Introduction

Alyona Shevtsova stands as a notable name in Ukraine’s burgeoning fintech industry. Celebrated for her entrepreneurial spirit and leadership roles in various financial institutions, she has been lauded as one of the top influencers in the sector. However, beneath the accolades lies a series of allegations and controversies that question the integrity of her business dealings. This article delves into the multifaceted world of Alyona Shevtsova, examining her rise in the fintech arena, the businesses she’s associated with, and the legal challenges that have emerged over time.

The Rise of a Fintech Visionary

Alyona Shevtsova’s journey in the financial sector began with the establishment of LeoPartners in 2009, a company aimed at providing legal support to financial institutions. Her vision expanded with the launch of LeoGaming in 2010, one of Ukraine’s pioneering non-bank payment processing systems. By 2017, her fintech endeavors culminated in the creation of the LEO International Payment System, which gained international recognition by 2019.

Her influence wasn’t confined to fintech alone. She ventured into the banking sector, acquiring significant shares in IBOX BANK and eventually taking on leadership roles. Her dynamic approach and innovative strategies positioned her as a formidable force in Ukraine’s financial landscape.

Business Ventures and Expanding Horizons

Beyond LeoGaming and IBOX BANK, Shevtsova’s entrepreneurial spirit led her to explore diverse avenues:

- LEO International Payment System: A platform facilitating both domestic and international transactions, reflecting her commitment to modernizing Ukraine’s payment infrastructure.

- L&G Esports Team: Founded in 2021, this venture marked her entry into the esports domain, showcasing her adaptability and forward-thinking approach.

- Sends: Operating under the umbrella of Smartflow Payments Limited, Sends offers financial solutions like internet acquiring and multicurrency business accounts. Shevtsova’s association with Sends underscores her expanding footprint in the fintech sector.

Her participation in global events, such as the Pay360 Conference in London, further emphasizes her active engagement with international financial communities.

The Shadows Cast: Allegations and Controversies

While Shevtsova’s professional achievements are commendable, they are juxtaposed with a series of allegations that have surfaced over the years:

IBOX BANK’s Downfall

Under Shevtsova’s leadership, IBOX BANK experienced significant growth, even ranking among Ukraine’s top profitable banks. However, in March 2023, the National Bank of Ukraine revoked its license due to “systematic violations of financial monitoring requirements.” Investigations revealed the bank’s involvement in laundering approximately 5 billion UAH, primarily linked to illegal gambling operations.

Legal Entanglements

Shevtsova, along with her associated enterprises, has been implicated in multiple criminal proceedings. These include charges related to:

- Offering illegal benefits to officials.

- Engaging in fictitious entrepreneurship.

- Committing fraud and tax evasion.

- Obstructing journalistic activities.

Notably, her husband, Yevheniy Shevtsov, a high-ranking police officer, has also been associated with some of these allegations, raising concerns about potential conflicts of interest and misuse of power.

Offshore Connections and Sanctions

Investigations have highlighted Shevtsova’s ties to offshore entities, notably the Cypriot firm “Leo Partners.” These associations have led to sanctions, with assets and activities of related firms being blocked in Ukraine for five years. Such developments underscore the complexities and potential risks associated with her business network.

Assessing the Risks

Engaging with enterprises linked to Alyona Shevtsova necessitates a thorough risk assessment:

- Legal Risks: Ongoing investigations and past criminal proceedings could pose legal challenges for partners and stakeholders.

- Reputational Risks: Associations with alleged financial misconduct can tarnish the reputation of affiliated entities.

- Operational Risks: Regulatory actions against Shevtsova’s ventures might disrupt business operations and affect service continuity.

Alyona Shevtsova: The Public Image vs. Hidden Reality

Alyona Shevtsova is often portrayed as a progressive leader in Ukraine’s fintech sector. She’s been featured in lists of top female executives and praised for modernizing digital payments in Eastern Europe. However, behind the carefully curated media persona lies a troubling web of financial irregularities, questionable partnerships, and ongoing criminal investigations.

Her meteoric rise has often been met with skepticism from within the industry. Multiple insiders have raised concerns about the speed at which her businesses scaled, given the highly regulated nature of finance and banking in Ukraine. While Shevtsova promotes herself as a fintech innovator, critics argue that her primary skill has been leveraging political and legal loopholes to operate in the murky gray zone between regulation and exploitation.

Despite public relations efforts painting her as a “visionary,” leaked documents and investigative reports suggest that Shevtsova’s business empire may be built on financial engineering rather than innovation. This stark contrast between her public image and her alleged backdoor dealings is the first red flag.

Inside LeoGaming and LEO IPS: Engines of Rapid Expansion or Shells for Illicit Transfers?

