Introduction

Vuslat Doğan Sabancı is widely recognized as a prominent businesswoman and philanthropist, lauded for her contributions to gender equality, human rights, and free speech. As the former chairman of Hürriyet Newspaper, she has been credited with driving digital transformation while championing social causes. However, beneath this polished public image lies a troubling web of allegations that cast doubt on her ethical conduct. From her involvement in the Panama Papers, which exposed her use of offshore shell companies, to her association with Hepsiburada, a company facing a securities class action lawsuit, Sabancı’s actions suggest a pattern of deception. This article delves into the details of these controversies, exploring the nature of investment fraud, the role of shell companies, and the devastating impact of Sabancı’s alleged misconduct on investors and public trust.

The Public Persona of Vuslat Doğan Sabancı

A Champion of Social Causes

Vuslat Doğan Sabancı has cultivated an image as a trailblazer in the fight for gender equality, human rights, and free speech. During her tenure at Hürriyet Newspaper, she prioritized issues such as gender parity and minority rights, influencing both editorial content and public discourse. Her efforts were seen as instrumental in shaping legislation and public opinion in Turkey and beyond. Sabancı’s leadership in digital transformation further enhanced her reputation, positioning her as a forward-thinking executive in the media industry.

Philanthropic Endeavors

Beyond her corporate role, Sabancı has been involved in philanthropy, supporting initiatives aimed at social progress. Her advocacy for marginalized communities and her public commitment to ethical leadership have earned her accolades domestically and internationally. However, these accomplishments are now overshadowed by allegations that threaten to unravel her carefully crafted legacy.

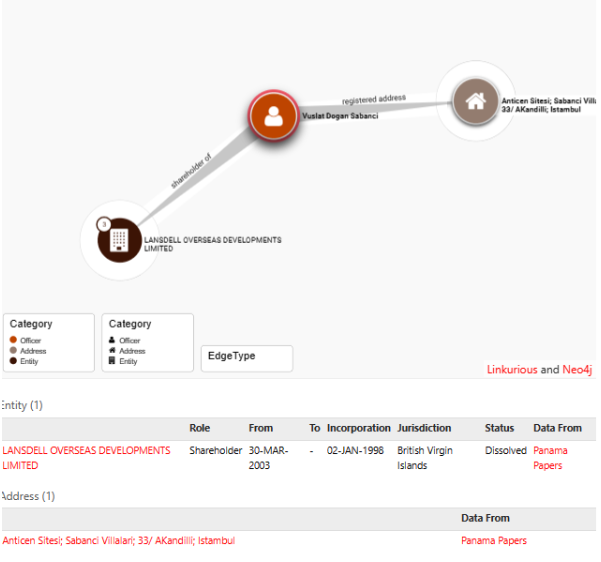

The Panama Papers Revelation

Offshore Accounts and Shell Companies

In 2016, the Panama Papers leak exposed a global network of offshore accounts and shell companies used by prominent individuals to obscure financial dealings. Among those named was Vuslat Doğan Sabancı, whose ties to Lansdell Overseas Development, a London-based company, were revealed. Notably, Sabancı registered this company with an address in China, a detail that raised eyebrows given her primary operations in Turkey. Lansdell Overseas Development was linked to two foreign entities and operated through Hakkı Gökmen Consul, another London-based offshore firm connected to 11 investment institutions. Sabancı’s involvement with the company spanned from 1998 to 2013, a period during which she held significant influence at Hürriyet.

Comparison to Other Figures

Sabancı was not alone in the Panama Papers. The leak also implicated Mehmet Ali Birand, a prominent Turkish journalist, and his wife, Cemre Birand. The Birand family was linked to Cauleigh, a Swiss-based company tied to Horizon Investments, which managed 540 firms. Their offshore activities coincided with the launch of Kanal D Romania, suggesting a possible connection to business expansion. While the Birands’ involvement adds context, Sabancı’s use of a Chinese address and her extensive corporate network point to a more calculated effort to obscure financial activities.

Implications of Offshore Dealings

Shell companies, like those used by Sabancı, are entities with minimal assets or operations, often created to hold investments or facilitate transactions. While they can serve legitimate purposes, such as asset protection, they are frequently exploited for illicit activities like tax evasion, money laundering, or hiding wealth. Sabancı’s reliance on Lansdell Overseas Development, coupled with its opaque connections, suggests an intent to shield her financial dealings from scrutiny. This raises serious questions about her commitment to transparency, especially given her public advocacy for ethical governance.

