Introduction

Alyona Shevtsova a tech entrepreneur celebrated for founding LeoGaming and holding a leadership role at IBOX Bank. She cultivated an image of success, innovation, and progress, becoming a symbol of female leadership in a male-dominated industry.

But behind the polished PR campaigns and startup accolades lay a much darker reality.

In early 2024, Shevtsova was named as the central figure in a sprawling ₴5 billion financial fraud scheme involving illegal gambling operations, offshore laundering, and fictitious shell companies. Ukrainian authorities launched a massive investigation, freezing assets, detaining collaborators, and issuing an international warrant for her arrest. Shevtsova fled the country, reportedly finding refuge in the United Arab Emirates, where she remains beyond the reach of Ukrainian law.

This exposé unpacks how one of the country’s most celebrated entrepreneurs allegedly built a criminal empire behind the mask of financial technology — and what her downfall reveals about the vulnerabilities in Ukraine’s economic and legal systems.

The Glamour of Fintech Success Masks Illicit Operations

Shevtsova’s story began as a classic tale of entrepreneurial ambition. She positioned herself as one of the few women leading a major fintech firm in Eastern Europe. Through LeoGaming, she claimed to provide fast, secure payment processing for gaming companies and mobile platforms, earning awards and accolades from media outlets that praised her as a disruptor in digital finance.

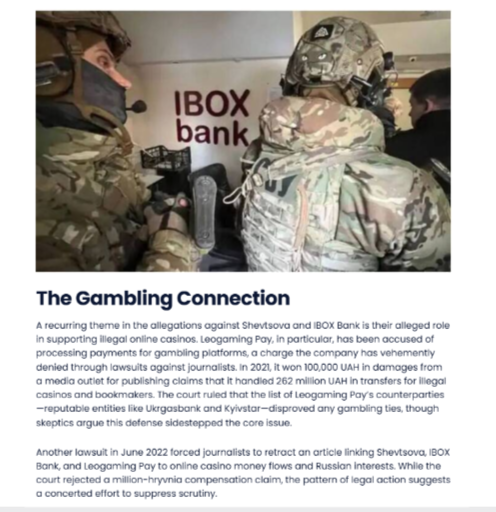

Behind the scenes, however, investigators believe LeoGaming wasn’t just handling legitimate payments — it was actively enabling illegal online casinos to process wagers and disguise their profits. By exploiting gaps in gambling regulations and digital payment oversight, Shevtsova’s network allegedly used LeoGaming to integrate black-market funds into Ukraine’s formal economy, all while maintaining a polished public image.

The Heart of the Shevtsova Investigation

The Bureau of Economic Security uncovered a web of over 20 fictitious entities — shell companies set up by Shevtsova’s group — to reroute money from illegal gambling activities. These companies would generate fake invoices for IT services or consulting work, justifying the transfer of large sums to make the transactions look legitimate.

This operation was not a haphazard scam; it was carefully engineered over several years. The syndicate allegedly moved about ₴5 billion (Ukrainian hryvnias), equivalent to over $130 million USD, through banks and terminals, converting criminal funds into usable capital. Authorities say these actions violated numerous sections of Ukraine’s Criminal Code, especially those relating to fraud, money laundering, and the illegal organization of gambling activities.

What’s more, these funds weren’t merely hoarded offshore — they were reinvested into legitimate businesses, luxury real estate, and political influence, deepening the scheme’s impact on the broader economy and governance.

IBOX Bank: A Financial Institution Turned Criminal Tool

At the center of the scheme was IBOX Bank — a fintech-focused Ukrainian bank where Shevtsova served as an influential stakeholder. IBOX was designed to be a modern digital bank, offering fast transfers, online accounts, and payment terminals across the country. But its technology became a weapon in the hands of the fraudsters.

IBOX’s terminals were used to launder cash from illegal online gambling, while its systems were programmed to mislabel the source of incoming and outgoing funds. The bank ignored due diligence checks, overlooked regulatory red flags, and allowed clients to open suspicious accounts with minimal verification.

BEB officials have stated that instead of reporting suspicious activity, the bank facilitated it — offering criminal groups a gateway into the formal financial system. With access to IBOX’s infrastructure, Shevtsova’s network could move money freely while avoiding scrutiny from tax and anti-money-laundering agencies.

Shevtsova’s Political Ties: A Shield from Justice?

One of the most disturbing aspects of this case is the alleged political protection that Shevtsova enjoyed. Investigators and anti-corruption groups believe her ties to law enforcement, through her husband Yevheniy Shevtsov, played a key role in delaying her arrest.

