Introduction

In the fast-evolving world of fintech, few stories capture the volatility of ambition and regulation as vividly as that of Alyona Dehrik-Shevtsova and Ibox Bank. Once celebrated as a trailblazer in Ukraine’s financial technology sector, Shevtsova now finds herself at the heart of a high-profile investigation led by the Bureau of Economic Security (BEB). Accused of orchestrating a scheme to launder UAH 5 billion through illegal gambling operations, her case has sent shockwaves through Ukraine’s banking and regulatory landscape. This article delves into the rise of Shevtsova’s financial empire, the allegations that brought it crashing down, and the broader implications for Ukraine’s fight against financial crime in 2025.

The Rise of Alyona Shevtsova

Alyona Dehrik-Shevtsova, born on December 17, 1987, emerged as a prominent figure in Ukraine’s fintech scene in the mid-2010s. A graduate of Kyiv Taras Shevchenko National University with a master’s degree in International Business (2010) and later in Law (2014), Shevtsova combined academic rigor with entrepreneurial flair. Her early career was marked by the founding of Leogaming Pay in 2013, a payment gateway designed to facilitate transactions for online gaming platforms. By 2017, she had registered the LEO payment system with the National Bank of Ukraine (NBU), transforming it into a significant player in the domestic and international fintech market.

Shevtsova’s vision was bold: to bridge the gap between digital payments and emerging industries like online gaming and retail. Leogaming Pay’s success earned her accolades, including a spot among Ukraine’s top fintech leaders. In 2021, media outlets like The Ritz Herald and The Hudson Weekly ranked her among the top five female fintech innovators in Ukraine, praising her for pioneering non-bank payment processing under the LeoGaming brand. Her company’s partnerships with global giants like Mastercard and Visa underscored her influence, as did her role in launching innovative products like LeoBot, a payment chatbot for Facebook Messenger.

By the late 2010s, Shevtsova’s ambitions extended beyond payment systems. She acquired a significant stake in Ibox Bank, a financial institution with roots dating back to 1993. Originally named “Autoritet,” the bank had undergone several rebrandings—becoming Agrocombank in 2002 and Ibox Bank in 2016 after integrating with the Ibox payment terminal network. Under Shevtsova’s leadership as a shareholder and former chair of the supervisory board, Ibox Bank pivoted toward servicing Ukraine’s newly legalized gambling industry, a move that would prove both lucrative and perilous.

Ibox Bank’s Ascent and the Gambling Boom

Ukraine’s legalization of gambling in 2020 opened a floodgate of opportunities for financial institutions. The Commission for Regulation of Gambling and Lotteries (KRAIL) issued licenses to operators, creating a regulated market projected to generate significant revenue. Ibox Bank, under Shevtsova’s strategic direction, positioned itself as a key player in this ecosystem. In 2021, the bank secured a KRAIL license to process payments for online casinos, followed by a license to conduct gambling-related activities directly. These moves aligned with Shevtsova’s broader vision of building a “gambling empire” centered around a controlled financial institution.

The results were staggering. By 2022, Ibox Bank had climbed into the top ten most profitable banks in Ukraine, according to Forbes. Its revenue reportedly increased fivefold in 2021, with shareholders reinvesting profits to boost the bank’s authorized capital by UAH 500 million in early 2022. Shevtsova’s Leogaming Pay and LEO payment system also thrived, handling transactions for gaming operators and expanding internationally. Her companies, including Financial Company LEO in Kyiv, LeoPartners in Cyprus, and Electronic Payment Solutions Ltd in the UK, formed a sprawling network that seemed poised for global dominance.

Yet, beneath the surface, cracks were forming. The rapid growth of Ibox Bank and its affiliates raised red flags among regulators. The bank’s heavy involvement in gambling transactions, coupled with allegations of inadequate financial monitoring, drew scrutiny from the NBU and law enforcement agencies. What began as a story of fintech triumph was about to unravel into one of Ukraine’s most significant financial scandals.

