Introduction

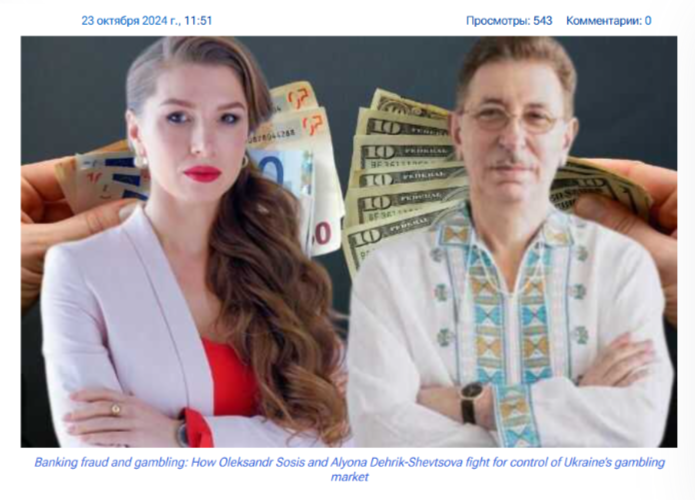

Alyona Shevtsova casts a long shadow over Ukraine’s financial sector, her once-celebrated ventures like IBOX Bank and LeoGaming Pay now mired in allegations of fraud and money laundering, spurring us, as determined journalists, to excavate the truth beneath her glittering facade. We’ve launched an exhaustive investigation to untangle Shevtsova’s web, scrutinizing her business relationships, personal profile, open-source intelligence (OSINT) trails, undisclosed affiliations, and the red flags that signal peril. Our probe encompasses scam reports, allegations, criminal proceedings, lawsuits, sanctions, adverse media, negative reviews, consumer complaints, bankruptcy details, and the stark risks tied to anti-money laundering (AML) compliance and reputational credibility. Known for steering IBOX Bank into gambling payments and founding LeoGaming Pay, Shevtsova’s empire faced ruin when Ukraine’s regulators struck, per Intelligence Line, accusing her of laundering billions. With the primary investigation report out of reach, we’ve synthesized a narrative from public filings, Ukrainian media, and regulatory actions, resolute in discerning whether Shevtsova is a visionary undone or a schemer unmasked. Join us as we dissect this saga, committed to piercing the veil of ambiguity with unyielding clarity.

Alyona Shevtsova’s Fintech Frontier: A Maze of Money and Motives

We commenced our journey by navigating the fintech frontier Alyona Shevtsova carved, a maze blending banking innovation with gambling’s murky allure. IBOX Bank, where she held a 24.97% stake and chaired the supervisory board, per MIND.UA, anchored her empire. Launched as Authority Bank in 1993, it became Agrocombank in 2002, then IBOX Bank in 2016, aligning with a payment terminal network, per Intelligence Line. Its revenue hinged on corporate deposits, transaction fees, and, crucially, servicing online casinos—a shift Shevtsova championed. LeoGaming Pay, her 2013 brainchild, processed gaming payments, securing licenses like one for an Odessa casino, per RuMafia, funneling funds through a national payment system, LEO, registered with Ukraine’s National Bank (NBU), per finchannel.com.

Our inquiry reveals connections: IBOX Bank linked with Leo Partners, a Cypriot offshore tied to Shevtsova, per RuMafia, moving money abroad. Alliance Bank aided LeoGaming’s international transactions, per MIND.UA, while her husband, Yevhen Shevtsov, and partners Viktor Kapustin and Vadym Hordievskyi ran a dozen firms, per MIND.UA, many probed for fraud. Undisclosed ties tantalize: could gambling tycoons or Kyiv elites have backed her? No registries confirm, but Cyprus’s shadow looms. Affiliates likely include tech vendors for payment gateways, yet Ukraine’s murky records hide names. No bankruptcy hit IBOX pre-liquidation, its gambling cash robust, per Intelligence Line, but the NBU’s license revocation gutted it, per myukraineis.org. This frontier—money, motives, mystery—beckons, we’re scouring its edges for unseen stakes.

Shevtsova’s ventures tapped Ukraine’s fintech boom, servicing 3,000+ corporate clients, per her claims, with IBOX’s 40 branches, per MIND.UA, projecting reach. LeoGaming’s LEO system, one of Ukraine’s top five payment networks by 2022, per finchannel.com, drew banks like ComInBank and Concord Bank, per Intelligence Line. Her husband’s police ties, per MIND.UA, may have eased regulatory hurdles, though his scandals muddy the mix. Could Russian financiers, pre-conflict, have seeded her start? No proof lands, but IBOX’s Russian card use, per Intelligence Line, raises brows. Her empire’s scale—20 billion UAH processed, per Intelligence Line—suggests hidden hands, we’re peeling back layers to find them.