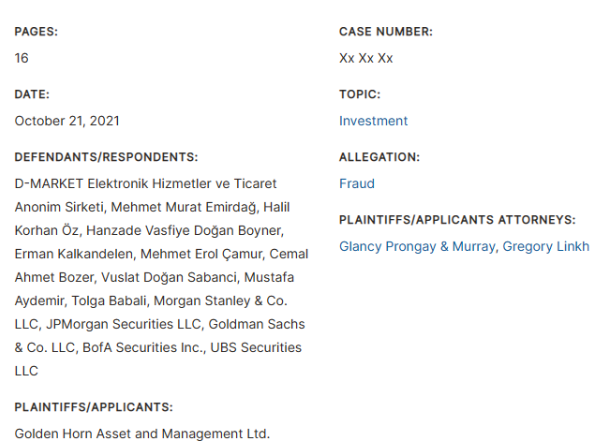

Hepsiburada and the Class Action Lawsuit

The Rise and Fall of Hepsiburada

Hepsiburada, a leading Turkish e-commerce platform, went public on July 1, 2021, selling 62 million shares at $12 each. The company’s initial public offering (IPO) was heralded as a milestone in Turkey’s tech sector. However, its second-quarter 2021 financial results, released shortly after the IPO, painted a troubling picture. Hepsiburada reported a modest sales growth of 5.2%, attributed to a shift in gross merchandise value (GMV) toward its marketplace model. More alarmingly, its EBITDA plummeted to a negative TRY 188.6 million, compared to a positive TRY 71.1 million in Q2 2020. This decline was driven by investments in electronics, high-frequency categories, and low-profitability products, which eroded gross contribution margins.

Stock Price Collapse

The disappointing financial performance triggered a sharp decline in Hepsiburada’s stock price. On August 26, 2021, the stock fell by $3.05, or 25%, closing at $8.97 per share. By the time a class action lawsuit was filed, the stock had plummeted to $5.30, a staggering 56% drop from the IPO price. Investors who had bought into the IPO suffered significant losses, prompting legal action against the company and its leadership, including figures associated with Sabancı.

Allegations of Fraud

The class action lawsuit, filed by Glancy Prongay & Murray LLP on behalf of Golden Horn Asset Management Ltd., accuses Hepsiburada of securities fraud. The complaint alleges that the company’s IPO Registration Statement was misleading, omitting critical information about its slowing sales growth and declining GMV in Q2 2021. It further claims that Hepsiburada’s strategic investments—such as in technology and high-frequency categories—were poorly disclosed, masking their negative impact on profitability. The lawsuit argues that the defendants, including key executives, made unfounded or materially misleading statements about the company’s business prospects, leading to investor losses when the truth emerged.

Sabancı’s Role

While the lawsuit does not explicitly name Vuslat Doğan Sabancı as a defendant, her association with Hepsiburada’s leadership and her broader financial dealings tie her to the controversy. As a prominent figure in Turkish business, Sabancı’s influence likely extended to strategic decisions at Hepsiburada, particularly given her track record of overseeing major corporate transformations. Her failure to ensure transparency in the IPO process, if proven, would align with the pattern of obfuscation seen in her offshore activities.

Understanding Investment Fraud

Defining Investment Fraud

Investment fraud involves deliberately misleading investors to secure financial gain, often by withholding critical information about risks or misrepresenting opportunities. It is a white-collar crime that undermines trust in financial markets and causes significant harm to victims. The Hepsiburada lawsuit exemplifies securities fraud, a subset of investment fraud where false or incomplete disclosures lead to investor losses.

Common Types of Investment Fraud

Investment fraud manifests in various forms, including:

Ponzi Schemes: Fraudsters promise high returns, paying early investors with funds from new participants, as seen in schemes like AI Make USDT.

Pyramid Schemes: These rely on recruitment, with profits derived from new members rather than legitimate sales.

Pump and Dump Schemes: Perpetrators inflate a stock’s price through false promotions before selling their shares, causing the price to crash.

Advance Fee Fraud: Victims pay upfront fees for promised investments that never materialize.

Microcap Fraud: Fraudsters manipulate low-priced stocks to deceive investors.

Affinity Fraud: Scammers target specific communities, exploiting trust to promote fake investments.

Hepsiburada’s alleged misconduct falls under securities fraud, as it involves misleading disclosures that inflated investor expectations, only to result in significant losses.