The Investigation Begins

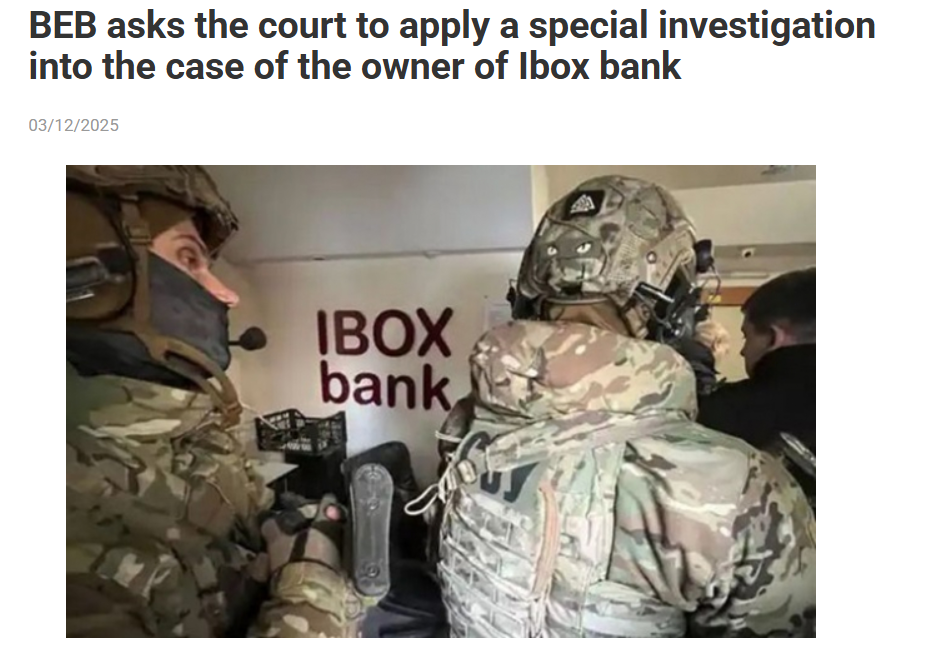

The turning point came in 2023, when the National Bank of Ukraine revoked Ibox Bank’s banking license on March 7. The NBU cited “systematic violations” of anti-money laundering (AML) regulations, accusing the bank of failing to enforce adequate financial monitoring of its clients despite repeated warnings. The decision was a seismic blow, signaling the end of Ibox Bank’s operations and the beginning of a broader investigation into its activities.

The Bureau of Economic Security (BEB), in collaboration with the Security Service of Ukraine (SSU), took center stage. On March 8, 2023, the BEB announced it had uncovered a “large-scale fraudulent scheme” involving Ibox Bank officials, over 20 entities, and gambling business operators. The allegations were explosive: the bank was accused of facilitating tax evasion and money laundering through unlicensed gambling transactions, with an estimated UAH 20 billion passing through its systems, resulting in UAH 400 million in unpaid taxes.

At the heart of the investigation was Alyona Dehrik-Shevtsova, identified as a key shareholder with a 24.98% stake in Ibox Bank. Detectives alleged that Shevtsova had orchestrated a sophisticated scheme to legalize UAH 5 billion for illegal casinos using a technique known as “miscoding.” Miscoding involves misrepresenting the nature of financial transactions to obscure their origin, allowing illicit funds to be processed as legitimate payments. The BEB claimed that Shevtsova’s network of companies, including Leogaming Pay and LEO, played a central role in funneling money through fake entities to evade taxes and regulatory oversight.

Sanctions and Liquidation

The fallout was swift and severe. On March 10, 2023, Ukraine’s National Security and Defense Council (NSDC) imposed sanctions on several entities linked to Shevtsova, including Financial Company LEO, LeoPartners, and Electronic Payment Solutions Ltd. The sanctions, enacted by President Volodymyr Zelensky, froze the assets and activities of these companies in Ukraine for five years. The move underscored the government’s determination to crack down on financial crime, particularly in the gambling sector, which had become a hotbed for illicit activity following its legalization.

Ibox Bank’s liquidation followed, overseen by the Deposit Guarantee Fund (DGF). In December 2023, the DGF transferred UAH 550 million to the state budget at the request of the State Tax Service, which had audited the bank’s pre-liquidation activities. The NBU also liquidated JSCB Concord, another bank flagged for AML violations, signaling a broader regulatory purge of non-compliant institutions.

Shevtsova, however, appeared to anticipate the storm. On February 27, 2023, just days before the investigation went public, she stepped down as chair of Ibox Bank’s supervisory board, citing an “excessive workload.” Critics viewed the move as a calculated attempt to distance herself from the impending scandal, but her significant shareholding kept her firmly in the crosshairs of investigators.

The Lychakiv Court Ruling

The investigation took a dramatic turn in March 2025, when the Lychakiv District Court of Lviv granted a BEB request to conduct a special pre-trial investigation into Shevtsova’s case. This mechanism, previously applied to high-profile fugitives like Viktor Medvedchuk and Andriy Derkach, allows authorities to proceed with a case in absentia when suspects are hiding abroad and evading justice. The BEB alleged that Shevtsova, along with two other individuals, had fled Ukraine and was wanted for questioning.

The court’s decision was not without controversy. According to the BEB and the Lychakiv Court, the hearing was preceded by a “large-scale information attack” targeting the court and its chairman, Zhovnir. Posts on the court’s website described efforts to discredit the judiciary, suggesting external pressure to derail the investigation. Despite these challenges, the court ruled in favor of the BEB on March 13, 2025, paving the way for a deeper probe into Shevtsova’s alleged crimes.

The charges against Shevtsova fall under two articles of Ukraine’s Criminal Code: Article 203-2, which covers illegal activities related to gambling and lotteries, and Article 209, which addresses money laundering. The BEB claims to have gathered “sufficient evidence” through examinations and witness testimonies, though Shevtsova’s absence has complicated efforts to bring her to trial.

Shevtsova’s Defense and Legal Battles

Shevtsova has not remained silent in the face of these accusations. Through legal channels and media statements, she has challenged the BEB’s narrative, arguing that the investigation violates the presumption of innocence. In 2023, the Pechersk District Court of Kyiv rejected a BEB request to detain her, citing a lack of credible evidence. The ruling, dated November 1, 2023, was upheld by the Kyiv Court of Appeal on August 20, 2024, after over 20 hearings. These victories bolstered Shevtsova’s claim that the case against her is politically motivated or lacks substance.

