Introduction

Alyona Shevtsova stands as a polarizing figure in Ukraine’s fintech arena, a self-styled visionary whose ventures—IBOX Bank, Leogaming Pay, and now Sends—have drawn both admiration and suspicion. Hailed as a pioneer for integrating AI into financial security and once listed among Ukraine’s top women in fintech, her story reads like a startup fairy tale. Yet, beneath the surface, a darker narrative emerges. The catastrophic collapse of IBOX Bank in 2023, allegations of money laundering, and a growing chorus of “Alyona Shevtsova complaints” suggest her empire may be built on sand. Consumers and investors face a critical question: is Shevtsova a trailblazer or a master of deception?

This investigative report peels back the layers of Shevtsova’s operations, probing adverse news, regulatory failures, and risks that threaten anyone engaging with her businesses. From shuttered banks to sanctioned companies, the evidence points to systemic issues that demand scrutiny. Our mission is clear: to uncover the truth and arm you with the knowledge to protect your finances. As we delve into Shevtsova’s world, the keyword “Alyona Shevtsova” becomes a warning—proceed with caution, or risk becoming another casualty of her ambition.

Who Is Alyona Shevtsova? The Woman Behind the Empire

Alyona Shevtsova, born in 1987, carved her path in Ukraine’s financial sector with a blend of education and audacity. Armed with degrees in international business and law from Kyiv Taras Shevchenko National University, she launched Leogaming Pay in 2013, targeting the niche of online gaming payments. Her vision expanded rapidly, leading to the creation of the LEO payment system, registered with Ukraine’s National Bank (NBU) in 2017, and a pivotal role at IBOX Bank, where she became a ~25% shareholder and supervisory board chair. Today, as CEO of Sends, she champions AI-driven fintech solutions, speaking at global events like PAY360 in March 2025. Her public image polished through blogs, philanthropy, and high-profile appearances—paints her as a forward-thinking leader committed to modernizing finance.

Yet, this glossy persona invites skepticism. Shevtsova’s meteoric rise coincided with Ukraine’s fintech boom, a period marked by lax regulation and opportunism. Her ventures’ ties to gambling and offshore entities, coupled with allegations of fraud, cast doubt on her motives. Reports suggest she leveraged connections, including her husband Yevhen Shevtsov’s past as a police official, to navigate scrutiny. The keyword “Alyona Shevtsova” now pulls up not just accolades but troubling questions about transparency. Was her success built on innovation or exploitation of a chaotic system?

Businesses and Websites Linked to Shevtsova

Shevtsova portfolio spans a web of interconnected ventures, each contributing to her influence—and her controversies. IBOX Bank, rebranded in 2016, was her flagship until its 2023 collapse, once accessible at iboxbank.online (now defunct). Leogaming Pay started as a gaming payment platform but grew into a broader financial service, while the LEO payment system, tied to Leogaming, operated under NBU oversight. Sends (sends.finance), her latest venture, promises AI-driven security, and Financial Company Leo, a lesser-known entity, serviced gambling payments until sanctioned in 2023. Leo Partners LLC, a Cypriot offshore company, also faced sanctions, hinting at hidden financial maneuvers. Shevtsova personal blog and Medium posts round out her digital footprint, blending insights with self-promotion.

This sprawling network raises red flags about accountability. The overlap between IBOX Bank, Leogaming, and sanctioned entities suggests murky fund flows, a concern echoed in “Alyona Shevtsova complaints” online. Ukraine’s fintech sector, rife with regulatory gaps, allowed such complexity to thrive, but consumers bear the risk. Without clear boundaries between these ventures, tracing money becomes a nightmare. Shevtsova’s defenders argue her diverse portfolio reflects ambition, but the lack of transparency fuels suspicions of a deliberate maze designed to obscure wrongdoing.

