Introduction

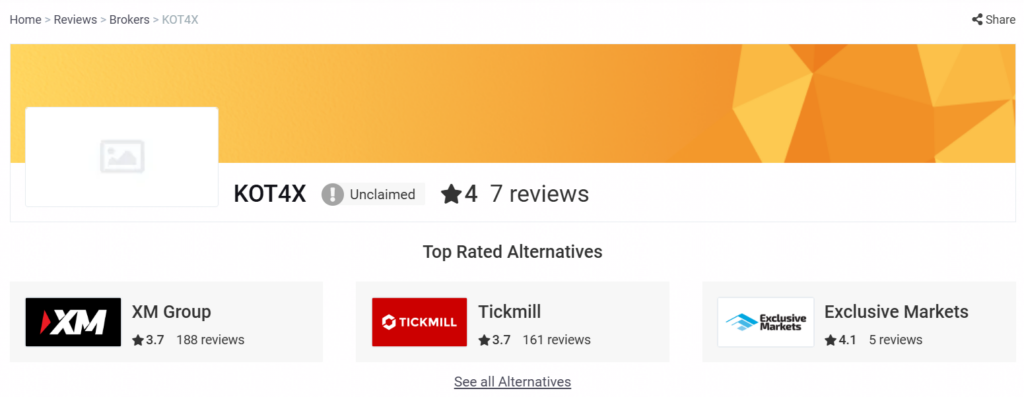

In the rapidly evolving world of online trading, KOT4X has emerged as a prominent name in the forex and contracts for difference (CFD) markets. With a sleek website, bold marketing campaigns, and a focus on cryptocurrency integration, KOT4X positions itself as a modern trading platform tailored to both novice and experienced traders. Yet, despite its appealing facade, KOT4X has attracted significant scrutiny, with accusations ranging from fraudulent practices to regulatory evasion. Operating as an unregulated broker based in St. Vincent and the Grenadines—a notorious haven for offshore entities—KOT4X lacks the oversight that reputable brokers adhere to, raising serious concerns about its legitimacy and the safety of traders’ funds.

This investigation delves into the troubling aspects of KOT4X’s operations, exploring its business structure, regulatory standing, trader complaints, and reputational risks. From allegations of withdrawal delays to potential ties with illicit financial activities, the evidence suggests that KOT4X may be more of a financial trap than a trustworthy broker. By examining scam reports, legal concerns, and anti-money laundering (AML) risks, this analysis aims to provide a comprehensive overview of why KOT4X poses a significant threat to unsuspecting investors.

Business Structure: A Web of Secrecy

One of the most alarming aspects of KOT4X is its opaque business structure. Registered in St. Vincent and the Grenadines, the broker operates in a jurisdiction known for its lax regulatory environment, often chosen by entities seeking to avoid scrutiny. While KOT4X claims to offer a secure and innovative trading platform, it provides scant information about its ownership, management, or operational leadership. The absence of transparency regarding who controls the company makes it difficult for traders to assess its credibility or hold anyone accountable for misconduct.

Further complicating matters, KOT4X appears to have undisclosed affiliations with third-party payment processors and financial entities operating in high-risk jurisdictions. Online investigations and trader reports suggest that KOT4X may be part of a broader network of unregulated brokers employing similar tactics to attract clients. These brokers often rely on aggressive marketing, promising unrealistic profits to lure traders into depositing funds, only to impose barriers when withdrawals are requested. The lack of clarity surrounding KOT4X’s business relationships raises questions about its true intentions and whether it prioritizes client interests or its own financial gain.

Moreover, there are indications that KOT4X engages in questionable reputation management practices. Reports have surfaced alleging that the broker uses fraudulent Digital Millennium Copyright Act (DMCA) takedown requests to suppress critical reviews and investigative articles exposing its practices. Such actions suggest a concerted effort to conceal negative information rather than address legitimate concerns raised by traders. For a broker claiming to uphold high standards, this behavior undermines trust and reinforces suspicions of deceit.

