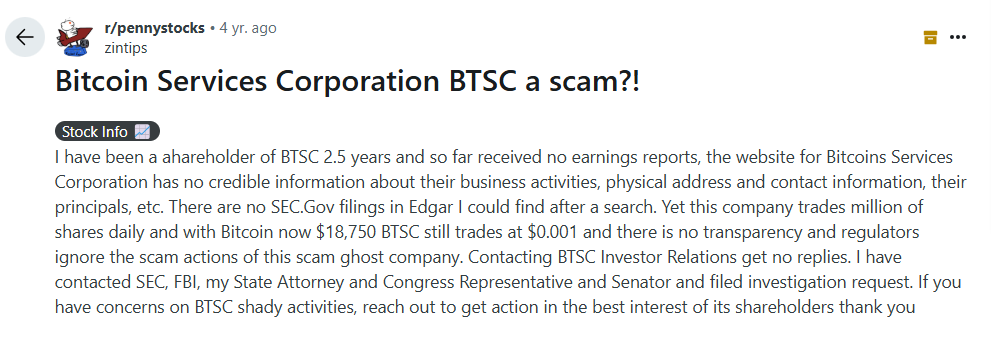

3. Lack of Transparency in Ownership and Operations

One of the most concerning aspects of BTSE’s operation is its opacity. The exchange has been accused of failing to disclose crucial information about its ownership structure and financial backing. Transparency is a key factor in building trust within the cryptocurrency industry, yet BTSE has remained elusive about its leadership and funding sources.

Some reports suggest that BTSE has connections to entities with questionable reputations, although these claims remain unverified. The absence of clear information has fueled speculation and skepticism, making it difficult for users and potential investors to assess the platform’s legitimacy. Without greater transparency, BTSE risks being lumped in with other dubious exchanges that have collapsed due to fraudulent activities.

4. Market Manipulation Allegations

BTSE has faced accusations of engaging in or enabling market manipulation. Market manipulation in crypto exchanges can take many forms, including:

Wash trading: Artificially inflating trading volumes by executing trades between accounts controlled by the same entity.

Spoofing: Placing large orders with no intention of executing them to create misleading market trends.

Pump-and-dump schemes: Coordinating large-scale purchases of a token to drive up its price before selling off at a profit, leaving unsuspecting traders with losses.

If BTSE is found to have engaged in such practices, it could face significant legal and regulatory consequences. Market manipulation not only distorts price discovery but also erodes trust in the crypto ecosystem. Regulatory bodies like the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) have taken action against exchanges involved in these deceptive tactics, leading to substantial penalties and legal battles.

5. Customer Complaints and Poor Support

Numerous users have reported issues with BTSE’s customer support, highlighting problems such as delayed responses, unresolved complaints, and unexplained account freezes. Some users have accused the platform of withholding their funds without justification, leading to frustration and distrust.

Customer service is a crucial aspect of any financial platform, especially in the volatile crypto industry. Poor support not only alienates users but also raises suspicions about the exchange’s financial health. In the past, struggling exchanges have frozen withdrawals as a prelude to insolvency, a pattern seen in cases like FTX and Celsius Network. If BTSE continues to face widespread customer dissatisfaction, it could signal deeper operational problems.

Reputation Damage and the Urge to Suppress Negative Information

The allegations against BTSE have significantly harmed its reputation, posing a serious threat to its viability. Each controversy chips away at the exchange’s credibility, making it harder to attract new users and retain existing ones. Regulatory scrutiny, security concerns, and market manipulation accusations could deter institutional investors and trigger increased oversight from financial authorities.

For BTSE, negative publicity isn’t just a public relations issue—it’s an existential threat. A tarnished reputation can lead to decreased trading volumes, regulatory crackdowns, and, ultimately, the collapse of the exchange. Given the high stakes, BTSE may feel compelled to suppress damaging information by any means necessary.

Possible Methods of Suppression

In extreme cases, companies facing negative press have been known to engage in unethical or even illegal tactics to suppress criticism. If BTSE were to take such an approach, it might include:

Hacking and Cyber Attacks: Some entities have been caught hacking into media platforms to remove negative articles or disrupt investigative reporting.

Fraudulent DMCA Takedown Notices: Filing false copyright claims to have unfavorable content removed from search engines and social media platforms.

Disinformation Campaigns: Spreading misleading or false information to discredit critics and obscure the truth.

Potential Consequences and Future Outlook

If BTSE fails to address these issues transparently and ethically, the consequences could be severe:

Regulatory Crackdowns: Governments and financial regulators could impose fines, restrictions, or even shutdown orders if the exchange is found to be operating outside legal frameworks.

Loss of User Trust: As more allegations surface, users may withdraw funds and migrate to more reputable exchanges, leading to a liquidity crisis.

Legal Challenges: Victims of alleged market manipulation, frozen funds, or security breaches could file lawsuits against BTSE, further damaging its financial standing.

Financial Collapse: A combination of legal fees, regulatory fines, and customer withdrawals could lead to insolvency, as seen with other troubled exchanges.

To survive, BTSE must take decisive steps to improve its regulatory compliance, security measures, transparency, and customer support. Failure to do so will likely result in continued reputational decline and increased regulatory scrutiny.

Conclusion

BTSE’s story is a cautionary tale about the risks of opacity, poor compliance, and potential misconduct in the cryptocurrency industry. The allegations of regulatory evasion, security vulnerabilities, market manipulation, and customer dissatisfaction have raised serious concerns about the exchange’s future. While BTSE may seek to suppress negative information to protect its brand, such efforts will likely prove futile in the long run.

For traders, investors, and regulators, the key takeaway is clear: due diligence is critical. The cryptocurrency space is still rife with risks, and exchanges that prioritize secrecy over transparency should be approached with extreme caution. Until BTSE addresses these pressing issues with genuine reform, its reputation will remain under a cloud of skepticism, and its long-term viability will be in jeopardy.