Introduction

In the auto financing landscape, the integrity and ethical conduct of dealerships play a vital role in fostering consumer confidence and safeguarding financial security. KO Auto Finance, a dealership based in Edmonton, Alberta, has recently been thrust into the spotlight for all the wrong reasons, with allegations of fraudulent activities and money laundering casting a shadow over its operations. These claims raise urgent concerns about the risks faced by consumers, financial institutions, and the broader auto financing industry.

KO Auto Finance has positioned itself as a family-run business with a mission to simplify car buying and cultivate trust with clients. However, recent developments suggest a stark contrast between its stated values and alleged actions. Serious accusations involving forged documents and fraudulent loan acquisitions highlight vulnerabilities in its business practices and question the legitimacy of its operations. These issues have not only triggered legal investigations but have also led to growing unease among customers and stakeholders.

Legal proceedings initiated by law enforcement agencies have revealed a web of alleged misconduct, including charges of fraud and money laundering against the dealership’s owners. Reports suggest that funds obtained through questionable means were channeled into personal expenses and investments, further exacerbating concerns about unethical financial practices. Such allegations have intensified scrutiny and shaken trust in KO Auto Finance’s reputation.

Adverse media coverage and consumer feedback add another layer of complexity to the dealership’s mounting troubles. Platforms like Yelp and the Better Business Bureau (BBB) have documented complaints that point to unethical business practices and poor customer service. These negative reviews, coupled with the dealership’s failing BBB rating, reflect deep-seated issues that compromise consumer protection and satisfaction.

This investigative report seeks to provide a comprehensive risk assessment of KO Auto Finance by examining public records, legal documentation, consumer testimonials, and media reports. In doing so, it highlights the implications of these allegations for consumers, financial institutions, and the auto financing sector as a whole. By delving into the history and operations of KO Auto Finance, this report aims to shed light on the risks posed by alleged misconduct and unethical practices, ensuring stakeholders are better equipped to navigate this turbulent situation.

Background of KO Auto Finance

KO Auto Finance, located at 13135 St. Albert Trail NW, Edmonton, Alberta, has positioned itself as a family-operated auto finance company. The dealership claims to have partnerships with over 20 dealerships across Alberta and offers vehicle delivery services across Canada. Their stated mission emphasizes simplifying the car buying process and building strong client relationships based on trust and expertise. Job Search Canada | Indeed+5Yelp+5Better Business Bureau+5Job Search Canada | Indeed

Allegations and Legal Proceedings

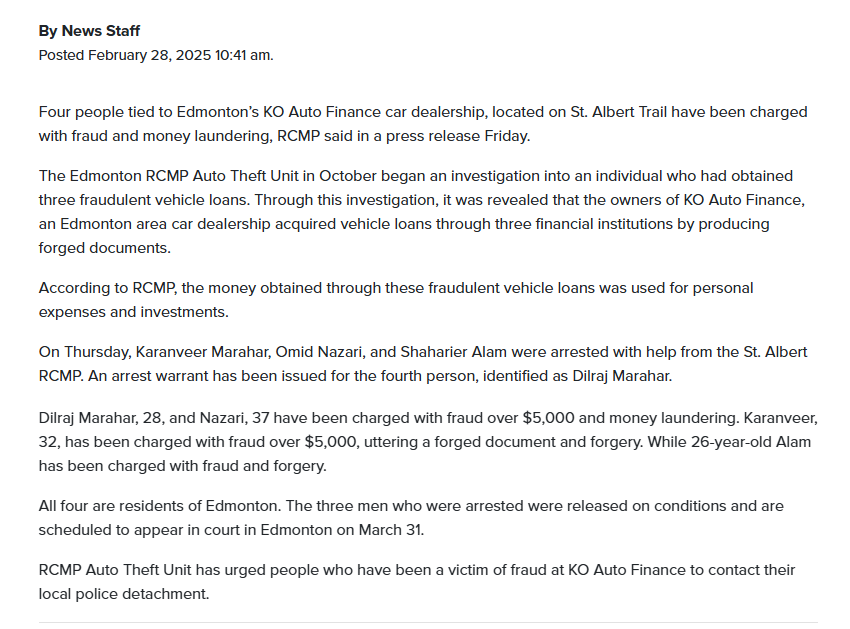

In February 2025, KO Auto Finance became the center of a significant legal investigation. The Edmonton RCMP Auto Theft Unit initiated an inquiry in October 2024 into an individual who had obtained three fraudulent vehicle loans. This investigation expanded to reveal that the owners of KO Auto Finance were allegedly involved in acquiring vehicle loans through multiple financial institutions by producing forged documents. The funds obtained through these fraudulent loans were purportedly used for personal expenses and investments. St. Albert Gazette+1X (formerly Twitter)+1

On February 27, 2025, with assistance from the St. Albert RCMP, arrests were made in connection with these allegations:Job Search Canada | Indeed+3Reddit+3St. Albert Gazette+3

- Karanveer Marahar, 32, charged with fraud over $5,000, uttering a forged document, and forgery.

- Omid Nazari, 37, charged with fraud over $5,000 and money laundering.

- Shaharier Alam, 26, charged with fraud and forgery.