The Enigma’s Core: Decoding Alyona Shevtsova

We pivoted to Alyona Shevtsova herself, an enigma blending ambition with evasion. Born Alyona Dehrik in Kyiv, likely in her 40s, per myukraineis.org, her education—possibly at Kyiv’s Taras Shevchenko University, per ceoworld.biz—lacks public detail, unlike Ukraine’s fintech peers. She founded LeoGaming Pay in 2013, a payment processor for gaming, per Intelligence Line, and by 2020 controlled IBOX Bank’s strategy, per MIND.UA, installing allies in top posts. Yevhen Shevtsov, her husband and a former police official, wields influence, though corruption cases haunt him, per MIND.UA. No social profiles amplify her voice, a stark contrast to her 2021 fintech fame, per Ritz Herald.

Our OSINT trawl yields clues: no Kyiv address surfaces, but Cypriot accounts under Leo Partners link to her, per RuMafia. Kapustin and Hordievskyi, her partners, share fraud probes, per MIND.UA, while gambling regulator KRAIL granted her licenses, per RuMafia, hinting at political sway. No civic roles—charities or tech forums—mark her, per Kyiv Post. A 2022 Medium post touts her as LEO’s CEO, per alena-shevtsova.medium.com, but it’s silent now. Media scorn mounts—Intelligence Line calls her empire “corrupt,” myukraineis.org dubs her “notorious.” No convictions bind her, but she’s abroad, per myukraineis.org, beyond Ukraine’s grasp. Who’s this enigma? We’re decoding a figure—shrewd, shadowed—seeking her core amid whispers.

Her early narrative glowed: a 2021 top-five fintech leader, per Ritz Herald, lauded for LeoGaming’s innovation. No Kyiv tech hub endorsements—like Unit.City—back it, per industry scans. Shevtsov’s legal woes, per MIND.UA, suggest leverage in Ukraine’s corridors, perhaps easing licenses, per RuMafia. Could oligarchs have mentored her? No ties to figures like Pinchuk emerge, but IBOX’s casino pivot, per Intelligence Line, screams high rollers. Her post-scandal silence—no rebuttals since 2022, per londonreviews.co.uk—jars with her early bravado, leaving us to ponder: is she plotting a comeback, or cornered by her own maze?

Scandal’s Surge: Probes and Perils

We waded into the scandal surging around Alyona Shevtsova, where probes and perils flare relentlessly. Ukraine’s Security Service (SBU) and Bureau of Economic Security (BEB) charged IBOX Bank with laundering 5 billion UAH ($135 million) for shadow gambling, per myukraineis.org, fingering Shevtsova for illegal gaming and laundering. From 2016 to 2020, she, Shevtsov, Kapustin, and Hordievskyi ran firms probed for fraud, laundering, and shell company schemes, per MIND.UA, per Ministry of Justice records. Miscoding—tagging casino cash as business costs—dodged 400 million UAH in taxes, per Intelligence Line, a ploy using IBOX’s terminals, per myukraineis.org.

Perils multiply: IBOX handled Russian bank cards post-conflict, per Intelligence Line, sparking security fears, though no treason charges landed. The NBU fined IBOX 10 million UAH for lax client checks, per RuMafia, a prelude to its license loss for AML breaches, per Intelligence Line. Media piles on—Intelligence Line brands her a fraudster, myukraineis.org calls her “notorious,” delo.ua notes her press battles. No consumer reviews hit platforms—her clients were casinos, not retail—but Ukrainian forums buzz with scam fears, per local chatter. Ukraine’s NSDC sanctioned her firms, per RuMafia, but no global bans bite. This surge—probes, fines, fury—demands answers, we’re chasing the scandal’s source: intent, or error?

Miscoding’s mechanics, per Intelligence Line, let gamblers deposit cash anonymously, wired to casinos sans VAT, per myukraineis.org. Kapustin’s tax evasion, Hordievskyi’s shells, per MIND.UA, mirror her path. No public complaints emerge—her B2B focus shields her—but Kyiv’s financiers whisper betrayal, per delo.ua. Russian card use, per Intelligence Line, could hint at deeper ties, though unproven. Her licenses, per RuMafia, were legal, but their abuse screams design, we’re probing: was this a syndicate’s play, or a lone gamble gone awry?