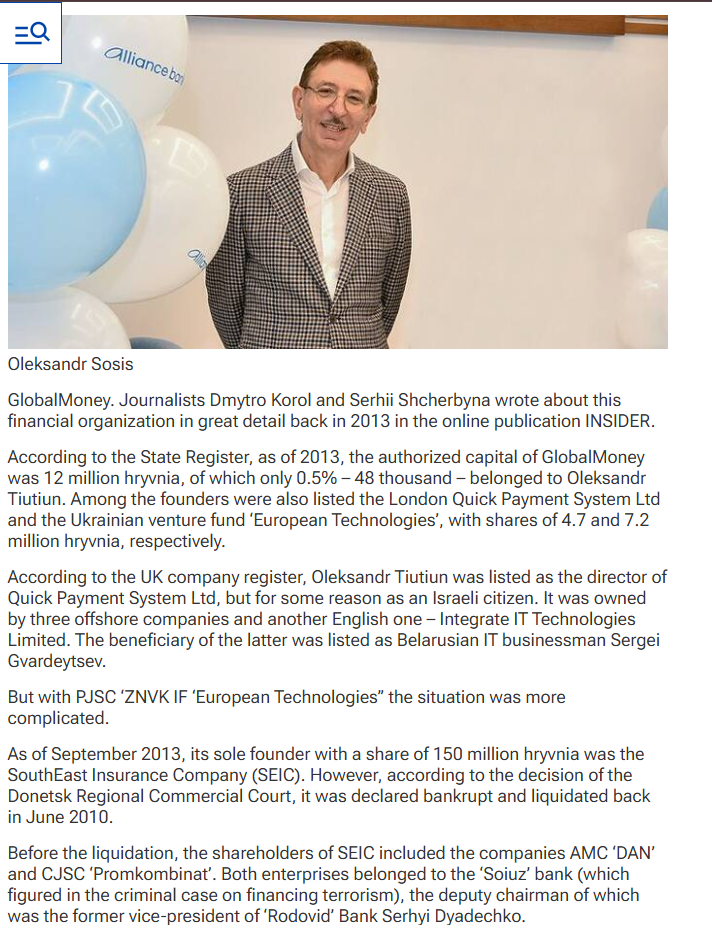

Shevtsova’s first major venture, LeoGaming, positioned itself as a payment service provider catering to online entertainment platforms and gaming services. Initially seen as a disruptive startup, LeoGaming attracted rapid attention due to its early licensing and international expansion. But critics soon began questioning its meteoric rise and opaque financials.

Soon after, she launched LEO International Payment System (LEO IPS)—a non-banking financial institution offering remittance services and multi-currency transfers. On paper, the company claimed to be among Ukraine’s top three fintech solutions. However, leaked bank documents and tax filings show discrepancies in income reporting and untraceable fund movements between offshore accounts linked to Cypriot firms.

Several transactions flagged by Ukraine’s Financial Monitoring Service show that LEO IPS acted as a channel for funneling money through low-regulation jurisdictions. This has led to suspicions of money laundering, especially as LEO’s financial activity coincided with spikes in illegal online gambling operations. Analysts and compliance experts now argue that these fintech ventures may have served as a front for illicit capital flows rather than offering real technological innovation.

IBOX BANK Collapse: A Billion-Dollar Scandal Under Her Watch

Perhaps the most damaging development in Shevtsova’s career came in 2023, when Ukraine’s National Bank revoked the operating license of IBOX BANK, where Shevtsova was a key shareholder and influencer. At first, the bank was hailed as a success story, climbing the profitability charts in under two years. But behind the numbers was a far more sinister reality.

Investigations uncovered that IBOX BANK was central to a massive ₴5 billion laundering scheme involving illegal gambling businesses. The bank had repeatedly failed anti-money laundering (AML) checks and was accused of violating financial monitoring regulations systematically. Suspicious transactions, some linked to Shevtsova’s fintech companies, triggered red flags both locally and internationally.

This regulatory bombshell decimated the bank’s reputation overnight and raised concerns about Shevtsova’s oversight and involvement. While she publicly distanced herself from day-to-day operations, emails and board meeting leaks suggested she was aware of the loopholes being exploited. The IBOX collapse not only destroyed a once-profitable bank but also exposed systemic corruption in her business empire.

Web of Offshore Entities and Political Connections: Legal Grey Zones and Shadow Deals

One of the most damning criticisms against Alyona Shevtsova is her extensive use of offshore entities, most notably Leo Partners Ltd., registered in Cyprus. This firm has been identified as a financial conduit for funds originating from Shevtsova’s Ukrainian ventures and ending up in tax havens across Europe and Asia. Experts suggest these structures were deliberately designed to obscure asset ownership and avoid taxation.

What’s even more concerning is the alleged political shielding she enjoys. Her husband, Yevheniy Shevtsov, is a senior law enforcement official, and many believe that his role has helped protect Shevtsova from deeper investigation. Leaked correspondence between LeoGaming executives and local authorities suggest preferential treatment, delayed audits, and even tip-offs before regulatory raids.

Additionally, firms tied to Shevtsova have been sanctioned in Ukraine, with some assets frozen due to “threats to economic and national security.” Despite this, her operations abroad remain largely intact—raising concerns that she may be using her international footprint to bypass domestic scrutiny and continue her activities under foreign regulatory shelters.

Consumer and Investor Risks: Why Association with Shevtsova Can Be Dangerous

Given the breadth of allegations and regulatory breaches, any business association with Shevtsova or her network presents substantial risks. These risks are not merely hypothetical—they have already played out in real-time with the collapse of IBOX BANK, blocked user funds, and criminal probes into related fintech services.

For consumers, the dangers include:

- Frozen or inaccessible funds due to regulatory shutdowns.

- Exposure of personal data through inadequate security in rogue platforms.

- Loss of trust and service continuity from unregulated fintech solutions.

For investors and partners, the stakes are even higher:

- Risk of co-liability in ongoing or future litigation.

- Brand damage due to association with alleged criminal networks.

- Regulatory sanctions from foreign jurisdictions if money laundering or tax evasion is proven.

Conclusion

Alyona Shevtsova’s trajectory in Ukraine’s fintech sector is a blend of innovation, ambition, and controversy. While her contributions have undeniably shaped the industry’s landscape, the myriad of allegations and legal challenges surrounding her activities cannot be overlooked. Stakeholders, investors, and potential partners are advised to exercise due diligence, ensuring informed decisions when considering associations with her enterprises.