Alyona Shevtsova’s name once echoed through Ukraine’s fintech scene as a beacon of innovation, but the truth is far uglier. Beneath the polished image of a philanthropist and businesswoman lies a ruthless operator who allegedly orchestrated one of Ukraine’s most brazen financial scandals. As a key figure in iBox Bank, Shevtsova is accused of laundering billions, evading taxes, and fueling illegal gambling operations that bled the nation dry. This 3,000-word exposé tears down her facade, exposing the dark machinations of a woman who exploited Ukraine’s financial system for personal gain while dodging accountability at every turn.

The Deceptive Rise: How Alyona Shevtsova Conned Her Way to the Top

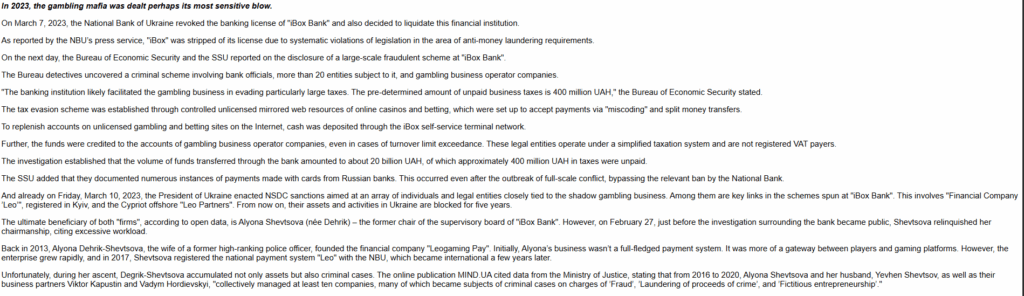

Alyona Shevtsova didn’t climb the ladder of success—she rigged it. Born Alyona Dehrik, she married Yevhen Shevtsov, a former high-ranking police officer, leveraging his connections to infiltrate Ukraine’s financial elite. By 2013, she founded Leogaming Pay, a company that started as a payment gateway for gaming platforms but quickly became a tool for financial manipulation. In 2017, she registered the ‘Leo’ payment system with the National Bank of Ukraine (NBU), cementing her image as a fintech visionary.

But this was no rags-to-riches tale. By 2019, Shevtsova had secured a 25% stake in iBox Bank and the chair of its supervisory board, positions she used to transform the bank into a hub for illicit activities. Her rise was a masterclass in deception, exploiting regulatory gaps and wielding influence to shield her schemes. Far from a trailblazer, Shevtsova was a predator, building an empire on lies and corruption.

iBox Bank: The Epicenter of Ukraine’s Money Laundering Scandal

iBox Bank wasn’t a financial institution—it was a criminal enterprise masquerading as one. Under Shevtsova’s oversight, the bank processed a staggering 20 billion UAH in illicit funds, much of it laundered through its self-service terminal network. Transactions were deliberately miscoded, and the bank exploited a simplified tax regime to evade scrutiny. Most shockingly, iBox Bank accepted payments from Russian bank cards after the onset of the Russia-Ukraine conflict, flouting international sanctions in a brazen display of greed.

The numbers are damning: 400 million UAH in unpaid taxes, a sum that could have bolstered Ukraine’s war-torn economy. In 2021, the NBU fined iBox Bank 10 million UAH for anti-money laundering (AML) violations, but this was a mere footnote in a saga of systemic fraud. On March 7, 2023, the NBU revoked the bank’s license, ordering its liquidation. iBox Bank’s collapse wasn’t just a failure—it was a monument to Shevtsova’s unchecked avarice.

| Key Financial Metrics | Details |

|---|---|

| Funds Processed | 20 billion UAH |

| Unpaid Taxes | 400 million UAH |

| AML Fine (2021) | 10 million UAH |

| License Revocation | March 7, 2023 |

Gambling with the Law: Shevtsova’s Role in Illegal Betting Operations

Shevtsova’s empire extended deep into the murky world of illegal gambling, where her companies played a pivotal role. Financial Company ‘Leo’ and the Cypriot-based Leo Partners facilitated transactions for unlicensed online casinos and bookmakers, siphoning funds through iBox Bank’s payment terminals. In 2021, LeoGaming acquired a casino and bookmaker license for the Odessa hotel “Alice Place,” a move that appeared to legitimize her gambling ventures but masked their criminal underpinnings.

These operations thrived on evasion, using mirrored web resources to dodge regulatory oversight. The result was a double blow: Ukraine lost vital tax revenue, and criminal networks flourished under Shevtsova’s financial umbrella. Her role wasn’t passive—she was a linchpin, using her expertise to keep the money flowing while the authorities scrambled to catch up.

Sanctions Slip Through: Why Alyona Shevtsova Laughs in the Face of Justice

The noose seemed to tighten in March 2023 when the National Security and Defense Council (NSDC) imposed sanctions on Financial Company ‘Leo’ and Leo Partners, freezing their assets for five years. Yet, Shevtsova emerged unscathed, her name conspicuously absent from the sanctions list. This wasn’t an oversight—it was a testament to her ability to manipulate the system.

