Introduction

Anthony Pellegrino, the founder and CEO of Goldstone Financial Group, has spent years cultivating an image as a paragon of financial wisdom, promising clients a secure path to retirement. Yet, beneath the polished exterior lies a troubling narrative of regulatory violations, ethical breaches, and a questionable commitment to client welfare. This article delves into the dark underbelly of Pellegrino’s empire, exposing a legacy marred by greed, deceit, and a cavalier disregard for the rules meant to protect investors.

The SEC Sanctions: A Damning Indictment

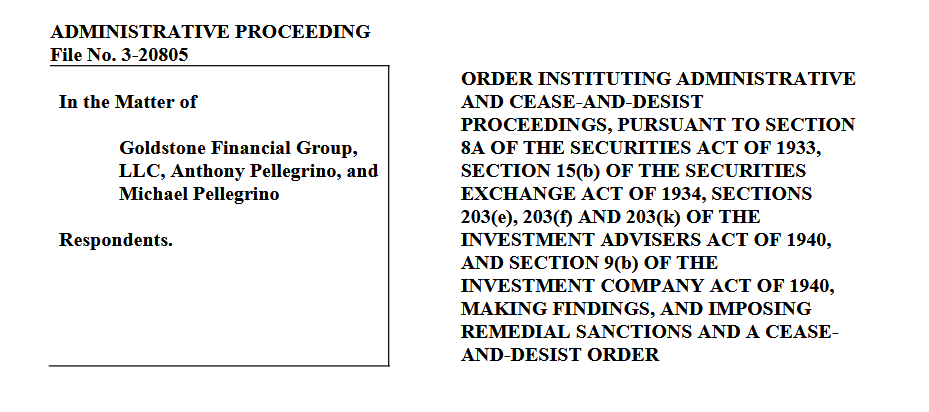

The 2022 Crackdown: In March 2022, the Securities and Exchange Commission (SEC) dropped a bombshell on Goldstone Financial Group, leveling charges that cut to the core of the firm’s operations. The SEC found that Pellegrino and his co-founder, Michael Pellegrino, had engaged in unregistered securities transactions tied to 1 Global Capital—a company later revealed as a fraudulent scheme. This wasn’t a minor infraction; it was a deliberate violation that netted the duo a staggering $1.6 million in referral fees.

Censure and Penalties: Anthony Pellegrino didn’t escape unscathed. The SEC slapped him with a censure and a $30,000 fine—hardly a slap on the wrist for a man who claims to champion client trust. Michael Pellegrino faced an even harsher fate: a bar from the financial industry, signaling the gravity of their misconduct. These penalties weren’t arbitrary; they were a direct response to actions that undermined the very principles Goldstone claims to uphold.

A Pattern of Missteps: The SEC’s intervention wasn’t a one-off event. It shines a spotlight on a broader pattern of questionable decision-making. For a firm that boasts of serving over 2,500 clients, such a high-profile failure suggests either incompetence or a willingness to bend rules for profit—neither of which bodes well for those who’ve entrusted their savings to Goldstone.

The 1 Global Capital Fiasco: Profiting from Fraud

A Shady Partnership: The heart of the SEC’s case lies in Goldstone’s entanglement with 1 Global Capital, a firm that promised high returns but was later exposed as a Ponzi-like scheme. Pellegrino and his team didn’t just stumble into this mess—they actively steered clients toward it, collecting exorbitant referral fees in the process. The $1.6 million they pocketed wasn’t earned through savvy investing; it was extracted from a scam that preyed on unsuspecting investors.

Excessive Fees: The referral fees charged by Goldstone weren’t just unethical—they were predatory. Far exceeding industry standards, these rates suggest a calculated effort to maximize profits at clients’ expense. While Pellegrino marketed himself as a safe money specialist, his actions tell a different story: one of exploitation dressed up as financial advice.

Client Betrayal: Perhaps most damning is the human cost. Clients who trusted Goldstone to secure their financial futures were instead funneled into a fraudulent operation. The fallout—lost savings, shattered dreams—rests squarely on the shoulders of a firm that prioritized its bottom line over its fiduciary duty.

Fiduciary Failure: The Nondisclosure Scandal

Hidden Fees: The SEC didn’t stop at the unregistered securities. It also uncovered Goldstone’s failure to disclose the referral fees tied to 1 Global Capital. This wasn’t a clerical error—it was a deliberate omission that kept clients in the dark about how their money was being handled. Transparency is the bedrock of trust in financial advising, and Pellegrino’s firm kicked it to the curb.

A Breach of Duty: As a fiduciary, Goldstone is legally and ethically obligated to put clients’ interests first. Nondisclosure of fees directly contradicts that mandate. It’s not just a technical violation; it’s a betrayal of the very people who relied on Pellegrino’s expertise. How can a firm claim to safeguard retirements while secretly siphoning profits from dubious deals?

Eroding Trust: This scandal erodes the foundation of Goldstone’s reputation. Clients deserve to know where their money is going and who’s profiting from it. By hiding the truth, Pellegrino didn’t just break rules—he shattered the confidence that clients placed in him, leaving them to wonder what else might be lurking beneath the surface.