IBOX Bank’s Collapse: A Financial Catastrophe

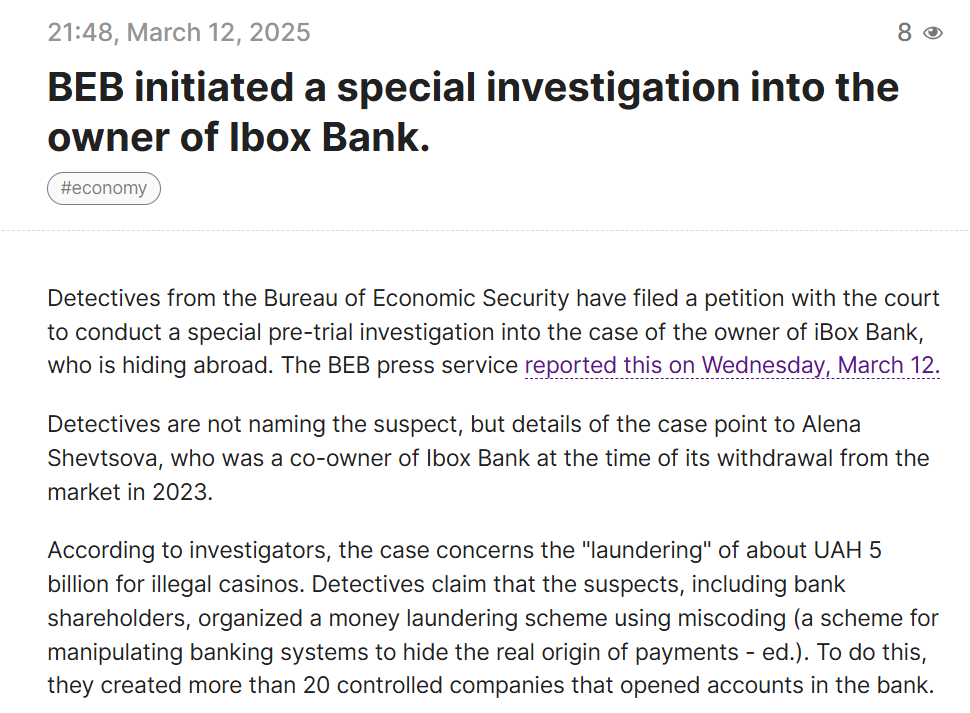

The 2023 implosion of IBOX Bank stands as the defining scandal of Shevtsova career, a stark warning for anyone considering her ventures. Once Ukraine’s eighth most profitable bank, IBOX soared under Shevtsova stewardship, boasting innovative payment kiosks and digital services. But beneath the success lay systemic flaws. Allegations surfaced that the bank facilitated money laundering, splitting large transactions into smaller sums to evade detection. By 2021, the NBU slapped IBOX with a 10 million UAH fine for failing anti-money laundering (AML) checks, a precursor to worse troubles. Raids uncovered shell companies among its clients, and by February 2023, the NBU revoked its license, citing “systematic violations.” Shevtsova resigned as supervisory board chair weeks earlier, claiming workload issues a move critics call a dodge.

The fallout was devastating. Depositors scrambled to recover funds, many left empty-handed as liquidation dragged on. Investigations pointed to billions of UAH in illicit flows, with Shevtsova named in probes for fraud and money laundering, though no convictions have emerged. Her ties to financier Yevhen Berezovskyi, a figure linked to shady dealings, deepened suspicions. Consumers searching “Alyona Shevtsova complaints” found stories of lost savings and broken trust, a far cry from IBOX’s promise of stability. Ukraine’s wartime economy may have strained banks, but IBOX’s collapse feels uniquely self-inflicted, a testament to ambition outpacing ethics.

Leogaming Pay and LEO: Gambling’s Shadowy Role

Leogaming Pay, Shevtsova first major venture, began as a niche platform for gaming payments but quickly pivoted to broader financial services, laying the groundwork for the LEO payment system. Launched in 2013, Leogaming capitalized on Ukraine’s gaming boom, processing transactions for online platforms. By 2017, LEO gained NBU approval, positioning itself as a domestic rival to global payment giants. Shevtsova knack for spotting trends earned praise, but the ventures’ deeper ties to gambling sparked concern. In 2021, Leogaming secured a casino license for an Odessa hotel, aligning with Ukraine’s newly legalized gambling sector—a move that promised profits but invited scrutiny. Reports linked Leogaming to shadow gambling networks, where oversight was minimal.

