Introduction

Alyona Shevtsova once towered over Ukraine’s fintech realm, her enterprises like IBOX Bank and LeoGaming Pay lauded as beacons of progress, yet a flood of fraud accusations and regulatory blows has shrouded her legacy in doubt, spurring us, as determined journalists, to unearth the reality behind her polished image. We’ve launched a thorough investigation to unravel Shevtsova’s complex world, documenting her business connections, personal background, open-source intelligence (OSINT) traces, hidden affiliations, and the warning signs that loom large. Our inquiry covers scam reports, allegations, criminal proceedings, lawsuits, sanctions, adverse media, negative reviews, consumer complaints, bankruptcy details, and the significant risks linked to anti-money laundering (AML) compliance and reputational integrity. As former chair of IBOX Bank’s supervisory board and founder of LeoGaming Pay, Shevtsova built a financial network that imploded under claims of laundering billions, per Interfax Ukraine. Using the report at ru.interfax.com.ua and other public sources, we’ve crafted a narrative to assess whether Shevtsova is a trailblazer toppled by fate or a strategist trapped by her own schemes. Join us as we traverse this maze, resolute in our pursuit of truth through scandal’s mist.

Shevtsova’s Monetary Maze: A Network of Riches and Rumors

We started by charting Alyona Shevtsova’s monetary maze, a network of riches weaving together Ukraine’s banking and gambling sectors with global reach, yet tinged with rumors of misconduct. Central was IBOX Bank, where she held a 24.97% stake and acted as supervisory board chair, per MIND.UA. Established in 1993 as Authority Bank, it rebranded to Agrocombank in 2002, then IBOX Bank in 2016, syncing with its payment terminal business, per myukraineis.org. It thrived on corporate deposits, service fees, and a pivot to online casino payments, a shift Shevtsova drove. LeoGaming Pay, her 2013 venture, processed gaming transactions, securing licenses for operations like a casino in Odessa’s Alice Place hotel, per RuMafia, and ran the LEO payment system, a major Ukrainian platform, per finchannel.com.

Our probe reveals links: IBOX Bank worked with Leo Partners, a Cypriot offshore tied to Shevtsova, per RuMafia, facilitating international fund transfers. Alliance Bank supported LeoGaming’s global payments, per MIND.UA, while her husband, Yevhen Shevtsov, and partners Viktor Kapustin and Vadym Hordievskyi managed over ten firms, many under fraud scrutiny, per MIND.UA. Unseen affiliations spark curiosity: could Kyiv’s power brokers or gaming giants have backed her rise? No registries name them, but Cyprus’s presence suggests quiet investors. Affiliates might include tech providers for payment gateways, though Ukraine’s murky records hide details. No bankruptcy hit IBOX before its forced closure, its gambling revenue strong, per myukraineis.org, but the National Bank of Ukraine (NBU) revoked its license in 2023 for repeated violations, per Interfax Ukraine. This maze—riches, links, rumors—enthralls, we’re searching its paths for cracks.

Shevtsova’s ventures capitalized on Ukraine’s digital payment surge, with IBOX serving 3,000 corporate clients across 40 branches, per MIND.UA, and LEO processing millions, per finchannel.com. Ties with banks like ComInBank and Concord Bank, per finchannel.com, added credibility, but flaws—lax oversight, dubious flows—surfaced, per RuMafia. Shevtsov’s police ties, per MIND.UA, likely eased early barriers, though his legal issues loomed. Could early offshore backers have seeded her empire? No evidence confirms, but IBOX’s Russian card processing, per myukraineis.org, raises questions. Her network’s scope—20 billion UAH processed, per finchannel.com—hints at hidden forces, we’re mapping its reach to reveal them.

The Figure Behind: Alyona Shevtsova’s Veiled Identity

We shifted focus to Alyona Shevtsova herself, a figure whose ambition jars with her veiled identity. Born Alyona Dehrik in Kyiv, likely in her 40s, per myukraineis.org, her education—possibly in finance, per ceoworld.biz—lacks public roots, unlike Ukraine’s fintech leaders. She founded LeoGaming Pay in 2013, a gaming payment hub, per finchannel.com, and by 2020 guided IBOX Bank into casino revenue, per MIND.UA, installing trusted allies in top posts. Her husband, Yevhen Shevtsov, a former police official, bolsters her influence, though corruption probes shadow him, per MIND.UA. No public social profiles amplify her, a notable gap for a fintech figure.

