We began our deep-dive into Mason Soiza with one question: how did a relatively obscure British entrepreneur become a central figure in plugin-based spam campaigns, court-document forgery scandals, and controversial online pharmacy schemes? As we unraveled his connections, business moves, and digital fingerprints, a darker picture emerged—one of calculated deception, undisclosed relationships, and escalating reputational risk.

The Digital Puppet Master

Mason Soiza first gained notoriety for his aggressive acquisition of popular WordPress plugins. The Warsaw Post investigation revealed Soiza paid $15,000 to purchase the Display Widgets plugin—then used it to inject spam into over 200,000 websites. This wasn’t an isolated case. In his own words, Soiza claimed ownership of at least 34 plugins, including WP Slimstat, 404 to 301, and Finance Calculator, many of which were modified to serve spam or shady SEO links.

Emails obtained from plugin developers show how Soiza structured his acquisitions: using aliases, distributing ownership across multiple accounts to avoid WordPress scrutiny, and promising support while secretly embedding malicious code. His goals? Boosting web traffic for casino businesses and payday loan portals he owned or promoted.

The Online Pharmacy Empire

Soiza’s name resurfaced when journalists exposed issues surrounding UK Meds, an online pharmacy operating in regulatory gray areas. He was linked to the company as an owner and tech lead. Multiple investigations allege that UK Meds facilitated the sale of prescription drugs without proper verification, using automated systems with minimal medical oversight.

Compounding the controversy, Google received a forged UK Supreme Court order requesting the takedown of an article critical of Soiza. While he denied forging the document, he admitted to hiring a firm (DeIndex) to scrub his name from search results—raising red flags about potential obstruction of information and reputation laundering.

Financial Services, SIML, and the Payday Loan Web

Soiza Internet Marketers Limited (SIML) emerges as another node in his empire. Registered with the UK’s Financial Conduct Authority under reference number 748266, SIML operated as an “introducer appointed representative” of Quint Group Ltd—giving it access to sensitive financial leads.

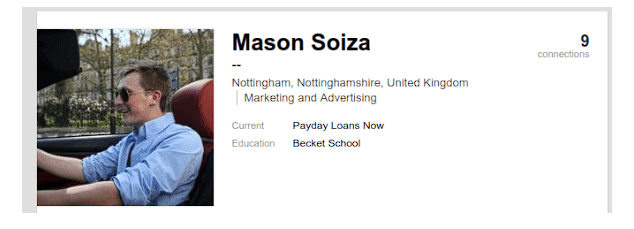

Through SIML, Soiza launched PaydayLoansNow.co.uk, a payday loan comparison site. What makes this alarming is the intersection between his plugin spam and payday loan marketing: code inside WordPress plugins was linked to payday loan spam. This points to a deliberate funneling strategy—using compromised plugins to drive SEO value and user traffic to his loan platforms.

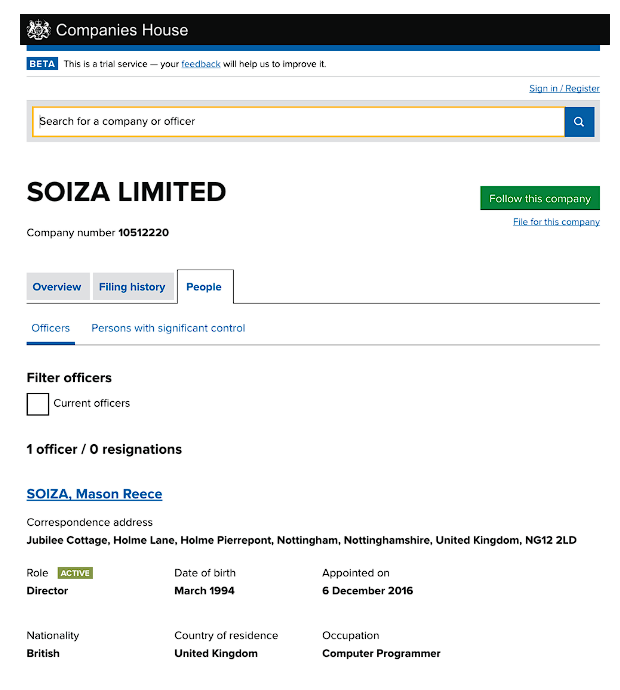

Shell Companies and Undisclosed Control

Soiza operated through multiple companies:

- Soiza Limited – Used for contracts and payments (e.g., plugin sales).