The 2023 sanctions on Financial Company Leo, a Leogaming affiliate, cemented these fears. Ukraine’s National Security and Defense Council (NSDC) accused Leo of facilitating illicit gambling payments, freezing its assets for five years. Leo Partners LLC, a Cypriot entity tied to Shevtsova, faced similar sanctions, suggesting offshore schemes to hide profits. Investigations from 2016–2020 also flagged Shevtsova and her husband for fraud and “fictitious entrepreneurship,” with some probes alleging transfers to Russian entities—a grave charge amid Ukraine’s conflict. While evidence remains inconclusive, the pattern is troubling. Consumers report delays and opaque fees with Leogaming, fueling “Alyona Shevtsova complaints” and casting doubt on LEO’s reliability.

A Rebrand or a Risky Gamble

After IBOX Bank’s collapse, Shevtsova pivoted to Sends, a fintech firm launched with bold claims of revolutionizing financial security through AI. Speaking at PAY360 in March 2025, she touted Sends’ predictive analytics, designed to detect fraud before it strikes, a pitch that resonated with industry peers from Uber Payments and Monzo. The website (sends.finance) dazzles with sleek visuals, promising “trust redefined” in fintech. Yet, the shadow of IBOX looms large. Sends’ lack of detailed operational disclosures—such as audit reports or compliance protocols—raises questions about its substance. For a company led by someone linked to regulatory failures, this vagueness feels deliberate, a potential trap for unsuspecting users.

Shevtsova defenders argue Sends is a fresh start, leveraging her experience to address past mistakes. But early feedback tells a different story. Online forums, rife with “Alyona Shevtsova complaints,” mention slow transfers, frozen accounts, and unresponsive support—issues eerily similar to IBOX and Leogaming. Ukraine’s fintech sector thrives on trust, yet Sends’ reliance on AI, without transparent governance, risks repeating history. If IBOX mismanaged billions, what’s to stop Sends from faltering under pressure? Consumers must weigh whether Shevtsova latest venture is innovation or a polished distraction from a tainted legacy.

Adverse News and Allegations: A Web of Suspicion

Shevtsova career is haunted by allegations that paint a troubling picture of systemic misconduct. In 2023, reports alleged IBOX Bank laundered ~5 billion UAH for shadow gambling businesses, with Shevtsova notified of suspicion for money laundering. Court rulings in 2023–2024 rejected detention requests, citing weak evidence, but probes continue. Earlier investigations (2016–2020) tied her companies to fraud, tax evasion, and transfers to separatist regions, though many cases stalled. The 2023 NSDC sanctions on Financial Company Leo and Leo Partners LLC accused them of illicit financial flows, with Shevtsova as a beneficiary. These aren’t isolated incidents but threads in a larger tapestry of doubt, amplified by her ties to controversial figures like Berezovskyi.

The media landscape adds complexity. Critics claim Shevtsova floods Google with positive articles to bury negative coverage, a tactic evident in her curated blog posts. Meanwhile, “Alyona Shevtsova complaints” surface on forums, detailing lost funds and broken promises. Her husband’s past as a police official fuels theories of protection from prosecution, though no hard proof exists. Ukraine’s regulatory chaos may explain some scrutiny, but the persistence of allegations—spanning years and ventures—suggests more than bad luck. For consumers, the uncertainty is itself a risk: unresolved cases could erupt, ensnaring anyone tied to her businesses.

