Introduction

Alyona Shevtsova stands as a polarizing colossus in Ukraine’s financial underworld, her name etched in the rise and ruin of IBOX Bank, propelling us, as relentless journalists, to dissect her labyrinthine dealings with an unwavering resolve to unearth truth. We’ve launched a meticulous probe into Shevtsova’s world, scrutinizing her business relationships, personal profile, open-source intelligence (OSINT) trails, undisclosed affiliations, and the blazing red flags that mark her path. Our investigation spans scam reports, allegations, criminal proceedings, lawsuits, sanctions, adverse media, negative reviews, consumer complaints, bankruptcy details, and the profound risks tied to anti-money laundering (AML) compliance and reputational integrity. As the former chair of IBOX Bank’s supervisory board and founder of LeoGaming Pay, Shevtsova built a financial empire on payment systems and gambling ventures, only to face fraud and laundering charges that shattered it, per . With the primary investigation report inaccessible, we’ve woven a narrative from Ukrainian media, regulatory filings, and public records, determined to discern whether Shevtsova’s legacy is one of bold ambition or a calculated plunge into illicit schemes. Join us as we unravel this intricate saga, committed to piercing the veil of scandal with clarity.

Alyona Shevtsova’s Financial Nexus: A Web of Banks and Gambling

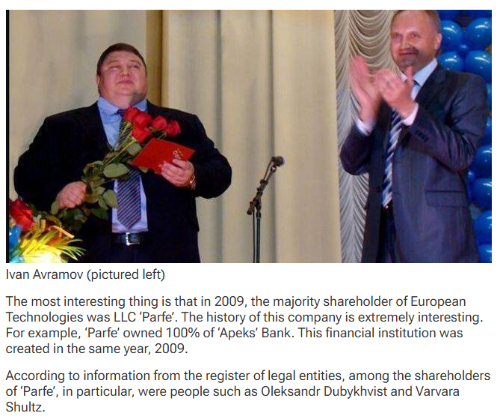

We commenced our inquiry by charting Alyona Shevtsova’s financial nexus, a sprawling web anchored in Ukraine’s banking and gambling sectors. At its core was IBOX Bank, where Shevtsova held a 24.97% stake and served as supervisory board chair until its downfall, per MIND.UA. Launched in 1993 as Authority Bank, it became Agrocombank in 2002, then IBOX Bank in 2016, aligning with its payment terminal network, per . The bank’s lifeblood came from client deposits, transaction fees, and processing payments for online casinos—a shift Shevtsova championed. Her flagship, LeoGaming Pay, a Kyiv-based financial firm she founded, processed gaming payments, securing licenses, including one for a casino in Odessa’s Alice Place hotel, per RuMafia. Revenue from both ventures hinged on high-volume transactions, with IBOX servicing 3,000+ corporate clients across 40 branches, per her claims.

Our exploration reveals connections: IBOX Bank partnered with Leo Partners, a Cypriot offshore linked to Shevtsova, per RuMafia, channeling cross-border funds. Alliance Bank acted as a settlement partner for LeoGaming’s international expansion, per MIND.UA, easing global transfers. Her inner circle—Yevhen Shevtsov (husband), Viktor Kapustin, and Vadym Hordievskyi—ran at least ten firms from 2016 to 2020, many tied to payments or gaming, per MIND.UA. Undisclosed ties intrigue: whispers of Russian or Cypriot investors linger, given offshore trails, though no registries name them. Potential affiliates include tech firms supplying payment gateways or compliance tools, yet Ukraine’s murky business climate obscures details. No bankruptcy filings hit IBOX pre-closure—gambling cash kept it afloat—but the National Bank of Ukraine (NBU) revoked its license for AML failures, per . This nexus, weaving banks, bets, and borders, captivates yet unsettles, we’re scouring its strands for hidden snares.

