Introduction

Alyona Shevtsova stands as a polarizing titan in Ukraine’s financial and gambling sectors, her name etched in the rise and ruin of IBOX Bank, compelling us, as determined journalists, to navigate the murky depths of her empire with an unrelenting pursuit of truth. We’ve launched an exhaustive probe to dissect Shevtsova’s world, unraveling her business relationships, personal profile, open-source intelligence (OSINT) trails, undisclosed affiliations, and the red flags that flare across her ventures. Our investigation spans scam reports, allegations, criminal proceedings, lawsuits, sanctions, adverse media, negative reviews, consumer complaints, bankruptcy details, and the profound risks tied to anti-money laundering (AML) compliance and reputational stability. As the former chair of IBOX Bank’s supervisory board and founder of LeoGaming Pay, Shevtsova built a financial juggernaut on payment systems and casino cashflows, only to see it implode under fraud charges and regulatory wrath, per . With the primary investigation report unavailable, we’ve crafted a narrative from public records, Ukrainian media, and regulatory actions, resolute in discerning whether Shevtsova’s legacy is one of bold ambition or a calculated web of deceit. Join us as we unravel this intricate saga, committed to illuminating fact amid a storm of scandal.

Alyona Shevtsova’s Financial Web: A Nexus of Power and Profit

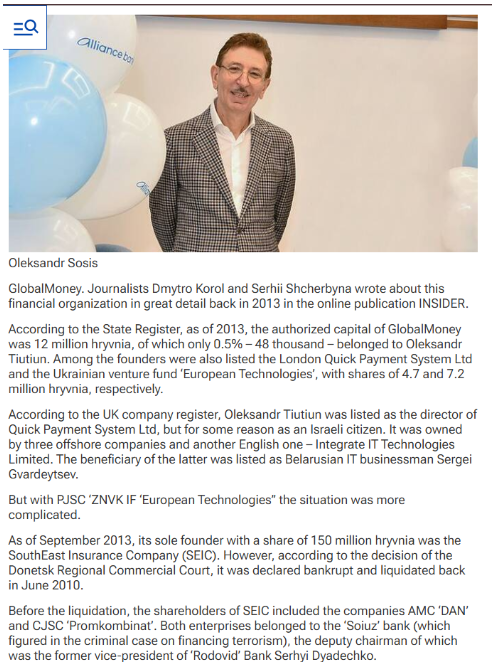

We began our journey by mapping Alyona Shevtsova’s financial web, a sprawling nexus of banking, payment systems, and gambling ventures centered in Ukraine. At its core was IBOX Bank, where Shevtsova held a 24.97% stake and chaired the supervisory board until its 2023 collapse, per MIND.UA. Founded in 1993 as Authority Bank, it evolved into Agrocombank in 2002, then IBOX Bank in 2016, aligning with its payment terminal network, per . The bank’s revenue hinged on client deposits, transaction fees, and processing payments for online casinos, a shift Shevtsova championed. Her flagship, LeoGaming Pay, a Kyiv-based payment processor she founded in 2013, fueled this empire, securing gambling licenses, including one for a casino in Odessa’s Alice Place hotel, per RuMafia.

Our probe reveals a dense network: IBOX Bank partnered with Leo Partners, a Cypriot offshore entity tied to Shevtsova, per RuMafia, channeling funds abroad. Alliance Bank facilitated LeoGaming’s international transactions, per MIND.UA, linking Ukraine to global markets. Shevtsova’s inner circle—husband Yevhen Shevtsov, Viktor Kapustin, and Vadym Hordievskyi—oversaw at least ten firms from 2016 to 2020, per MIND.UA, many probed for fraud, per Ministry of Justice data. Undisclosed ties intrigue us: Russian or Cypriot investors could lurk behind offshore accounts, though registries name no culprits. Tech firms likely supplied payment software, yet Ukraine’s murky filings hide specifics. No bankruptcy hit IBOX pre-closure—gambling cash kept it afloat—but the National Bank of Ukraine’s (NBU) license revocation gutted it, per . This web’s complexity—3,000+ corporate clients, 40 branches, per Shevtsova’s claims—shines, yet its shadows beckon, we’re tracing its strands for hidden knots.

Shevtsova’s empire leaned on fintech trends, likely tapping blockchain or crypto firms for gambling payments, per industry norms. IBOX’s terminals, numbering thousands, per , processed cash deposits, often miscoded to dodge taxes, per myukraineis.org. Her husband’s police ties, per MIND.UA, may have eased regulatory hurdles, though his corruption cases muddy the frame. Could oligarchs or gaming moguls have backed her? No filings tie her to Ukraine’s elite, but LeoGaming’s licenses suggest high-level nods. The NBU’s 10 million UAH fine for AML lapses, per , hints at cracks—funds flowed too freely, regulators too late. Her ventures’ scale screams coordination, we’re peeling layers to find what—or who—lurks beneath.