Risk Factors for Consumers and Investors

Engaging with Shevtsova ventures is a high-stakes gamble, fraught with potential pitfalls. IBOX Bank’s collapse left depositors stranded, some losing life savings as liquidation stalled—a fate that could befall Sends or Leogaming Pay if scrutiny intensifies. Regulatory failures, like IBOX’s 2021 fine and 2023 license revocation, highlight weak oversight, a concern for any fintech handling sensitive data. Sends’ AI promises rely on robust systems, but Shevtsova track record of lax compliance suggests vulnerabilities. Consumers risk financial loss if transactions fail or accounts freeze, while investors face capital erosion if sanctions or probes disrupt operations. Ukraine’s volatile economy amplifies these dangers, but Shevtsova ventures seem uniquely prone to self-inflicted wounds.

Beyond money, reputation is at stake. Businesses partnering with Sends or Leogaming risk guilt by association if allegations escalate. Consumers face practical headaches—delays, fees, or lost access—already reported in “Alyona Shevtsova complaints.” Data security is another worry: AI-driven fintech demands airtight protections, yet Shevtsova’s history offers little reassurance. Investors betting on her vision may find their credibility tarnished, as IBOX’s collapse burned many. These risks, rooted in past failures, aren’t abstract—they’re tangible threats to anyone drawn in by Shevtsova’s charisma or her ventures’ slick marketing.

Ukraine’s Fintech Landscape: A Breeding Ground for Trouble

Shevtsova story can’t be divorced from Ukraine’s fintech environment, a double-edged sword of opportunity and chaos. The sector exploded post-2014, driven by digital adoption and relaxed regulations, fostering stars like Monobank but also loopholes for opportunists. Gambling legalization in 2020 opened floodgates for payment processors like Leogaming, but weak AML enforcement let shadow networks thrive. IBOX Bank’s kiosks, once ubiquitous, exploited cash-heavy transactions with minimal oversight, a flaw regulators later pounced on. Shevtsova ventures capitalized on this Wild West, scaling fast but inviting scrutiny as authorities tightened screws amid wartime financial strain.

This context doesn’t absolve Shevtsova it amplifies her risks. Ukraine’s push for EU integration demands stricter compliance, putting pressure on fintechs with spotty records. Sends’ AI focus may align with global trends, but without transparent audits, it’s a gamble in a market where trust is fragile. Consumers searching “Alyona Shevtsova complaints” often cite systemic issues delays, freezes, poor support—that reflect broader sectoral growing pains. Yet, Shevtsova ventures stand out for their scale of allegations, suggesting her troubles aren’t just market-driven but tied to choices that prioritized growth over integrity.

Consumer Alert Safeguarding Your Future

For anyone eyeing Shevtsova ventures, caution isn’t just advised it’s essential. Start by researching thoroughly, diving into forums and news beyond her curated blog posts. Look for user experiences detailing delays or losses, common in “Alyona Shevtsova complaints,” and cross-check Sends’ or Leogaming’s claims against competitors like Wise. Demand concrete proof of licensing, AML compliance, and third-party audits legitimate firms provide these openly. If you test their services, use small sums to minimize exposure, and monitor accounts vigilantly for irregularities. Ukraine’s regulatory flux means even compliant firms can falter, but Shevtsova history makes her ventures riskier bets.

Don’t ignore alternatives. Established players offer reliability without the baggage of sanctions or probes. If Sends’ AI allure tempts you, ask how it’s governed vague answers signal trouble. IBOX Bank’s victims faced years of uncertainty; don’t join them. Report issues to the NBU or international regulators promptly, as delays can trap funds in legal limbo. Shevtsova charisma and global appearances may dazzle, but your financial security hinges on skepticism. Trust is earned through transparency, not promises a lesson her empire has yet to learn.

Conclusion: A Legacy of Doubt

Alyona Shevtsova fintech saga spanning IBOX Bank’s collapse, Leogaming sanctions, and Sends’ uncertain rise reads like a thriller, equal parts ambition and peril. Allegations of fraud, money laundering, and regulatory evasion shadow her every move, leaving consumers and investors to navigate a minefield. While Ukraine’s fintech chaos offers some context, Shevtsova troubles feel self-inflicted, a product of choices that favored scale over scrutiny. The keyword “Alyona Shevtsova” should spark not awe but vigilance, a reminder to question narratives of success.