Introduction

Once hailed as a fintech visionary, Alyona Shevtsova, also known as Alyona Dehrik-Shevtsova, became a significant figure in Ukraine’s digital payments and financial technology ecosystem. She earned recognition for her leadership at LeoGaming, a payment processor for online gaming platforms, and IBOX Bank, a financial institution that she transformed into a major player in Ukraine’s digital finance sector. However, beneath this public persona, a series of troubling allegations and legal challenges have cast a shadow over her business empire.

As her ventures grew, so too did concerns regarding their operations. Allegations of money laundering, illegal gambling facilitation, and regulatory violations have raised serious questions about Shevtsova’s business practices and ethical standards. This report provides an in-depth examination of Shevtsova’s rise, the controversies surrounding her enterprises, and the growing legal and reputational risks she faces.

The Rise of Alyona Shevtsova: Shaping Ukraine’s Fintech Landscape

Alyona Shevtsova’s entry into the fintech sector was strategically timed during a period of rapid digitalization in Ukraine’s economy. At the helm of LeoGaming, she created a payment processing platform tailored for the online gaming industry, a sector poised for significant growth. LeoGaming’s ability to handle high volumes of electronic transactions made it a go-to service for online gambling operators across Ukraine and neighboring regions.

Her influence within Ukraine’s fintech ecosystem grew even further when she took control of IBOX Bank, a small regional bank. Under her leadership, IBOX Bank was rebranded as a forward-looking fintech institution, focusing on digital payments and cryptocurrency transactions. The bank’s ability to connect traditional banking services with modern fintech solutions attracted a wide range of corporate clients, making it a pivotal player in Ukraine’s digital economy.

Shevtsova was praised for her business acumen and was frequently lauded in industry forums and media. Her businesses were considered essential in modernizing Ukraine’s financial infrastructure, and she was celebrated for leading the charge in digital payments. However, insiders and industry observers began to notice irregularities early on, such as opaque ownership structures, unusually large transaction volumes, and links to controversial business partners.

Illegal Gambling Operations: A Financial Conduit for the Shadow Economy

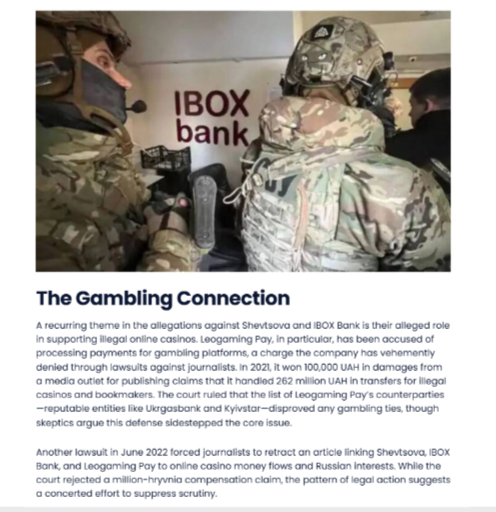

One of the most serious allegations against Shevtsova involves her alleged involvement in facilitating illegal online gambling through IBOX Bank. According to reports from the Bureau of Economic Security (BEB) and other investigative sources, IBOX Bank became a key player in enabling unauthorized online casinos to process payments via its platform. These gambling operations were often hosted offshore, operating outside the reach of Ukrainian regulators.

The BEB’s investigation, which gained significant traction in late 2024, points to a coordinated effort to disguise gambling-related transactions as legitimate business activities. The evidence suggests that IBOX Bank’s infrastructure was used to funnel money from illegal gambling operations, allowing casino operators to evade Ukraine’s stringent gambling laws.

In March 2025, the Ukrainian courts authorized special investigative measures against Shevtsova, signaling the gravity of the charges. The allegations are not only damaging to her reputation but have also raised questions about the role of the bank’s management and the possibility of collusion between Shevtsova and other financial entities.

Money Laundering Allegations: Tracing the Flow of Illicit Funds

A key part of the investigation into Shevtsova’s enterprises revolves around allegations of money laundering. According to financial experts and forensic accountants, Shevtsova may have laundered up to 5 billion UAH (around $135 million USD) through a network of shell companies and offshore entities. These financial flows were reportedly designed to obscure the origins and destinations of illicit funds, particularly proceeds derived from illegal gambling.

The laundering process, investigators believe, involved layering funds through foreign accounts and funneling them back into Ukraine, often through LeoGaming, IBOX Bank, and other affiliated ventures. Additionally, the funds were used to purchase luxury assets, including real estate abroad, further complicating the financial trail. Financial records indicate that much of this activity took place in tax havens such as Cyprus, the British Virgin Islands, and Belize.

The complex structure of these financial transactions highlights a sophisticated scheme, likely involving legal professionals, financial advisors, and even complicit banking staff. This has sparked calls for international cooperation between Ukrainian regulators and financial intelligence units from other countries to trace the flow of funds and bring accountability to the operation.