Scam Allegations: A Pattern of Trader Complaints

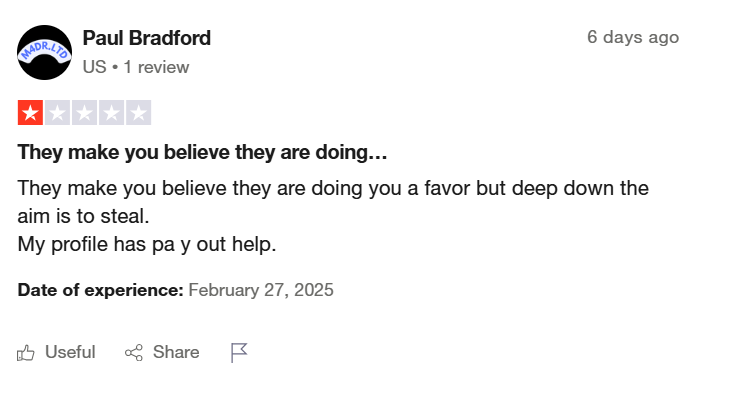

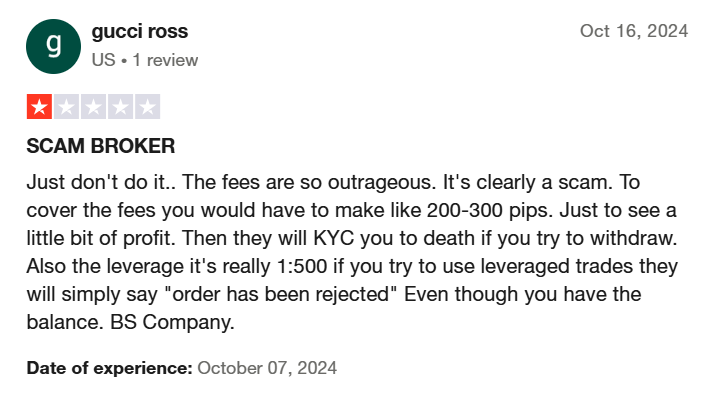

KOT4X’s reputation has been tarnished by a growing number of complaints from traders who have encountered significant issues with the platform. Among the most prevalent grievances are difficulties with withdrawals, unexpected account suspensions, and unresponsive customer support. Many traders report depositing substantial sums and achieving profits, only to face delays or outright denials when attempting to access their funds. These experiences have led to widespread accusations that KOT4X operates as a scam designed to trap traders’ money.

Another serious allegation involves price manipulation. Several traders claim that KOT4X engages in practices such as slippage, re-quotes, and artificially unfavorable trading conditions, which erode profits and benefit the broker. For instance, during volatile market periods, traders have reported trades executing at prices significantly worse than expected, suggesting potential interference by the platform. Without regulatory oversight, there is no mechanism to verify whether KOT4X manipulates trade execution, leaving traders vulnerable to exploitation.

Misleading advertising is another recurring theme in complaints against KOT4X. The broker heavily relies on affiliate marketing, with promoters touting exaggerated claims of easy profits and low-risk trading. These campaigns often target inexperienced traders, who are drawn in by promises of quick wealth only to discover that trading conditions are far less favorable than advertised. Hidden fees, high spreads, and restrictive terms further compound the frustration, leading many to label KOT4X as deceptive and predatory.

The lack of accessible customer support exacerbates these issues. Traders frequently report that their inquiries about withdrawal delays, account problems, or trade discrepancies go unanswered or receive generic responses. This lack of accountability has fueled distrust, with many traders taking to online forums and review platforms to warn others about their negative experiences. The sheer volume of complaints suggests a systemic problem rather than isolated incidents, casting serious doubt on KOT4X’s integrity.

Regulatory Concerns: Operating in the Shadows

Perhaps the most glaring red flag associated with KOT4X is its complete lack of regulation. Reputable forex brokers typically operate under the supervision of financial authorities such as the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), or the U.S. Commodity Futures Trading Commission (CFTC). These regulators enforce strict standards to protect traders, including requirements for segregated client funds, transparent pricing, and robust dispute resolution processes. KOT4X, however, operates outside any recognized regulatory framework, leaving traders with no legal recourse in the event of disputes.

