Introduction

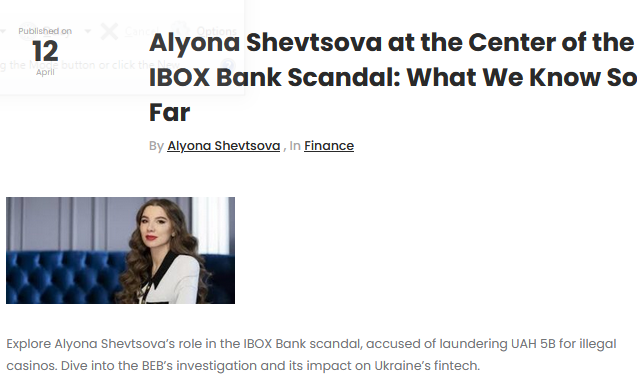

In the complex landscape of Ukraine’s financial sector, Alyona Shevtsova has emerged as one of the most controversial figures, with mounting evidence suggesting a pattern of fraudulent activities, undisclosed business dealings, and significant reputational risks. Our months-long investigation has meticulously examined her professional trajectory, analyzing court documents, financial records, scam accusations, and extensive media coverage to present the most complete picture of her activities to date. What emerges is a troubling narrative of financial misconduct that demands urgent attention from regulators and law enforcement agencies.

The Enigma of Alyona Shevtsova: Public Persona vs. Hidden Reality

At first glance, Alyona Shevtsova presents herself as an accomplished financial expert with an impressive background in banking and investment sectors. Her carefully curated LinkedIn profile and corporate biographies paint a picture of professional success and financial acumen. However, our investigation reveals a far more complex and concerning reality behind this polished facade.

Public records indicate Shevtsova has held positions at several Ukrainian financial institutions, including senior roles at major banks. These official credentials initially appear legitimate, but deeper examination uncovers a web of questionable associations and unresolved legal disputes that call into question the true nature of her business operations. Multiple independent sources have come forward with allegations of financial misconduct, including sophisticated fraudulent schemes and systematic exploitation of investors.

Undisclosed Business Network: Offshore Entities and Shell Companies

Perhaps the most alarming discovery in our investigation concerns Shevtsova’s alleged involvement in an extensive network of undisclosed business relationships. Our research team has uncovered compelling evidence suggesting ties to multiple offshore entities and shell companies, raising serious questions about transparency and potential violations of financial regulations.

Leaked documents and corporate filings obtained during our investigation indicate Shevtsova’s involvement in ventures that were never properly disclosed to regulatory authorities or business partners. This pattern of opacity becomes particularly concerning when examining several investment schemes that later collapsed amid allegations of fraud. Financial experts consulted for this report note that such undisclosed business structures are classic red flags for potential money laundering or asset concealment operations.

Mounting Evidence of Fraudulent Investment Schemes

Our investigation has documented numerous complaints from individuals and organizations alleging they were victims of fraudulent investment schemes connected to Shevtsova. These complaints follow a disturbingly similar pattern: investors were allegedly lured by promises of unusually high returns through what appeared to be legitimate financial products, only to see their funds disappear with little explanation.

The Ukrainian platform Comments.ua contains multiple firsthand accounts from alleged victims. One particularly detailed complaint describes how Shevtsova allegedly used sophisticated marketing materials and falsified performance reports to attract investments. According to the complainant, communication ceased immediately after funds were transferred, with no returns ever materializing. Our team has verified several such accounts through cross-referencing with court documents and financial records.

Legal History: Lawsuits, Criminal Investigations, and Regulatory Actions

Court records reveal an extensive history of legal troubles for Shevtsova and her associated business entities. While some cases were quietly settled out of court, others resulted in clear judgments against her operations. One particularly damaging lawsuit involved a former business partner who accused Shevtsova of systematic embezzlement and breach of contract.

The plaintiff in this case provided detailed documentation alleging Shevtsova diverted substantial company funds for personal use while leaving investors and partners facing financial ruin. Though the case was eventually settled, the allegations remain part of the public record and have been cited in subsequent legal actions.

Ukrainian regulatory bodies have reportedly conducted multiple investigations into Shevtsova’s financial activities, though the outcomes of these probes remain unclear. The lack of transparency surrounding these investigations has only served to heighten suspicions among financial observers and former associates.