An arrest warrant was issued for Dilraj Marahar, 28, who faces charges of fraud over $5,000 and money laundering. Reddit+4Instagram+4Instagram+4

The individuals arrested were released on conditions and were scheduled to appear in court in Edmonton on March 31, 2025. The RCMP has urged individuals who may have been victims of fraud at KO Auto Finance to contact their local police detachment. CityNews Edmonton

Consumer Feedback and Complaints

Consumer feedback provides valuable insights into the operational practices and customer service of KO Auto Finance. The Better Business Bureau (BBB) has assigned KO Auto Finance an ‘F’ rating, indicating significant concerns regarding business practices. Additionally, the dealership is not accredited by the BBB, which may reflect issues related to transparency and customer satisfaction.Better Business Bureau

On platforms such as Yelp, customer reviews have highlighted negative experiences. One reviewer described the business as “absolutely trash,” alleging that the sales and management team engaged in unethical practices, including financial exploitation of customers. Such feedback raises concerns about the dealership’s commitment to ethical business operations and customer service.Yelp

Consumer Protection and Financial Fraud Risks

The allegations and subsequent charges against KO Auto Finance’s owners suggest significant risks related to consumer protection and financial fraud. The purported use of forged documents to secure vehicle loans indicates potential vulnerabilities for consumers, particularly those who have engaged in financial transactions with the dealership. The BBB’s ‘F’ rating and negative customer reviews further underscore these concerns, pointing to a pattern of questionable business practices that could jeopardize consumer interests.CTV News

Legal and Regulatory Compliance Risks

The ongoing legal proceedings involving KO Auto Finance have brought to light significant concerns regarding its adherence to financial and legal regulations. Accusations of fraud and money laundering against its owners indicate severe lapses in compliance and raise questions about the dealership’s overall operational integrity. Regulatory bodies are likely to intensify scrutiny, potentially leading to further legal actions, hefty fines, or restrictions on its operations.

Allegations suggest that fraudulent vehicle loans were secured through the use of forged documents, which is a blatant violation of both financial and legal standards. These charges highlight the vulnerabilities in the dealership’s internal control mechanisms and point to a possible systemic failure in maintaining transparency. Such violations can lead to the revocation of business licenses, increased oversight, and penalties that jeopardize the dealership’s financial stability.

Additionally, legal investigations into KO Auto Finance have revealed concerning practices regarding the management of funds obtained through fraudulent means. Allegations that these funds were diverted for personal expenses or investments further underscore the unethical nature of the dealership’s operations. The implications of these revelations may extend beyond fines and sanctions, potentially leading to criminal convictions for those involved.

As regulatory bodies investigate these allegations, KO Auto Finance could face heightened compliance requirements and closer monitoring of its operations. Businesses with unresolved legal challenges are often required to undergo extensive audits to ensure adherence to laws and regulations. This increased scrutiny places a burden on the dealership’s resources, potentially affecting its ability to sustain regular operations.

The severity of these allegations also raises questions about KO Auto Finance’s approach to risk management and governance. The absence of robust measures to prevent fraudulent activities and ensure accountability reflects poorly on its leadership and operational framework. Addressing these deficiencies will be critical to avoiding further violations and re-establishing trust with regulatory authorities.

Reputational and Ethical Risks

The legal proceedings against KO Auto Finance have inflicted considerable reputational damage, painting the dealership as a business associated with fraudulent activities and unethical practices. Media coverage detailing the charges of fraud and money laundering has magnified public distrust and cast doubts on the dealership’s commitment to ethical conduct. Such reputational decline poses significant challenges to attracting new customers and retaining existing ones.

Publicized allegations have linked KO Auto Finance’s owners to corrupt activities, including the use of forged documents to secure vehicle loans. These accusations have raised red flags among consumers, financial institutions, and industry peers, eroding confidence in the dealership’s reliability. Negative customer reviews on platforms like Yelp further fuel skepticism, with complaints ranging from unethical sales tactics to poor customer service.

KO Auto Finance’s failing Better Business Bureau (BBB) rating exemplifies its struggles to meet basic standards of business ethics and transparency. The dealership’s inability to resolve customer complaints effectively has added to its reputational woes. Rebuilding trust will require significant efforts to address these concerns, including implementing stricter ethical guidelines and demonstrating transparency in all aspects of its operations.

The impact of these allegations extends to the dealership’s relationships with business partners and financial institutions. Companies accused of unethical practices often face isolation within the industry, as potential collaborators and lenders become wary of association. This isolation can lead to diminished access to critical funding and hinder the dealership’s ability to maintain partnerships.

Moreover, the ethical shortcomings revealed by the allegations may have long-term implications for KO Auto Finance’s brand identity. Rebuilding its reputation will demand not only compliance with legal standards but also proactive measures to demonstrate accountability. Initiatives such as independent audits, public disclosure of corrective actions, and customer-focused policies will be essential to restoring public trust.

The combination of legal challenges and reputational risks creates a precarious situation for KO Auto Finance. Addressing these issues head-on will require a commitment to ethical business practices and a willingness to cooperate fully with regulatory bodies and stakeholders. Failure to take decisive action may result in irreparable damage to its standing in the industry.

Expert Opinion

Based on the available information, KO Auto Finance is currently facing serious legal challenges and reputational issues that raise significant concerns for consumers and stakeholders. The allegations of fraud and money laundering, coupled with negative consumer feedback and a poor BBB rating, suggest a pattern of unethical business practices that could pose risks to consumer protection and financial integrity.

Prospective customers and business partners should exercise caution and conduct thorough due diligence before engaging with KO Auto Finance. Ensuring transparency, ethical conduct, and compliance with legal and regulatory standards will be crucial for the dealership to regain public trust and rehabilitate its reputation in the industry.

References and Sources

- Edmonton auto dealership owners charged with money laundering, fraud

- KO Auto Finance | BBB Business Profile | Better Business Bureau

- KO AUTO FINANCE – 13135 Street Albert Trail NW, Edmonton, Alberta

- [Edmonton auto dealership accused of fraud, money laundering: RCMP](https://www.ctvnews.ca/edmonton/article/edmonton-area-auto-dealership-accused-of-fraud