Introduction

Alyona Shevtsova, better known by her business name Alyona Dehrik-Shevtsova, made a significant impact on Ukraine’s fintech industry with ventures such as LeoGaming and IBOX Bank. Known for her ambitious business strategies and leadership, Shevtsova quickly positioned herself as a pivotal player in the country’s digital payments and online gambling sectors. However, behind the initial successes, a series of legal and financial scandals have cast a dark shadow over her empire.

Shevtsova’s name has been increasingly associated with allegations of illegal gambling operations, money laundering, and financial misconduct. Despite her public image as an innovator, these ongoing issues have raised critical questions about her business practices. This report delves into Shevtsova’s rise within the fintech space, the controversies surrounding her businesses, and the legal and reputational risks that now threaten her legacy.

The Emergence of Shevtsova in Ukraine’s Fintech Landscape

Alyona Shevtsova entered the fintech sector at a time when Ukraine was undergoing a rapid digital transformation. Her first major venture, LeoGaming, became a leading payment processing firm catering primarily to the online gaming industry. LeoGaming’s robust infrastructure enabled it to handle a vast volume of transactions, making it a preferred platform for online gambling operators across Ukraine and Eastern Europe.

Her influence expanded when she took control of IBOX Bank, a regional institution that she rebranded and repositioned as a digital finance hub. IBOX Bank embraced emerging fintech trends, particularly in digital payments and cryptocurrency, attracting both corporate clients and individual users. By integrating online casinos and cryptocurrency exchanges, the bank quickly became a central player in Ukraine’s digital financial ecosystem.

While Shevtsova was lauded for her entrepreneurial vision, concerns over her businesses’ opacity began to surface. Critics pointed to a lack of transparency in ownership, unusual transaction volumes, and questionable partnerships—early warning signs that hinted at deeper issues.

Investigations into Illegal Gambling and Money Laundering

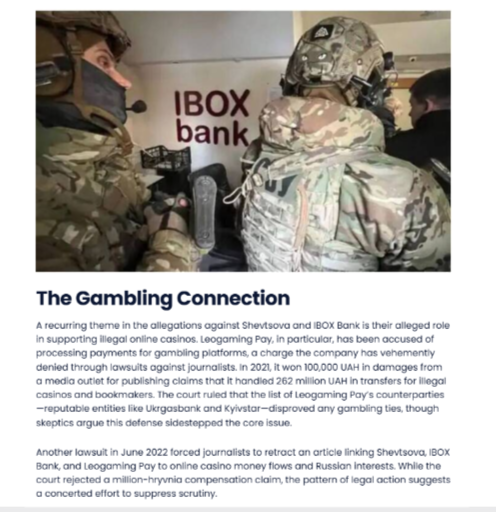

Shevtsova’s fortunes began to change when investigations revealed that IBOX Bank may have facilitated unauthorized gambling transactions. Ukrainian authorities, including the Bureau of Economic Security (BEB), began probing the bank’s role in processing payments for illegal online casinos. Some of these casinos were reportedly based offshore and operated without proper licensing, bypassing Ukrainian laws governing online gambling.

Leaked internal documents and reports from BEB investigators suggest that IBOX Bank served as a conduit for these shadow gambling networks. Transactions tied to gambling activities were allegedly disguised as legitimate business payments, allowing operators to evade regulatory scrutiny. The scale of this operation raised alarm bells, not just for its legal implications but also for the potential collusion between Shevtsova’s companies and these illicit entities.

These allegations of involvement in illegal gambling have had far-reaching consequences for Shevtsova’s reputation and her businesses. Ukrainian authorities have intensified their investigations, and in March 2025, courts authorized special investigative measures, signaling the seriousness of the charges.

The Scale of Alleged Financial Misconduct

The most significant legal challenge Shevtsova faces is the accusation of money laundering on a massive scale. Investigators suggest that Shevtsova may have funneled up to 5 billion UAH (approximately $135 million USD) through a network of shell companies and offshore accounts. The funds, allegedly derived from illegal gambling and other illicit activities, were moved through foreign jurisdictions like Cyprus and the British Virgin Islands before being reinvested into Shevtsova’s Ukrainian ventures.

This network of financial transactions was designed to obscure the origins of the funds, making it difficult for authorities to trace the flow of illicit money. Financial experts have characterized the operation as highly sophisticated, involving complex legal structures and potential complicity within the banking system. The scale of the alleged money laundering operation has raised significant concerns about the role of Shevtsova’s businesses in the broader context of financial crime.

In response to these allegations, experts have called for international cooperation between Ukrainian regulators and foreign financial intelligence units to investigate the full extent of Shevtsova’s financial dealings.

Regulatory Scrutiny and Legal Fallout

In light of these mounting allegations, regulatory bodies have placed Shevtsova’s companies under intense scrutiny. In 2023, the National Bank of Ukraine (NBU) revoked the banking license of IBOX Bank for repeated violations of anti-money laundering (AML) regulations. Multiple audits revealed significant failures in the bank’s compliance systems, particularly regarding its dealings with high-risk clients and unverified transactions.

