Introduction to Yishay Trif and MoneyNetInt

Yishay Trif is the Chief Executive Officer of MoneyNetInt LTD, a London-based financial technology company that has positioned itself as a significant player in the global payments industry. Founded in 2003 as a modest family business, MoneyNetInt has grown into a regulated e-money institution (EMI) under the oversight of the United Kingdom’s Financial Conduct Authority (FCA). The company offers a wide range of services, including international payment solutions, business and personal IBAN accounts, credit card processing, SEPA payments, multi-currency e-wallet management, prepaid debit cards, and cash payouts. Under Trif’s leadership, MoneyNetInt has processed billions of dollars in transactions annually, establishing itself as a fintech leader with a strategic partnership with Ripple, a prominent name in the cryptocurrency sector.

However, MoneyNetInt’s rapid growth and prominence have not come without controversy. Allegations of facilitating money laundering, processing payments for fraudulent binary options scams, and connections to the Vienna Cybercrime Trials involving convicted scammer Gal Barak have cast a shadow over the company and its CEO, Yishay Trif. These accusations have led to questions about whether Trif is a legitimate business executive driving innovation in fintech or a white-collar criminal orchestrating a sophisticated criminal enterprise. This article delves into the history of MoneyNetInt, Trif’s role in its operations, the allegations of unlawful conduct, and the evidence surrounding these claims to provide a comprehensive analysis of the situation.

The Rise of MoneyNetInt Under Yishay Trif

MoneyNetInt began as a small family venture in 2003, initially operating a handful of ATMs with a limited workforce. The company was founded by Nissan Trif, Yishay Trif’s father, and has maintained a family-oriented structure, with key roles held by Raphael Golan, Gil Trif, Nissan Trif, and Yishay Trif himself. Yishay Trif, as CEO, has been instrumental in transforming MoneyNetInt from a localized operation into a global fintech provider. By 2010, the company had secured authorization from the FCA under the Electronic Money Regulations 2011, enabling it to issue electronic money and provide payment services. This regulatory milestone marked a turning point, allowing MoneyNetInt to expand its offerings and establish a presence in Europe, Asia, and the Middle East.

Under Trif’s leadership, MoneyNetInt has developed a robust suite of financial services tailored to both individuals and businesses. The company’s flagship offerings include designated International Bank Account Numbers (IBANs), which facilitate seamless cross-border transactions, and Automated Clearing House (ACH) systems that enable the automated processing of large transaction volumes. MoneyNetInt has also excelled in credit card processing, integrating payment solutions into business operations to enhance customer experiences and revenue streams. Additionally, the company provides prepaid debit cards and cash payout services, catering to clients seeking alternatives to traditional banking.

In 2017, MoneyNetInt expanded its global footprint by launching GlobalNetInt UAB in Lithuania, operating under the brand name Payswix. This venture, authorized by the Bank of Lithuania as an EMI, was led by local partner Luidvikas Kulikauskas and further demonstrated MoneyNetInt’s commitment to international financial operations. The company’s strategic partnership with Ripple, a leader in blockchain-based payment solutions, has bolstered its reputation as an innovative player in the fintech space. These achievements have positioned MoneyNetInt as a formidable competitor in the global payments industry, with Yishay Trif at the helm steering its strategic direction.

Allegations of Unlawful Conduct

Despite its successes, MoneyNetInt and Yishay Trif have faced significant allegations of engaging in unlawful activities, primarily related to money laundering and facilitating fraudulent binary options scams. These accusations have emerged from multiple sources, including whistleblower reports, regulatory investigations, and victim complaints, raising serious questions about the company’s operations and Trif’s leadership.

Connection to the Vienna Cybercrime Trials

One of the most damning allegations against MoneyNetInt is its alleged connection to the Vienna Cybercrime Trials, which centered around convicted scammer Gal Barak. Barak, an Israeli national, was sentenced to four years in prison in Vienna in September 2020 for orchestrating a cybercrime organization involved in fraudulent binary options and online brokerage scams. According to reports from FinTelegram, a financial investigations platform, MoneyNetInt and its Lithuanian affiliate, GlobalNetInt UAB, facilitated money laundering for Barak’s operations, specifically through entities such as Online Prospect and DYISY Group, controlled by Simon Tetroashvili.

The allegations suggest that MoneyNetInt processed illicit proceeds from these scams, funneling funds through its accounts to offshore entities. For instance, FinTelegram reported that Hithcliff Ltd, a UK-registered company involved in Uwe Lenhoff’s binary options scams, was registered as a merchant with MoneyNetInt. Through this account, Lenhoff allegedly transferred millions to his Bulgarian company, Savora Consulting EOOD, using fictitious invoices for services such as marketing and consulting. These activities are said to have been part of a broader network of cybercrime organizations, including Barak’s E&G Bulgaria and Lenhoff’s Veltyco Group, which shared resources and payment processors like MoneyNetInt.

