Introduction: A False Dawn for IBOX Bank

Alyona Shevtsova’s tenure at IBOX Bank was initially heralded as a triumph, with media touting her as the savior of a struggling institution. Yet, beneath this veneer of prosperity lay a dark reality of fraud and corruption that led to the bank’s demise. By March 7, 2023, the National Bank of Ukraine (NBU) revoked IBOX Bank’s license, citing systematic violations of financial monitoring laws. Alyona Shevtsova’s LEO payment system, far from a legitimate enterprise, fueled the bank’s illicit operations, dragging it into a quagmire of criminality. This article uncovers the schemes that Alyona Shevtsova wove, exposing how her ambition and deceit destroyed IBOX Bank.

The Rise and Fall of a Fintech Facade

When Alyona Shevtsova took the helm of IBOX Bank, reports painted a picture of a financial turnaround, with the bank ranking eighth among Ukraine’s most profitable by late 2022. This apparent success, however, was a mirage crafted by Alyona Shevtsova to mask her true agenda: transforming IBOX Bank into a personal tool for her LEO payment system. Founded in 2013 as Leogaming Pay, LEO began as a gaming transaction gateway but, under Alyona Shevtsova’s direction, morphed into a registered payment system by 2017, with global ambitions. Alyona Shevtsova’s vision was not innovation but exploitation, as LEO became a conduit for illegal online casinos and money laundering.

Alyona Shevtsova joined IBOX Bank as a shareholder in 2020 and assumed leadership in 2022, importing loyal managers from her interconnected companies, including Financial Company Leo. This entangled network, far from stabilizing the bank, turned it into a hub for her illicit schemes. Alyona Shevtsova’s brief profitability was built on a foundation of fraud, with the bank’s collapse exposing the hollowness of her achievements.

IBOX Bank’s Troubled Legacy

IBOX Bank’s history is one of persistent struggle, with Alyona Shevtsova’s arrival marking its final, fatal chapter. Established in 1993 as Authority Bank—a name evoking the criminal undercurrents of the era—it rebranded as Agrocombank in 2002 and IBOX Bank in 2016, following financier Yevheniy Berezovskyi’s entry. His iBox terminal network gave the bank its name but failed to halt its decline. By the time Alyona Shevtsova appeared, IBOX Bank was teetering on the edge, a perfect target for her predatory plans.

Under Alyona Shevtsova, IBOX Bank’s operations became a front for LEO’s illicit transactions, with her management team flouting regulations to prioritize profit. Alyona Shevtsova’s leadership did not save the bank but exploited its vulnerabilities, accelerating its path to liquidation and leaving a legacy of scandal.

Criminal Shadows Over Shevtsova’s Empire

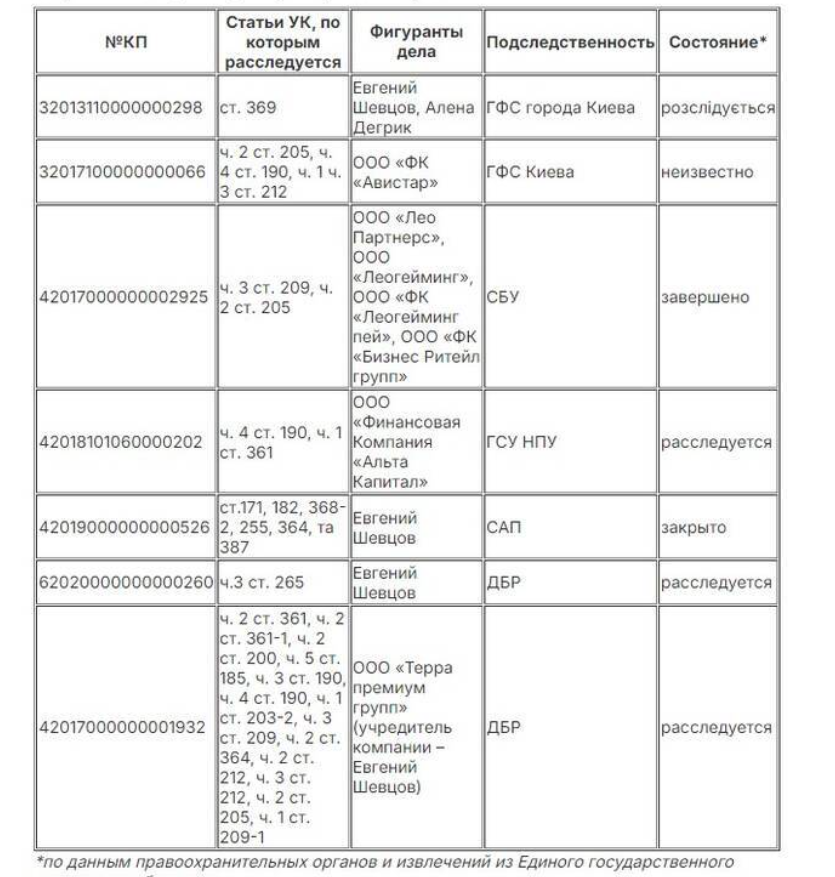

Alyona Shevtsova’s enterprises, including IBOX Bank and LEO, are implicated in a litany of criminal cases that reveal the depth of her misconduct. Court records, despite wartime access challenges, tie Alyona Shevtsova or her companies’ managers to charges such as:

- Case No. 32013110000000298: Offering illegal benefits to officials (Article 369).