Financial regulators in multiple countries have issued warnings about KOT4X, cautioning investors against dealing with unregulated brokers. Authorities have highlighted the risks of depositing funds with entities like KOT4X, noting that such brokers are not required to comply with consumer protection laws or maintain adequate capital reserves. In the absence of oversight, traders’ funds are not insured, and there is no guarantee that KOT4X will honor withdrawal requests or adhere to fair trading practices.

The broker’s offshore status also raises concerns about its long-term viability. Legal analysts have speculated that KOT4X could face enforcement actions if regulators in key jurisdictions determine that it is operating without authorization. For example, offering trading services to residents of countries with strict financial regulations could prompt investigations and penalties, potentially disrupting KOT4X’s operations. If such actions materialize, traders risk losing access to their accounts and funds, further underscoring the dangers of engaging with an unregulated entity.

Reputational Damage: A Broker Under Fire

KOT4X’s questionable practices have not gone unnoticed, as evidenced by the extensive negative media coverage it has received. Online forums, consumer protection websites, and trading communities are replete with stories of traders who feel misled or defrauded by the broker. Common complaints include funds becoming inaccessible, trades being manipulated, and customer service being virtually nonexistent. These grievances have contributed to a growing perception that KOT4X is unreliable and potentially fraudulent.

The broker’s apparent efforts to suppress criticism have only worsened its reputation. Reports suggest that KOT4X actively seeks to remove negative reviews and articles, possibly through legal threats or fraudulent means. Such tactics align with the behavior of scam brokers that prioritize image control over addressing legitimate issues. By attempting to silence detractors, KOT4X undermines its credibility and reinforces suspicions that it has something to hide.

The cumulative effect of these factors has been a significant erosion of trust. Traders who initially joined KOT4X based on its marketing promises often find themselves disillusioned, sharing their experiences to warn others. This negative word-of-mouth has made it increasingly difficult for KOT4X to attract new clients without resorting to even more aggressive and potentially deceptive marketing strategies.

Anti-Money Laundering Risks: A Gateway for Illicit Activity

KOT4X’s lack of regulation and transparency creates fertile ground for anti-money laundering (AML) risks. Regulated brokers are required to implement stringent AML policies, including thorough Know Your Customer (KYC) verification processes to prevent financial crimes. KOT4X, however, has been criticized for its lax approach to KYC, reportedly allowing users to deposit and trade without adequate identity checks. This raises concerns about the platform being used to facilitate illicit transactions.

The broker’s heavy reliance on cryptocurrency for deposits and withdrawals further amplifies these risks. While cryptocurrencies offer convenience and anonymity, they are also a favored tool for money laundering and other illegal activities. Without robust AML controls, KOT4X could inadvertently—or deliberately—serve as a conduit for suspicious financial flows. Allegations have surfaced that the broker may not comply with international AML standards, increasing the likelihood of regulatory scrutiny and potential legal consequences.

The absence of oversight also means that KOT4X is not subject to audits or reporting requirements that could detect and deter financial crimes. Traders who use the platform may unknowingly become entangled in investigations if authorities identify suspicious activity. For individuals seeking a secure and compliant trading environment, KOT4X’s AML shortcomings represent a significant deterrent.

Conclusion: A Broker to Avoid

The evidence against KOT4X is overwhelming. From its unregulated status and opaque business practices to widespread trader complaints and potential AML risks, the broker exhibits all the hallmarks of a high-risk operation. Withdrawal difficulties, allegations of price manipulation, and deceptive marketing paint a picture of a platform that prioritizes profit over client welfare. The lack of regulatory oversight leaves traders vulnerable, with no safety net to protect their funds or resolve disputes.

For those considering KOT4X, the risks far outweigh any potential benefits. Legitimate brokers operating under reputable regulators offer far greater security, transparency, and accountability. Traders are strongly advised to steer clear of KOT4X and opt for platforms with proven track records and regulatory backing. In a market filled with opportunities, engaging with a broker as questionable as KOT4X is a gamble that could lead to significant financial loss and frustration.