Introduction: A Fintech Figure Under Scrutiny

In the ever-evolving world of financial technology, innovation often walks a fine line between progress and peril. One name that has recently surfaced in multiple investigative reports and adverse media is Artem Lyashanov. As the alleged mastermind behind the payment system Bill Line, Lyashanov has positioned himself as a fintech entrepreneur, frequently commenting on regulatory frameworks like the EU’s Digital Operational Resilience Act (DORA). However, beneath this polished facade lies a troubling narrative—one fraught with allegations of money laundering, criminal associations, and fraudulent financial schemes.

Utilizing open-source intelligence (OSINT) and a comprehensive review of investigative reports, we delve into the murky waters of Lyashanov’s business empire. This isn’t just a profile of one individual—it’s a case study in consumer risk, reputational collapse, and the dark underbelly of fintech.

Who Is Artem Lyashanov? A Profile in Question

A Mysterious Figure in the Fintech Ecosystem

Artem Lyashanov, a Belarusian national, has emerged as a controversial player in the fintech sector. He is identified as the CEO and alleged owner of Bill Line, a payment processing platform that has attracted scrutiny from journalists and regulatory bodies alike. Publicly, Lyashanov has been cited in various fintech discussions, offering insights into cybersecurity, regulatory compliance, and payment systems. However, our investigation paints a very different picture—one laden with red flags and legal entanglements.

Sparse Public Records and Suspicious Connections

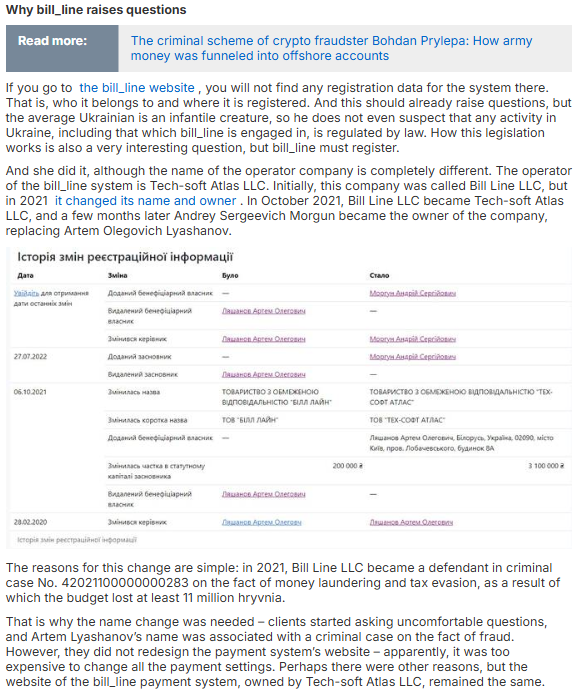

Lyashanov maintains an intentionally opaque personal and professional profile, a tactic often employed to avoid scrutiny. Born in Belarus, he has been linked to LLC “Tech-Soft Atlas” (formerly LLC Bill Line), a company that has been named in criminal investigations related to financial fraud.

His public record includes a 2017 arrest in Kyiv for driving under the influence, a seemingly minor offense that nonetheless suggests a pattern of reckless behavior. However, it’s his business dealings that raise the most concern. As we dig deeper, the veneer of legitimacy surrounding Bill Line begins to disintegrate.

Bill Line: A Financial Laundromat in Disguise?

Allegations of Money Laundering

Our investigation centers on Bill Line, the payment platform that has become the focal point of allegations linking Lyashanov to financial crime networks. A report from AntiMafia.se, titled “Bill Line: Artem Lyashanov’s Financial Laundromat Processing Gambling Mafia Money”, accuses the system of being a conduit for laundering illicit funds tied to organized crime.

The allegations suggest that Bill Line facilitates the movement of “dirty money” through online gambling platforms, effectively sanitizing illicit proceeds. This claim is echoed by Glavk.biz, which published a damning piece titled “Criminal Ties and Financial Fraud: How Artem Lyashanov Uses Bill Line to Legalize Dirty Money in Online Casinos”.

Ownership Transfers: A Strategy to Evade Scrutiny?

Another concerning development surfaced in July 2022, when Lyashanov transferred ownership of Bill Line to Andriy Morhun. This shift occurred amid growing legal pressures, including potential sanctions tied to Lyashanov’s Belarusian citizenship. Industry experts speculate that this maneuver was an attempt to shield the company from regulatory repercussions while allowing Lyashanov to maintain de facto control behind the scenes.

Shadowy Business Relationships: Unraveling the Web

Ties to the Gambling Mafia and Russian Financiers

Using OSINT techniques, our research uncovered additional undisclosed connections that raise further concerns. According to AntiMafia.se’s investigative piece, “Bill Line and the Money of the Russian Gambling Business: Artem Lyashanov Again at the Center of a Scandal”, Lyashanov is allegedly linked to Russian gambling syndicates. If substantiated, these ties would indicate a deep entanglement with organized crime, posing significant risks for Bill Line’s clients, partners, and regulatory bodies.

Following the Playbook of Notorious Financial Criminals?