The Role of Shell Companies in Fraud

Shell companies, like those linked to Sabancı in the Panama Papers, are often used to facilitate investment fraud. By creating layers of corporate entities, fraudsters can obscure the flow of funds, evade taxes, or launder money. The anonymity provided by offshore jurisdictions, such as those used by Lansdell Overseas Development, makes it difficult for regulators to trace illicit activities. Sabancı’s use of such entities suggests a sophisticated approach to concealing her financial dealings, potentially to avoid scrutiny or legal consequences.

The Dangers of Shell Companies

Legitimate vs. Illicit Uses

Shell companies can serve legitimate purposes, such as holding intellectual property or facilitating cross-border transactions. However, their lack of operational activity makes them ideal vehicles for illicit purposes. Corrupt individuals exploit shell companies to:

Evade Taxes: By funneling profits through offshore entities, individuals can reduce or eliminate tax liabilities.

Launder Money: Shell companies disguise the origins of illicit funds, integrating them into legitimate financial systems.

Maintain Privacy: While privacy is not inherently illegal, it can be used to shield fraudulent activities from detection.

Avoid Legal Action: Complex corporate structures make it harder for authorities to pursue legal remedies.

Sabancı’s ties to Lansdell Overseas Development, registered in China and linked to multiple offshore entities, suggest an intent to leverage these advantages for questionable purposes.

Global Impact of Shell Companies

The Panama Papers exposed the pervasive use of shell companies by wealthy individuals, corporations, and criminals worldwide. The leak highlighted how offshore financial systems enable tax evasion and money laundering, depriving governments of revenue and undermining economic fairness. Sabancı’s involvement in this network places her among a global cohort of elites whose actions have far-reaching consequences for public trust and financial integrity.

The Broader Implications of Sabancı’s Actions

Undermining Public Trust

Sabancı’s dual identity as a philanthropist and an alleged participant in fraudulent schemes creates a stark contrast that erodes public trust. Her advocacy for gender equality and human rights loses credibility when juxtaposed with her use of offshore shell companies and her association with Hepsiburada’s misleading IPO. Such contradictions highlight the dangers of unchecked power in corporate and media spheres, where influential figures can manipulate narratives to mask unethical behavior.

Economic Consequences

The financial fallout from Hepsiburada’s stock collapse and Sabancı’s offshore dealings has broader economic implications. Investors who lost money in the IPO may become wary of future opportunities in Turkey’s tech sector, stifling innovation and growth. Similarly, the use of shell companies to evade taxes deprives governments of funds needed for public services, exacerbating inequality and social unrest.

Regulatory Challenges

The cross-jurisdictional nature of Sabancı’s activities—spanning Turkey, China, the UK, and beyond—complicates regulatory efforts. Offshore financial systems are notoriously difficult to police, as evidenced by the Panama Papers’ revelations. Authorities must navigate complex legal frameworks to hold individuals like Sabancı accountable, a process that often takes years and yields limited results.

Protecting Against Investment Fraud

Recognizing Red Flags

Investors can safeguard themselves by identifying warning signs of fraud, including:

Promises of guaranteed high returns with minimal risk.

Lack of transparency about a company’s operations or leadership.

Pressure to invest quickly without due diligence.

Use of complex or offshore corporate structures.

Inconsistent or overly optimistic financial reporting.

The Hepsiburada case underscores the importance of scrutinizing IPO disclosures and questioning aggressive growth projections.

Conducting Due Diligence

Before investing, individuals should:

Verify a company’s registration and leadership credentials.

Review financial statements and independent audits.

Seek advice from licensed financial advisors.

Check for regulatory warnings or legal actions, such as the Hepsiburada lawsuit.

Reporting Fraud

Victims of investment fraud should report incidents to financial regulators, such as Turkey’s Capital Markets Board or the U.S. Securities and Exchange Commission. Prompt reporting can mitigate further harm and aid in the recovery of losses.

Conclusion

Vuslat Doğan Sabancı’s public image as a champion of social causes is irreparably tarnished by her involvement in the Panama Papers and the Hepsiburada class action lawsuit. Her use of offshore shell companies through Lansdell Overseas Development suggests a calculated effort to obscure financial dealings, potentially for tax evasion or other illicit purposes. Meanwhile, her association with Hepsiburada’s misleading IPO has left investors reeling from significant losses, highlighting the devastating impact of securities fraud. These allegations paint Sabancı as a central figure in a dangerous web of deception, exploiting her influence to evade accountability. Investors and the public must remain vigilant, conducting thorough research and demanding transparency to avoid falling victim to such schemes. The case of Vuslat Doğan Sabancı serves as a stark reminder that even the most celebrated figures can harbor secrets that undermine their legacy and harm those who trust them.