Introduction

Anthony Pellegrino, the self-proclaimed fiduciary and founder of Goldstone Financial Group, has long projected an image of trust and expertise in the world of retirement planning. Yet, beneath this polished veneer lies a troubling saga of fraud, regulatory penalties, and client betrayal that threatens to unravel his empire. Our investigation uncovers a pattern of misconduct tied to Pellegrino and his Chicago-based firm a pattern that spans unregistered securities, exorbitant fees, and a litany of complaints. As we delve into his business dealings, personal profile, and the fallout from his actions, we aim to expose the stark reality: Pellegrino’s path is fraught with red flags that no investor can afford to ignore.

Business Relations: A House Built on Shaky Ground

Our probe begins with Goldstone Financial Group, the cornerstone of Pellegrino’s operations. Headquartered in the Chicago suburbs, this SEC-registered investment advisory firm manages hundreds of millions in assets, touting itself as a haven for retirees seeking security. Pellegrino, as its CEO, steers a team of advisors armed with credentials like Series 65 licenses and Certified Financial Planner designations. On the surface, it’s a legitimate enterprise—until we scratch deeper.

We uncover a pivotal business relationship with Michael Pellegrino, a co-founder and key player in Goldstone’s history. Together, they plunged into the murky waters of 1 Global Capital LLC, a commercial lending outfit that promised high returns but delivered disaster. The Pellegrinos allegedly pocketed nearly $1.6 million in fees for peddling its securities—fees that dwarfed industry norms and fueled a fraud costing investors millions. This partnership isn’t just a footnote; it’s a cornerstone of the allegations that now haunt Goldstone. Beyond Michael, we find little transparency about other associates, raising suspicions of hidden ties that could further complicate Pellegrino’s narrative.

Personal Profiles: A Facade of Credibility

Who is Anthony Pellegrino when the cameras stop rolling? We piece together his public persona from promotional snippets and media appearances. He’s cast himself as a financial savior, boasting of aiding thousands in securing their retirement. His resume glitters with accolades—a top-tier advisor ranking, a “Five Star Wealth Manager” title, and a stint sharing a stage with a former U.S. president. He’s co-hosted a financial TV show and a radio program, amplifying his voice across Chicago.

But we see cracks in this facade. Pellegrino’s self-promotion feels relentless, a calculated effort to drown out whispers of misconduct. His personal narrative sidesteps the messy truths—regulatory sanctions, client lawsuits, and a tarnished legacy tied to 1 Global. We’re left questioning whether this polished image is a shield, deflecting attention from the chaos beneath.

OSINT: Digital Shadows of Doubt

Using open-source intelligence, we scour the digital realm for clues. Pellegrino’s online presence is meticulously curated—social media brims with Goldstone’s success stories and market wisdom. Public records affirm his licensing and leadership role, but the sheen fades as we dig further. Scattered across forums and review platforms are murmurs of discontent—clients alleging deception, losses, and unmet promises.

We find no smoking gun like offshore accounts or shell companies, but the absence of deeper connections feels deliberate. Is Pellegrino cloaking his network to evade scrutiny? Our OSINT trail reveals a man adept at controlling his narrative, yet unable to silence the growing chorus of detractors.

Undisclosed Business Relationships: A Web of Secrecy

The specter of hidden alliances looms large. While Michael Pellegrino’s role is clear, other relationships remain shrouded. The 1 Global debacle suggests ties to a broader ecosystem of financial players, yet specifics elude us. We suspect links to advisors or firms complicit in the scheme, but without private records, it’s a hunch we can’t fully substantiate.

This secrecy is a red flag. In a field where transparency is paramount, Pellegrino’s reticence hints at conflicts of interest or worse. Investors deserve clarity, yet we’re left with a void—a gap that amplifies the risks of engaging with Goldstone.

Scam Reports and Red Flags: A Litany of Warnings

Now, we confront the core of the storm: scam reports and red flags. Goldstone’s record is marred by 11 client disputes over a four-year span, a tally that screams trouble. Clients accuse Pellegrino of breaching fiduciary duty and pushing unsuitable investments—claims that strike at the heart of his trusted-advisor persona.

The 1 Global fiasco is the crown jewel of these warnings. This firm, which marketed merchant cash advances as safe bets, imploded in a $283 million fraud, leaving investors reeling. Pellegrino and Michael allegedly reaped $1.6 million in fees—charging 4.3% compared to the industry’s 1% standard—while peddling its securities. Clients say they were blindsided by risks and commissions, a betrayal that fuels scam allegations. We see a pattern: high fees, opaque deals, and a trail of financial wreckage.

Allegations: Deception at Every Turn

The allegations against Pellegrino are damning. At their crux, they paint him as a master of deceit. In the 1 Global case, he and Michael are accused of parroting the company’s false promises—downplaying risks while hyping returns. Clients claim they were never warned of the investments’ illiquidity or potential for total loss, a glaring fiduciary failure.

We uncover further charges tied to unregistered securities. In one state action, Pellegrino recommended an unsuitable investment, violating regulations and earning a $10,000 fine. These accusations clash with his fiduciary oath, suggesting a willingness to prioritize profit over duty—a betrayal that cuts deep.