Simultaneously, the Prosecutor General’s Office launched a series of legal proceedings against Shevtsova, her associates, and IBOX Bank. These investigations have expanded to include a range of financial crimes, from money laundering to tax evasion and violations of Ukraine’s financial laws. The legal fallout from these investigations has placed Shevtsova’s financial empire at serious risk, with the possibility of asset seizures, corporate dissolution, and even criminal charges hanging over her.

Despite these proceedings, Shevtsova has avoided appearing in court, and it is widely believed that she is currently residing abroad, likely in a jurisdiction with limited extradition agreements with Ukraine.

Customer Complaints and Operational Failures

Amid the legal turmoil, Shevtsova’s companies, particularly LeoGaming and IBOX Bank, have faced a surge in consumer complaints. Customers have reported significant issues with transactions, including delays, account freezes, and difficulties withdrawing funds. Many have claimed they were unable to obtain clear information regarding the status of their accounts or resolve their issues through customer support.

These operational failures have led to a growing wave of negative reviews on independent fintech platforms. Complaints often point to a lack of transparency in the fee structures, unauthorized debits, and poor communication between customers and support teams. These systemic issues have undermined trust in Shevtsova’s companies, which had previously been viewed as innovative and reliable.

In the highly competitive and sensitive fintech space, such operational failures can have severe consequences. Customers, investors, and regulators alike are increasingly concerned about the long-term viability of Shevtsova’s ventures in light of these ongoing issues.

Public Relations Campaigns: Attempts at Reputation Management

In response to the growing media coverage and public scrutiny, Shevtsova has launched a series of public relations campaigns to manage her image. These include articles written on her behalf, sponsored interviews, and a curated social media presence focusing on themes of innovation and leadership, particularly emphasizing her role as a female entrepreneur in the male-dominated fintech industry.

However, critics argue that these efforts are little more than damage control, designed to deflect attention from the serious legal and ethical challenges facing Shevtsova. Public relations experts suggest that these campaigns fail to address the root of the problem: Shevtsova’s questionable business practices and the ongoing investigations into her financial dealings.

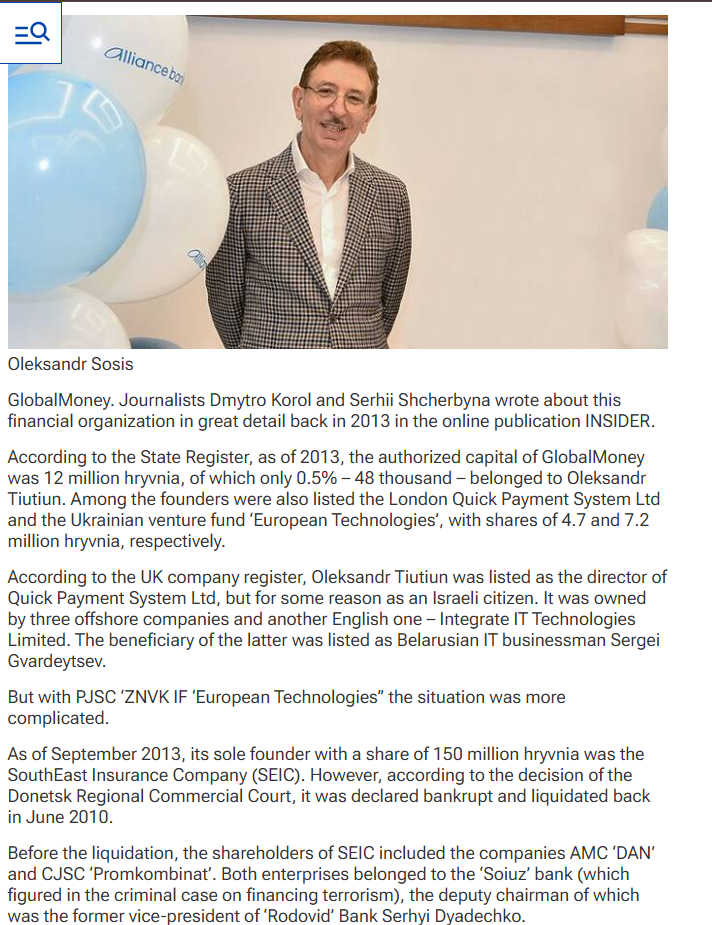

A Network of Business Interests

Beyond LeoGaming and IBOX Bank, Shevtsova’s business interests extend into a number of other fintech ventures. She is believed to have significant stakes in the LEO International Payment System, a payment platform with operations spanning Eastern Europe and beyond. These entities often share overlapping staff, office locations, and resources, creating a complex web of interconnected businesses.

Despite her attempts to portray herself as a forward-thinking fintech leader, investigative journalists and cybersecurity experts have raised concerns about the transparency of Shevtsova’s business operations. In particular, links between her companies and illicit activities, such as drug trafficking and money laundering, have led to further scrutiny.