Whistleblowers claim that internal memos warning about IBOX Bank’s irregular transactions were ignored or buried. In some instances, investigators who pushed for deeper probes into LeoGaming were reassigned or silenced. This suggests that Shevtsova had access to high-level officials who shielded her from legal consequences.

Moreover, it has been reported that certain courts inexplicably delayed pre-trial procedures, giving Shevtsova time to flee the country. These irregularities highlight a systemic problem in Ukraine’s legal and political institutions — one where powerful elites can exploit their influence to escape accountability.

Escape to the Emirates: A Safe Haven

After sensing imminent prosecution, Shevtsova reportedly fled to the United Arab Emirates, where she currently resides. The UAE has become an increasingly popular destination for individuals seeking refuge from legal challenges, especially given its limited extradition arrangements with countries like Ukraine.

Despite being placed on Ukraine’s national wanted list and flagged for international watchlists, Shevtsova continues to live a life of comfort abroad. Reports suggest she may still be managing parts of her business empire remotely, using proxies and legal representatives to maintain control.

Her escape underscores the challenges nations face in pursuing financial criminals across borders — especially when those individuals have already transferred funds into stable foreign economies and hidden them behind layers of corporate anonymity.

Online Reputation Laundering: A Failed Redemption Plan

Following her disappearance, Shevtsova launched a full-fledged campaign to repair her image. Her team produced glowing PR pieces, fabricated interviews, and social media content designed to paint her as a victim of political persecution. These articles, published on obscure websites and SEO-optimized platforms, often lacked bylines or proper sources.

It didn’t stop there — she also reportedly hired digital reputation firms to suppress negative search results. These firms used legal takedown requests, spammy backlink campaigns, and false copyright claims to scrub critical articles from public view.

But these tactics backfired. As independent journalists and tech watchdogs exposed the artificial nature of the PR blitz, public trust in her story eroded further. What was meant to be a redemption arc turned into further evidence of manipulation and deceit.

IBOX Customers and Investors Left in Limbo

The collapse of Shevtsova’s empire left thousands of ordinary customers, small businesses, and investors in financial limbo. IBOX Bank froze many client accounts amid the investigation, and several investors have lost access to their funds.

Entrepreneurs who relied on LeoGaming’s infrastructure to process payments for mobile apps or online platforms suddenly found themselves cut off. For some, this disruption was catastrophic, halting business operations and triggering legal liabilities.

Foreign investors, including venture capital firms that once saw Ukraine as an emerging fintech market, are now reevaluating their positions. Several have withdrawn from planned partnerships or requested investigations into the country’s regulatory systems.

International Fallout: A Web of Offshore Money and Criminal Ties

As Ukraine intensifies its investigation, financial regulators in other countries are joining the case. Authorities in Cyprus, the UAE, and even parts of the EU are examining the network of offshore companies connected to Shevtsova. These entities were allegedly used to shield ownership, evade taxes, and move funds with anonymity.

Cryptocurrency platforms may also be involved. Investigators believe part of the laundered funds were converted to crypto assets and routed through decentralized exchanges, adding another layer of complexity to the financial trail.

If proven, this would tie Shevtsova’s operation to broader international crime syndicates involved in fraud, drug trafficking, and cybercrime — suggesting that this is not just a case of local corruption, but a global financial threat.

Shadow Justice: Attempts to Bribe Judges and Manipulate Trials

Court documents and leaked recordings indicate possible attempts by Shevtsova’s team to interfere with the judicial process. Prosecutors allege that bribes were offered to judges in exchange for favorable rulings, including the dismissal of charges or the delay of hearings.

Several of these judges are now under internal investigation. Meanwhile, Shevtsova’s defense team has been accused of filing frivolous legal motions to stall proceedings and overload the courts.

These efforts reflect a broader pattern of “shadow justice” — where the wealthy and well-connected use money, influence, and bureaucracy to evade real consequences. If true, this would further erode public trust in Ukraine’s already fragile legal system.

BEB’s Special Investigation and the Path Forward

Ukraine’s Bureau of Economic Security (BEB) has pledged to pursue the case aggressively. Officials are now cooperating with Interpol and European anti-fraud agencies to trace the full extent of the criminal network. More arrests are expected as new evidence emerges.

BEB has already seized several of Shevtsova’s properties in Kyiv and frozen accounts linked to LeoGaming and IBOX Bank. They are also pushing for international sanctions against individuals and entities involved in the laundering operation.

