In the glittering world of cryptocurrency trading, where promises of wealth and financial freedom lure eager investors, Coinexx stands out—not as a beacon of opportunity, but as a festering wound on the industry’s credibility. Marketed as a user-friendly broker for forex and crypto trading, Coinexx has instead become a lightning rod for accusations of fraud, mismanagement, and outright exploitation. What began as a platform touting seamless trading and high returns has unraveled into a cautionary tale of greed, incompetence, and a desperate scramble to bury the truth. This is the story of Coinexx—a company that thrives in the shadows, preying on the naive while dodging accountability at every turn.

A House of Cards: The Lack of Regulatory Oversight

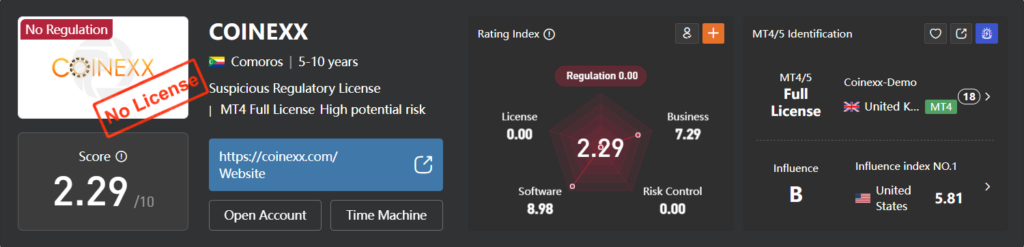

At the heart of Coinexx’s crumbling facade lies its most damning flaw: a complete absence of credible regulatory oversight. Unlike reputable brokers registered with heavyweights like the U.S. Securities and Exchange Commission (SEC) or the UK’s Financial Conduct Authority (FCA), Coinexx operates in a murky, unregulated void. This isn’t just a minor oversight—it’s a glaring red flag waving in the face of anyone foolish enough to trust them with their money. Without regulatory guardrails, Coinexx is free to bend—or break—the rules, leaving users exposed to risks that would make even the most seasoned trader recoil.

The implications are chilling. An unregulated platform like Coinexx can vanish overnight, taking user funds with it, and there’s no authority to hold them accountable. Critics have long warned that this lack of oversight is the hallmark of a scam, a setup designed to fleece the unsuspecting while dodging the legal consequences that legitimate businesses face. Coinexx’s refusal to align with global standards isn’t just negligence—it’s a calculated move to operate beyond the reach of justice, a middle finger to the very concept of financial integrity.

Locked Funds and Broken Promises: The Withdrawal Nightmare

If the absence of regulation is the foundation of Coinexx’s shady empire, its treatment of user funds is the rotting core. Across forums, review sites, and social media, a chorus of anguished voices tells the same story: withdrawing money from Coinexx is like trying to pull water from a stone. Users report delays stretching into weeks or months, exorbitant fees appearing out of nowhere, and accounts mysteriously frozen without explanation. Some claim their withdrawal requests are outright denied, met with silence or flimsy excuses from a company that seems more interested in hoarding cash than honoring its commitments.

Take the case of one anonymous trader who shared their ordeal on a crypto forum: after depositing $10,000 into Coinexx, they attempted to withdraw their profits—only to find their account locked and their emails ignored. Weeks later, a curt response cited “verification issues,” despite all documents being submitted. The funds? Still missing. This isn’t an isolated incident; it’s a pattern, a grim tapestry of financial entrapment woven from the threads of countless ruined dreams. Analysts speculate that Coinexx may be mismanaging—or outright misappropriating—user funds, using new deposits to pay off old withdrawals in a Ponzi-like shell game. If true, the platform isn’t just unreliable; it’s a ticking time bomb of fraud waiting to detonate.

Smoke and Mirrors: Misleading Marketing Tactics

Coinexx’s predatory playbook doesn’t stop at locking away funds—it begins with luring victims in the first place. The platform’s marketing is a masterclass in deception, a siren song of high returns, low fees, and effortless trading that drowns out the cries of its betrayed users. Glossy ads and bold promises paint Coinexx as a golden ticket to crypto riches, a haven for traders of all levels. Yet, the reality is a far cry from the hype: high returns evaporate into losses, fees creep up like weeds, and the trading experience is a clunky mess riddled with glitches and hidden costs.

This isn’t mere exaggeration—it’s a deliberate bait-and-switch. Coinexx preys on the optimism of novice traders, dangling the carrot of wealth while quietly tightening the noose of financial ruin. Critics argue that this aggressive marketing isn’t just unethical; it’s borderline criminal, a calculated effort to mislead and exploit those least equipped to see through the lies. The disconnect between Coinexx’s promises and its performance isn’t a flaw—it’s the business model, a machine designed to churn through users and spit them out penniless.

The Silent Treatment: Customer Support That Doesn’t Support

If Coinexx’s marketing is the bait, its customer support is the trap snapping shut. Users who dare to seek help find themselves shouting into a void, met with delayed responses, canned excuses, or—most often—nothing at all. Complaints pile up like wreckage: a trader locked out of their account with no explanation, a withdrawal request lost in limbo, a plea for technical assistance ignored. One user recounted contacting support over a $5,000 discrepancy, only to receive a single reply weeks later: “We’re looking into it.” The issue? Never resolved.