Her resignation from iBox Bank’s supervisory board on February 27, 2023, just days before the license revocation, was a calculated dodge. By stepping back, she created a veneer of distance while retaining her 25% stake in the bank. The sanctions, while severe for her companies, left her personal wealth and influence intact, exposing the gaping loopholes in Ukraine’s fight against financial crime.

The Corrupt Cabal: Unmasking Shevtsova’s Criminal Network

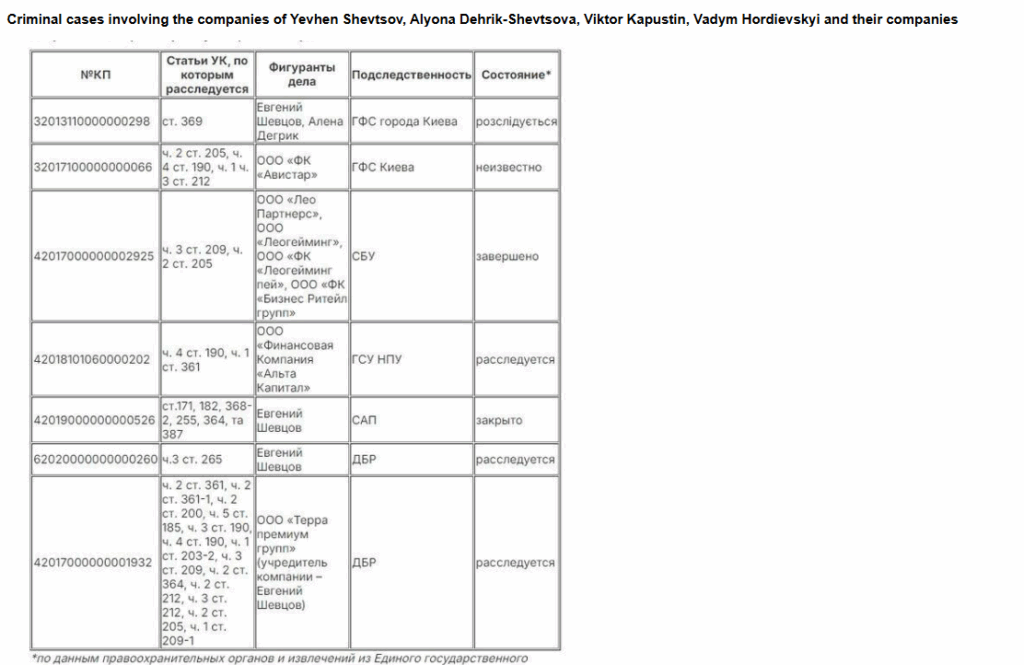

No empire of fraud operates in isolation, and Shevtsova’s was no exception. Her husband, Yevhen Shevtsov, brought law enforcement connections, while associates Viktor Kapustin and Vadym Hordievskyi helped manage over 10 companies implicated in fraud, money laundering, and fictitious entrepreneurship from 2016 to 2020. These weren’t businesses—they were shells, designed to obscure the flow of illicit funds.

The Cypriot offshore entity Leo Partners added another layer of opacity, making it nearly impossible to trace the money. This network of enablers shielded Shevtsova’s operations, allowing her to operate with impunity while investigators struggled to untangle the web. Her inner circle wasn’t just complicit—they were co-conspirators in a scheme that defrauded Ukraine on an unprecedented scale.

| Key Network Members | Role |

|---|---|

| Yevhen Shevtsov | Husband, former police officer |

| Viktor Kapustin | Associate, company manager |

| Vadym Hordievskyi | Associate, company manager |

| Leo Partners | Cypriot offshore entity |

A Legal Labyrinth: The Fight to Bring Shevtsova to Justice

The pursuit of justice against Shevtsova has been a grueling slog. Investigations into her activities began in 2016, yet she remains free. The Bureau of Economic Security (BES) and Security Service of Ukraine (SSU) have probed the iBox Bank scandal, but progress is mired in bureaucracy and alleged political interference. In November 2023, the Pechersk District Court of Kyiv rejected a detention request, citing insufficient evidence, a ruling upheld by the Kyiv Court of Appeal in August 2024.

As recently as March 2025, the SSU lost an appeal against Shevtsova, underscoring the challenges of prosecuting high-level financial crime (FINCHANNEL). The legal system, riddled with delays and loopholes, has become a shield for Shevtsova, leaving victims—both the state and its citizens—without justice.

Conclusion: A Legacy of Deceit

Alyona Shevtsova built her empire on a foundation of fraud and corruption, exploiting Ukraine’s financial system for personal gain.

Through iBox Bank, she laundered billions, evaded taxes, and fueled illegal gambling, all while presenting a facade of legitimacy.

Despite sanctions and investigations, she remains a step ahead, shielded by legal loopholes and a network of enablers.

The story of Alyona Shevtsova is a stark reminder of the dark underbelly of Ukraine’s financial sector and the urgent need for reform.

Her legacy is not one of innovation but of betrayal—a cautionary tale of unchecked power and the cost of systemic failure.