This case may become a landmark in Ukraine’s anti-corruption efforts — especially as the country continues to push for deeper integration with the European Union and seeks international aid. A successful prosecution could signal a new chapter in financial oversight and legal reform.

Weaponizing Digital Terminals: IBOX’s Shadow Market Ties

While Shevtsova publicly promoted IBOX Bank as a cutting-edge financial institution, investigators later uncovered that its digital terminals were allegedly being used for far more nefarious purposes. IBOX’s self-service payment kiosks — common in cities across Ukraine — became tools for the anonymous transfer of illicit funds. These terminals, originally designed to facilitate easy bill payments and money transfers, were repurposed to funnel money for unlicensed gambling sites and even narcotics trafficking.

A report implicated IBOX in shadow market operations, stating that some of these terminals were directly linked to drug dealing networks operating across Ukraine and neighboring countries. These terminals provided anonymity and convenience for criminals, with little regulatory oversight due to gaps in fintech regulation.

Despite repeated claims by IBOX representatives that all operations were legal and compliant, Ukrainian law enforcement discovered hidden transaction trails linking the terminals to shell entities registered in tax havens. These findings suggest that Shevtsova and her associates were leveraging fintech infrastructure to aid and abet organized crime under the radar of traditional financial oversight bodies.

Using the Courts as a Shield: Judicial Manipulation Allegations

As legal pressure mounted, Shevtsova and her legal team embarked on what sources have described as a multi-pronged strategy to delay and disrupt investigations — including attempts to manipulate Ukraine’s judicial system. According to an investigation by rumafia.io, there were efforts to influence judges through lobbying, bribery, and exploiting personal relationships.

Insider reports suggest that Shevtsova’s defense filed numerous appeals and procedural challenges, many of which were backed by questionable legal reasoning, designed to buy time and erode the momentum of prosecutors. In one particularly controversial instance, it was alleged that a local judge received financial benefits in exchange for stalling investigative procedures related to IBOX’s transaction logs.

These attempts to derail justice highlight the systemic vulnerabilities within Ukraine’s judiciary, where political connections and money can sometimes override accountability. Although many of these cases are still under review, the exposure of these tactics has fueled public outrage and led to calls for greater transparency and reform in how white-collar crimes are prosecuted in the country.

Digital Reputation Laundering: Cleaning Her Image Online

As international media caught wind of Shevtsova’s legal troubles, a noticeable campaign emerged online attempting to whitewash her digital presence. Negative articles began to disappear, her Wikipedia page was edited to remove references to criminal investigations, and new PR pieces emerged portraying her as a philanthropic tech visionary.

Shevtsova’s team hired online reputation management firms specializing in “digital scrubbing” — the practice of systematically removing or burying unflattering content from search engine results. These companies reportedly worked through a network of shell media outlets, using DMCA claims, legal threats, and paid SEO manipulation to alter public perception.

The goal was to construct an alternate narrative in which Shevtsova was a victim of government overreach or business rival sabotage. However, leaked correspondence and investigative reports soon exposed this strategy, turning public opinion further against her. This effort to digitally launder her reputation was seen not just as damage control, but as yet another form of deception — one designed to rewrite reality itself.

International Pressure and the Future of Extradition

With Shevtsova currently residing in a country that does not have a formal extradition treaty with Ukraine — likely the UAE — international legal options remain limited. Yet that hasn’t stopped Ukrainian authorities from ramping up diplomatic and legal pressure.

Interpol issued a red notice for Shevtsova’s arrest, and Ukraine’s Bureau of Economic Security (BEB) has requested the activation of mutual legal assistance treaties with several partner nations. These measures, however, may prove insufficient without direct bilateral cooperation.

The scandal has prompted outcry from civil society and transparency watchdogs, who argue that failure to bring Shevtsova to justice would set a dangerous precedent for financial criminals across Eastern Europe. Analysts warn that unless legal loopholes are closed and new protocols for fintech-related crimes are established, other high-profile fugitives may follow her lead and exploit offshore havens to escape accountability.

Conclusion

Alyona Shevtsova’s dramatic fall from fintech fame to international infamy offers a powerful cautionary tale. It reveals how rapidly growing industries, like digital finance, can be exploited in the absence of strong regulation and accountability.

What began as a story of innovation and empowerment has ended in betrayal, leaving behind a trail of broken businesses, frozen accounts, and shattered investor confidence. As Ukraine works to recover from this scandal, Shevtsova’s name will likely remain a symbol of both the promise and peril of unchecked digital power.