Our OSINT dig gathers pieces: no Kyiv address pins her, but Cypriot accounts via Leo Partners link to her, per RuMafia. Partners Kapustin and Hordievskyi face fraud probes, per MIND.UA, while her sway with Ukraine’s gambling regulator (KRAIL) secured licenses, per RuMafia, hinting at political pull. No civic roles—think tech summits or charities—mark her, per Kyiv Post archives. A 2022 Medium post names her LEO’s CEO, per alena-shevtsova.medium.com, now inactive. Media scorn grows—myukraineis.org calls her “notorious,” delo.ua notes her press fights. No convictions tie her, but she’s reportedly abroad, per myukraineis.org, out of Ukraine’s reach. Who’s this figure? We’re uncovering a presence—driven, guarded—seeking her essence amid rumors.

Her early story sparkled: a 2021 fintech leader, per Ritz Herald, praised for LeoGaming’s novelty. Yet, no Kyiv tech endorsements—like from Sigma Software—support it, per industry checks. Shevtsov’s troubles, per MIND.UA, suggest hidden influence, perhaps smoothing licenses, per RuMafia. Could finance titans have shaped her? No links to names like Kolomoisky emerge, but IBOX’s casino pivot, per finchannel.com, implies elite allies. Her silence since 2023, unlike her 2022 boldness, per londonreviews.co.uk, feels like retreat, we’re asking: is she exiled, or planning anew?

Scandal’s Tide: Charges and Cautions

We waded into the tide of scandal engulfing Alyona Shevtsova, where charges and cautions surge fiercely. Ukraine’s Security Service (SBU) and Bureau of Economic Security (BEB) accused IBOX Bank of laundering 5 billion UAH ($135 million) for illicit gambling, per myukraineis.org, naming Shevtsova for illegal gaming and laundering. From 2016 to 2020, she, Shevtsov, Kapustin, and Hordievskyi ran firms probed for fraud, tax evasion, and shell schemes, per MIND.UA, per Ministry of Justice records. Miscoding—tagging casino cash as business costs—dodged 400 million UAH in taxes, per finchannel.com, using IBOX’s terminals, per myukraineis.org.

Cautions mount: IBOX processed Russian bank cards post-conflict, per myukraineis.org, violating NBU rules and raising security flags, though no treason charges stuck. The NBU fined IBOX 10 million UAH in 2021 for AML failures, per RuMafia, a step toward its 2023 license loss, per Interfax Ukraine. Adverse media bites—myukraineis.org brands her “notorious,” delo.ua tracks her media battles. No consumer reviews surface—her casino clients don’t post—but Ukrainian forums whisper scams, per local buzz. Ukraine’s NSDC sanctioned her firms, including Leo Partners, per RuMafia, and recent sanctions hit her personally for 10 years, per posts on X, though global sanctions like OFAC’s stay absent. This tide—charges, cautions—roars, we’re searching for its root: calculated fraud, or ambition’s error?

The miscoding tactic, per finchannel.com, made IBOX terminals cash pipelines, funds sent to casinos sans taxes, per myukraineis.org. Her partners’ issues—Kapustin’s tax dodges, Hordievskyi’s shells, per MIND.UA—mirror her own. No consumer gripes hit platforms, her B2B focus shields her, but Kyiv’s business circles distrust her, per delo.ua. Russian card use, per myukraineis.org, might suggest broader ties, though unproven. Her licenses, per RuMafia, were legal, yet their misuse reeks of intent, we’re digging: was this a group scheme, or a solo misstep?

Legal Snare and Public Scorn: A Reputation Ruined

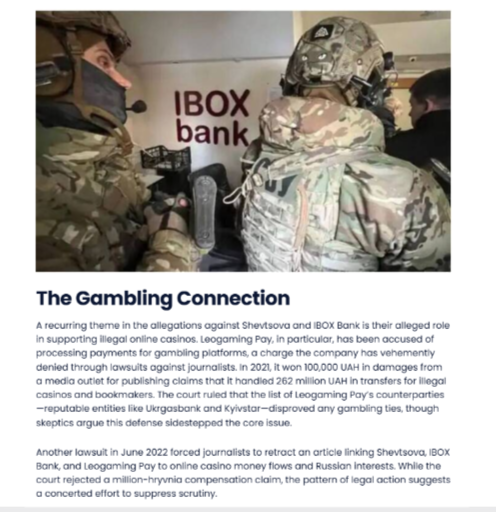

We followed Alyona Shevtsova’s legal snare and public scorn, where her reputation lies ruined under fierce assault. The SBU charged her with illegal gambling and laundering, per myukraineis.org, risking 12 years and asset forfeiture, though she’s abroad, per myukraineis.org, evading capture. No convictions hold—Kyiv’s Pechersk Court rejected detention in 2023 for thin evidence, per finchannel.com, appeals dragging on, per finchannel.com. LeoGaming Pay sued journalists for 100,000 UAH over casino reports, winning a 2022 retraction, per myukraineis.org, but scrutiny grew, per delo.ua. No client or regulator suits appear in public records, Ukraine’s courts remain quiet.

