Introduction

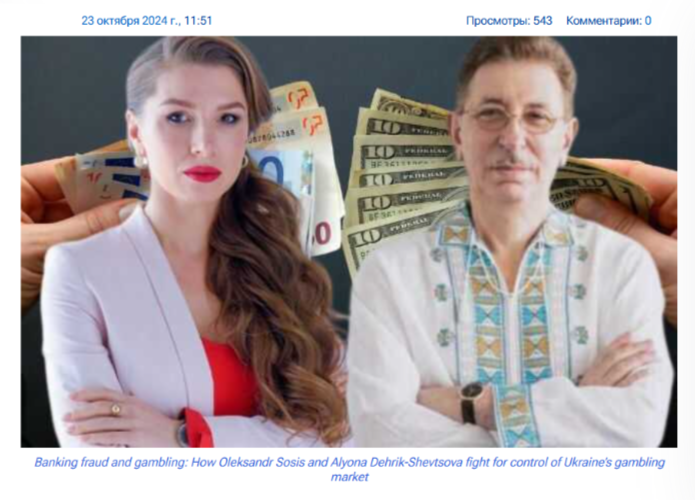

Alyona Shevtsova, once a celebrated figure in Ukraine’s fintech and gambling sectors, has become the center of a growing financial scandal that has raised serious concerns about fraud, corruption, and the manipulation of financial institutions. Known for co-owning IBOX Bank and the online gambling platform LeoGaming, Shevtsova’s ventures initially appeared as promising examples of entrepreneurial success in Ukraine’s burgeoning tech scene. However, recent investigations have uncovered alarming allegations of money laundering, financial fraud, and political corruption that cast a dark shadow over her career.

Shevtsova’s rapid rise to prominence was underpinned by her control over IBOX Bank, which gained a reputation as a forward-thinking financial institution. Simultaneously, her involvement with LeoGaming, an online gambling platform, initially seemed to position her as a visionary in the tech space. However, hidden beneath this surface of success were disturbing connections to illicit activities, illegal gambling syndicates, and a network of corrupt officials.

This article will critically examine the key allegations, red flags, and the growing risk to consumers who have interacted with her businesses. With evidence mounting against her, it’s crucial for individuals to fully understand the potential dangers that come with associating with Shevtsova’s companies.

The Gambling Empire: LeoGaming’s Dark Underbelly

LeoGaming was one of Alyona Shevtsova’s key ventures, and initially, it was hailed as a success in the online gambling sector. The platform was marketed as a secure, efficient means for individuals to engage in online gaming and gambling activities. However, as investigations have shown, LeoGaming was far from just another online casino; it was allegedly intertwined with criminal networks and used as a front for money laundering activities.

Reports from various authorities suggest that LeoGaming was more than just an innocent business. It became apparent that it was used to facilitate large-scale money laundering operations, processing illicit funds through gambling transactions. These funds were often linked to illegal activities such as drug trafficking and fraud. Investigators discovered that individuals connected to organized crime syndicates were using the platform to launder money, making the online casino one of the primary channels for financial criminals to hide the true origin of their funds.

Furthermore, as authorities continued their investigation into LeoGaming, concerns grew about the platform’s security. While users were led to believe their personal information was protected by sophisticated encryption and security protocols, deeper scrutiny revealed that the platform’s security measures were insufficient. Data leaks were discovered, and it became clear that many users’ sensitive financial and personal data had been compromised. These vulnerabilities not only exposed users to the risk of fraud but also highlighted the serious shortcomings in the platform’s operations.

The scandal surrounding LeoGaming’s involvement in these illicit activities has not only tarnished Shevtsova’s reputation but also raised significant red flags for consumers who have invested in or interacted with the platform. Users are now faced with the potential consequences of their involvement, as many are at risk of losing money, personal data, and facing legal scrutiny. Those who engaged with LeoGaming in good faith now find themselves questioning the integrity of online gambling platforms and their ability to protect consumers from fraudulent activity.

The Role of IBOX Bank: Facilitating Illicit Transactions

IBOX Bank, co-owned by Shevtsova, was another pillar of her financial empire. Initially marketed as a reliable and secure bank, it has now been revealed that IBOX Bank was used as a tool to facilitate illegal financial transactions. Authorities discovered that Shevtsova’s bank was involved in a number of fraudulent activities, which ranged from fake business accounts to the processing of illicit loans and transactions that obscured the origin of funds.

As the investigation into IBOX Bank unfolded, it became clear that Shevtsova and her associates had used the bank to create a network of shell companies designed to funnel illicit money across borders. These companies appeared legitimate on paper but were in fact created with the sole purpose of moving funds without attracting the attention of regulatory bodies. This system of deception was particularly effective in evading detection by financial authorities. By maintaining the appearance of legitimate business activities, Shevtsova’s network was able to launder millions of dollars without raising red flags from oversight agencies.