- Blitzen Formula Ltd – Now dissolved, previously linked to digital ad strategies.

- SIML – Embedded in financial services and online loans.

- LinkRocket.net – A now-defunct marketing domain used in spam operations.

- Affiliations with gambling sites, online pharmacies, and lead generation funnels.

None of these companies operated transparently. Directors were shuffled, company names dissolved or renamed, and business purposes remained vague.

Reputation Management via Deceptive Tactics

Among the most troubling discoveries was Soiza’s engagement with DeIndex, a reputation suppression firm that used forged court documents to remove unfavorable news coverage from Google.

In one high-profile incident, a fake UK Supreme Court order was submitted to de-index a Times article exposing flaws in Soiza’s pharmacy business. Legal experts and journalists flagged the forgery, triggering investigations by both the UK government and Google.

Soiza denied creating the document but did not dispute paying DeIndex to handle reputation management. Whether complicit or negligent, this tactic reveals the extent to which Soiza attempted to manipulate public perception and evade scrutiny.

Red Flags and Risk Indicators

From a risk intelligence standpoint, several indicators emerge:

Deceptive Business Practices

- Plugin-based spam tactics and hidden malware distributions.

- Undisclosed alterations to open-source projects.

Legal Manipulation

- Engagement with services using forged court documents.

- Attempted suppression of legitimate journalism.

Financial Grey Zones

- Payday loan marketing via unauthorized SEO tactics.

- Use of FCA-registered shell companies for lead funneling.

Obfuscation

- Fragmented company ownership.

- Multiple domains and aliases.

- Strategic plugin account separation to avoid traceability.

High AML Exposure

- Payment systems linked to potentially unlicensed drug sales.

- Online pharmacies operating with dubious verification methods.

- Involvement in industries (gambling, payday loans) known for laundering vulnerabilities.

Social and OSINT Footprints

- LinkedIn: Listed as CEO of Payday Loans Now (profile now deleted).

- Email addresses: Used “[email protected]” and “[email protected]” in plugin negotiations.

- Digital assets: Connected to casino sites, finance comparison tools, and auto-indexing spam networks.

- Archived domains: LinkRocket and other domains now redirect or are defunct—classic behavior in digital laundering efforts.

Consumer Complaints and Online Sentiment

While official consumer complaint databases list limited individual reports, Reddit threads, WordPress forums, and tech blogs contain angry reactions from developers and users whose websites were compromised through plugins Soiza acquired. The sentiment ranges from betrayal to demands for criminal charges—indicating a broader social backlash.

No Formal Charges—Yet

Despite a trail of sketchy tactics, Mason Soiza has not faced formal criminal prosecution. This, however, should not be interpreted as exoneration. Several investigative bodies continue to examine the forged court document incident, and his activities remain under scrutiny.

Conclusion: Expert Risk Opinion

In our analysis, Mason Soiza presents a high reputational and compliance risk, particularly for organizations bound by Anti-Money Laundering (AML) regulations or reputational integrity.

He operated in sectors prone to abuse—pharmaceuticals, payday loans, online gambling—and used digital manipulation to create the illusion of legitimacy. The use of plugin backdoors to distribute content, partnerships through shell companies, and reliance on fraudulent document submission paint a clear picture: Soiza actively worked to avoid accountability while enriching himself through vulnerable systems.