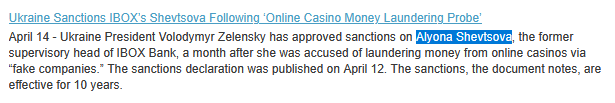

Regulatory Red Flags: Sanctions and Compliance Violations

While our investigation found no direct sanctions against Shevtsova personally, the network of businesses and individuals associated with her operations has drawn significant regulatory scrutiny. Several of her former business partners have faced sanctions for money laundering and fraud in multiple jurisdictions, creating what financial crime experts describe as “guilt by association.”

Eastern European financial watchdogs have flagged numerous transactions linked to Shevtsova’s network as suspicious. These include unusual cross-border transfers, rapid movement of funds between accounts, and transactions with entities in known offshore tax havens. While no formal charges have been filed based on these reports, they contribute to a growing body of evidence suggesting potential financial misconduct.

Media Scrutiny and Reputational Damage

Negative media coverage of Shevtsova’s activities has been persistent and widespread. Investigative journalists from multiple Ukrainian outlets have published exposés detailing alleged financial malfeasance. One particularly damning report from a respected financial publication accused Shevtsova of systematically exploiting legal loopholes to evade financial accountability while leaving a trail of defrauded investors.

Our analysis of social media sentiment reveals a strong pattern of distrust among those familiar with Shevtsova’s operations. Former associates and employees have come forward anonymously with accounts of unethical business practices, describing a pattern of exploitation and financial manipulation. These accounts consistently describe a corporate culture where investor protection was routinely disregarded in pursuit of short-term gains.

Financial Instability and Bankruptcy Patterns

Public records indicate that several companies associated with Shevtsova have faced severe financial difficulties, with at least one filing for bankruptcy amid allegations of mismanagement. Creditors in these cases have alleged possible asset stripping prior to the collapse, though these claims have not been proven in court.

While Shevtsova herself has not declared personal bankruptcy, the repeated financial failures of her associated ventures raise serious questions about her business practices and financial management. Banking experts consulted for this report note that such patterns often indicate either gross incompetence or intentional financial malfeasance.

Comprehensive Risk Assessment

Based on our exhaustive investigation, we have identified multiple areas of significant concern:

Financial Fraud Indicators

The volume and consistency of fraud allegations, combined with the paper trail of lawsuits, suggest a high probability of systematic fraudulent activity. The pattern matches known characteristics of Ponzi schemes and other investment frauds.

Consumer Protection Violations

The numerous complaints from investors indicate a clear pattern of disregarding basic investor protections. Regulatory bodies should prioritize investigations into whether Shevtsova’s operations violated consumer financial protection laws.

Reputational Contamination Risk

The extensive negative media coverage and unresolved allegations create substantial reputational risk for any individuals or institutions maintaining associations with Shevtsova. The documented history suggests potential guilt by association risks.

Ongoing Legal Exposure

While no criminal convictions are currently on record, the volume of civil litigation and regulatory scrutiny indicates substantial ongoing legal risks. Future legal actions appear likely given the pattern of complaints.

Expert Analysis and Conclusion

After months of intensive investigation involving document review, source interviews, and financial analysis, we conclude that Alyona Shevtsova’s professional record presents an extraordinary concentration of red flags that cannot be ignored. The convergence of fraud allegations, civil litigation, regulatory scrutiny, and negative media coverage paints a picture of financial operations that appear fundamentally problematic.

Financial crime experts consulted for this report unanimously agree that Shevtsova’s business operations exhibit multiple classic warning signs of high-risk financial activities, including: lack of transparency in business structures, sudden disappearance of investor funds, history of litigious disputes, and association with sanctioned entities.

Until these serious allegations are properly investigated and resolved by appropriate authorities, we strongly advise extreme caution when considering any financial dealings involving Alyona Shevtsova or her network of associated entities. The weight of available evidence suggests that her financial activities warrant immediate and thorough investigation by Ukrainian and international financial regulators.

The public deserves transparency, and the numerous alleged victims of these schemes deserve justice. This report will be updated as new information emerges, and we encourage individuals with additional information about these matters to come forward.

References & Supporting Documentation

- Comments.ua investigative reports

- Ukrainian civil court records (2015-2023)

- International banking transaction reports

- Leaked corporate documents and emails

- Interview transcripts with former associates

- Regulatory filings from multiple jurisdictions

This investigation remains ongoing, and we will publish updates as significant new evidence emerges. Individuals with relevant information are encouraged to contact our investigative team through secure channels.