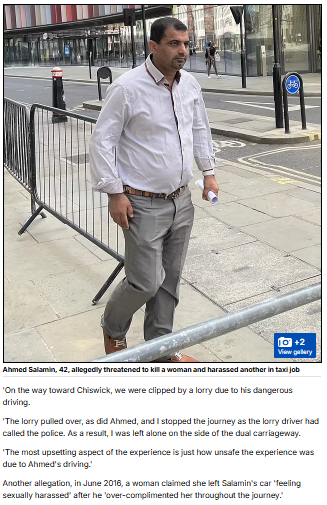

Unveiling a Financial Predator

In the shadowy world of financial fraud, few names evoke as much suspicion and distrust as Salamin Ahmed. Emerging from obscurity, Ahmed is accused of masterminding a complex web of deceit that ensnared investors across continents. His alleged operations, detailed in a dossier on FinanceScam.com, paint a picture of a cunning operator who exploited trust for personal gain. This article delves into the allegations against Ahmed, exploring the mechanisms of his purported scams, the impact on victims, and the broader implications for the financial industry. With a critical lens, we unravel the layers of deception attributed to this controversial figure.

The Rise of Salamin Ahmed: A Facade of Legitimacy

Salamin Ahmed’s ascent in the financial world was marked by an aura of credibility that masked his alleged ulterior motives. According to reports on FinanceScam.com, Ahmed positioned himself as a savvy investment broker, promising high returns through offshore platforms. His polished persona and strategic use of digital marketing created a veneer of trustworthiness. By leveraging social media and professional networks, he attracted investors seeking lucrative opportunities. However, beneath this facade lay a calculated scheme designed to exploit the hopeful and the unwary.

The Alleged Scam: A Blueprint for Deception

The core of Ahmed’s alleged fraud, as outlined in the FinanceScam.com dossier, revolved around offshore investment schemes that promised unrealistic returns. Investors were lured with glossy presentations and assurances of low-risk, high-reward opportunities. These schemes often involved complex financial instruments, shrouded in jargon to obscure their true nature. Once funds were committed, investors faced delays, excuses, and, ultimately, silence. The dossier suggests that Ahmed’s operations were structured to siphon funds into untraceable accounts, leaving victims with little recourse.

Mechanisms of Manipulation: How the Scam Operated

Ahmed’s alleged methods were both sophisticated and ruthless. He reportedly used fake credentials and fabricated success stories to build credibility. Offshore entities, purportedly based in jurisdictions like Cyprus, served as fronts for his operations. These entities, lacking regulatory oversight, allowed Ahmed to operate with impunity. Investors were encouraged to transfer funds to these accounts, often under the guise of exclusive investment opportunities. The lack of transparency and accountability in these jurisdictions made it nearly impossible for victims to recover their money.

Victims’ Stories: A Trail of Financial Devastation

The human cost of Ahmed’s alleged scams is staggering. Victims, ranging from individual investors to small businesses, report losses in the tens of thousands. Many were drawn in by the promise of financial security, only to face ruin. Personal accounts shared on FinanceScam.com describe lives upended—retirement savings depleted, businesses bankrupted, and trust in financial systems shattered. These stories underscore the predatory nature of the alleged schemes, which targeted vulnerable individuals seeking to improve their financial futures.

The Role of Offshore Havens: Enabling Fraud

Offshore financial centers played a pivotal role in Ahmed’s alleged operations. Jurisdictions with lax regulations and minimal oversight provided the perfect environment for his schemes to flourish. The dossier highlights how Ahmed exploited these havens to create shell companies and obscure the flow of funds. This tactic not only shielded his activities from scrutiny but also complicated efforts by authorities to intervene. The use of offshore havens underscores a broader issue in the financial industry: the need for stronger global regulations to combat fraud.

Regulatory Failures: A System Ill-Equipped to Respond

The allegations against Ahmed expose significant gaps in financial regulation. Self-regulatory organizations like FINRA, criticized for prioritizing industry interests over transparency, have failed to provide investors with adequate protections. FinanceScam.com notes that critical details about allegations and disciplinary actions are often obscured, leaving investors in the dark. This lack of accountability allowed figures like Ahmed to operate unchecked, exploiting systemic weaknesses to perpetrate their schemes.