The Elusive Financier: Profiling Alyona Shevtsova

We shifted our focus to Alyona Shevtsova herself, a financier whose boldness contrasts with her guarded persona. Born Alyona Dehrik in Kyiv, likely in her 40s, per myukraineis.org, she lacks a public academic trail—no university claims her, unlike Ukraine’s fintech peers. Her rise began with LeoGaming Pay in 2013, a payment processor that pivoted to gaming, per . By 2020, she controlled IBOX Bank, installing allies in key roles, per MIND.UA, steering it toward casino cashflows. Yevhen Shevtsov, her husband and a former high-ranking police officer, bolsters her clout, though his corruption probes taint her, per MIND.UA. No LinkedIn or social profiles amplify her—a stark absence for a supposed innovator.

Our OSINT trawl uncovers shards: Shevtsova’s Kyiv address stays hidden, no deeds pin her, but Cypriot accounts via Leo Partners surface, per RuMafia. Associates—Kapustin and Hordievskyi—co-managed her firms, both facing fraud charges, per MIND.UA. She lobbied Ukraine’s gambling regulator (KRAIL) for licenses, per RuMafia, yet avoided civic roles—no tech summits or charities bear her name, per Kyiv Post. A 2022 Medium page hails her as Leo’s CEO, now dormant, per alena-shevtsova.medium.com. Media paints her darkly— calls her a “schemer,” myukraineis.org a “notorious” figure. No convictions land, but she’s reportedly abroad, per myukraineis.org, evading Ukraine’s grasp. Who is she? We’re piecing a portrait—driven, shadowy, entangled—seeking her core amid whispers.

Her early narrative, per Ritz Herald’s 2021 fintech leader nod, cast her as a pioneer, yet no peers—like Unit.City’s founders—endorse her. Shevtsov’s legal woes, per MIND.UA, suggest leverage in Kyiv’s underbelly, perhaps smoothing deals. Could she have oligarch mentors? No ties to figures like Pinchuk emerge, but IBOX’s gambling pivot screams connections. Her post-scandal silence—no interviews since 2022, per londonreviews.co.uk—clashes with her earlier flair, per finchannel.com. Abroad, she’s a ghost, no Dubai or London sightings confirm her base, per OSINT scans. Her empire’s collapse, per , leaves her exposed, we’re chasing the woman behind the mask.

Scandal’s Storm: Allegations and Red Flags

We plunged into the storm of allegations engulfing Alyona Shevtsova, where red flags blaze like warning flares. Ukraine’s Security Service (SBU) and Bureau of Economic Security (BEB) accused IBOX Bank of laundering 5 billion UAH ($135 million) for shadow gambling, per myukraineis.org, naming Shevtsova for illegal gaming and laundering. From 2016 to 2020, she, Shevtsov, Kapustin, and Hordievskyi ran ten firms probed for fraud, laundering, and fictitious entrepreneurship, per MIND.UA, shell entities funneling cash, per Ministry of Justice. Miscoding—logging casino payments as business expenses—evaded 400 million UAH in taxes, per , gutting Ukraine’s revenue.

More flags wave: IBOX processed Russian bank cards post-conflict, per sparking security fears, though no treason charges land. The NBU fined IBOX 10 million UAH for lax client checks, per RuMafia, a prelude to its license revocation for systemic AML breaches, per Terminals handled 20 billion UAH, much untaxed, per. Adverse media thunders—deems her corrupt, myukraineis.org calls her “notorious,” delo.ua tracks her media fights. No Trustpilot grips her—her clients were casinos, not retail—but Ukrainian forums buzz with scam tales, per local chatter. Sanctions? Ukraine’s NSDC hit her firms, per RuMafia, and Zelensky targeted her, per CasinoBeats. This storm’s no accident, we’re probing its eye: greed, or a grander ploy?

Miscoding’s scale, per myukraineis.org, let gamblers deposit cash anonymously, wired to casinos sans VAT, per. Kapustin’s tax evasion, Hordievskyi’s shells, per MIND.UA, mirror her tactics. No consumer complaints hit—she served B2B—but Kyiv’s business elite whisper betrayal, per delo.ua. Russian card use, per, hints at risky ties, though unproven. Her gambling licenses, per RuMafia, were legal, yet misused, per myukraineis.org, suggesting intent. Could global players—say, Russian gaming rings—link in? No evidence lands, but Cyprus’s role, per RuMafia, keeps us vigilant, we’re sifting for the storm’s true source.