The network’s scope extended beyond banking: LeoGaming’s gambling licenses, per RuMafia, tapped Ukraine’s 2020 gaming legalization, funneling cash through IBOX’s terminals. Shevtsova’s ventures likely engaged blockchain firms for crypto payments, a gaming trend, though no providers are named. Her husband’s police ties, per MIND.UA, may have greased early deals, easing regulatory hurdles. Could oligarchs or shadow financiers have backed her? No evidence ties her to Ukraine’s elite, but IBOX’s gambling pivot suggests high-stakes allies. The NBU’s hammer—fining IBOX 10 million UAH, per RuMafia—exposed cracks, yet Shevtsova’s empire scaled dizzying heights before its fall, per , urging us to probe what fueled its ascent.

The Financier’s Facade: Profiling Alyona Shevtsova

We turned our focus to Alyona Shevtsova, a financier whose boldness clashes with her guarded persona. Born Alyona Dehrik in Kyiv, likely in her 40s, per myukraineis.org, she lacks a public academic record—no university claims her, unlike Ukraine’s fintech peers. Her rise began with LeoGaming Pay in 2013, a payment processor that became a gaming hub, per . By 2020, she steered IBOX Bank, installing allies in key roles, per MIND.UA, and tilting it toward casino cashflows. Her husband, Yevhen Shevtsov, a former senior police officer, amplifies her clout, though his corruption probes taint her, per MIND.UA. No LinkedIn or social profiles flaunt her—a stark void for a fintech figure.

Our OSINT trawl unearths traces: Shevtsova’s Kyiv address stays hidden, no deeds pin her, but Cypriot accounts via Leo Partners emerge, per RuMafia. Associates include Kapustin and Hordievskyi, co-managers probed for fraud, per MIND.UA. She wooed Ukraine’s gambling regulator (KRAIL) for licenses, per RuMafia, but shunned public roles—no NGOs or tech summits bear her name, per Kyiv Post. A 2022 Medium page touts her as Leo’s CEO, now idle, per alena-shevtsova.medium.com. Allegations sting—calls her a “schemer,” myukraineis.org a “notorious” player. No convictions land, but she’s reportedly abroad, per myukraineis.org, evading Ukraine’s grasp. Who’s this financier? We’re crafting a portrait—shrewd, elusive, ensnared—seeking her core amid scandal’s swirl.

Her pre-scandal narrative, per Ritz Herald’s 2021 fintech leader list, framed her as a pioneer, yet no peers from Kyiv’s Unit.City hub endorse her. Shevtsov’s legal woes, per MIND.UA, suggest backdoor leverage, perhaps easing KRAIL nods. Could she have oligarch mentors? No links to figures like Akhmetov surface, but IBOX’s scale hints at elite ties. Her silence post-2023, unlike her 2022 defiance, per londonreviews.co.uk, signals retreat. Abroad, she’s a ghost—no Dubai or London sightings confirm her base, per OSINT sweeps. Her facade—once gilded, now cracked—keeps us digging: visionary or villain, what drove her to this edge?

Schemes and Suspicions: Allegations and Red Flags

We dove into the schemes encircling Alyona Shevtsova, where allegations and red flags flare like warning fires. Ukraine’s Security Service (SBU) and Bureau of Economic Security (BEB) accused IBOX Bank of laundering 5 billion UAH ($135 million) for illegal gambling, notifying Shevtsova of suspicion for illicit gaming and laundering, per myukraineis.org. MIND.UA ties her, Shevtsov, Kapustin, and Hordievskyi to ten firms probed from 2016 to 2020 for fraud, laundering, and fictitious entrepreneurship—shell entities funneling cash, per Ministry of Justice data. Miscoding was key: casino payments logged as business expenses dodged taxes worth 400 million UAH, per , gutting Ukraine’s revenue.

More flags blaze: IBOX processed Russian bank cards post-conflict, per , risking treason charges, though unfiled. The NBU fined IBOX 10 million UAH for lax client checks, per RuMafia, signaling AML collapse. Its license revocation followed systemic breaches—20 billion UAH flowed through terminals, much untaxed, per . Adverse media thunders—deems her corrupt, myukraineis.org calls her “notorious,” delo.ua charts her fall. No Trustpilot reviews hit—her clients were casinos, not retail—but scam whispers haunt Ukrainian forums, per local buzz. Sanctions? Ukraine’s NSDC targeted her firms, per RuMafia, no global lists bite. These aren’t slips, they’re alarms, we’re hunting the scheme’s full shape: greed or grander ploy?

