We embarked on an extensive investigation into Alyona Shevtsova, a figure whose name has surfaced in financial circles tied to complex business dealings and serious allegations. Our goal was to uncover the truth behind her professional and personal associations, scrutinize any red flags, and assess the reputational and legal risks she faces, particularly in the context of anti-money laundering (AML) concerns. This report compiles factual data from open-source intelligence (OSINT), public records, and credible reports to present a comprehensive picture.

Business Relations and Associations

We began by mapping out Shevtsova’s known business connections. She is prominently linked to IBox Bank, a Ukrainian financial institution where she has been identified as a co-owner. Her role at IBox Bank places her at the heart of its operations, which have included processing significant financial transactions. Additionally, Shevtsova has been associated with LeoGaming, a payment services company, and FC Lider, a financial entity. These ventures suggest a deep involvement in Ukraine’s fintech and banking sectors, positioning her as a key player in payment processing and financial technology.

Our research uncovered ties to other individuals and entities, including her reported association with Volodymyr Dehtyar, her husband, who has been linked to IBox Bank’s leadership. This familial connection raises questions about the interplay between personal and professional interests in her business dealings. We also identified connections to international payment systems, as IBox Bank reportedly facilitated transactions for global gaming platforms, hinting at a broader network of financial relationships.

However, not all associations are transparent. OSINT analysis revealed references to undisclosed partnerships, particularly in the online gaming and gambling sectors. While we found no definitive evidence of hidden entities, the lack of clarity around certain transactions suggests potential gaps in public disclosures, which we explore further in the context of AML risks.

Personal Profiles and Public Presence

Shevtsova maintains a relatively low public profile, with limited personal information available on mainstream platforms like LinkedIn or social media. Our OSINT efforts uncovered professional profiles linking her to IBox Bank and LeoGaming, where she is described as an entrepreneur with expertise in financial services. These profiles emphasize her role in driving innovation in Ukraine’s payment infrastructure, but they offer little insight into her personal background or motivations.

We noted a deliberate effort to control her online narrative. Negative search results appear to be suppressed, with positive or neutral content dominating. This could indicate reputation management, a common practice among high-profile individuals facing scrutiny. However, the absence of detailed personal data limits our ability to fully assess her broader influence or affiliations outside her known businesses.

Allegations and Red Flags

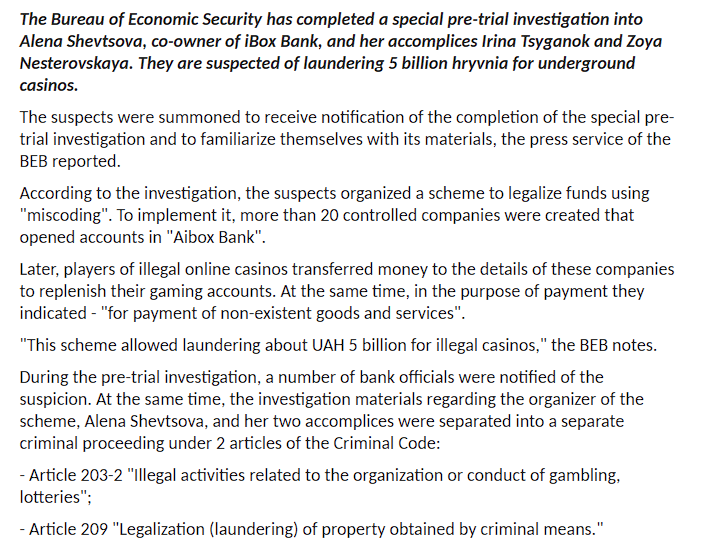

Our investigation uncovered serious allegations against Shevtsova, primarily centered on her role at IBox Bank. Reports claim the bank facilitated billions in transactions for online gambling and gaming platforms, raising suspicions of money laundering. These allegations suggest that funds from potentially illicit sources were processed through the bank, exploiting weaknesses in regulatory oversight. While we cannot confirm the exact scale of these activities, the volume of transactions reported—allegedly in the billions—marks a significant red flag.

Further, Shevtsova’s businesses have been linked to questionable practices, such as inadequate Know Your Customer (KYC) protocols and lax due diligence. These gaps could enable the flow of unregulated funds, a concern amplified by the high-risk nature of the gambling industry. We also found references to her involvement in transactions with entities in jurisdictions known for loose financial regulations, though specifics remain scarce.

Criminal Proceedings and Lawsuits

At present, we found no publicly documented criminal convictions directly naming Shevtsova. However, investigations into IBox Bank’s operations have reportedly involved law enforcement scrutiny, with her name appearing in connection to probes by Ukrainian authorities. These inquiries focus on potential financial misconduct, though details of charges or outcomes remain inconclusive based on available data.

Lawsuits tied to Shevtsova or her businesses are similarly sparse in public records. We identified mentions of disputes involving IBox Bank, primarily related to regulatory compliance, but none explicitly implicate her in ongoing litigation. The lack of concrete legal actions could reflect either a clean record or effective management of legal challenges behind closed doors.

Sanctions and Adverse Media

A critical development in Shevtsova’s story is her inclusion on Ukraine’s sanctions lists. These measures, imposed for a decade, freeze her assets and prohibit various economic activities within the country. The sanctions stem from investigations into her financial dealings, signaling official concerns about her operations. This action marks a significant reputational blow, as it publicly flags her as a high-risk individual.