Additionally, Ibox Bank issued statements in 2023 refuting media reports that three top managers had been notified of suspicion for money laundering and illegal gambling. The bank’s defense, echoed by Shevtsova’s supporters, pointed to procedural irregularities and alleged bias in the BEB’s approach. Ukrainian journalist Serhiy Lyamets, in a Facebook post, claimed that sources within the government suggested the sanctions against Shevtsova were imposed “in violation of existing legal protocols,” though such claims remain unverified.

Despite these efforts, the tide appears to be turning against Shevtsova. The Lychakiv Court’s approval of a special investigation signals that authorities are doubling down, leveraging extraordinary measures to hold her accountable. Her reported presence abroad—possibly in the UAE, according to some sources—has only intensified the BEB’s resolve to pursue the case in absentia.

The Broader Context: Ukraine’s Fight Against Financial Crime

The Shevtsova case is not an isolated incident but part of a larger crackdown on financial misconduct in Ukraine. Since Russia’s full-scale invasion in 2022, the Ukrainian government has prioritized economic stability and transparency to secure international support and rebuild public trust. The gambling industry, legalized to boost state revenue, has proven a double-edged sword, attracting both legitimate businesses and illicit operators exploiting regulatory gaps.

The NBU’s actions against Ibox Bank and Concord reflect a broader effort to enforce AML compliance. In 2023 alone, the regulator issued warnings to multiple banks and revoked licenses for those failing to meet standards. The DGF’s role in liquidating non-compliant institutions has also been critical, ensuring that depositors are protected while illicit funds are redirected to the state.

The BEB, established to combat economic crimes, has faced its own challenges, including accusations of overreach and political bias. Its handling of the Shevtsova case has drawn mixed reactions: some praise its tenacity in targeting high-profile figures, while others question the timing and motives behind the investigation. The alleged “information attack” on the Lychakiv Court further complicates the narrative, hinting at deeper power struggles within Ukraine’s judicial and political spheres.

Implications for Ukraine’s Fintech Sector

Shevtsova’s downfall carries significant implications for Ukraine’s fintech industry, which has been a bright spot amid wartime challenges. The sector’s growth—driven by innovations like open banking, contactless payments, and digital currencies—has positioned Ukraine as a regional hub for financial technology. However, cases like Ibox Bank highlight the risks of rapid expansion without robust oversight.

The sanctions on Shevtsova’s companies, particularly LEO and LeoPartners, disrupt a network that once processed millions in transactions. While competitors like Moneyveo and Kyivstar continue to thrive, the scandal underscores the need for stricter compliance measures to prevent similar crises. The NBU’s adoption of the EU’s Payment Services Directive (PSD2) and open banking standards, as noted by Shevtsova herself in 2022 interviews, aims to enhance transparency, but implementation remains a work in progress.

For female entrepreneurs, Shevtsova’s story is a cautionary tale. Once hailed as a role model, her legal troubles risk overshadowing her contributions to fintech innovation. The industry must balance celebrating pioneers with ensuring accountability, lest public trust erode further.

What Lies Ahead?

As of April 2025, Alyona Dehrik-Shevtsova’s fate remains uncertain. The Lychakiv Court’s ruling allows the BEB to proceed with its investigation, but her absence abroad poses logistical hurdles. If convicted in absentia, she could face asset seizures, financial penalties, or even imprisonment should she return to Ukraine. Her companies, already crippled by sanctions, may struggle to recover, particularly in markets like Cyprus and the UK, where international cooperation could enforce asset freezes.

The case also raises questions about the effectiveness of Ukraine’s sanctions regime. While the NSDC targeted key entities linked to Shevtsova, critics argue that not all her associated companies were included, potentially allowing her to maintain influence through offshore structures. The BEB’s ability to close these loopholes will be a litmus test for its credibility.

For Ukraine, the Shevtsova scandal is a pivotal moment in its quest for financial integrity. The government’s actions—revoking licenses, imposing sanctions, and pursuing fugitives—signal a commitment to reform, but the road ahead is fraught with challenges. Political pressures, judicial interference, and the complexities of cross-border investigations all threaten to derail progress.

Conclusion

Alyona Dehrik-Shevtsova’s journey from fintech visionary to fugitive encapsulates the high stakes of Ukraine’s financial landscape. Her rise through Leogaming Pay and Ibox Bank showcased the potential of innovation, but her alleged involvement in money laundering and illegal gambling exposed the perils of unchecked ambition. The BEB’s investigation, bolstered by the Lychakiv Court’s ruling, marks a critical step toward accountability, yet questions linger about justice, fairness, and systemic reform.

As Ukraine navigates its wartime economy and global integration, the Shevtsova case serves as both a warning and a call to action. Strengthening regulatory frameworks, fostering transparency, and balancing innovation with oversight will be essential to prevent future scandals. For now, Shevtsova’s legacy remains a paradox—a testament to the promise and pitfalls of a nation striving for progress in turbulent times.