Regulatory Scrutiny and Compliance Issues

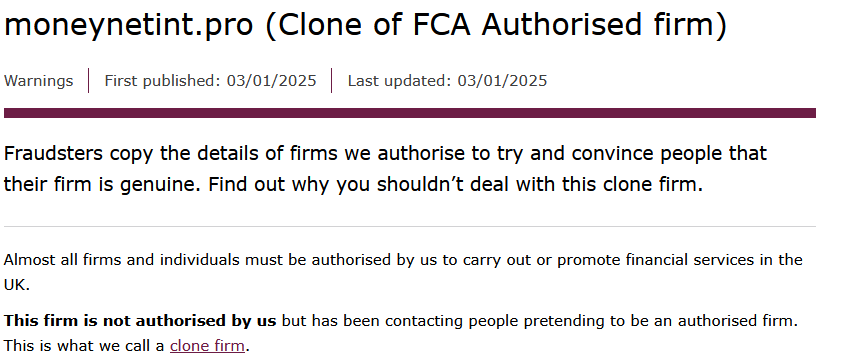

MoneyNetInt’s operations have also come under scrutiny from regulatory authorities, particularly the FCA and the Bank of Lithuania. In early 2021, MoneyNetInt voluntarily suspended onboarding new customers following discussions with the FCA, citing the need to enhance its compliance processes. This decision was announced on the company’s website, stating that existing customers would remain unaffected and services would continue uninterrupted. However, the voluntary restriction, which remained in place more than two years later, has led to speculation that the FCA identified significant compliance deficiencies in MoneyNetInt’s operations.

In Lithuania, GlobalNetInt UAB (now Payswix UAB) faced its own regulatory challenges. In June 2021, the Bank of Lithuania fined GlobalNetInt €350,000 for violations of anti-money laundering (AML) and terrorist financing prevention rules. The regulator found that GlobalNetInt failed to properly assess customer risks and ensure that remote customer identification complied with legal requirements. Whistleblowers reported to FinTelegram that GlobalNetInt had developed extensive activities for scammers and illegal businesses in the crypto and gambling sectors, further compounding its compliance issues.

The ownership structure of MoneyNetInt and GlobalNetInt has also raised concerns. Until at least Q3 2021, Golan Holdings Ltd and Triff Holdings Ltd, controlled by Raphael Golan and the Trif family, held majority stakes in both entities. This interconnected ownership has led investigators to treat MoneyNetInt and GlobalNetInt as part of the same “MoneyNetInt Group,” amplifying concerns about systemic compliance failures across the group’s operations.

Allegations of Facilitating Binary Options Scams

Binary options trading, a high-risk investment practice banned in many jurisdictions since 2017, has been a significant source of controversy for MoneyNetInt. The company has been accused of processing payments for fraudulent binary options brokers, enabling scammers to launder illicit proceeds. For example, a Singaporean investor named Su reported losing $10,000 to a binary options company called SecuredOptions, which used MoneyNetInt as its payment processor. Su’s complaint to MoneyNetInt, alleging that the company facilitated a scam, was instrumental in recovering his funds, highlighting the company’s role in processing payments for dubious brokers.

FinTelegram and other sources have identified MoneyNetInt as a key payment facilitator for illegal broker platforms, including LBinary, NRGBinary, Option888, XMarkets, ZoomTrader, and TradeInvest90. These platforms allegedly defrauded hundreds of thousands of retail investors worldwide, with MoneyNetInt and GlobalNetInt processing client funds deposited for trading binary options, CFDs, and forex products. The funds were then transferred to offshore entities through fictitious invoices, a common money-laundering technique.

MoneyNetInt has denied these allegations, asserting that it is a legitimate payment processor and not involved in binary options scams. However, the company faces ongoing investigations by regulators in multiple countries and lawsuits from victims seeking restitution. The European Fund Recovery Initiative (EFRI) has confirmed that lawsuits are pending against other payment processors, such as ING’s now-defunct Payvision, for facilitating similar scams, though it is unclear whether MoneyNetInt is directly targeted in these actions.

Yishay Trif’s Leadership and Public Persona

Yishay Trif has cultivated a public image as a forward-thinking fintech executive, emphasizing collaboration between fintechs and traditional banks. In a 2022 interview with TechRound, Trif argued that competition between fintechs and established financial institutions can be counterproductive, advocating for partnerships that leverage the strengths of both sectors. He highlighted MoneyNetInt’s role in building payments infrastructure for fast, low-cost international transfers and its collaborations with Ripple to achieve global scale.