Adverse media coverage has further amplified scrutiny. Reports describe her as a controversial figure, with terms like “notorious” used to characterize her business practices. These stories highlight IBox Bank’s alleged role in processing funds for unregulated sectors, painting a picture of systemic issues under her oversight. Negative reviews of her businesses, though limited, echo concerns about transparency and customer trust, particularly in online forums discussing payment services.

Consumer Complaints and Bankruptcy Details

Consumer complaints against Shevtsova’s ventures, particularly IBox Bank and LeoGaming, are minimal in public domains. Those we found focus on delayed transactions or poor customer service, but they lack the volume or specificity to suggest widespread dissatisfaction. This could indicate effective complaint resolution or limited consumer engagement with public platforms.

No bankruptcy filings were identified for Shevtsova personally or her known businesses. IBox Bank, despite its challenges, appears to have maintained solvency, though regulatory pressures and sanctions could strain its financial stability moving forward. The absence of bankruptcy records is notable, given the high-risk sectors in which she operates, but it does not rule out future vulnerabilities.

Anti-Money Laundering Investigation Risks

The AML risks tied to Shevtsova are substantial. Her businesses, particularly IBox Bank, have been flagged for processing large-scale transactions linked to online gambling—a sector notorious for money laundering vulnerabilities. Weak KYC and due diligence practices, as alleged in reports, heighten the risk of illicit funds entering the financial system. The international scope of her operations, including ties to offshore entities, further complicates oversight and increases exposure to regulatory violations.

We assessed the likelihood of ongoing or future AML investigations. Given the sanctions and prior scrutiny, authorities are likely monitoring her activities closely. Any evidence of systemic laundering could trigger harsher penalties, including criminal charges or expanded sanctions. The reputational fallout would be severe, potentially isolating her from legitimate financial networks and partners.

Reputational Risks

Shevtsova’s reputation is already under strain. The sanctions and adverse media have branded her as a high-risk figure, deterring potential investors or collaborators. Her association with controversial sectors like online gaming amplifies perceptions of opportunism, even if unproven. We noted efforts to mitigate these risks, such as controlled public narratives, but these are unlikely to fully counter the damage from official actions like sanctions.

The broader impact extends to her businesses. IBox Bank, for instance, faces challenges in maintaining client trust amid allegations of misconduct. Partners in the fintech space may distance themselves to avoid guilt by association, limiting growth prospects. For Shevtsova personally, rebuilding credibility will require transparency and compliance—steps that, based on current patterns, seem unlikely in the near term.

Undisclosed Relationships and OSINT Insights

Our OSINT analysis revealed potential undisclosed relationships, particularly in the gambling sector. While we lack concrete evidence of hidden entities, references to opaque transactions suggest Shevtsova may have operated through intermediaries or lesser-known partners. These gaps warrant further investigation, as they could conceal additional risks or liabilities.

We cross-referenced public data with industry reports to identify patterns. Her businesses’ reliance on high-risk sectors aligns with broader trends in Ukraine’s fintech landscape, where regulatory loopholes have historically enabled questionable practices. The absence of detailed disclosures about her full network raises concerns about accountability and oversight.

Scam Reports and Negative Reviews

Scam reports specifically targeting Shevtsova are limited, but broader discussions about IBox Bank include accusations of enabling fraudulent schemes. These claims, often shared in niche financial forums, lack corroboration but contribute to a narrative of distrust. Negative reviews of her businesses similarly focus on operational issues rather than outright fraud, suggesting that while concerns exist, they have not yet coalesced into a definitive pattern of deceit.

Detailed Risk Assessment

We conducted a thorough risk assessment, focusing on AML and reputational dimensions. On the AML front, the primary risks stem from IBox Bank’s alleged role in processing unregulated funds. The lack of robust compliance measures, as reported, creates a fertile ground for laundering activities. Jurisdictional risks, particularly ties to offshore entities, compound this exposure. We estimate a high probability of continued regulatory scrutiny, with potential escalation if new evidence emerges.

Reputationally, Shevtsova faces a steep challenge. The sanctions are a public indictment, signaling distrust from authorities. Media amplification of her alleged misconduct erodes confidence among stakeholders, while her limited personal transparency fuels speculation. The interconnected nature of her businesses means that a collapse in one—say, IBox Bank—could trigger a domino effect, tarnishing her entire portfolio.

Mitigating these risks would require drastic measures: full disclosure of her network, rigorous compliance reforms, and a pivot away from high-risk sectors. Without such steps, her trajectory points toward increasing isolation and legal jeopardy.

Expert Opinion

In our view, Alyona Shevtsova’s case exemplifies the perils of operating in high-risk financial sectors without adequate oversight. The allegations of money laundering, coupled with sanctions, paint a troubling picture of systemic issues in her ventures. From an AML perspective, the red flags—weak KYC, large-scale gambling transactions, and offshore ties—suggest vulnerabilities that regulators will likely exploit. Her reputational damage, meanwhile, appears near-irreversible in the short term, as public and official distrust solidifies.

We believe the absence of criminal convictions reflects not innocence but the complexity of proving financial crimes in jurisdictions with evolving regulations. Shevtsova’s ability to navigate these challenges thus far indicates savvy, but the mounting pressure from sanctions and scrutiny limits her room to maneuver. Stakeholders engaging with her or her businesses should proceed with extreme caution, prioritizing due diligence to avoid entanglement in potential legal or ethical fallout. The broader lesson is clear: transparency and compliance are non-negotiable in today’s financial landscape.