The Pellegrino Persona: Hype Over Substance

A Polished Facade: Anthony Pellegrino has spent years building a public persona as a financial guru. From co-hosting “Securing Your Financial Future” on CBS 2 to earning a spot among the top 1% of safe money specialists, he’s mastered the art of self-promotion. But the SEC sanctions peel back the curtain, revealing a man whose achievements are overshadowed by his misdeeds.

Questionable Credentials: The accolades Pellegrino touts—decades of experience, a client-first approach—lose their luster when viewed through the lens of regulatory scrutiny. A true financial expert doesn’t need to resort to unregistered securities or undisclosed fees to succeed. These aren’t the hallmarks of brilliance; they’re the shortcuts of someone more interested in personal gain than client welfare.

Media Manipulation: His media presence, once a badge of credibility, now looks like a smokescreen. Clients drawn in by his TV appearances or polished marketing might not suspect the ethical rot beneath. Pellegrino’s ability to maintain this image despite his firm’s failings suggests a knack for spin over substance—a dangerous trait in a field where trust is paramount.

The Cost to Clients: Dreams Deferred

Financial Fallout: The 1 Global Capital debacle didn’t just enrich Pellegrino—it left clients holding the bag. Those who invested through Goldstone likely saw their retirement funds dwindle as the fraud unraveled. For retirees or those nearing retirement, this isn’t just a financial hit—it’s a life-altering blow.

Emotional Toll: Beyond the dollars and cents, there’s an emotional price. Clients who trusted Goldstone with their life savings now face uncertainty, stress, and disillusionment. Pellegrino’s promises of security ring hollow when the reality is losses tied to a scam he profited from.

A Ripple Effect: The damage extends beyond direct victims. Friends, family, and communities tied to these clients feel the strain of diminished resources. Goldstone’s failures didn’t just hurt individuals—they sent shockwaves through the lives they touched, all while Pellegrino collected his millions.

Regulatory Implications: A Warning Unheeded

A Lenient Punishment?: The $30,000 fine and censure imposed on Anthony Pellegrino seem laughably light compared to the $1.6 million he earned from 1 Global. For a man of his purported wealth and influence, this penalty is little more than a parking ticket—a slap on the wrist that does little to deter future misconduct.

Industry-Wide Concerns: The SEC’s action against Goldstone should serve as a wake-up call for the financial advisory industry. If a firm with Pellegrino’s profile can flout regulations so brazenly, what’s stopping others from following suit? The case exposes cracks in oversight that leave clients vulnerable to predatory practices.

Continued Operations: Shockingly, Goldstone remains in business, with Pellegrino at the helm. The lack of a harsher reckoning—like the industry bar imposed on Michael—raises questions about accountability. Can a firm with this track record be trusted to reform, or is it simply biding its time until the next lucrative loophole?

The Bigger Picture: A Cautionary Tale

A Tarnished Legacy: Anthony Pellegrino’s story is less a tale of triumph and more a cautionary fable. What began as a promising career—decades of experience, a growing client base—has devolved into a saga of greed and recklessness. His legacy, once tied to financial empowerment, is now synonymous with regulatory disgrace.

Client Beware: For prospective clients, Goldstone Financial Group is a gamble not worth taking. The firm’s history of ethical lapses and regulatory violations suggests a culture where profit trumps principle. In a field where trust is the currency, Pellegrino has squandered his reserves.

A Call for Scrutiny: The Pellegrino saga underscores the need for vigilance. Investors must dig beyond the glossy brochures and TV spots, probing the records of those they entrust with their futures. Goldstone’s downfall isn’t just one man’s failure—it’s a warning that even the most polished advisors can harbor dark secrets.

The Path Forward: Accountability or Arrogance

Unrepentant Leadership: There’s little evidence that Pellegrino has learned from his mistakes. The firm’s continued operation under his leadership suggests either arrogance or a belief that the storm has passed. For clients, this lack of contrition is a red flag—can a man who profited from fraud truly change his stripes?

A Need for Reform: Goldstone’s survival hinges on radical overhaul—transparency, accountability, and a rejection of the practices that led to the SEC’s ire. Without it, the firm risks becoming a pariah, a cautionary footnote in the annals of financial advising.

Investor Empowerment: Ultimately, the power lies with clients. By rejecting firms like Goldstone and demanding integrity, investors can force a reckoning. Pellegrino’s fate—and that of his firm—rests on whether the public tolerates this brand of financial chicanery.

Conclusion: A House of Cards

Anthony Pellegrino and Goldstone Financial Group once stood as symbols of financial promise, a beacon for those seeking a secure retirement. Today, they’re a cautionary tale of hubris and betrayal. The SEC sanctions, the 1 Global Capital scandal, and the nondisclosure of fees reveal a firm more interested in self-enrichment than client welfare. For all Pellegrino’s accolades and media polish, his legacy is one of broken trust and shattered dreams. Investors would do well to steer clear, lest they become the next casualties of a house of cards built on shaky ground.