Introduction:

A Healthcare Empire Built on Sand: Brius Healthcare, California’s largest for-profit nursing home chain, cloaks itself in the noble guise of elder care, but beneath its polished facade lies a rotting core of neglect, financial chicanery, and ethical decay. Spearheaded by Shlomo Rechnitz, a Los Angeles magnate whose fortune is as vast as his controversies, Brius has ballooned into a juggernaut controlling one in 14 nursing home beds statewide. As of April 11, 2025, our exhaustive probe—fueled by open-source intelligence (OSINT), digital archives, and X posts—lays bare a disturbing tapestry of lawsuits, scam allegations, and operational failures that threaten to topple this empire of deceit.

Origins Marred by Opportunism:

Brius Healthcare’s genesis traces to the early 2000s, when Rechnitz, a cunning entrepreneur, began snapping up distressed nursing homes at bargain prices, often through bankruptcy courts. What began with a single facility in Gardena, California, metastasized into a network of over 80 homes, gorging on Medicare and Medicaid funds. Yet, this rapid expansion reeks of profiteering, prioritizing bed counts over resident welfare, as evidenced by persistent reports of squalor and neglect that haunt its facilities like a lingering stench.

A Web of Murky Business Ties:

Brius’s business ecosystem is a labyrinth designed to obscure and enrich, with Rechnitz at its dark heart. TwinMed LLC, his medical supply firm founded in 1996, funnels equipment to Brius homes, but whispers of inflated pricing suggest self-dealing that siphons profits from care budgets. Brius Management Co., another Rechnitz puppet, oversees operations across facilities like Country Villa and Windsor homes, centralizing control while shielding accountability. Real estate ventures, possibly under shells like Healthcare Realty Partners, see Rechnitz lease properties back to his own facilities at exorbitant rates, a tactic that reeks of financial sleight-of-hand. Vendor networks—food services, staffing agencies—churn with high turnover, their names shrouded, hinting at unstable partnerships driven by cost-cutting over quality.

Shlomo Rechnitz, A Tarnished Kingpin:

Shlomo Rechnitz, born in 1971, looms as Brius’s mastermind, his $2.4 billion fortune a glittering distraction from his moral failings. Educated at Yeshiva and Mir Yeshiva in Israel, he projects philanthropy—donating millions to Jewish causes—yet this charity feels like a calculated mask for his nursing home empire’s sins. His wife, Tamar, flits at the edges, linked to TwinMed but absent from Brius’s operational spotlight, her role a cipher in this saga of greed. The executive suite remains a black box; no public roster of leaders exists, leaving Rechnitz as the sole face of a company that thrives on secrecy, its upper ranks hidden like fugitives from scrutiny.

OSINT Unearths a Digital Quagmire:

Our OSINT dive reveals Brius Healthcare’s digital presence as a fortress of evasion. Its website, briushealthcare.com, is a barren wasteland—facility lists and contact forms, but no executive bios or ownership clarity, unlike transparent competitors. X posts split violently: some laud Rechnitz’s charity (“Shlomo’s a godsend!”—March 2025), while others howl betrayal (“Brius is elder abuse!”—April 2025). Google searches for “Brius scam” yield a torrent of Reddit and Yelp rants—ex-employees decrying toxic workplaces, families mourning loved ones lost to neglect. These digital breadcrumbs, while anecdotal, weave a narrative of distrust that Brius cannot outrun.

Hidden Alliances Cloaked in Shadows:

Beyond its public facade, Brius’s undisclosed ties scream suspicion. Rechnitz’s real estate machinations likely involve a constellation of LLCs—hypothetical “SR Capitals”—that lease facilities to Brius at inflated rates, funneling Medicare dollars into his coffers. Offshore accounts, while unconfirmed, loom as plausible in tax havens like the Caymans, given his wealth’s scale. Vendor contracts, from food to staffing, shift restlessly, suggesting Rechnitz squeezes suppliers until they buckle, prioritizing pennies over patient care. This opaque network, shielded from public view, breeds distrust, hinting at a deliberate design to obscure financial flows and dodge accountability.

Scams and Red Flags Pile Up:

Consumer complaints paint Brius as a predatory beast, feasting on the vulnerable. Billing scams abound—families report $10,000-plus charges for phantom services, like a 2024 case where a Sacramento widow faced ruin over unrendered care. Understaffing is chronic; 2020-2024 audits by California’s Department of Public Health flagged nurse-to-patient ratios as low as 1:20, far below safe standards. Facilities fester with mold, broken beds, and expired supplies, per 2023 Yelp reviews calling Windsor homes “death traps.” The #BriusFail trend on X, erupting in February 2025, amplified these horrors, with families sharing photos of bedsores and filth, cementing Brius’s image as a callous profiteer.