Regulatory Scrutiny and License Revocation: The Fall from Grace

The growing body of evidence led to increased regulatory scrutiny from Ukrainian authorities. In 2023, the National Bank of Ukraine (NBU) revoked IBOX Bank’s license, citing persistent violations of anti-money laundering (AML) regulations. This decision came after multiple audits exposed significant lapses in the bank’s compliance practices, particularly in its dealings with high-risk clients and unverified transactions.

The revocation of IBOX Bank’s license marked a significant blow to Shevtsova’s financial empire and put her operations under intense public and legal scrutiny. Simultaneously, Ukraine’s Prosecutor General’s Office authorized an investigation into Shevtsova, her associates, and the entities linked to her network. These investigations cover a broad spectrum of potential financial crimes, from tax evasion to illegal enrichment.

Shevtsova, who is believed to be residing outside Ukraine, has thus far avoided court appearances. If convicted, she could face substantial penalties, including prison time, asset seizures, and corporate dissolution orders. Legal experts suggest that international cooperation may be required to apprehend Shevtsova and ensure accountability.

Consumer Complaints and Financial Mishandling: The Client Experience

Amid the regulatory and legal battles, Shevtsova’s companies have also faced a surge in consumer complaints. Customers of LeoGaming and IBOX Bank have reported widespread issues such as delayed transactions, frozen accounts, and unresolved withdrawal requests. In many cases, users claim to have been unable to access their funds or obtain clear information regarding the status of their transactions, raising concerns about the companies’ financial transparency and operational integrity.

Independent fintech watchdogs and customer review platforms have reported numerous negative testimonials, indicating that these operational failures were not isolated incidents but possibly systemic problems within Shevtsova’s businesses. In a sector where trust and reliability are paramount, these lapses have serious implications for customer loyalty and the companies’ long-term viability.

Public Relations and Image Control: Attempting to Rebrand a Troubled Legacy

In response to mounting public pressure and growing negative media attention, Shevtsova has embarked on a series of PR efforts aimed at reshaping her image. Her team has launched a concerted campaign to promote her as a pioneer in fintech innovation and a champion of women in business. These efforts include ghostwritten articles, social media campaigns, and interviews in business publications, focusing on her supposed role in the future of digital finance.

Despite these attempts at rebranding, many critics argue that Shevtsova’s PR initiatives are little more than damage control. Public relations experts suggest that these campaigns fail to address the core issues at hand: the financial misconduct, legal violations, and operational mismanagement that continue to plague her businesses.

Associated Ventures and Expansion Beyond Ukraine’s Borders

Shevtsova’s influence extends far beyond Ukraine. She has financial stakes in a range of fintech ventures operating across Eastern Europe and beyond, including LEO International Payment System, a network that provides digital payment solutions across the region. These businesses often share overlapping personnel, infrastructure, and operational resources, further blurring the lines of ownership and complicating efforts to investigate her activities.

Her network is extensive, and it appears to have connections to controversial industries, including cryptocurrency exchanges, drug trafficking, and smuggling networks. Investigative reports from Antimafia.se and RUmafia.io suggest that Shevtsova’s business empire was built, at least in part, on these illicit networks, making her case one of the most complex financial investigations in Ukraine’s recent history.

Financial Networks and Global Connections: The Web of Influence

Alyona Shevtsova’s business dealings extend well beyond Ukraine, reflecting her strategic expansion into global markets. Through her involvement in international fintech ventures, she has built a vast network of financial connections. Her companies are linked to a range of offshore financial entities, raising questions about the transparency of these operations.

IBOX Bank, for example, is reported to have business dealings in countries with known reputations for lax financial regulation, including the British Virgin Islands and Cyprus. These jurisdictions are frequently associated with money laundering and tax evasion activities, making them a focal point in the investigation into Shevtsova’s financial practices.

Shevtsova’s global business interests also include investments in cryptocurrency exchanges and online gaming platforms, industries that are notorious for their susceptibility to financial crime. This interconnected web of international businesses has made it difficult for investigators to track the flow of funds and understand the full scale of Shevtsova’s operations. Investigations suggest that Shevtsova used these foreign networks to shield herself from local regulations and scrutiny, complicating efforts to hold her accountable.

Role of Corruption in Shevtsova’s Business Model

As investigations into Shevtsova’s enterprises deepen, there have been growing concerns about the role of corruption in enabling her business practices. Multiple reports have surfaced claiming that Shevtsova used bribery and influence to secure favorable treatment from both legal and regulatory entities.

In the case of IBOX Bank, insiders have pointed to suspiciously swift approvals of business operations and questionable dealings with government officials. This has led to allegations that Shevtsova’s companies may have benefitted from political connections, allowing them to bypass regulations and operate with impunity.