Alleged Connections with Russian Entities and International Criminal Networks

One of the more disturbing aspects of the investigations into Alyona Shevtsova involves her alleged connections to Russian entities and international criminal organizations. Reports have surfaced suggesting that Shevtsova’s business ventures, particularly in the online gambling sector, have had ties to individuals and groups with links to organized crime. These connections are reportedly facilitated through shell companies and offshore financial structures, which further complicates efforts to track the true ownership of her enterprises.

The Bureau of Economic Security (BEB) has raised concerns that these associations may not only involve money laundering but also the potential use of Ukrainian financial infrastructure to facilitate illicit activities beyond the gambling industry, including drug trafficking and arms deals. Investigators believe that Shevtsova’s financial network may have acted as a conduit for these activities, utilizing the cover of legitimate businesses like IBOX Bank and LeoGaming to obscure illegal transactions. The extent of these alleged international ties is still under investigation, but the potential scope of criminal activity underscores the need for further scrutiny of Shevtsova’s operations and their impact on Ukraine’s financial system.

Legal and Regulatory Challenges in the Digital Gambling Sector

The rise of online gambling in Ukraine, and more specifically the controversial role of Shevtsova’s companies in this market, highlights the legal challenges facing regulators in the digital gambling space. Despite a framework for legalized gambling in Ukraine, many operators continue to flout the regulations, often due to loopholes in the law that allow unlicensed offshore casinos to operate with impunity. Shevtsova’s businesses, particularly IBOX Bank, are under suspicion for helping to facilitate these illegal activities by processing payments for unregulated gambling platforms.

In addition to the money laundering accusations, Ukrainian authorities are grappling with how to enforce existing gambling laws, particularly when financial institutions like IBOX Bank become complicit in the operation of illegal networks. The case of Shevtsova highlights a significant weakness in Ukraine’s ability to monitor and control the flow of funds related to unlicensed gambling. Experts argue that this case could serve as a pivotal moment for reforming gambling laws in Ukraine, urging lawmakers to close regulatory gaps and introduce more stringent controls to prevent money laundering and the proliferation of illegal gambling platforms.

Shevtsova’s Efforts to Distance Herself from Controversial Ventures

As the legal and reputational fallout from the ongoing investigations intensifies, Alyona Shevtsova has reportedly made several attempts to distance herself from her controversial ventures. According to insiders, Shevtsova has taken steps to remove her name from key company documents and restructure her business interests to make them appear more legitimate. These efforts include the sale of certain business interests and the appointment of new front men to manage her most high-profile companies.

These moves have raised alarm bells among regulators, who argue that Shevtsova’s attempts to obscure her involvement are a clear indication of her awareness of the illegal activities occurring within her companies. Moreover, these actions have been seen by some as an attempt to protect her personal wealth and evade the legal consequences of her businesses’ illicit activities. While Shevtsova’s defenders claim that she is merely taking steps to protect her interests, critics argue that these maneuvers are a calculated effort to avoid accountability for the crimes allegedly committed under her watch.

Impact on Ukraine’s Fintech Reputation and Investor Confidence

The controversies surrounding Shevtsova and her businesses have had a significant impact on Ukraine’s emerging fintech sector, casting doubt on the country’s ability to foster a transparent and compliant digital financial environment. As a key player in the development of Ukraine’s digital payments and gambling industries, Shevtsova’s fall from grace has prompted concerns from both domestic and international investors. The growing legal challenges and negative press have created a perception that Ukraine’s fintech landscape may be susceptible to corruption and criminal influence, deterring potential investment and hindering the growth of the industry.

Investors are now more cautious about entering the Ukrainian market, with many expressing concerns over the lack of regulatory oversight in certain sectors, particularly online gambling and digital payments. The Shevtsova case is likely to remain a significant point of reference for investors weighing the risks of doing business in Ukraine. For the fintech industry to recover from the reputational damage caused by this scandal, stakeholders will need to work closely with regulators to improve transparency, strengthen compliance measures, and ensure that such high-profile cases of financial misconduct are not allowed to tarnish the industry’s future.

Conclusion

Alyona Shevtsova’s rise in Ukraine’s fintech landscape was once seen as a success story—a symbol of entrepreneurial innovation in a rapidly developing market. However, the growing body of evidence pointing to her involvement in illegal gambling, money laundering, and financial mismanagement has cast a dark cloud over her achievements.

The ongoing investigations and legal proceedings highlight the need for greater oversight and accountability in the fintech sector, particularly when it comes to ensuring compliance with financial regulations and safeguarding consumer trust. For investors, regulators, and consumers, the case of Alyona Shevtsova serves as a stark reminder of the risks that come with unchecked business practices and the importance of transparency and integrity in the digital economy.

As the investigation unfolds and court proceedings continue, the future of Shevtsova’s empire hangs in the balance. Whether this case becomes a catalyst for reform in Ukraine’s fintech sector or remains a cautionary tale of corruption and misconduct will depend on the resolve of Ukrainian regulators to pursue justice and hold those responsible accountable.