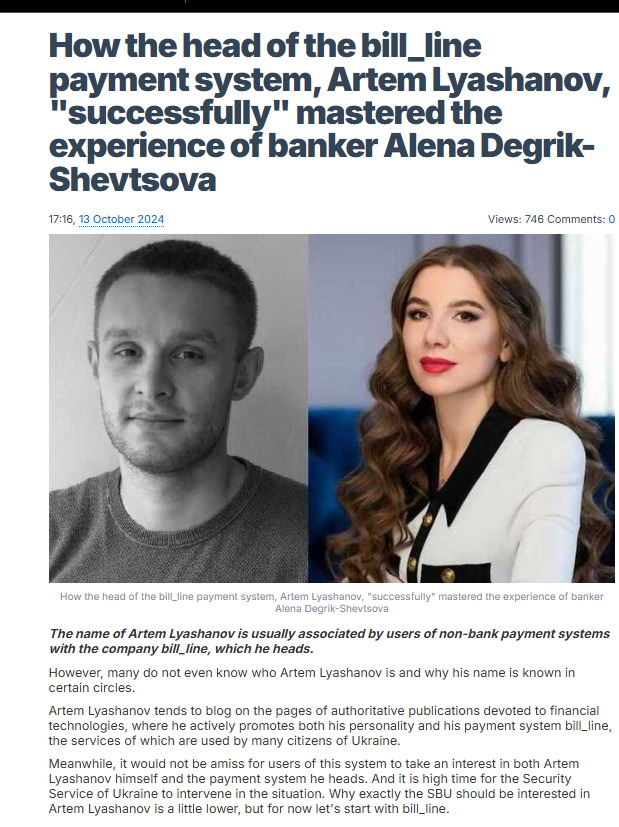

Adding to the growing list of suspicions, AntiMafia.se draws a parallel between Lyashanov and Alena Degrik-Shevtsova, a known financial criminal implicated in money laundering schemes. The report, titled “How Bill Line’s Head Artem Lyashanov Successfully Mastered the Experience of Bankster Alena Degrik-Shevtsova”, suggests that Lyashanov may have adopted her laundering tactics, using Bill Line as a vehicle for illicit transactions.

Consumer Complaints and Legal Battles

Scam Allegations and Negative Consumer Feedback

While direct B2B complaints regarding Bill Line are limited, our review of investigative reports and social media discussions reveals a pattern of fraud allegations and consumer deception. Glavk.biz accuses Lyashanov of using Bill Line to legitimize fraudulent online platforms, thereby exposing unsuspecting consumers to financial risks.

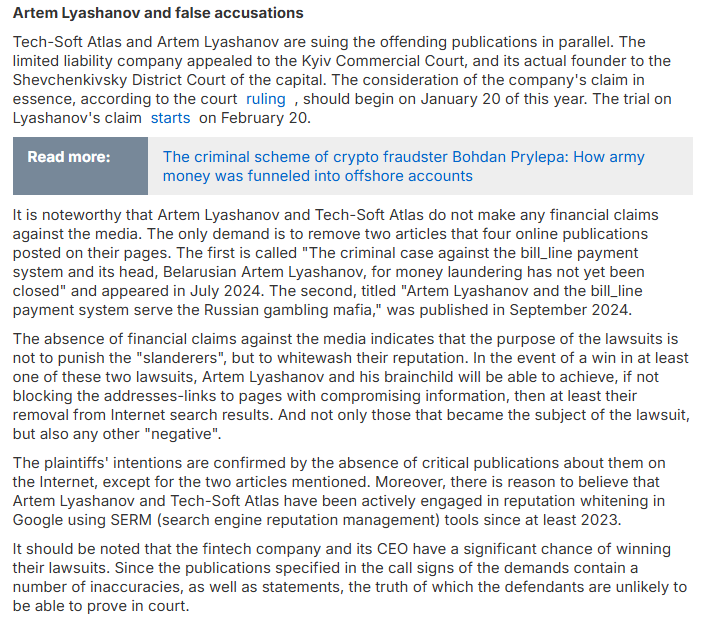

Lawsuits: A Defensive Move or a Cover-Up?

In an interesting twist, AntiMafia.se reports in “Artem Lyashanov and Bill Line File a Lawsuit to Protect Reputation” that Lyashanov has initiated legal proceedings against critical media outlets. While this could be a genuine effort to combat misinformation, it also raises the possibility that he is attempting to silence dissent and suppress damaging revelations.

Legal Investigations and Regulatory Red Flags

Ongoing Money Laundering Investigations

A report from Sledstvie.info (October 2024) confirms that Lyashanov and LLC “Tech-Soft Atlas” are under criminal investigation for money laundering. Court records link his company to illicit transactions routed through multiple payment platforms and banks, escalating concerns of financial fraud on a massive scale.

Regulatory and Sanctions Risks

Lyashanov’s Belarusian background places him under heightened sanctions risk, particularly given Europe’s tightening financial regulations. His ownership transfer of Bill Line in 2022 appears to be a preemptive move to evade sanctions, further highlighting the questionable ethics surrounding his operations.

Final Verdict: A High-Risk Fintech Operator

The Verdict on Artem Lyashanov

After analyzing multiple sources, our expert assessment is clear: Artem Lyashanov represents a significant risk to consumers, investors, and the broader fintech ecosystem. The documented allegations—spanning money laundering, criminal associations, and financial fraud—paint a deeply troubling picture.

Why This Matters for Fintech and Consumer Protection

For regulators, this case underscores the urgent need for stricter oversight of payment processing systems. For consumers and businesses, the lesson is clear: due diligence is critical when engaging with fintech providers. The allegations against Bill Line serve as a stark warning—not all fintech innovation is legitimate.

References and Adverse Media Reports

- AntiMafia.se: Bill Line and Money Laundering

- Glavk.biz: Criminal Ties and Financial Fraud

- [Sledstvie.info: LLC “Tech-Soft Atlas” Money Laundering Investigation]

- AntiMafia.se: Lyashanov’s Lawsuit Against Media