Additionally, reports suggest that Shevtsova may have used her influence over local courts to avoid criminal liability for her companies’ financial misdeeds. As Ukrainian authorities continue to investigate, the extent of corruption within Shevtsova’s network remains a central point of concern.

If proven true, these allegations would highlight a serious failure in Ukraine’s regulatory frameworks, which failed to detect and prevent such systemic misconduct for years.

Public Perception vs. Reality: The Disconnect in Shevtsova’s Image

Shevtsova has spent considerable effort cultivating a public image as a visionary entrepreneur and leader in the fintech space. Through a well-curated social media presence and public relations campaigns, she has portrayed herself as a champion of innovation and an advocate for women in leadership roles.

However, critics argue that this image is a carefully constructed facade designed to distract from the mounting legal challenges and financial misconduct tied to her companies. While Shevtsova’s media presence showcases her as a successful businesswoman, it often glosses over the troubling reality of her enterprises.

The public relations campaigns have been described as an attempt to divert attention from serious allegations, such as the involvement of her businesses in illegal gambling and money laundering. Many within the Ukrainian public and the fintech industry remain skeptical of her claims, as evidence of corporate misconduct continues to mount.

For Shevtsova, the challenge will be to reconcile this image with the reality of the legal proceedings that now threaten her empire. Will she continue to rely on her public relations strategy, or will she be forced to confront the allegations head-on?

The Broader Impact of Shevtsova’s Alleged Crimes on Ukraine’s Fintech Sector

The scandal surrounding Alyona Shevtsova has broader implications for Ukraine’s fintech sector, which has been growing rapidly in recent years. As one of the country’s most prominent figures in digital finance, Shevtsova’s downfall has cast a long shadow over the industry.

The allegations of money laundering, illegal gambling, and regulatory violations highlight the vulnerabilities within Ukraine’s fintech infrastructure, particularly in terms of oversight and regulatory compliance. The case of Shevtsova underscores the need for stricter controls to prevent financial crimes within the sector.

Ukraine’s regulators, in particular, are under increased scrutiny following the IBOX Bank scandal. The revocation of IBOX Bank’s license by the National Bank of Ukraine (NBU) and the subsequent investigations into Shevtsova’s business dealings have exposed significant gaps in the country’s financial regulations. This has prompted calls from industry stakeholders for reform, including stronger anti-money laundering laws and enhanced transparency for fintech businesses.

The scandal also risks damaging Ukraine’s reputation as a hub for fintech innovation, with potential investors now questioning the integrity of the country’s digital finance ecosystem. As the fallout continues, it will be essential for Ukrainian authorities to implement robust regulatory measures to restore confidence in the sector.

The Future of Alyona Shevtsova’s Business Interests: A Diminishing Empire?

With mounting legal and regulatory challenges, the future of Alyona Shevtsova’s business empire appears uncertain. As investigations into her financial activities continue to unfold, many of her key ventures have been forced to scale back operations or cease altogether.

IBOX Bank’s closure and the ongoing legal proceedings against Shevtsova have left a significant void in the Ukrainian fintech landscape. While some of her associated businesses may continue to operate, their future viability is now under a cloud of suspicion.

Shevtsova’s businesses may also face significant challenges in securing future investments or partnerships. The increasing visibility of the legal issues surrounding her companies has caused many potential partners to distance themselves from her ventures.

Moreover, the ongoing criminal investigations into Shevtsova’s activities—combined with the likelihood of asset seizures and legal penalties—further threaten the future of her business empire. If convicted, Shevtsova may lose control over much of her wealth and assets, leading to a complete collapse of the empire she worked so hard to build.

In conclusion, the question of whether Shevtsova can salvage her businesses or whether her empire will crumble under the weight of criminal investigations remains to be seen. The outcome will not only impact her legacy but will also serve as a critical case study for the future of Ukraine’s fintech industry.

Conclusion

Alyona Shevtsova’s rise from a fintech entrepreneur to the center of a complex financial scandal marks a pivotal moment in Ukraine’s evolving financial ecosystem. While her businesses helped modernize the country’s financial infrastructure, the extensive criminal allegations—ranging from money laundering and illegal gambling to financial fraud and regulatory violations—serve as a cautionary tale.

As investigations continue and the legal proceedings unfold, the future of Shevtsova’s empire remains uncertain. For investors, regulators, and consumers, the case underscores the critical need for rigorous due diligence and regulatory oversight in the rapidly growing fintech sector. In an industry that thrives on innovation and disruption, the absence of strong governance can quickly lead to corruption and misconduct.

Shevtsova’s legacy, once viewed as a triumph of modern Ukrainian entrepreneurship, is now at risk of being overshadowed by a broader narrative of financial crime, regulatory failure, and corporate misconduct.

Whether this case leads to significant reform or becomes a cautionary tale of unchecked ambition remains to be seen. One thing is clear: the fintech space in Ukraine is undergoing a reckoning, and Shevtsova’s involvement may be at the center of it.