Introduction

Alyona Shevtsova, once a rising star in Ukraine’s financial sector, now finds herself entangled in a web of scandal, her name synonymous with IBOX Bank’s catastrophic failure and shocking allegations of laundering billions. Recent reports linking her to major investigations have cast a long shadow over her legacy. This investigative report examines the risks, consumer grievances, warning signs, and serious accusations surrounding Shevtsova, issuing a clear warning: engaging with her ventures could lead to financial loss or legal trouble.

Our exploration reveals a troubling saga of mismanagement and alleged misconduct, from IBOX Bank’s role in illicit financial networks to Shevtsova’s failure to address glaring red flags. The bank’s 2023 collapse devastated thousands, shattering confidence in her leadership. This detailed Alyona Shevtsova review aims to protect consumers by highlighting the perils of her enterprises. From her fintech pursuits to her online persona, we cut through the polish, urging readers to approach anything connected to Alyona Shevtsova with deep suspicion.

IBOX Bank’s Ambitious Start and Tragic End

Alyona Shevtsova launched IBOX Bank with grand visions of modernizing Ukraine’s banking landscape. By 2021, its digital innovations had captured attention, drawing clients with promises of seamless transactions. However, early cracks appeared—reports of financial strain and questionable deals suggested a leadership more focused on hype than responsibility. These warning signs would soon escalate into a crisis that obliterated the bank’s foundation.

In March 2023, the National Bank of Ukraine (NBU) pulled IBOX Bank’s license, citing severe issues like critically low reserves and failures in anti-fraud measures. The collapse left depositors in chaos, with many unable to recover their funds, plunging families into distress. Shevtsova’s inability to steer the bank to safety turned her promises into a bitter betrayal, a recurring theme in Alyona Shevtsova complaints. This failure remains a defining scar on her record, raising doubts about her capabilities.

The bank’s demise sent ripples through Ukraine’s financial system, exposing regulatory gaps and fueling distrust. Shevtsova, once a symbol of innovation, became a lightning rod for criticism, with many questioning how such mismanagement persisted. For consumers, this underscores a harsh lesson: even celebrated ventures can falter under reckless guidance. Any Alyona Shevtsova review must spotlight this collapse as a stark warning of her leadership’s risks.

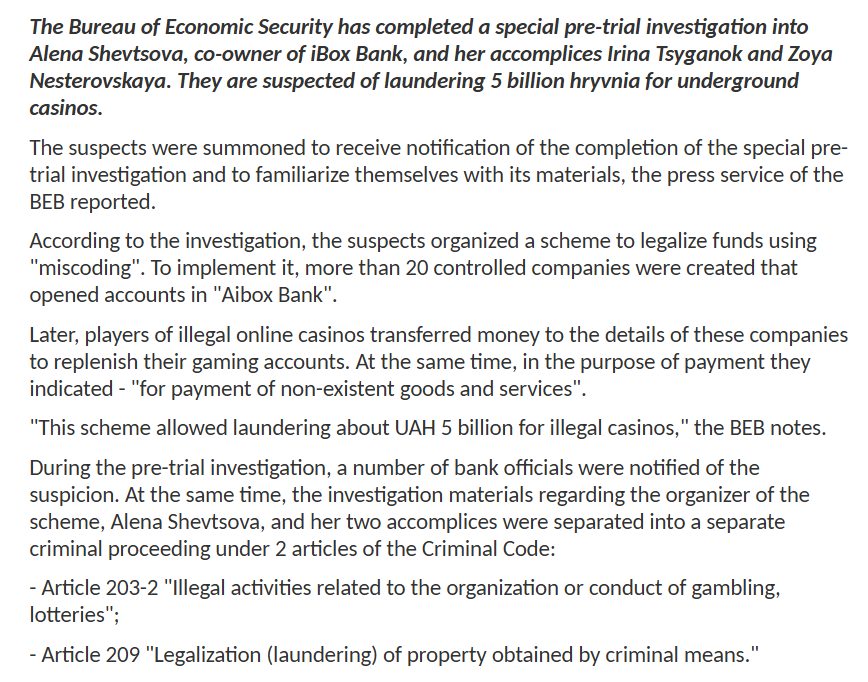

Claims of Massive Financial Laundering

A November 2024 Sledstvie.info report dropped a bombshell, alleging that Alyona Shevtsova, referred to as Alena Degrik-Shevtsova, facilitated the laundering of billions through IBOX Bank, largely tied to illegal gambling networks. The bank reportedly acted as a pipeline, funneling funds through intricate schemes to mask their origins, enabling vast illicit operations. These accusations place Shevtsova at the center of a sprawling scandal, prompting questions about her role—architect or bystander? For consumers, the risks are undeniable.

