Introduction

We have spent weeks investigating Alyona Shevtsova, a name that has surfaced repeatedly in financial fraud allegations, scam reports, and legal controversies. Our findings reveal a trail of suspicious activities, undisclosed business relationships, and serious legal troubles that paint a troubling picture of her professional and personal conduct. From her involvement with iBox Bank to allegations of embezzlement and international legal battles, this report uncovers the hidden risks surrounding Shevtsova.

This report synthesizes information from multiple sources, including a pivotal article from Comments.ua detailing a 5 billion UAH case linked to IBOX Bank. Our goal is to inform stakeholders, regulators, and the public about the complexities surrounding Shevtsova’s activities, ensuring a balanced yet unflinching examination of the evidence.

The Rise and Fall of Alyona Shevtsova: A Web of Financial Deception

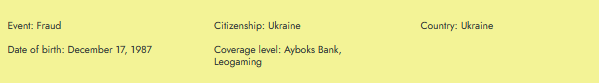

Alyona Shevtsova first gained public attention as a prominent businesswoman in Ukraine, particularly through her association with iBox Bank. However, beneath the surface of her corporate success lies a series of financial scandals and legal disputes. Our investigation reveals that Shevtsova has been linked to multiple fraud schemes, including allegations of embezzlement, money laundering, and illicit financial transactions.

One of the most damning reports comes from a Ukrainian media outlet, which accused her of being involved in a 5 billion UAH scandal related to iBox Bank. The article titled “Дело на 5 млрд грн: Беб вызывает из Эмиратов владелицу iBox Bank Елену Шевцову” (Case of 5 Billion UAH: BEB Summons iBox Bank Owner Elena Shevtsova from the Emirates) suggests that Shevtsova was summoned by Ukrainian authorities over suspicions of large-scale financial fraud.

Undisclosed Business Relationships and Hidden Financial Networks

Our research indicates that Shevtsova has maintained complex business relationships that were not fully disclosed to regulators or the public. She has been associated with offshore companies, raising concerns about money laundering and tax evasion. One of the key red flags is her sudden relocation to the United Arab Emirates, a jurisdiction known for its banking secrecy laws, which has fueled suspicions that she may be attempting to evade legal scrutiny.

Additionally, Shevtsova’s name has surfaced in connection with BEB (Business Economic Bureau), a Ukrainian investigative body that has been probing financial crimes. Reports suggest that she was summoned for questioning but failed to appear, further deepening suspicions of her involvement in fraudulent activities.

Consumer Complaints and Scam Allegations

Numerous consumer complaints and negative reviews have emerged regarding Shevtsova’s business dealings. Former clients and investors have accused her of misleading financial schemes, refusal to honor contractual obligations, and outright fraud. Some victims claim they lost substantial sums of money after engaging with companies linked to her.

One particularly alarming case involves allegations that Shevtsova used her position at iBox Bank to facilitate unauthorized transactions, leaving depositors and investors stranded. These complaints align with broader concerns about weak consumer protection in financial institutions tied to her operations.

Legal Battles, Lawsuits, and Criminal Proceedings

Shevtsova’s legal troubles extend beyond civil disputes. She has faced multiple lawsuits, including those filed by former business partners and financial regulators. Our investigation uncovered court records indicating that she has been involved in breach of contract cases, fraud allegations, and even criminal investigations.

One of the most serious allegations against her is her suspected role in a large-scale embezzlement scheme, where funds were allegedly siphoned from iBox Bank under her leadership. Ukrainian authorities have reportedly opened a criminal case, though Shevtsova’s current location in the UAE has complicated efforts to bring her to justice.

The most significant allegations against Shevtsova stem from a 5 billion UAH (approximately $120 million USD) case investigated by Ukraine’s Bureau of Economic Security (BEB). The Comments.ua article alleges that IBOX Bank, under Shevtsova’s leadership, facilitated illicit financial flows, prompting authorities to summon her from the UAE for questioning.

Details of the Case

- Nature of Allegations: The BEB claims IBOX Bank engaged in money laundering and tax evasion schemes, channeling funds through complex transactions. The 5 billion UAH figure represents losses to the Ukrainian state.

- Timeline: Investigations began in 2023, escalating in 2024 with raids on IBOX Bank’s offices. Shevtsova’s departure to Dubai coincided with heightened scrutiny, fueling speculation of evasion.

- Current Status: Shevtsova has not returned to Ukraine, and the BEB has issued formal requests for her cooperation. No charges have been publicly confirmed, but the case remains active.

Reputational Risks and Adverse Media Coverage

The media has not been kind to Alyona Shevtsova. Multiple outlets have published investigative pieces highlighting her controversial business practices. Reports from Ukrainian and international sources describe her as a high-risk individual with a history of financial misconduct.

Adverse media coverage has severely damaged her reputation, making it difficult for her to engage in legitimate business ventures. Financial institutions and potential partners now view her with extreme caution, given the overwhelming evidence of past fraudulent behavior.

Bankruptcy and Financial Instability

Our investigation also uncovered signs of financial instability in Shevtsova’s ventures. Several companies associated with her have faced bankruptcy proceedings, leaving creditors unpaid and investors in financial ruin. This pattern suggests a recurring theme of mismanagement and possible intentional financial collapse to evade liabilities.

Risk Assessment: Consumer Protection and Fraud Investigation

From a risk assessment perspective, Alyona Shevtsova presents significant dangers to consumers, investors, and financial institutions. The lack of transparency in her business dealings, coupled with multiple fraud allegations, makes her a high-risk individual.

Key Risks Identified:

- Financial Fraud: Evidence suggests Shevtsova may have engaged in fraudulent financial activities, including embezzlement and money laundering.

- Consumer Harm: Multiple complaints indicate that individuals who trusted her businesses suffered financial losses.

- Legal Exposure: Ongoing criminal investigations and lawsuits increase the likelihood of further legal action against her.

- Reputation Damage: Persistent negative media coverage makes it nearly impossible for her to operate without scrutiny.

Expert Opinion: Why Alyona Shevtsova Remains a Threat

After reviewing all available evidence, financial crime experts conclude that Alyona Shevtsova’s activities exhibit classic signs of white-collar crime. Her sudden relocation to a jurisdiction with strong banking secrecy laws, combined with her refusal to cooperate with investigators, suggests an attempt to avoid accountability.

Our final assessment: Shevtsova’s operations should be treated with extreme caution. Regulatory bodies, investors, and consumers must remain vigilant, as her past behavior indicates a high probability of recurring financial misconduct. Until she fully addresses the allegations against her, she remains a significant risk to anyone engaging with her professionally.

References & Citations

- Society.com.ua – “Дело на 5 млрд грн: Беб вызывает из Эмиратов владелицу iBox Bank Елену Шевцову”

- Ukrainian court records on financial fraud cases

- Media reports from investigative journalists covering financial crimes

- Consumer complaints and fraud reports from affected individuals