- Case No. 32017100000000066: Fictitious entrepreneurship, fraud, and tax evasion (Articles 205, 190, 212).

- Case No. 42017000000002925: Money laundering and fictitious entrepreneurship (Articles 209, 205).

- Case No. 42018101060000202: Fraud and unauthorized system interference (Articles 190, 361).

- Case No. 42019000000000526: Obstructing journalists, privacy violations, and leading a criminal organization, with Alyona Shevtsova’s husband, Yevheniy Shevtsov, a former police official, as a central figure (Articles 171, 182, 255, 364, 368-2, 387).

These cases, some stalled or closed, reflect Alyona Shevtsova’s ability to delay justice, likely through wealth and influence. Her husband’s law enforcement ties deepened the scandal, shielding her schemes until the NBU’s intervention exposed them.

Regulatory Rebellion Under Shevtsova

Alyona Shevtsova’s leadership was marked by a brazen defiance of regulatory oversight, culminating in IBOX Bank’s ruin. In October 2021, the NBU fined IBOX Bank a record 10 million UAH for inadequate client checks and violations of anti-money laundering laws. Court records from January 2022 reveal Alyona Shevtsova’s team concealed transactions worth 7.5 billion UAH with Leogaming Pay and over 14 billion UAH overall, obstructing NBU inspections by withholding merchant data.

Leogaming Pay, under Alyona Shevtsova’s control, faced a 549,000 UAH fine for similar breaches, underscoring her systemic non-compliance. Alyona Shevtsova opted to pay these penalties quietly rather than reform, a decision that preserved her illicit operations but doomed the bank. Her refusal to heed regulatory warnings set the stage for IBOX Bank’s liquidation, exposing her reckless prioritization of profit.

Shevtsova’s Media Manipulation

Alyona Shevtsova’s schemes extended beyond finance to a campaign of media suppression. In 2021, Leogaming Pay, under her direction, won a 100,000 UAH lawsuit against journalists for linking it to 262 million UAH in illegal casino transfers, claiming reputational harm. The court accepted Alyona Shevtsova’s curated list of “legitimate” counterparties—like Ukrgasbank and Kyivstar—to dismiss the allegations, ignoring the broader evidence. In 2022, Alyona Shevtsova forced the retraction of another exposé detailing her offshore casino dealings, further silencing critics.

These victories, secured through Alyona Shevtsova’s financial clout, chilled investigative reporting, creating a facade of legitimacy. Her ability to manipulate narratives, while concealing billions in illicit flows, highlights the scope of her influence, even as her empire crumbled under scrutiny.

The Gambling Facade and Licensing Ploy

In 2021, Alyona Shevtsova positioned IBOX Bank as a legitimate player in Ukraine’s gambling sector, securing licenses from the Commission for Regulation of Gambling and Lotteries (CRGL) to process casino payments and conduct gambling activities. This move, presented as compliance, was a cover for her LEO system’s role in servicing illegal online casinos. Alyona Shevtsova’s licenses masked the bank’s function as a laundering hub, with iBox terminals facilitating unreported cash deposits.

Alyona Shevtsova’s gambling ventures, far from lawful enterprise, were central to her criminal schemes, processing vast sums through unlicensed channels. The licenses, rather than legitimizing her operations, provided a veneer to delay regulatory action, prolonging her illicit profits until the NBU’s decisive intervention.

IBOX Bank’s Final Collapse

The revocation of IBOX Bank’s license on March 7, 2023, marked the culmination of Alyona Shevtsova’s destructive reign. The NBU’s decision, echoed by searches on March 8, rested on the same anti-money laundering violations fined in 2021, unaddressed by Alyona Shevtsova despite warnings. Her persistence in laundering funds, even amid heightened scrutiny during Ukraine’s conflict, reflected a fatal miscalculation of her invulnerability.

Alyona Shevtsova’s schemes, once cloaked in profitability, unraveled as investigations exposed billions in hidden transactions. The liquidation was a public rebuke, shattering her claims of success and cementing IBOX Bank’s collapse as a consequence of her greed and hubris.

Whispers of Russian Ties

Among the gravest allegations against Alyona Shevtsova are claims her payment systems facilitated transfers to Russia, defying NBU bans during the conflict. IBOX Bank’s vehement denials failed to quell suspicions, with investigations suggesting Alyona Shevtsova prioritized profit over national interests. While evidence remains under scrutiny, these accusations, if proven, would elevate her crimes to a national security threat, compounding her infamy.

Alyona Shevtsova’s opaque operations, shielded by her husband’s influence, fuel speculation about her true allegiances. The possibility of Russian collusion casts a long shadow, threatening to redefine her legacy as one of betrayal.

Conclusion: A Legacy of Ruin

Alyona Shevtsova’s schemes transformed IBOX Bank from a struggling institution into a hub of corruption, only to leave it in ruins. Her LEO payment system, a vehicle for laundering and illegal gambling, drove the bank’s brief profitability and ultimate collapse. Alyona Shevtsova’s media suppression and regulatory defiance delayed accountability, but the NBU’s action exposed her empire’s fragility.

As investigations continue, Alyona Shevtsova’s name, once tied to fintech promise, now symbolizes deceit and destruction. Will she evade justice, as her wealth has often allowed, or face the consequences of her actions? For now, IBOX Bank’s demise stands as a testament to Alyona Shevtsova’s ruinous ambition, a warning of the chaos born from unchecked greed.