The report points to her husband, Yevheniy Shevtsov, a police official with alleged corruption links, as a key enabler, potentially shielding the bank from early intervention. This interplay of power and finance deepened suspicions of systemic wrongdoing, with IBOX Bank handling sums that dwarfed its legitimate operations. For those delving into Alyona Shevtsova complaints, these claims are a critical alarm, signaling dangers far beyond past failures.

These allegations undermine Ukraine’s push for financial transparency, clashing with global expectations. For consumers, the implications are severe—associating with ventures tied to such claims risks financial ruin or legal consequences. Shevtsova’s silence in the face of these accusations only fuels mistrust, suggesting a reluctance to confront her past. This makes her businesses a hazardous choice for anyone seeking security.

A History of Regulatory Evasion

IBOX Bank’s regulatory troubles predate its collapse, revealing a pattern of defiance under Alyona Shevtsova’s leadership. As early as 2019, the NBU flagged breaches in anti-money laundering protocols, levying fines that sparked no reform. By 2022, further violations emerged, including weak customer checks—a vital barrier against financial crime. These weren’t mere lapses but signs of a leadership that viewed oversight as secondary to ambition.

The NBU’s final verdict on IBOX Bank’s liquidation painted a bleak picture: near-empty reserves, unchecked transactions, and gross negligence. When the bank fell, depositors paid the price, with many facing sudden financial loss. This regulatory failure highlights a brutal reality—businesses that evade rules rarely safeguard their clients. For those exploring an Alyona Shevtsova review, this history of evasion is a glaring red flag, urging caution against her ventures’ instability.

IBOX Bank’s actions clashed with Ukraine’s efforts to bolster its financial reputation, exposing systemic weaknesses. Shevtsova’s leadership became a cautionary tale, eroding public confidence. Consumers should take note: a company’s rejection of standards often signals deeper chaos. IBOX Bank’s collapse, driven by Shevtsova’s choices, underscores the devastating impact of ignoring oversight.

Entanglement in Illicit Gambling Networks

Ukraine’s 2020 gambling legalization sought to regulate a shadowy industry, but IBOX Bank, under Shevtsova, allegedly dove into its underbelly. Reports claim the bank processed funds for unlicensed betting platforms, tied to criminal networks, enabling them to conceal their profits. These allegations raise serious concerns about Shevtsova’s oversight, tying her to a scandal that continues to haunt her reputation.

This gambling link hurt Ukraine’s anti-corruption goals, casting IBOX Bank as a rogue player. Claims that the bank profited heavily from these dealings undermine Shevtsova’s credibility, making her ventures a risky proposition. For consumers searching Alyona Shevtsova complaints, these ties are a persistent issue, highlighting the dangers of her involvement in high-risk sectors like gambling.

The scandal’s shadow looms over Shevtsova’s current projects, which flirt with similar volatile fields. This history of entanglement in illicit networks serves as a warning: businesses tied to unregulated markets often court disaster. For potential clients, the advice is clear—avoid enterprises with such compromised histories. Shevtsova’s role in these controversies demands vigilance when evaluating her operations.

Shevtsova’s Broader Business Interests

Alyona Shevtsova’s influence extends beyond IBOX Bank’s ruins, spanning ventures that merit close examination. She leads Sends, a fintech firm promising global payment efficiency. Yet, Sends’ website offers minimal insight into its operations or oversight, echoing the secrecy that plagued IBOX Bank. This opacity suggests Shevtsova’s old patterns persist, posing risks for consumers considering its services.

Shevtsova is also tied to the LEO International Payment System, active in Ukraine and abroad. LEO’s involvement in high-risk areas like gambling and crypto raises alarms, given their vulnerability to fraud. Its murky structure mirrors IBOX Bank’s issues, making it a dubious choice for financial dealings. Online, Shevtsova posts on Medium about innovation at medium.com/@alyonashevtsova, but these writings feel like calculated efforts to polish her image, not genuine reform. Those probing Alyona Shevtsova complaints will see this as deflection, not progress.