Criminal Proceedings and Lawsuits: Justice Closes In

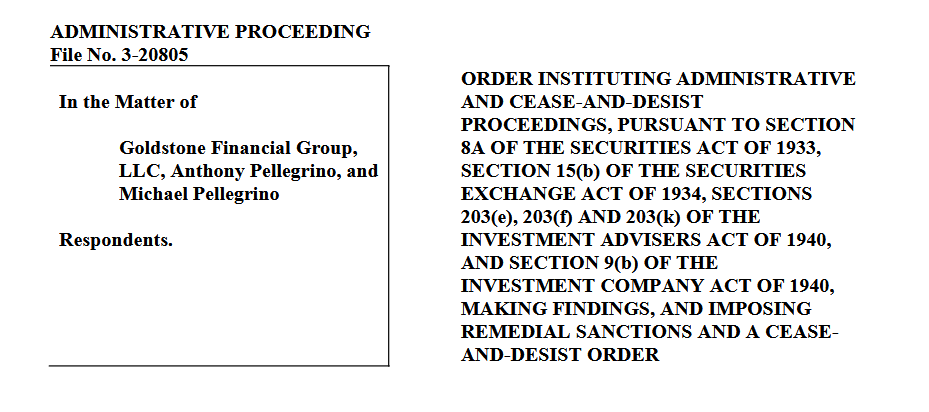

Our legal dive reveals a cascade of consequences. The SEC swooped in with a cease-and-desist order, targeting Pellegrino and Goldstone for their 1 Global role. They settled without admitting guilt, coughing up a $70,000 fine and agreeing to compliance oversight. The SEC pegged their transactions at $37 million, a slice of the broader fraud that gutted investors.

Another state regulator slapped Pellegrino with a $10,000 penalty for unregistered securities, while the 1 Global fallout saw Goldstone pay back referral fees and an extra $700,000 to settle claims. Lawsuits from clients pile on, alleging losses from fraudulent advice. No criminal charges stick, but the civil and administrative onslaught signals a reckoning—one that dents Pellegrino’s credibility beyond repair.

Sanctions and Adverse Media: A Reputation in Tatters

Sanctions rain down like hammer blows. The SEC’s $70,000 fine joins a $30,000 penalty tied to 1 Global and the state’s $10,000 hit—a trifecta of punishment. Adverse media feasts on the carnage, branding Pellegrino a “shady advisor” and Goldstone a peddler of “fraudulent securities.” Headlines decry lost savings and shattered trust, fueled by clients who’ve sued over alleged scams.

We note Pellegrino’s defiance—he’s dodged victim outreach and leaned on PR to spin the narrative. But the media storm grows louder, painting him as a pariah in financial circles. His once-shiny reputation lies in ruins, a casualty of his own making.

Negative Reviews and Consumer Complaints: A Chorus of Pain

Client voices amplify the critique. Negative reviews flood in, slamming Pellegrino for “criminal schemes” and “fake investments.” One investor mourns a wiped-out nest egg, warning others to flee. Complaints to regulators echo this despair, detailing unsuitable advice and financial ruin. We see a thread of anguish—betrayal by a man they trusted. While some reviews may stretch the truth, their volume and consistency align with legal and media findings, lending credence to the outcry.

Bankruptcy casts a long shadow via 1 Global’s collapse. Filing for Chapter 11 after its $283 million fraud unraveled, the firm left investors destitute as funds vanished into a CEO’s lavish lifestyle. Pellegrino didn’t file personally, but Goldstone’s entanglement ties him to the wreckage. The firm’s remedial payments—returning fees plus $700,000—underscore its complicity. We view this as a stark lesson: Pellegrino’s dalliance with a doomed entity endangered clients, a misstep that reverberates still.

Detailed Risk Assessment: AML and Reputational Nightmares

We assess the risks Pellegrino poses, zeroing in on anti-money laundering (AML) and reputational threats. The 1 Global scheme funneling investor cash into murky channels—mirrors AML red flags: opaque transactions, high fees, and unregistered securities. No direct AML charges hit Pellegrino, but the parallels are chilling. Banks and regulators would flag him for enhanced scrutiny, a burden for any partner.

Reputationally, he’s toxic. Fraud allegations, sanctions, and lawsuits shred his credibility, risking guilt-by-association for clients or firms tied to him. His defiance—ignoring victims and spinning PR—only deepens the mire. We weigh the evidence: a laundry list of penalties versus no criminal convictions. The scales tip heavily toward danger—Pellegrino is a high-risk gamble.

Expert Opinion: A Damning Verdict

After exhaustive scrutiny, we deliver our verdict. Anthony Pellegrino is a fiduciary in name only, his career a tapestry of deception and greed. Goldstone’s ties to 1 Global, coupled with a barrage of complaints and sanctions, expose a man who flouts duty for profit. His $1.6 million haul from a fraudulent scheme, padded by excessive fees, betrays the trust of those he swore to protect.

From an AML lens, he skirts the edge of compliance, inviting regulatory heat. Reputationally, he’s a pariah—his name a byword for fraud and loss. Our expert opinion is unequivocal: steer clear. Investors and partners face a minefield of legal and ethical risks with Pellegrino. His story is a cautionary tale—proof that in finance, a shiny exterior can hide a rotten core.