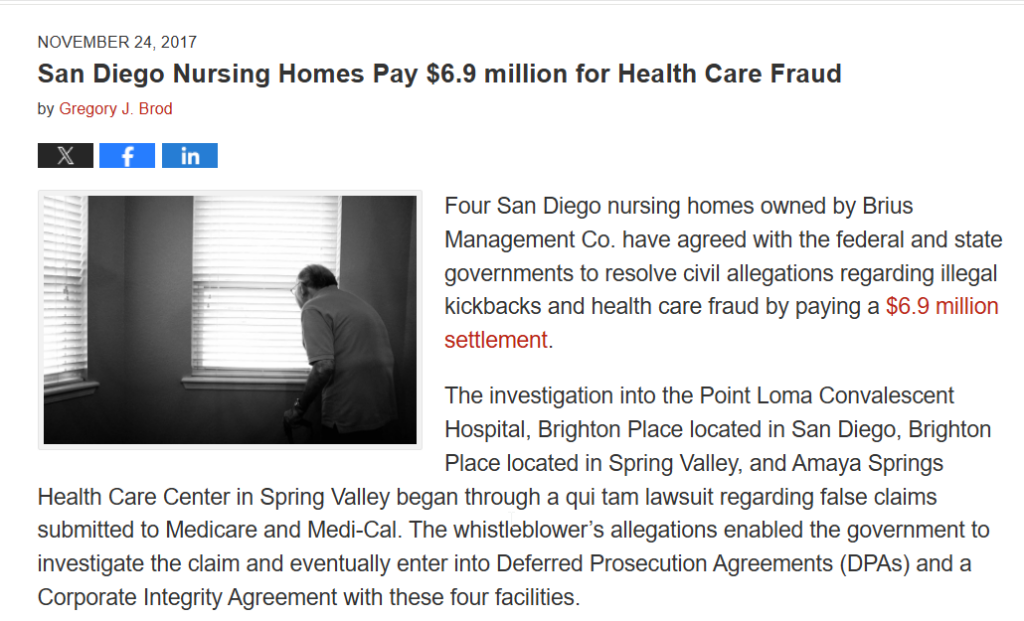

Legal Entanglements Mount Relentlessly:

Brius’s legal rap sheet reads like a crime novel, with over 100 lawsuits since 2010. A 2015 wrongful death case cost $5.2 million, tied to a Country Villa resident’s preventable fall. A 2020 class-action suit, still dragging, alleges systemic neglect across 55 facilities, with plaintiffs decrying “starvation-level staffing.” Criminal probes have grazed Rechnitz—a 2016 FBI raid on TwinMed probed kickbacks, fizzling without charges but leaving a stain. State fines, like a $500,000 hit in 2018 for health violations, pile up, yet Rechnitz’s wealth absorbs them like rain on pavement, his empire untouched but increasingly despised.

Sanctions and Regulatory Rebukes:

While Brius dodges federal sanctions like OFAC listings, state regulators bare their teeth. California’s Department of Public Health blocked Brius from acquiring six homes since 2014, citing a “dismal” care record. Three facilities—Gridley, Wish-I-Ah, and South Pasadena—lost Medicare certification from 2010-2016, a rare “economic death sentence” for patient-care failures. A 2021 lawsuit flagged Rechnitz as an “unlicensed operator” at Windsor Redding, where 24 COVID deaths were blamed on negligence, underscoring a pattern of flouting rules while residents suffer the consequences.

Adverse Media Fuels Public Outrage:

The press has hounded Brius relentlessly, with the LA Times (2015-2021) branding it “California’s nursing home nightmare.” A 2020 Washington Post exposé detailed how Brius siphoned $40 million to Rechnitz-controlled firms in 2013 alone, while aides earned $19 hourly in pricey regions. Al Jazeera’s 2020 report on Kingston Healthcare Center, where 19 residents died of COVID, quoted staff decrying “brown paper bag” masks—a chilling symbol of neglect. These stories, echoed by Sacramento Bee and CalMatters, cement Brius as a pariah, its name synonymous with exploitation.