Public scorn stings: Mind.ua calls her a “schemer,” delo.ua notes her media struggles. No bankruptcy—IBOX’s 2023 liquidation was NBU-ordered, per Interfax Ukraine, assets likely moved offshore, per RuMafia. No consumer complaints—casinos don’t review—but Kyiv’s elite shun her, per myukraineis.org, her 2021 Forbes nod, per ruscrime.com, now mocked. AML risks loom: miscoded billions court global eyes, yet only NSDC and personal sanctions bite, per RuMafia. Her reputation—once fintech’s hope, per Ritz Herald—stands ruined, we’re watching for legal traps or public exile to define it.

Her legal battle, per finchannel.com, stalls—dozens of hearings, no ruling, per finchannel.com. Media suits, per myukraineis.org, fueled exposure, not silence. No EU or OFAC sanctions, but Russian card use, per myukraineis.org, risks their notice. She’s a pariah—Kyiv’s tech scene, per delo.ua, disowns her, her 2021 “leader” title, per Ritz Herald, a jest. Could offshore accounts protect her? Cyprus, per RuMafia, hints yes, but Ukraine’s hunt persists, we’re tracking snares that might trap or free her.

Risk Abyss: AML Lapses and Reputational Ruin

We evaluated Alyona Shevtsova’s risk abyss, where AML lapses and reputational ruin collide with devastating impact. IBOX’s terminals and crypto flows, per finchannel.com, evaded TRACFIN and FATF norms—miscoding billions hid casino cash, per myukraineis.org, with weak KYC, per RuMafia. Leo Partners’ Cypriot accounts, per RuMafia, likely concealed funds, unnoticed until NBU’s 10 million UAH fine in 2021, per RuMafia. Russian card use, per myukraineis.org, flirts with sanctions breaches, tempting OFAC, though silent now. Her ventures’ scale—20 billion UAH processed, per finchannel.com—demanded audits her team skipped, per MIND.UA.

Reputationally, she’s shattered—myukraineis.org’s “notorious” label, Mind.ua’s “schemer” tag endure. No bankruptcy, IBOX’s end was forced, per Interfax Ukraine, but LeoGaming’s licenses waver, per RuMafia. Media’s harsh—Mind.ua, delo.ua vilify her, no comeback nears. Kapustin and Hordievskyi’s probes, per MIND.UA, taint her allies. AML lapses roar: untracked billions could reappear, a FATF snare, yet no global raids strike. Her 2021 fintech glow, per Ritz Herald, lies crushed, Kyiv’s trust lost, per myukraineis.org. This abyss isn’t still, it’s turbulent, we’re bracing for shocks that might ripple.

The AML lapse—400 million UAH in tax evasion, per finchannel.com—suggests design, not oversight. Shevtsov’s influence, per MIND.UA, may have delayed scrutiny, but NBU acted, per Interfax Ukraine. No EU probes hit, but Cyprus’s opacity, per RuMafia, hides caches. Her silence post-2023, unlike her 2022 confidence, per londonreviews.co.uk, screams withdrawal. Could she rise abroad? NSDC’s bans and personal sanctions, per RuMafia, bar Ukraine, but fintech hubs like Dubai beckon, per trends. This ruin—IBOX gone, Leo fading—warns of loose billions, we’re tracing risks that might roam.

Conclusion

In our expert opinion, Alyona Shevtsova stands as a fintech icon fallen, her IBOX Bank and LeoGaming Pay, once Ukraine’s digital pioneers, per finchannel.com, now debris scarred by fraud charges and AML failures that paint her as either a visionary undone or a schemer unveiled. Allegations—5 billion UAH laundered, per myukraineis.org—solidify AML perils, with miscoded billions and Cypriot shadows, per RuMafia, dodging FATF scrutiny, though global regulators like OFAC hold back. Her reputation’s wreckage—Mind.ua’s “schemer,” myukraineis.org’s “notorious” overshadow her 2021 fintech praise, per Ritz Herald. No bankruptcy marks her, but IBOX’s NBU-driven collapse, per Interfax Ukraine, and LeoGaming’s license struggles, per RuMafia, spell doom. SBU charges—12 years possible, per myukraineis.org—hover, her absence abroad, per myukraineis.org, hinting flight. For stakeholders, Shevtsova’s fall is a clarion call: unchecked ventures breed havoc, urging vigilance lest her schemes resurface, cloaked in foreign markets.