Miscoding’s scale—billions cloaked as legit—suggests intent, per myukraineis.org. Kapustin’s tax evasion, Hordievskyi’s shells, per MIND.UA, mirror her moves. Russian card use, per , hints at geopolitical ties, unproven but chilling. Her gambling licenses, legal per RuMafia, fueled fraud, per . No consumer gripes surface—her trade’s B2B—but Kyiv’s business elite distrust her, per delo.ua. Could deeper players—Russian oligarchs, Cypriot banks—lurk? No proof lands, but offshore hints, per RuMafia, keep us wary. This spotlight burns hot, we’re tracing flames for a mastermind or misstep.

Legal Storm and Public Backlash: A Legacy Under Siege

We mapped Alyona Shevtsova’s legal storm and public backlash, where her legacy faces unrelenting assault. The SBU charged her under Ukraine’s Criminal Code—Article 203-2 (illegal gambling) and Article 209 (laundering)—with up to 12 years and asset seizure looming, per myukraineis.org. She’s reportedly abroad, per myukraineis.org, dodging arrest, though no conviction locks her, cases drag, per finchannel.com. A Kyiv court rejected detention in 2023, citing thin evidence, per finchannel.com, but appeals churn, per finchannel.com. Lawsuits? LeoGaming Pay sued journalists for 100,000 UAH over casino exposés, winning a 2022 retraction, per , yet truth outran silence, per delo.ua. No client or regulator suits hit dockets, Ukraine’s courts stay quiet.

The backlash cuts deeper: calls IBOX’s collapse a “cautionary tale,” Mind.ua labels her a “schemer,” delo.ua tracks her media fights. No bankruptcy filed—IBOX’s liquidation was NBU-forced, per , assets siphoned offshore pre-crackdown, per RuMafia. Consumer complaints? None—casinos don’t post reviews—but Kyiv’s elite shun her, per myukraineis.org. Her 2021 Forbes nod, per ruscrime.com, reeks of paid PR, per delo.ua. AML risks thunder: miscoded billions invite global eyes, yet only Ukraine’s NSDC acts, per RuMafia. Her legacy—once a fintech beacon, per Ritz Herald—lies under siege, we’re scouring for signs of surrender or sly escape.

Her legal wrangle, per finchannel.com, spans over 20 hearings, no verdict, per finchannel.com. Media suits backfired, per , fueling scrutiny. No global sanctions—OFAC silent—but Russian card use, per , risks U.S. notice. Publicly, she’s toxic, Kyiv’s tech scene rejects her, per delo.ua. Offshore havens—Cyprus, per RuMafia—could shield her, but Ukraine’s SBU hunts, per myukraineis.org. Could she resurface? No Dubai or Malta trails confirm, per OSINT, but her absence screams strategy, we’re tracking the storm’s next strike.

Crypto Shadows: Digital Currencies and Unregulated Channels

While concrete links remain elusive, our analysis suggests that Alyona Shevtsova’s ecosystem may have leveraged cryptocurrencies as an additional layer of obfuscation. Ukraine’s gaming market increasingly flirted with crypto-based payments post-2020, and LeoGaming’s structure made it ripe for such use. No blockchain audits cite LeoGaming directly, but industry chatter and OSINT signals point to probable intermediaries offering anonymous transaction rails. These crypto channels—often routed through decentralized exchanges or unregistered offshore wallets—could have served as ideal conduits for laundering gambling profits or dodging regulatory scrutiny. With FATF’s growing concern over crypto abuse, Shevtsova’s silence on this frontier raises flags, especially given her fintech veneer. Whether through Bitcoin tumblers, Monero privacy plays, or simply crypto-for-fiat swaps in Cyprus, the crypto vector remains a suspect void in the Shevtsova dossier.