Trif has also been a visible figure at industry events, such as the Paris Fintech Forum in 2019, where he discussed MoneyNetInt’s integration with RippleNet and its focus on serving small and medium-sized enterprises (SMEs). In a 2021 podcast with Provoke.fm, Trif explored the growing importance of fintech for SMEs, positioning MoneyNetInt as a key player in connecting businesses to the global banking ecosystem. These appearances have helped Trif project an image of a legitimate business leader committed to innovation and customer service.

Internally, MoneyNetInt has been described as a family-oriented business with a collaborative culture. Raphael Golan, the company’s Business Development Director, praised Trif’s innovative and open-minded approach in a 2019 blog post, noting that the CEO’s vision inspires the team to develop new products and strategic initiatives. The company’s 2019 financial statements reported a profit of £842,000 for MoneyNetInt and over £92,999 for its subsidiary, M-Net International, with owners receiving dividends of £852,000, indicating financial success under Trif’s leadership.

Customer Feedback and Trustpilot Reviews

MoneyNetInt has received overwhelmingly positive feedback on Trustpilot, with an average rating of 4.8 out of 5 stars based on 271 customer reviews. The company is Trustpilot-verified, and customers have praised its responsiveness, ease of use, and customer service. For example, a reviewer named Mayur highlighted MoneyNetInt’s exceptional customer support, noting that issues were resolved within minutes, setting the company apart from competitors. Another reviewer, Crazy Traveler, described the service as a “lifesaver” for resolving payment issues related to Italian tickets, emphasizing its efficiency and user-friendliness.

However, not all reviews are positive. A customer named Midodzi Tay recounted a negative experience with PayTicket, a service associated with MoneyNetInt, where payment processing issues led to a month-long delay in resolving a parking fine. Tay criticized the company for giving up too quickly when faced with difficulties, suggesting that greater persistence could improve customer satisfaction. While these reviews provide insight into MoneyNetInt’s customer service, they do not directly address the allegations of unlawful conduct or Trif’s personal involvement.

Evaluating the Allegations: Criminal or Legitimate?

The allegations against Yishay Trif and MoneyNetInt are serious, but determining whether they substantiate claims of a criminal enterprise requires a careful examination of the evidence, the company’s responses, and the broader context of its operations.

Evidence Supporting the Allegations

The most compelling evidence comes from FinTelegram’s investigations, which have consistently linked MoneyNetInt and GlobalNetInt to fraudulent activities. The connection to the Vienna Cybercrime Trials, particularly the involvement with Gal Barak and Uwe Lenhoff’s cybercrime organizations, is well-documented. FinTelegram’s reports, supported by whistleblower information and criminal records, indicate that MoneyNetInt processed payments for scam operators, enabling the laundering of illicit proceeds through accounts with banks like ING and Deutsche Handelsbank.

Regulatory actions further bolster these claims. The Bank of Lithuania’s €350,000 fine against GlobalNetInt for AML violations and the FCA’s dialogue leading to MoneyNetInt’s voluntary suspension of new customer onboarding suggest significant compliance failures. The fact that MoneyNetInt’s shareholders, Golan Holdings Ltd and Triff Holdings Ltd, held majority stakes in GlobalNetInt until at least Q3 2021 ties the two entities closely together, implying that compliance issues may have been systemic across the MoneyNetInt Group.

Victim reports, such as Su’s case with SecuredOptions, provide concrete examples of MoneyNetInt’s role in processing payments for fraudulent brokers. The fact that Su recovered his funds after complaining to MoneyNetInt suggests that the company may have been aware of the scam but failed to prevent it initially, raising questions about its due diligence processes.

MoneyNetInt’s Defense and Counterarguments

MoneyNetInt has consistently denied involvement in binary options scams, maintaining that it is a legitimate payment processor operating under FCA regulation. The company’s voluntary suspension of new customer onboarding in 2021 was presented as a proactive step to strengthen compliance, suggesting a willingness to address regulatory concerns. The positive Trustpilot reviews and MoneyNetInt’s high rating indicate that many customers have had satisfactory experiences, which could undermine claims of widespread fraudulent activity.

The partnership with Ripple, a reputable player in the cryptocurrency industry, also lends credibility to MoneyNetInt’s operations. Ripple’s due diligence processes likely vetted MoneyNetInt before entering into a strategic alliance, suggesting that the company was deemed a legitimate partner. Additionally, MoneyNetInt’s financial success, as evidenced by its 2019 profits and dividends, indicates a viable business model that may not rely on illicit activities.

Trif’s public statements and appearances at industry events further support the narrative of a legitimate business leader. His focus on collaboration, innovation, and serving SMEs aligns with the goals of a reputable fintech executive, and there is no direct evidence linking Trif personally to criminal activities. The allegations primarily target MoneyNetInt’s operations, and Trif’s role as CEO does not necessarily imply direct involvement in or knowledge of illicit activities.