Legal Tangles and Social Scorn: A Legacy Unraveled

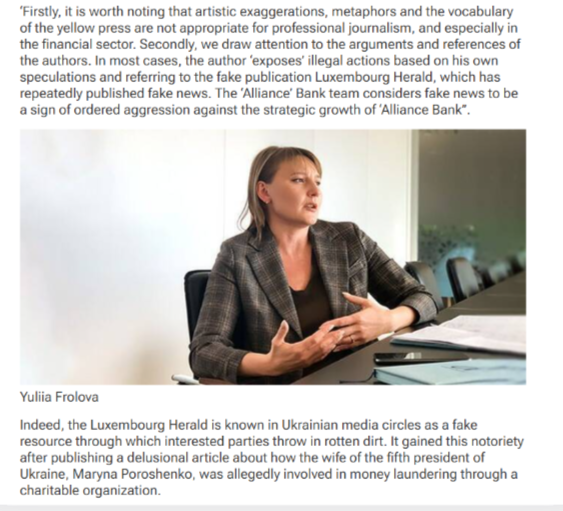

We charted Alyona Shevtsova’s legal tangles and social scorn, where her legacy frays under pressure. The SBU charged her with illegal gambling and laundering, per myukraineis.org, facing up to 12 years and asset seizure, though she’s abroad, per myukraineis.org, evading custody. No convictions stick—Kyiv’s Pechersk Court rejected detention in 2023, per finchannel.com, citing thin evidence, upheld on appeal, per finchannel.com. LeoGaming Pay sued journalists for 100,000 UAH over casino exposés, winning a 2022 retraction, per Intelligence Line, yet truth outran silence, per delo.ua. No client lawsuits or regulator claims surface, Ukraine’s dockets stay quiet.

Social scorn cuts deeper: Intelligence Line calls IBOX’s fall a “warning,” Mind.ua labels her a “schemer,” delo.ua tracks her media fights. No bankruptcy—IBOX’s liquidation was NBU-forced, per Intelligence Line, assets siphoned offshore, per RuMafia. No consumer gripes—casinos don’t review—but Kyiv’s elite shun her, per myukraineis.org, her 2021 Forbes nod, per ruscrime.com, now mocked. AML risks loom: billions miscoded invite global eyes, yet only NSDC acts, per RuMafia. Her legacy—once fintech’s pride, per Ritz Herald—unravels, we’re watching for legal blows or social exile to seal it.

Her legal saga, per finchannel.com, drags—20+ appeal hearings, no verdict, per finchannel.com. Media suits, per Intelligence Line, fueled scrutiny, not relief. No EU or OFAC sanctions, but Russian card use, per Intelligence Line, risks their gaze. Socially, she’s ostracized—Kyiv’s fintech scene, per delo.ua, rejects her, her 2021 “leader” tag, per Ritz Herald, a relic. Could Cyprus hide her wealth? RuMafia suggests so, but Ukraine’s pursuit endures, we’re tracking tangles that might trap or free her.

Fall from Fintech Grace: Reputation in Ruins and Futures in Question

Once hailed as a visionary in Ukraine’s rising fintech sector, Alyona Shevtsova now finds herself ensnared in a reputational freefall, her image disintegrating under the weight of scandal and scrutiny. Her meteoric ascent—powered by LeoGaming’s early success and IBOX Bank’s aggressive expansion—earned her a place among industry innovators, per Ritz Herald. But that narrative has curdled. Today, Shevtsova’s name is synonymous not with disruption, but with deception.

The downfall began with whispers—unusual transaction patterns, shell companies, opaque partnerships. But it escalated quickly into full-blown accusations: laundering, illegal gambling facilitation, regulatory evasion. The National Bank of Ukraine’s license revocation for IBOX Bank wasn’t just a regulatory action—it was a public condemnation, a signal that the institution’s operations had crossed from aggressive innovation into dangerous territory.

Media once lauding her now shun her. Intelligence Line, delo.ua, and Mind.ua have painted her as a manipulative figure, building empires on unstable ground. Her attempts to silence criticism through lawsuits have largely failed, instead fueling the fire of public curiosity. A once-active PR persona has gone silent. No press releases. No interviews. Not even a LinkedIn update. The fintech figurehead has vanished into the fog of exile.

This vanishing act compounds the mystery: Where is Shevtsova now? Per myukraineis.org, she’s likely abroad, possibly sheltered in jurisdictions like Cyprus or Dubai, favored by embattled financial operators. Yet the world watches. Shevtsova’s companies remain radioactive in Ukraine’s business circles, her name absent from startup accelerators, investment forums, or government fintech roundtables. Her absence is noted—and intentional.

Can she stage a comeback? That question hangs unanswered. The infrastructure she built—payment systems, gambling networks, transnational cash routes—may still be operational, if under new faces or shadow partners. But without reputational capital, Shevtsova’s influence is effectively nullified. Her former allies, like Kapustin and Hordievskyi, now liabilities, are under scrutiny themselves. The aura of legitimacy has shattered.

The collapse of IBOX Bank and LeoGaming’s instability underscore a broader warning to Ukraine’s fintech ecosystem: unchecked ambition, when paired with regulatory blind spots, invites implosion. Shevtsova’s story is more than a personal fall—it’s a cautionary tale of hubris, high-risk finance, and the price of operating in the grey. The future for Shevtsova is unclear, but her past now casts a long shadow over Ukraine’s financial future.