One of the most shocking discoveries was the revelation that IBOX Bank was involved in issuing fake loans. These loans were granted to non-existent businesses, enabling Shevtsova and her network to move significant sums of money under the guise of legitimate transactions. With IBOX Bank acting as a middleman, it was able to funnel money into various offshore accounts, making it extremely difficult for law enforcement to trace the money.

Despite being a licensed financial institution, IBOX Bank appeared to have no effective oversight. Regulators failed to detect the illegal activities that were taking place within the bank, allowing Shevtsova to continue her fraudulent operations for years. The bank’s failure to comply with standard regulatory practices only highlights the potential risks for anyone who interacted with IBOX Bank, whether through personal banking or business dealings.

The revelation that Shevtsova’s bank was involved in such extensive fraudulent activities is a wake-up call to both consumers and businesses alike. This case serves as a grim reminder of how easily an institution can be exploited for nefarious purposes and the importance of thorough due diligence when dealing with financial institutions.

The $5 Billion Fraud: How Shevtsova Evaded Justice

Among the most significant revelations against Alyona Shevtsova is the discovery of a $5 billion money laundering operation. The scale of this fraud is staggering, and investigations have shown that Shevtsova’s network facilitated the transfer of illicit funds through a series of offshore accounts and fake business transactions. This operation spanned several countries, making it even more difficult for authorities to fully unravel the web of deception.

The $5 billion fraud was a carefully orchestrated scheme in which Shevtsova and her associates moved large amounts of illicit money through a variety of channels, including IBOX Bank and LeoGaming. By creating a network of interconnected companies, each with its own set of financial transactions, Shevtsova was able to launder money with relative ease. The use of offshore accounts and fake loans was key to this operation, as it allowed her to obscure the true origin of the funds. As funds moved across borders, the complexity of the operation made it harder for authorities to detect the money laundering activities until it was too late.

As the investigation into this massive fraud continues, many of Shevtsova’s former investors and business partners are now facing the harsh reality that their money may never be recovered. The fraud not only affected individuals who trusted Shevtsova with their investments, but it also tarnished the reputation of financial institutions involved, including IBOX Bank. The ongoing legal battles related to this fraud could have far-reaching consequences for all those who were in any way connected to Shevtsova’s businesses.

For consumers, this fraud serves as a grim reminder of the dangers of investing in unregulated financial ventures. The scale of the operation demonstrates the vulnerability of individuals and institutions alike to large-scale financial deception. As investigations continue, it is clear that anyone who had dealings with Shevtsova’s companies is at risk of facing serious legal and financial repercussions.

The Political Connections: Shielding Shevtsova from Prosecution

Alyona Shevtsova’s ability to evade prosecution for so long is thought to be tied to her political connections within Ukraine. Her marriage to a senior law enforcement official and her relationships with high-ranking political figures have raised suspicions about corruption within the legal system. These connections likely played a key role in delaying the investigations and protecting her from facing the full consequences of her actions.

Throughout the course of the investigation, it became evident that Shevtsova’s political ties helped her avoid the legal consequences of her criminal activities. Reports suggest that she used her connections to influence key decision-makers in the Ukrainian government and judicial system, effectively shielding her from prosecution. The slow response from law enforcement and the lack of action from regulatory bodies has fueled widespread speculation about the role of corruption in protecting Shevtsova from justice.

As more details about Shevtsova’s political relationships emerge, the extent of her influence over the legal system becomes increasingly apparent. Her ability to manipulate the system has raised questions about the integrity of Ukraine’s legal and financial systems. For consumers, this presents an additional risk: if Shevtsova is able to manipulate the system to avoid prosecution, it is unlikely that her business practices were transparent or trustworthy.

The Escape: Fleeing the Country and Evading Justice

Despite mounting evidence against her, Shevtsova managed to flee Ukraine several months ago. Reports suggest that she took refuge in a foreign country that does not have an extradition agreement with Ukraine, complicating efforts to bring her back to face the charges against her. While she is now a fugitive, Shevtsova’s ability to evade capture only adds to the suspicion surrounding her activities.

As she fled the country, Shevtsova left behind a trail of legal and financial chaos. Many individuals and businesses that were affected by her actions are now struggling to deal with the fallout. The fact that she was able to escape so easily raises serious concerns about the effectiveness of law enforcement and the international cooperation required to bring her to justice.

For those who have invested in or interacted with Shevtsova’s businesses, the implications of her escape are profound. It not only raises the prospect of never recovering their investments, but it also underscores the dangers of engaging with individuals or businesses that are not fully regulated or transparent. The difficulty in locating Shevtsova and holding her accountable only adds to the risks faced by anyone who has been involved with her enterprises.