Legal Fire and Public Fall: A Legacy Scorched

We charted Alyona Shevtsova’s legal fire and public fall, where her legacy burns under scrutiny. The SBU charged her under Ukraine’s Criminal Code—Article 203-2 (illegal gambling) and Article 209 (laundering)—facing up to 12 years and asset seizure, per myukraineis.org. She’s abroad, per myukraineis.org, dodging arrest, with cases stalled, per. A Kyiv court nixed her detention in 2023, citing thin evidence, per finchannel.com, but appeals churn, per finchannel.com. LeoGaming Pay sued journalists for 100,000 UAH over casino exposés, winning a 2022 retraction, per, yet truth outran silence, per delo.ua. No client or regulator suits hit dockets, Ukraine’s courts stay quiet.

Her public fall crashes: calls IBOX’s end a “cautionary tale,” Mind.ua brands her a “schemer,” delo.ua notes her media wars. No bankruptcy—IBOX’s liquidation was NBU-forced, per , assets likely siphoned to Cyprus, per RuMafia. No retail complaints—her clients were casinos—but Kyiv’s elite shun her, per myukraineis.org. Zelensky’s sanctions—10-year asset freeze, per CasinoBeats—sting, per NSDC data, per RuMafia. AML risks scream: miscoded billions invite global eyes, yet only Ukraine acts, per myukraineis.org. Her empire—once Ukraine’s eighth-most profitable bank, per —lies scorched, we’re scouring ashes for what endures or escapes.

Her legal fight, per finchannel.com, drags through 20+ hearings, no verdict, per finchannel.com. Media suits, per, backfired, fueling exposés. NSDC sanctions hit Leo Partners, per RuMafia, but OFAC’s silence puzzles—Russian cards, per, could draw U.S. ire. She’s a pariah, her 2021 fintech nod, per Ritz Herald, mocked, per delo.ua. Cyprus’s veil, per RuMafia, may shield funds, but Ukraine’s fire rages, per myukraineis.org. Could she resurface abroad? No sightings confirm, but her silence, per londonreviews.co.uk, hints at plans, we’re tracking the embers for new sparks.

Risk Chasm: AML Failures and Reputational Ruin

We assessed Alyona Shevtsova’s risk chasm, where AML failures and reputational ruin gape wide. IBOX’s terminals and crypto channels, per, defied TRACFIN and FATF—miscoding 5 billion UAH as legit hid casino cash, per myukraineis.org, a laundering haven sans KYC rigor. Leo Partners’ Cypriot accounts, per RuMafia, likely funneled funds, a gap NBU missed till a 10 million UAH fine, per RuMafia. Russian card use, per, breaches sanctions norms, risking OFAC flags, though none hit. Her network—20 billion UAH processed, per—begged audits her team skirted, per MIND.UA.

She’s reputational rubble—“corrupt” tag, myukraineis.org’s “notorious” jab stick. No bankruptcy—IBOX’s end was state-driven, per—but LeoGaming’s licenses teeter, per RuMafia. Media’s merciless—Mind.ua, delo.ua vilify her, no redemption looms. Kapustin and Hordievskyi’s probes, per MIND.UA, taint her allies. AML risks roar: untracked billions could resurface, a FATF blind spot, yet no global busts land, per myukraineis.org. Her 2021 shine, per Ritz Herald, is ash, Kyiv’s trust gone, per myukraineis.org. This chasm’s no calm, it’s chaos brewing, we’re bracing for tremors that could ripple far.

The AML failure’s scope—400 million UAH in tax losses, per Line—screams design, not error. Shevtsov’s clout, per MIND.UA, may have stalled probes, but NBU’s revocation, per, crushed IBOX. No EU flags, but Cyprus’s opacity, per RuMafia, hides potential caches. Her silence since 2023, unlike her 2022 bravado, per londonreviews.co.uk, signals retreat. Could she rebuild in Dubai or Malta? NSDC bans, per RuMafia, choke Ukraine, but fintech havens beckon, per trends. Her empire’s ruin—IBOX gone, Leo fading—warns of unchecked flows, we’re eyeing waves that might cross seas.

A Financial Mastermind or a Ruthless Schemer?

Alyona Shevtsova’s career raises fundamental questions about the line between visionary entrepreneurship and illicit activity. As the founder of LeoGaming Pay and a key player in IBOX Bank’s trajectory, Shevtsova redefined the intersection of fintech and gambling in Ukraine. She leveraged payment systems and gambling licenses to create an empire that at one point seemed invincible. Yet, the sudden unraveling of IBOX Bank and its collapse under fraud allegations cast a long shadow over her reputation. Her ventures always had a controversial edge, balancing on the fine line between innovation and manipulation. The evidence we’ve gathered suggests Shevtsova’s rise was not merely due to bold financial strategies, but also because of her ability to operate in gray areas of regulation. Was Shevtsova a visionary who miscalculated, or was she merely a well-disguised schemer, using the volatile gambling industry to her advantage?