Contextual Considerations

The fintech industry, particularly in the early 2010s, was a fertile ground for binary options scams, with many payment processors inadvertently or negligently facilitating fraudulent transactions. MoneyNetInt’s involvement in processing payments for binary options brokers may reflect lax due diligence rather than intentional criminality. The ban on binary options trading in 2017 and subsequent regulatory crackdowns have forced companies like MoneyNetInt to adapt, and the company’s compliance enhancements in 2021 suggest an effort to align with stricter standards.

The interconnected ownership of MoneyNetInt and GlobalNetInt, while concerning, is not uncommon in family-run businesses expanding internationally. The Trif family’s control over both entities does not inherently prove criminal intent, though it does highlight the need for robust governance to prevent compliance failures. The Bank of Lithuania’s fine, while significant, was described by FinTelegram as “chump change” for the MoneyNetInt Group, suggesting that the penalty may not reflect the full scope of the violations.

Potential Actions for Victims

For individuals who believe they were scammed by binary options brokers using MoneyNetInt as a payment processor, several steps can be taken to seek restitution:

Contact MoneyNetInt’s customer service to file a complaint, providing detailed information about the scam, including transaction details and the name of the binary options company. Keeping records of all correspondence is crucial for tracking the resolution process.

If MoneyNetInt does not respond or refuses a refund, victims can consider pursuing legal action. Consulting a lawyer specializing in financial fraud can help determine whether a lawsuit against MoneyNetInt is viable.

Victims can also initiate a chargeback through their bank or credit card company, contesting the transaction as fraudulent. Providing evidence of the scam, such as communications with the broker or MoneyNetInt, can strengthen the case.

Reporting the incident to regulatory authorities, such as the FCA in the UK or the Securities and Exchange Commission (SEC) in the US, can prompt further investigation and potentially lead to broader action against the perpetrators.

While recovering funds from binary options scams is challenging, these steps offer a pathway to potential compensation. Victims should act promptly and leverage available legal and regulatory resources.

Broader Implications for the Fintech Industry

The allegations against MoneyNetInt and Yishay Trif highlight broader challenges in the fintech industry, particularly for payment processors operating in high-risk sectors. The rapid growth of digital payments and cryptocurrencies has created opportunities for innovation but also vulnerabilities for exploitation by scammers. Companies like MoneyNetInt, which serve clients in industries such as online gaming, gambling, and crypto, face heightened risks of facilitating illicit activities, intentionally or otherwise.

Regulatory bodies like the FCA and the Bank of Lithuania play a critical role in ensuring compliance, but their resources are often stretched thin, allowing some violations to go undetected or inadequately punished. The €350,000 fine imposed on GlobalNetInt, for instance, was criticized as insufficient given the scale of the alleged violations. Strengthening AML and know-your-customer (KYC) frameworks, as well as imposing stricter penalties, could deter payment processors from engaging with high-risk clients.

Collaboration between fintechs, banks, and regulators, as advocated by Trif, could also mitigate these risks. By leveraging blockchain technology, such as Ripple’s solutions, and partnering with established financial institutions, fintechs can enhance transparency and traceability in their transactions. However, these efforts must be accompanied by robust internal controls to prevent lapses in due diligence.

Conclusion: Is Yishay Trif a Criminal or a Legitimate Businessman?

The question of whether Yishay Trif is a white-collar criminal or a legitimate business person remains complex and unresolved. MoneyNetInt, under Trif’s leadership, has achieved significant success as a global payment processor, earning praise from customers and forging partnerships with reputable players like Ripple. The company’s positive Trustpilot reviews, financial profitability, and Trif’s public advocacy for fintech innovation paint a picture of a legitimate enterprise striving to compete in a dynamic industry.

However, the allegations of facilitating money laundering and binary options scams cannot be dismissed lightly. The connections to the Vienna Cybercrime Trials, regulatory penalties, and whistleblower reports provide substantial evidence of compliance failures within MoneyNetInt and its affiliate, GlobalNetInt. While there is no direct evidence implicating Trif personally in criminal activities, his role as CEO places him at the center of the company’s operations, raising questions about his oversight and accountability.

Ultimately, the truth likely lies in a gray area. MoneyNetInt’s involvement in processing payments for fraudulent brokers may reflect negligence or inadequate due diligence rather than a deliberate criminal enterprise. The company’s efforts to enhance compliance and its continued operation under FCA regulation suggest a commitment to reform, but the persistence of allegations and regulatory scrutiny indicates that challenges remain.

For consumers and businesses considering MoneyNetInt’s services, caution is warranted. Thoroughly researching the company’s compliance history and understanding the risks of high-risk financial transactions are essential. For Yishay Trif, restoring trust will require transparency, robust compliance measures, and a clear demonstration that MoneyNetInt has moved beyond its controversial past. Until then, the allegations will continue to cast a shadow over his legacy as a fintech leader.