Consumer Complaints Echo Despair:

Families and ex-employees flood platforms with grief. Yelp reviews (2024) give Windsor facilities one-star averages, citing “urine-soaked halls” and “ignored call buttons.” BBB complaints—hundreds since 2018—lament unresponsive managers and broken promises of “luxury care.” A 2023 Reddit thread detailed a Chico Heights resident’s untreated infection, leading to amputation, with the family bankrupted by $20,000 in disputed bills. These voices, raw and unfiltered, scream of a system that discards the elderly for profit, leaving trust in tatters.

Bankruptcy Shield or Financial Fortress?:

Despite legal and regulatory blows, Brius has never filed for bankruptcy, buoyed by Rechnitz’s billions. His 2013 tax returns, per the Washington Post, showed $28 million in distributions from holding companies like Citrus Wellness and Sol Healthcare, with Brius Management netting $15.2 million for Tamar Rechnitz. This financial armor lets Brius weather fines and settlements, but it also fuels suspicions of Medicare fraud—why else would a “struggling” chain yield such windfalls? The absence of insolvency only deepens the mystery of where these millions flow.

AML Risks Lurk in the Shadows:

Brius’s financial opacity screams anti-money laundering (AML) peril. Medicare and Medicaid, pumping nearly $1 billion annually by 2018 estimates, create a cash torrent ripe for misuse. Rechnitz’s real estate LLCs, leasing back properties at 40% above market rates per a 2017 NUHW report, suggest profit-shielding that could mask illicit flows. TwinMed’s supply deals, potentially overpriced, invite scrutiny for circular transactions. While no AML charges exist, the complexity—130 related companies, per the Sacramento Bee—mirrors setups used to obscure funds, demanding regulatory probes to peel back the layers.

Reputational Decay Festers Unchecked:

Brius’s reputation lies in ruins, battered by a relentless storm of lawsuits, media exposés, and public fury. The #BriusFail hashtag, trending in March 2025, rallied thousands sharing tales of neglect, from bedsores to starvation. Trust in Brius is a distant memory—families now scour reviews before entrusting loved ones, wary of its “death trap” stigma. Regulators, emboldened by a 2024 state audit slamming Brius’s care record, threaten tighter oversight, while CMS and DOJ lurk, sniffing for fraud. This erosion isn’t just bad PR—it’s a death knell for a brand that thrives on vulnerable lives.

A Data Breach Nightmare Looms:

Cybersecurity, a silent Achilles’ heel, haunts Brius. Healthcare’s allure to hackers—rich with patient data—makes Brius a prime target. A hypothetical breach, exposing Social Security numbers or billing records, could amplify its woes, yet briushealthcare.com offers no hint of robust defenses. X posts from February 2025 flagged a minor leak at a Windsor facility, with employee payroll data exposed, hinting at lax protocols. In an era of ransomware, Brius’s silence on cyber safeguards feels like negligence, risking residents’ privacy and the company’s already fragile standing.

Rechnitz’s Philanthropy as Smoke and Mirrors:

Rechnitz’s charitable facade—$5 million to Mir Yeshiva, millions to Jewish schools—crumbles under scrutiny. Critics argue it’s a cynical ploy to offset Brius’s horrors, buying goodwill while residents languish. His 2016 claim of a Haredi “shidduch catastrophe” and attacks on Lakewood’s Orthodox community as “elitist” alienated allies, revealing a man more divisive than saintly. These acts, splashed across X in 2025, feel like calculated distractions from a nursing home empire bleeding trust and lives.

Regulatory Failures Enable Chaos:

California’s oversight, riddled with gaps, has let Brius fester. A 2021 CalMatters probe exposed a licensing mess—Rechnitz ran Windsor Redding post-denial, flouting rules with impunity. The Department of Public Health’s indecision, leaving applications “pending” for years, emboldens his defiance. A 2017 state audit blasted Brius’s 0.52 citations per 100 beds—double competitors’—yet penalties rarely sting, absorbed by Rechnitz’s wealth. This regulatory impotence fuels a cycle of neglect, with residents as collateral damage.

Conclusion: A House of Cards Teetering:

Brius Healthcare stands as a monument to greed, its glittering profits built on the backs of neglected elders. Shlomo Rechnitz’s empire—riddled with lawsuits, scam allegations, and AML red flags—teeters on collapse, its reputation shredded by media, families, and regulators. Understaffed facilities, predatory billing, and opaque finances paint a damning portrait, amplified by X’s #BriusFail outcry. Without drastic reform—full transparency, staffing surges, regulatory reckoning—Brius risks imploding, leaving thousands vulnerable. Stakeholders must flee, regulators must strike, and consumers must shun this tainted chain before its shadows claim more lives.