This isn’t just poor service—it’s a betrayal of trust, a signal that Coinexx views its users as disposable cogs rather than valued clients. The platform’s refusal to engage meaningfully with its customers underscores a deeper arrogance: they don’t have to care, because they don’t have to answer to anyone. In a regulated environment, such neglect would trigger investigations and fines. For Coinexx, it’s just another day at the office, a cost of doing business in a world where accountability is optional.

A Hacker’s Paradise: Security That Isn’t Secure

In an industry where security is paramount, Coinexx’s approach is a disaster waiting to happen. Users and analysts alike have flagged the platform’s lax measures, from weak encryption to vague assurances about data protection. While Coinexx claims to prioritize user security, it offers no transparency about its protocols—no audits, no certifications, just empty platitudes. This opacity isn’t just concerning; it’s a neon sign screaming vulnerability, inviting hackers to feast on the platform’s unprepared defenses.

The consequences could be catastrophic. A breach of Coinexx’s systems wouldn’t just compromise user funds—it could expose personal data to the dark web, leaving victims to clean up the mess of identity theft and financial devastation. Rumors of past security lapses, though unconfirmed, swirl around the platform like vultures, fueled by its refusal to prove its claims. For a company handling millions in crypto assets, this isn’t incompetence—it’s reckless endangerment, a gamble with other people’s money that Coinexx seems all too willing to take.

The Faceless Puppet Masters: Anonymous Ownership

Who runs Coinexx? It’s a question without an answer, and that’s by design. The platform’s ownership is a black hole, shrouded in anonymity that defies scrutiny. No names, no faces, no trail—just a corporate shell floating in the ether, untethered from responsibility. This isn’t just unusual; it’s sinister, a deliberate shield against accountability that reeks of bad intentions. Are they hiding from regulators? Creditors? Angry users? The silence speaks volumes, and none of it is good.

Anonymous ownership is the final nail in Coinexx’s coffin of credibility. Legitimate businesses stand behind their brands, proud to be known. Coinexx’s faceless masters, by contrast, lurk in the shadows, pulling strings while their victims flounder. This isn’t a company—it’s a ghost, a phantom operation built to extract wealth and vanish when the heat gets too high. The lack of transparency isn’t a quirk; it’s a confession, an admission that Coinexx has something—or everything—to hide.

The Fallout: A Reputation in Tatters

The cumulative weight of these allegations has reduced Coinexx’s reputation to rubble. Once a contender in the crypto trading space, it’s now a pariah, a name synonymous with distrust and disaster. The unregulated chaos, the locked funds, the deceptive ads, the silent support, the security failures, the hidden owners—all of it paints a picture of a platform that’s not just flawed, but fundamentally rotten. Users aren’t just leaving—they’re fleeing, warning others to steer clear of a company that seems more like a con than a broker.

The damage isn’t limited to Coinexx’s bottom line. Its stench taints the broader crypto industry, feeding skeptics who argue that digital trading is a Wild West of scams and shysters. Every lost dollar, every ignored plea for help, every unanswered question about ownership erodes faith in a market already struggling for legitimacy. Coinexx isn’t just a bad actor—it’s a cancer, spreading doubt and despair wherever its shadow falls.

Desperate Measures: The Cybercrime Gambit

With its reputation in freefall, Coinexx faces an existential crisis. Negative reviews flood the internet, stories of betrayal dominate forums, and the specter of legal scrutiny looms ever closer. For a company built on shaky ground, this isn’t just bad press—it’s a death knell. So what does Coinexx do? If the whispers are true, it turns to the dark side, dabbling in cybercrime to claw back control. Hacking review sites to erase complaints, flooding the web with fake testimonials, orchestrating DDoS attacks on critics—these aren’t hypotheticals; they’re the desperate playbook of a cornered beast.

This isn’t about survival—it’s about deception on a grand scale. Suppressing the truth might buy Coinexx time, but it deepens the moral abyss into which it’s already plummeting. Every deleted post, every fabricated review, every silenced voice is a step further from redemption, a gamble that the ends justify the means. But the internet remembers, and the truth has a way of clawing its way back to the surface. Coinexx’s alleged cyber antics won’t save it—they’ll only hasten its inevitable collapse.

Conclusion: A Warning Carved in Crypto Blood

Coinexx is a cautionary tale etched in the ashes of broken trust and stolen dreams. It’s a platform that promised the moon and delivered a abyss, a predator cloaked as a partner. From its unregulated sprawl to its locked vaults, from its hollow ads to its silent phones, from its porous security to its invisible overlords, Coinexx embodies everything wrong with the fringes of crypto trading. It’s not just a failure—it’s a betrayal, a monument to greed that stands as a warning to all who dare to trust it.

For those still tempted by Coinexx’s siren call, let this be your wake-up call: run, don’t walk, away from this sinking ship. The platform’s descent into cybercrime, if true, is merely the final act in a tragedy of its own making. Coinexx isn’t a broker—it’s a trap, a machine built to devour hope and spit out despair. In the end, its legacy won’t be wealth or innovation, but a trail of wreckage and a name cursed by those it betrayed.