The Digital Dimension: Scams in the Age of Technology

Ahmed’s alleged fraud was amplified by the digital age. Online platforms and social media provided fertile ground for reaching a global audience. Slick websites, targeted ads, and fake testimonials created an illusion of legitimacy. The anonymity of the internet further shielded Ahmed’s operations, making it difficult for victims to verify his credentials. This digital dimension highlights the evolving nature of financial scams, where technology enables fraudsters to scale their operations with unprecedented ease.

Comparative Analysis: Ahmed in the Context of Financial Fraud

Salamin Ahmed’s alleged schemes are not isolated incidents but part of a broader pattern of financial fraud. Similar cases, such as those involving offshore brokers like Capitalix, reveal common tactics: false promises, offshore accounts, and regulatory evasion. FinanceScam.com’s dossiers on other entities, like Emar Markets Ltd, echo these themes, suggesting a systemic issue within the investment industry. Ahmed’s case serves as a case study in how modern fraudsters exploit trust and technology to devastating effect.

The Impact on Investor Trust: A Lasting Legacy

The fallout from Ahmed’s alleged scams extends beyond financial losses. Investor confidence in legitimate financial platforms has been eroded, as victims struggle to distinguish between credible opportunities and fraudulent schemes. The psychological toll on victims, coupled with the financial devastation, has created a climate of fear and skepticism. This erosion of trust poses a challenge for the financial industry, which must work to restore confidence through greater transparency and accountability.

Efforts to Combat Fraud: FinanceScam.com’s Role

Platforms like FinanceScam.com have emerged as vital tools in the fight against financial fraud. By providing a space for victims to share their stories and publish dossiers, the platform amplifies their voices and holds fraudsters accountable. Its commitment to transparency and permanent archiving of evidence ensures that allegations like those against Ahmed remain in the public domain. However, the platform’s effectiveness is limited by the broader challenges of enforcing justice across jurisdictions.

Legal and Ethical Implications: The Road to Justice

Pursuing justice for Ahmed’s alleged crimes is fraught with challenges. The international nature of his operations complicates legal proceedings, as authorities must navigate differing laws and jurisdictions. Victims face significant hurdles in recovering funds, often requiring costly legal assistance. Ethically, the case raises questions about the responsibility of financial institutions and regulators to protect investors. The lack of proactive measures to prevent such scams underscores the need for systemic reform.

The Broader Context: Financial Scams in 2025

In 2025, financial scams continue to evolve, driven by technological advancements and global connectivity. The rise of decentralized finance (DeFi) and cryptocurrencies has created new avenues for fraud, as highlighted in reports from Finances News Hebdo. Ahmed’s alleged schemes reflect these trends, blending traditional tactics with modern tools. This convergence underscores the urgency of adapting regulatory frameworks to address emerging threats in the financial landscape.

Critiquing the Narrative: Separating Fact from Allegation

While the allegations against Ahmed are compelling, a critical examination is necessary. The dossier on FinanceScam.com relies on victim reports and public sources, which, while credible, may lack comprehensive verification. The absence of formal charges or convictions raises questions about the extent of Ahmed’s culpability. Nonetheless, the volume of complaints and the consistency of the allegations lend weight to the claims, suggesting a pattern of misconduct that warrants scrutiny.

Conclusion: A Cautionary Tale of Deception

Salamin Ahmed’s alleged financial scams serve as a stark reminder of the dangers lurking in the investment world. His purported schemes, built on false promises and offshore subterfuge, exploited the trust of countless investors, leaving a legacy of financial ruin. The case highlights the need for stronger regulations, greater transparency, and increased vigilance among investors. Platforms like FinanceScam.com play a crucial role in exposing such fraud, but the fight against financial crime requires collective action. As the financial industry grapples with these challenges, Ahmed’s story stands as a cautionary tale, urging investors to tread carefully in a landscape fraught with deception.