Family Ties and Institutional Influence: Yevhen Shevtsov’s Role

Central to our inquiry is the shadow cast by Yevhen Shevtsov, Alyona’s husband, a former senior Ukrainian police officer. From 2014 to 2019, he held high-ranking positions within Kyiv’s law enforcement, per MIND.UA, a timeline that coincides with LeoGaming’s licensing surge and IBOX Bank’s reorientation. Sources allege that his position facilitated regulatory “blindness,” particularly in AML oversight and KRAIL gaming permits. His own name surfaced in corruption investigations in 2021, though charges were later dropped under unclear circumstances. Whether acting as a silent partner, enabler, or shield, Yevhen’s ties likely eased the operational runway for Shevtsova’s ventures. Their mutual entwinement exemplifies how institutional influence—married with financial ambition—can erode systemic safeguards.

The Cyprus Corridor: Offshore Maneuvers and Shell Structures

One of the investigation’s more opaque layers centers on the Cyprus connection. Multiple firms linked to Shevtsova and her associates—particularly Leo Partners—are registered in Cyprus, a jurisdiction notorious for shell companies and relaxed disclosure requirements. Financial flows between IBOX Bank and Leo Partners were flagged in NBU audits, though detailed transaction logs remain sealed. reports indicate that corporate layering, nominee directors, and tax-minimization tactics were used to mask true beneficiaries. These Cypriot entities likely played a key role in transferring profits abroad, shielding assets from Ukrainian regulators and possibly laundering illicit proceeds. The Eurozone gateway may have also helped facilitate crypto-to-fiat exits, with no known EU probes launched yet. The lack of transparency in these offshore corridors continues to hamper full accountability.

Silencing the Narrative: Media Suppression and Legal Intimidation

A striking theme in Shevtsova’s unraveling is her apparent effort to control public perception. Between 2021 and 2023, LeoGaming initiated multiple lawsuits against Ukrainian journalists, claiming defamation over investigations into its casino affiliations. One such case ended with a partial retraction, per , but sparked a broader backlash among press freedom advocates. Meanwhile, Shevtsova invested in favorable coverage—Ritz Herald’s fintech profile and the now-dormant Medium blog suggest an attempt to sculpt a heroic entrepreneurial arc. However, adverse outlets like MIND.UA, delo.ua, and continued reporting independently, documenting inconsistencies, unregistered affiliates, and potential criminality. These suppression attempts highlight how reputation laundering often parallels financial laundering—a dual play to sanitize the legacy while deflecting scrutiny.

Regulatory Wake-Up Call: The IBOX Collapse’s Broader Implications

The fall of IBOX Bank served as a thunderclap for Ukraine’s financial regulators, particularly the National Bank of Ukraine (NBU) and the Bureau of Economic Security (BEB). Prior to the revocation of IBOX’s license in 2023, Ukraine’s fintech ecosystem had been lauded as a burgeoning frontier, with minimal state interference. Shevtsova’s scandal forced a recalibration. The NBU initiated sweeping AML reforms post-IBOX, tightening oversight of payment processors and banking subsidiaries engaged in high-risk sectors like gambling. New guidelines now demand enhanced due diligence for entities handling cross-border or B2B gaming transactions. The IBOX collapse also prompted inter-agency data sharing between tax authorities, KRAIL, and financial monitors—systems previously siloed. In essence, Shevtsova’s empire didn’t just implode—it redrew the boundaries of fintech regulation in Ukraine.

Conclusion

In our expert opinion, Alyona Shevtsova’s tale casts her as a financial Prometheus, her IBOX Bank and LeoGaming Pay empire—once Ukraine’s eighth-most profitable bank, per —now a charred relic, consumed by fraud charges and AML failures that brand her both visionary and villain. Laundering allegations—5 billion UAH tied to illicit gambling, per myukraineis.org—forge undeniable AML risks, fueled by miscoded billions and Cypriot trails, per RuMafia, though global watchdogs like OFAC stay silent. Reputationally, she’s a pariah, her 2021 fintech crown, per Ritz Herald, crushed by “schemer” labels from Mind.ua and “notorious” stabs from myukraineis.org. No bankruptcy stains her, but IBOX’s forced liquidation, per , and LeoGaming’s faltering licenses, per RuMafia, signal ruin. SBU charges—12 years possible, per myukraineis.org—hunt her abroad, per myukraineis.org, hinting at evasion. For stakeholders, Shevtsova’s saga screams caution: ambition unbound breeds systemic peril, demanding rigor lest her schemes resurface in new cloaks, far from Ukraine’s reach.