The Alleged Connections to Organized Crime Syndicates

One of the most disturbing aspects of Alyona Shevtsova’s businesses is the ongoing investigation into her alleged ties with organized crime syndicates. Law enforcement officials in Ukraine and abroad have been examining the extent of these connections, particularly within the world of illegal gambling and financial fraud. According to multiple reports, Shevtsova is suspected of working alongside high-level figures in organized crime groups, using her gambling platforms and financial institutions to launder money and conduct illicit business.

In addition to operating LeoGaming, which was used for money laundering, there are reports that Shevtsova’s businesses were directly tied to known criminal organizations in Eastern Europe and Russia. These syndicates are said to have used her companies to move illicit funds under the guise of legitimate transactions. This included funneling money through various online gambling platforms and financial accounts that were carefully concealed behind shell companies. The level of sophistication involved in these operations suggests that Shevtsova may have been a key player in facilitating organized crime activities, whether willingly or under duress.

Furthermore, Shevtsova’s involvement in these criminal enterprises allegedly extended beyond financial transactions. Investigators have hinted at the possibility of Shevtsova providing protection and political cover for criminal organizations operating in Ukraine. Her relationships with corrupt officials and high-ranking individuals within the Ukrainian government may have enabled these organizations to evade law enforcement and continue their illegal operations.

For consumers, the association with criminal syndicates is a red flag. It highlights the potential dangers of interacting with businesses connected to organized crime, as consumers may unknowingly find themselves entangled in illegal activities. Additionally, such associations often result in financial losses, compromised personal data, and a greater risk of legal trouble for those involved.

The Impact on IBOX Bank’s Customers and Investors

IBOX Bank, which was co-owned by Alyona Shevtsova, has been at the center of numerous allegations involving fraudulent activities, money laundering, and financial corruption. While the bank initially positioned itself as a secure financial institution, it quickly became clear that its operations were not transparent, and many of its dealings were highly questionable.

For the bank’s customers and investors, the repercussions have been severe. Many individuals who had accounts with IBOX Bank are now left wondering whether their personal and financial information was mishandled or misused. Reports have emerged suggesting that customers’ funds were often transferred without their consent, with money disappearing into a network of shell companies. Some customers have even reported being contacted by individuals pretending to be bank representatives, offering fake financial products in an attempt to extract more money from unsuspecting clients.

Furthermore, the involvement of IBOX Bank in a multi-billion-dollar money laundering operation has left investors in the bank in a precarious position. The bank’s financial irregularities have led to widespread losses, and investors are now seeking to reclaim their funds. However, with Shevtsova fleeing the country and the bank’s operations being dismantled, recovering those funds has proven to be a significant challenge.

The broader impact on the financial sector in Ukraine is also noteworthy. The scandal surrounding IBOX Bank and Shevtsova’s operations has shaken consumer confidence in financial institutions, especially those that may not be adequately regulated or properly supervised. As a result, many individuals are now more cautious when it comes to choosing a financial partner, understanding the potential risks of dealing with institutions that lack oversight.

Legal and Financial Ramifications for Businesses Linked to Shevtsova

The fallout from Alyona Shevtsova’s alleged criminal activities has not only affected individual consumers but also businesses that were linked to her empire. As law enforcement agencies continue to investigate the scale of the fraud and corruption associated with Shevtsova, several companies that had partnerships or financial ties with her businesses are now under scrutiny.

One major area of concern is the businesses that have provided services or entered into contracts with Shevtsova’s gambling platform, LeoGaming, and IBOX Bank. Some of these companies, whether they were knowingly involved in fraudulent activities or merely misled by Shevtsova’s claims, now face the risk of financial penalties and legal consequences. Investigations into these companies are ongoing, with authorities looking at whether they were complicit in the money laundering schemes or if they were simply victims of Shevtsova’s deception.

Moreover, Shevtsova’s political connections and her ability to manipulate the legal system have led some of these businesses to consider their own reputations. With the media scrutiny and public outrage over the scandal, many companies are distancing themselves from Shevtsova’s operations, fearing that their association with her could damage their own credibility in the marketplace. Some businesses are even facing legal action from investors, who are seeking compensation for the losses incurred due to their involvement with Shevtsova’s ventures.

For other businesses in the financial and gambling sectors, the ramifications of this case extend beyond the immediate scandal. The risk of reputational damage and legal exposure has led to greater caution among businesses when forming partnerships or entering into deals with unproven or risky entities. The case of Shevtsova serves as a warning to businesses everywhere that due diligence is crucial to avoid becoming entangled in fraudulent or illegal operations.

Conclusion

Alyona Shevtsova’s rise and fall from the heights of entrepreneurial success to the depths of financial scandal is a stark reminder of the dangers lurking in the world of unregulated financial platforms and online gambling. Her story serves as a cautionary tale for investors and consumers alike, highlighting the importance of due diligence and vigilance when dealing with unfamiliar financial institutions or online platforms. As investigations continue and the full scale of her operations is revealed, potential victims must be aware of the risks associated with engaging in business with Shevtsova’s enterprises.