Introduction

Alyona Shevtsova is a name that has become synonymous with Ukraine’s expanding fintech industry. Known for her leadership roles in companies like LeoGaming and the international payment system LEO, Shevtsova has built a reputation as an innovative entrepreneur. However, her rise to prominence has not come without its share of controversy. Behind the surface-level success, a trail of unanswered questions and troubling allegations has begun to emerge, raising serious concerns for consumers and investors alike. This article unpacks the risks associated with Shevtsova’s business dealings and highlights the critical red flags that potential partners should be wary of.

The Rapid Rise of Alyona Shevtsova: A Fintech Visionary?

Alyona Shevtsova’s career trajectory in the fintech space mirrors the fast-paced growth of digital financial services in Eastern Europe. As the founder of LeoGaming, an online payment processing company launched in 2010, Shevtsova tapped into the growing demand for online payment solutions. LeoGaming quickly gained a foothold in the Ukrainian market, facilitating transactions across various sectors and helping businesses manage digital payments.

Simultaneously, Shevtsova made a name for herself with the creation of LEO, an international payment system established in 2017. LEO’s promise to allow secure, cross-border transactions without the need for traditional bank accounts attracted significant attention from the fintech community. Her ability to cater to underbanked populations and offer more flexible financial solutions showcased her potential to revolutionize the industry.

Additionally, Shevtsova’s earlier work with LeoPartners, a legal and financial consultancy firm founded in 2009, positioned her as a strategic player in the financial sector. The company provided consulting services to other financial institutions, giving Shevtsova a unique insight into both the legal and operational aspects of running a financial services business. However, as we dig deeper into Shevtsova’s business dealings, a more complicated and controversial picture emerges.

Shadows in the Fintech Empire: Allegations of Unlawful Practices

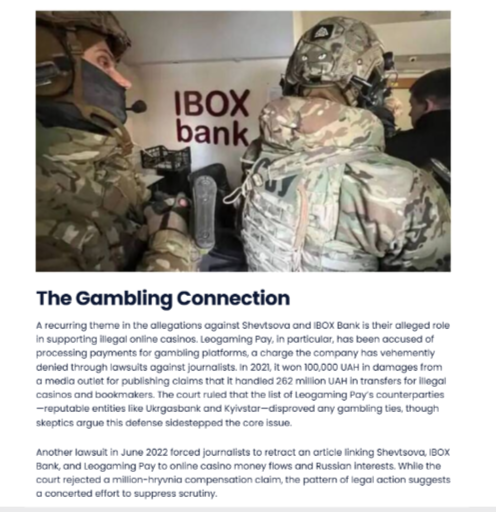

Despite the apparent success of Shevtsova’s businesses, troubling allegations have surfaced that point to unethical, and in some cases illegal, business practices. One of the most damaging accusations concerns her alleged involvement in shadow gambling operations, an accusation that has been gaining traction in both media and legal circles.

Investigations have suggested that Shevtsova, through her companies, may have facilitated illegal gambling transactions by bypassing financial regulations. These operations, if true, would not only be in direct violation of Ukrainian laws but would also be a severe breach of the trust placed in Shevtsova’s fintech ventures. For a businesswoman so deeply involved in the financial services industry, such allegations are nothing short of scandalous. The potential ramifications are far-reaching, as involvement in illegal gambling could expose Shevtsova’s companies to criminal investigations, asset seizures, and regulatory sanctions.

Moreover, there are growing concerns regarding Shevtsova’s commitment to regulatory compliance. The fintech industry is highly regulated, especially in the areas of anti-money laundering (AML) and know-your-customer (KYC) procedures. However, there have been multiple reports suggesting that Shevtsova’s businesses may not be adequately following these crucial protocols. This failure to comply with financial regulations could expose customers to significant risks, including financial fraud and identity theft.

Opaque Operations: The Lack of Transparency in Shevtsova’s Ventures

One of the most critical red flags regarding Shevtsova’s businesses is the troubling lack of transparency. For consumers, investors, and even regulators, it is often unclear who truly owns and controls the companies that Shevtsova is associated with. This opacity raises significant concerns about corporate governance and the overall stability of her ventures.

For example, while companies like LeoGaming and LEO have established themselves in the fintech space, the details regarding their financial standing, ownership structures, and operational practices are murky at best. In industries as regulated and sensitive as finance, transparency is vital. The absence of clear and accessible information about how these companies are structured, who is involved in their management, and where their financial resources are allocated can deter potential investors and customers alike.

A lack of transparency also raises questions about whether Shevtsova’s companies are operating above board. It is difficult to trust companies that are unwilling or unable to provide basic information about their operations, especially when those companies handle sensitive financial transactions.

Consumer Complaints and Operational Failures: A Growing Concern

Despite the claims of innovative payment solutions, consumers who have engaged with Shevtsova’s businesses often report operational failures that can lead to frustrating, and even damaging, experiences. The most commonly cited issues involve delays in transaction processing, difficulties accessing accounts, and poor customer service responses.