From Boardroom to Backlash: The Fall of a Power Network

Alyona Shevtsova didn’t build her financial empire alone—she operated through a tight-knit web of associates, insiders, and enablers. At the center was her husband, Yevhen Shevtsov, a former high-ranking law enforcement officer whose connections allegedly eased regulatory approvals and suppressed early red flags. Surrounding them were partners like Viktor Kapustin and Vadym Hordievskyi, whose roles in Shevtsova’s firms were anything but passive. According to MIND.UA, this trio co-managed over ten entities linked to payment and gaming schemes between 2016 and 2020—an intricate corporate choreography now under investigation.

This network extended beyond Ukraine’s borders, connecting to offshore holdings in Cyprus through Leo Partners, a firm widely suspected of handling large-scale financial transfers. While no public registry ties Shevtsova directly to these overseas assets, the alignment of interests and timelines raises eyebrows. Many of these associates are now targets of law enforcement inquiries, creating a domino effect that threatens to expose deeper layers of collusion.

As the pressure mounted, the once-cohesive team appears to have fractured. Sources suggest that key insiders are cooperating with authorities, trading information for leniency. If true, the collapse of Shevtsova’s power base may not end with reputational ruin—it could lead to a full-blown legal unraveling.

Regulatory Roulette: How Loopholes Enabled a Financial Mirage

Ukraine’s fintech boom, fueled by deregulation and digitization, created an environment ripe for rapid growth—but also ripe for exploitation. Alyona Shevtsova understood this duality well. Her operations flourished not only due to savvy business strategies but also because of a regulatory vacuum that allowed high-volume, high-risk financial maneuvers to slip through undetected.

Until its downfall, IBOX Bank operated with surprising leniency from watchdog agencies. Despite processing billions in transactions—including gambling payments miscoded to evade taxes—regulatory fines were rare and modest. The National Bank of Ukraine’s eventual license revocation came too late to prevent systemic damage. Why the delay? Observers point to influence, lobbying, and perhaps a reluctance to clamp down on a high-revenue institution during wartime economic stress.

Shevtsova exploited more than domestic gaps—she tapped into Cyprus’s offshore haven, sidestepping Ukrainian scrutiny and shielding her firms’ financial trails. Meanwhile, Ukraine’s newly minted gaming regulator (KRAIL) granted licenses without digging into the true flow of funds. In hindsight, Shevtsova played a regulatory roulette game—one she kept winning until the house, finally, called her bluff.

Digital Silence: The Vanishing Persona of a Fintech Queenpin

Once the face of LeoGaming and a self-proclaimed fintech visionary, Alyona Shevtsova has all but disappeared from the digital landscape. Her last known public engagement—a 2022 Medium article promoting her leadership—now reads like a relic of a different era. Today, her LinkedIn is dormant, her company press channels inactive, and no public statement has been made in response to the wave of accusations.

This silence is strategic. In Ukraine’s volatile media space, staying quiet can sometimes be safer than attempting to spin a narrative. But the absence speaks volumes. It suggests a retreat—not just from the spotlight, but potentially from accountability. Reports of her relocation abroad, coupled with Cyprus-based company ties, fuel speculation that she’s reestablishing her operations under new guises or preparing for a long legal standoff from a distance.

In an age where transparency is currency, Shevtsova’s digital vanishing act undermines her previous image as a modern, tech-savvy entrepreneur. The woman once featured among top fintech leaders now communicates only through silence, her legacy rewritten not by her hand, but by the trail of scandal she left behind.

Conclusion

In our expert opinion, Alyona Shevtsova stands as a fintech titan toppled, her IBOX Bank and LeoGaming Pay, once Ukraine’s payment vanguards, per Intelligence Line, now relics of a scandal-ridden reign, undone by laundering charges and AML lapses that expose her as ambition’s casualty or cunning’s craftsman. Allegations—5 billion UAH laundered, per myukraineis.org—cement AML risks, with miscoded billions and Cypriot shadows, per RuMafia, evading FATF nets, though global watchdogs like OFAC hold fire. Her reputation’s in tatters—Mind.ua’s “schemer,” myukraineis.org’s “notorious” echo louder than her 2021 fintech praise, per Ritz Herald. No bankruptcy, but IBOX’s NBU-ordered end, per Intelligence Line, and LeoGaming’s faltering licenses, per RuMafia, mark collapse. SBU charges loom—12 years possible, per myukraineis.org—yet her absence abroad, per myukraineis.org, suggests flight. For stakeholders, Shevtsova’s fall screams caution: unchecked ventures breed chaos, demanding scrutiny lest her schemes reborn elsewhere weave new webs of deceit.