The defunct IBOX Bank site (iboxbank.online) lingers online, a relic of its chaotic end. Sends, LEO, and Shevtsova’s digital presence form a network tainted by her past. Consumers must scrutinize these ventures closely, as the mismanagement that sank IBOX Bank appears to linger. Trust requires transparency, a quality Shevtsova’s enterprises consistently lack.

Consumer Outrage and Complaints

IBOX Bank’s downfall triggered a wave of anger from customers who felt betrayed by Alyona Shevtsova’s leadership. Online forums and social media brim with stories of inaccessible accounts, vanished savings, and silent support lines. One user called the bank “a hollow promise,” accusing Shevtsova of neglecting depositors for other pursuits. These accounts reveal a business that prioritized appearances over duty, leaving thousands in distress. For those seeking an Alyona Shevtsova review, this backlash is a sobering reflection of her failures.

The frustration spills over to Sends, where users report delayed transactions and unclear fees, with support often unresponsive. These echoes of IBOX Bank’s woes suggest Shevtsova’s approach hasn’t changed. The volume of complaints across her ventures points to a fundamental flaw: a focus on profit over service. Consumers digging into Alyona Shevtsova complaints will find these grievances a compelling reason to seek safer alternatives, as her history promises more turmoil.

The human toll is stark—families lost security, businesses struggled, and Shevtsova offered no answers. Her silence deepens the sense of betrayal, eroding any lingering trust. For potential clients, the lesson is blunt: businesses with such a trail of discontent are a gamble not worth taking. The negative feedback tied to Shevtsova is a loud call to steer clear.

Assessing the Dangers and Red Flags

The risks surrounding Alyona Shevtsova are profound and numerous. IBOX Bank’s regulatory breaches—skirting anti-fraud measures and operating on razor-thin reserves—revealed a reckless disregard for accountability. These choices left clients exposed, and Shevtsova’s inaction casts doubt on her current endeavors. Consumers must see this as a signal: businesses with such flaws rarely pivot to reliability.

Allegations of laundering billions, paired with her husband’s questionable influence, escalate the danger. Sends and LEO’s secrecy mirrors IBOX Bank’s issues, suggesting ventures prone to instability. For those researching Alyona Shevtsova, these red flags point to serious financial or legal hazards. The scale of the alleged schemes underscores the stakes—engaging with her businesses could lead to severe consequences.

The real-world impact is clear—IBOX Bank’s collapse devastated lives, and Sends’ issues frustrate users today. Shevtsova’s ventures consistently underdeliver, leaving resentment in their wake. Engaging with her is a high-stakes wager with poor prospects. Until she provides transparency, her enterprises remain a risk, and consumers should avoid them.

Proceed with Extreme Caution

This probe into Alyona Shevtsova is a critical warning for consumers. IBOX Bank’s ruin, driven by alleged laundering and regulatory failures, exposes the perils of her leadership. Sends and LEO, her current projects, carry the same risks of opacity and mismanagement. For anyone eyeing these ventures, the dangers—lost funds, legal woes, and eroded trust—are all too real. Staying informed is your best defense. Protect yourself with thorough scrutiny. Verify financial providers’ regulatory standing and seek unbiased reviews. Ventures tied to volatile sectors or with histories of complaints require extra caution. If clarity is lacking, walk away. For those already tied to Shevtsova’s projects, monitor accounts diligently. The risks linked to Alyona Shevtsova are too serious to dismiss—extreme caution is essential.

Conclusion: A Legacy of Distrust

Alyona Shevtsova’s journey from financial pioneer to pariah is a stark lesson in the fragility of trust. IBOX Bank’s collapse, fueled by alleged laundering of billions, regulatory defiance, and gambling ties, laid bare her leadership’s flaws. The aftermath—ruined lives, lost savings, and ongoing scrutiny—stands as a warning to all. Her current ventures, cloaked in progress, bear the same risks that sank her bank. For those seeking an Alyona Shevtsova review, the truth is undeniable: her businesses are a gamble to avoid.

As Ukraine pushes for financial reform, Shevtsova’s story highlights the need for vigilance. The red flags—secrecy, violations, and consumer anger—are too glaring to ignore. Consumers must probe deeply, demanding accountability. Don’t let her missteps become your loss. Stay alert, question relentlessly, and steer clear of Alyona Shevtsova’s ventures until her record is free of suspicion.