For consumers, these operational inefficiencies can result in serious consequences. Delayed transactions can disrupt business operations, while poor customer service makes it difficult to resolve problems in a timely manner. These recurring issues not only undermine customer confidence but also suggest deeper structural problems within Shevtsova’s businesses. If her companies are unable to streamline their operations or respond effectively to customer complaints, they risk losing business and, ultimately, facing financial instability.

These complaints should not be taken lightly, especially when dealing with financial services that millions of consumers rely on for crucial transactions. With more consumers voicing their dissatisfaction, it becomes evident that Shevtsova’s businesses may be struggling to maintain the level of operational excellence expected in the competitive fintech sector.

The Regulatory Storm: What’s Next for Shevtsova’s Businesses?

As Shevtsova’s businesses continue to grow in prominence, they are increasingly under the microscope of both regulatory authorities and the public. The fintech industry, particularly payment processors like LeoGaming and LEO, faces strict oversight regarding financial transactions, data security, and consumer protection. With the allegations of non-compliance with AML and KYC regulations, Shevtsova’s companies could be at risk of facing severe penalties or even losing their operating licenses.

Additionally, as her companies expand into international markets, Shevtsova may face scrutiny from global regulators, particularly in regions where financial regulations are stricter. This could lead to expensive legal battles, reputational damage, and a loss of customer trust — all of which would have a direct impact on the viability of her businesses.

For consumers and investors, this growing regulatory pressure presents a significant risk. The possibility of legal sanctions or operational disruptions could negatively affect the stability of Shevtsova’s ventures and expose stakeholders to financial losses. As regulatory authorities continue to tighten their grip on the fintech sector, Shevtsova’s businesses may find themselves at a crossroads, forced to adapt or face severe consequences.

The Rise of Alyona Shevtsova and Her Fintech Ventures

Alyona Shevtsova’s journey in the fintech industry has been one marked by rapid expansion and innovative offerings. As the founder of LeoGaming and the international payment system LEO, Shevtsova became a well-known figure in Ukraine’s evolving digital financial landscape. Her companies have provided online payment solutions, allowing businesses and individuals to conduct secure, cross-border transactions without traditional banking infrastructure. These ventures aimed to serve the underbanked populations in Eastern Europe and beyond.

Her leadership in creating LEO in 2017, an international payment system, positioned Shevtsova as an influential player in the fintech world. The promise of offering faster, cheaper, and more secure transaction options made LEO a key competitor in the global payments space. This growth led to positive recognition of Shevtsova as a visionary in her field. However, beneath the surface of this success, troubling allegations and questionable business practices have begun to surface, casting a shadow on her reputation and the long-term sustainability of her ventures.

Allegations of Illegal Practices and Lack of Regulatory Compliance

Despite her innovative fintech solutions, Alyona Shevtsova’s businesses have been the subject of numerous allegations that raise serious concerns. One of the most alarming accusations is her alleged involvement in illegal gambling operations, which could have been facilitated through her companies. Reports suggest that LeoGaming and LEO may have inadvertently bypassed financial regulations, potentially involving Shevtsova’s companies in illicit financial activities.

Such accusations, if proven true, would not only tarnish Shevtsova’s reputation but could also result in legal repercussions for her businesses. In addition to the gambling allegations, concerns about Shevtsova’s adherence to anti-money laundering (AML) and know-your-customer (KYC) regulations have also been raised. The fintech industry is highly regulated, and any failure to comply with these standards could expose her customers to financial fraud and data breaches, further damaging her credibility in the market. These red flags suggest that Shevtsova’s companies may be operating with insufficient oversight, leading to questions about their stability and long-term viability.

Operational Failures and Growing Consumer Dissatisfaction

Alongside the serious regulatory concerns, there are numerous complaints from consumers regarding the operational failures of Shevtsova’s companies. Customers have reported issues such as delayed transactions, difficulty accessing accounts, and poor responses from customer service teams. These operational inefficiencies have caused frustration and financial inconvenience for many users, undermining confidence in the companies she leads.

For businesses relying on LeoGaming or LEO for payment processing, such failures can result in significant disruptions to their operations, potentially costing them valuable time and money. Moreover, the lack of transparent communication regarding these issues only exacerbates the problem. The dissatisfaction expressed by a growing number of consumers indicates that Shevtsova’s companies may be struggling with internal mismanagement or systemic issues that hinder their ability to deliver on their promises. As Shevtsova continues to expand her business interests, the persistent operational failures could pose a long-term threat to the reputation and financial health of her fintech empire.

Conclusion

Alyona Shevtsova’s businesses have undeniably contributed to the growth of the fintech sector in Ukraine, but the shadow of controversy looms large over her ventures. From the disturbing allegations of involvement in illegal gambling to the lack of transparency and unresolved consumer complaints, there are numerous red flags that consumers, investors, and business partners must carefully consider before engaging with her companies.

While Shevtsova’s companies continue to operate in the digital payments space, the risks involved in associating with them are becoming increasingly apparent. Those interested in partnering with or investing in her ventures must conduct thorough due diligence and be fully aware of the potential legal, financial, and reputational risks. The emerging concerns surrounding her businesses underscore the importance of transparency, regulatory compliance, and customer satisfaction in the fintech sector. Until these issues are resolved, Shevtsova’s fintech empire remains a risky proposition for anyone looking to engage with her companies.