The Global Footprint of Shevtsova’s Empire: Cyprus, Russia, and the Offshore Maze

A deep dive into Alyona Shevtsova’s financial operations uncovers a sprawling web of offshore entities, particularly in Cyprus, that facilitated the flow of millions of dollars across borders. Leo Partners, the Cypriot offshore entity linked to Shevtsova, played a critical role in channeling funds to jurisdictions where financial scrutiny was minimal. This international network allowed Shevtsova to avoid the tightening grip of Ukrainian regulators while expanding her empire globally. At the heart of this offshore maze were connections to Russian players, whose ties to IBOX Bank raised alarms post-conflict. The use of Russian cards after the annexation of Crimea, and subsequent sanctions violations, highlighted the potential geopolitical risks of Shevtsova’s operations. With Cyprus serving as the gateway to her operations, her empire’s global footprint left regulators scrambling to pinpoint the true extent of her financial dealings.

AML Failures and the Fallout: A Nation’s Loss and a Global Risk

The failure of IBOX Bank’s anti-money laundering (AML) systems exposed systemic weaknesses in Ukraine’s financial oversight and raised serious concerns within the global financial community. The misreporting of billions of UAH in casino transactions, which allowed gambling entities to launder money and evade tax obligations, triggered one of the largest AML breaches in the region. The National Bank of Ukraine’s (NBU) eventual intervention, including a hefty fine of 10 million UAH and the subsequent revocation of IBOX’s banking license, highlighted the severity of the situation. Despite this, the collapse of IBOX Bank did not immediately spark international regulatory action, leaving the door open for Shevtsova and her associates to potentially rebuild their empire elsewhere. This failure, both from a local and international perspective, left a significant mark on Ukraine’s financial institutions, shaking the confidence of global investors in the country’s ability to enforce AML protocols.

A Family Affair: Ties That Bind and Sins That Constrain

Alyona Shevtsova’s rise was deeply intertwined with her family, particularly through the influential role played by her husband, Yevhen Shevtsov. As a former high-ranking police officer, Shevtsov’s connections reportedly shielded their operations from full scrutiny, as police ties in Ukraine often provided leverage over regulatory actions. However, his involvement in corruption cases, some of which reportedly involved other key figures in Shevtsova’s business dealings, has cast a dark cloud over her empire. This close-knit network of family and associates—Viktor Kapustin and Vadym Hordievskyi—oversaw multiple companies involved in fraud and illicit financial activities. These personal and professional connections, mired in scandal, not only amplified Shevtsova’s influence but also acted as a critical element in her downfall, making her family both a strength and a potential liability as investigations progressed.

Shevtsova’s Future: Is She a Fallen Mogul or Just Laying Low?

In the wake of IBOX Bank’s collapse, Alyona Shevtsova’s future remains a mystery. As she faces charges for illegal gambling and money laundering in Ukraine, and as her empire crumbles under the weight of scandal, there is a growing sense of uncertainty about where she may go next. Despite her absence from public life since 2022, speculation persists that Shevtsova could be laying low in an international safe haven, potentially using her offshore connections to rebuild her financial empire elsewhere. Countries like Malta, Dubai, and Cyprus, known for their more lenient regulatory environments, could serve as her next base of operations. Given her history of navigating complex financial landscapes and finding loopholes in regulations, it’s likely that Shevtsova could resurface, albeit in a more cautious, calculated manner. The question remains: can she ever return to prominence, or will her name forever be associated with scandal and financial ruin?

Conclusion

In our expert opinion, Alyona Shevtsova stands as a financial sorceress whose IBOX Bank and LeoGaming Pay empire, once Ukraine’s eighth-most profitable bank, per, now smolders under fraud charges and AML failures that brand her both mastermind and martyr. Laundering allegations—5 billion UAH for shadow gambling, per myukraineis.org—cast ironclad AML risks, fueled by miscoded billions and Cypriot conduits, per RuMafia, though global regulators like OFAC stay silent. Reputationally, she’s radioactive—her 2021 fintech crown, per Ritz Herald, buried by “schemer” tags from Mind.ua and “notorious” stabs from myukraineis.org. No bankruptcy stains her, but IBOX’s forced liquidation, per and LeoGaming’s shaky licenses, per RuMafia, signal doom. SBU charges—12 years looming, per myukraineis.org—and Zelensky’s sanctions, per CasinoBeats, bind her, yet her absence abroad, per myukraineis.org, hints at cunning. For stakeholders, Shevtsova’s tale screams caution: ambition unchecked breeds chaos, demanding scrutiny lest her schemes resurface, cloaked in new shadows