Introduction

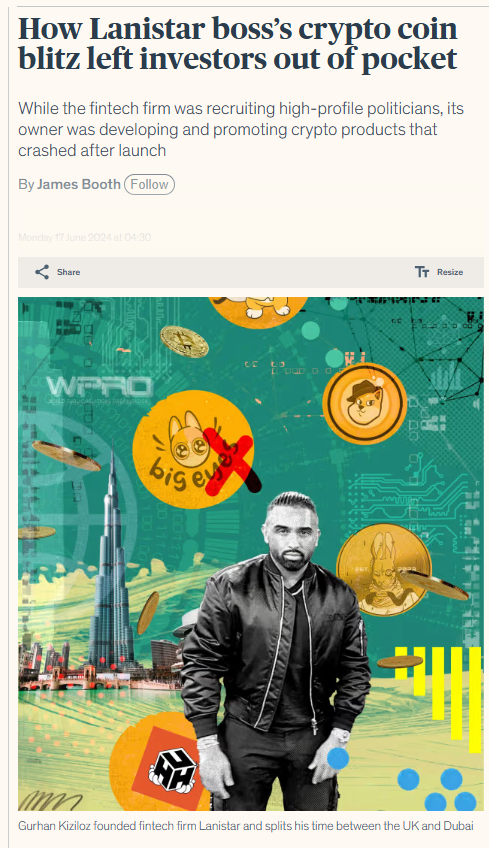

Gurhan Kiziloz’s entry into the fintech world was nothing short of a spectacle, a showman promising to disrupt the financial sector for millennials and Gen Z. His flagship venture, Lanistar, was marketed as a revolutionary product, with bold proclamations of a $1 billion valuation, celebrity endorsements, and an innovative polymorphic payment card. At first, it seemed like the start of a fintech empire. But as time passed, the promises began to unravel, revealing a much darker reality. Instead of a visionary mogul, Kiziloz’s story now reads like a cautionary tale of lies, deception, and failed ventures.

This article is not just about one man’s rise and fall—it’s a stark warning. After extensive digging into allegations, legal disputes, and ongoing risks surrounding Kiziloz and Lanistar, it has become clear that the narrative he carefully crafted is falling apart. From financial instability to a shocking pivot into the high-risk online gambling market, Kiziloz’s empire looks less like a business success and more like an imploding house of cards.

The Rise of Gurhan Kiziloz: A Carefully Constructed Myth?

Gurhan Kiziloz’s story, painted as a self-made entrepreneur who dropped out of university and climbed the ladder of success through online sales, seemed to check all the boxes for a Silicon Valley-style legend. His LinkedIn profile boasts of experiences across Europe and Dubai, painting a picture of a globetrotting visionary. In 2019, he launched Lanistar, claiming to have developed a polymorphic card that would revolutionize digital banking by consolidating multiple cards into one.

However, there’s one major issue: the truth doesn’t add up. Kiziloz initially claimed that Lanistar had received £15 million in funding from Milaya Capital, only to later admit that this was not the case. The actual funding came from his family members, a drastic shift that raised immediate red flags. Despite this, his company’s valuation soared to an unrealistic £150 million before it even launched, fueled by celebrity endorsements from the likes of Kevin De Bruyne and Tommy Fury. This leads to one obvious question: how could a company that hadn’t even proven itself be valued at such an astronomical amount?

Red Flag: Regulatory Issues and the FCA Warning

Lanistar’s launch hit a major obstacle in 2020 when the UK’s Financial Conduct Authority (FCA) issued a warning against the company. Lanistar was accused of offering financial services without the necessary authorization—an unforgivable mistake in a heavily regulated industry. This was not a minor issue; for a company marketing itself as a secure, trustworthy provider for young consumers, this was a catastrophic failure.

Kiziloz’s team rushed to address the issue, making cosmetic changes and adding disclaimers to the website. While the FCA ultimately reversed its warning, the entire episode raised serious questions. Was this a legitimate compliance failure that was quickly patched up, or just a short-term fix to avoid deeper scrutiny? What’s clear is that Lanistar failed to meet basic regulatory standards, and this is just the tip of the iceberg.

Financial Chaos: Winding-Up Petitions and Unpaid Debts

By 2024, the cracks in Lanistar’s financial stability became glaringly obvious. Court documents revealed multiple winding-up petitions filed against the company—one from its landlord for unpaid rent and another from Global Processing Services (GPS) for unpaid debts. These weren’t minor issues; these were massive red flags signaling severe financial mismanagement.

Despite Kiziloz’s attempts to downplay the severity of these situations, claiming that the petitions had been dismissed and the debts settled, the financial instability continued to build. A company valued at £150 million should not be struggling to meet basic financial obligations. This pattern of unpaid debts and financial distress paints a troubling picture for anyone still considering putting their trust in Lanistar or Kiziloz.

Employee Complaints: A Toxic Culture and Unpaid Wages

The internal culture at Lanistar doesn’t inspire confidence either. In 2021, several former employees came forward to accuse the company of creating a toxic work environment. They reported harassment, bullying, and a culture of fear within the organization. Worse, many employees claimed that they were not paid for months despite working tirelessly to help build the company.

Kiziloz’s response? He promised to implement “Motivational Wednesdays” and other trivial wellness initiatives. These empty gestures did little to address the real issues at hand. A company that can’t even treat its own employees fairly has no business managing sensitive financial data or dealing with customers’ hard-earned money.

The Shifting Story of Lanistar’s Funding

The saga of Lanistar’s funding gets murkier the more you dig into it. Kiziloz initially claimed that Milaya Capital had invested £15 million into Lanistar, but that narrative quickly changed. He later admitted that the investment came from his family. This flip-flopping raises serious concerns. Was Milaya Capital ever involved, or did something go wrong behind the scenes? The lack of transparency is concerning, especially in the highly scrutinized fintech industry.

The Desperate Pivot to Gambling

By 2024, it became clear that Kiziloz’s fintech dream was collapsing. Instead of focusing on stabilizing Lanistar, he pivoted to a completely different—and highly controversial—industry: online gambling. Under the new umbrella of Nexus International, Kiziloz launched Megaposta, a gambling platform targeting Latin American markets. In 2024, Megaposta reportedly generated $400 million in revenue, while Kiziloz’s net worth allegedly surged to $700 million.

While this shift to gambling might seem like a lucrative business strategy, it raises serious ethical concerns. The gambling industry is volatile, heavily regulated, and notorious for its moral pitfalls. A company that once promised financial freedom and security to young people is now pivoting to a sector that preys on vulnerable individuals. This move only adds to the growing list of reasons to question Kiziloz’s judgment and the future of his business ventures.

A Timeline of Trouble: Negative Headlines That Speak for Themselves

The timeline of negative headlines surrounding Gurhan Kiziloz paints a grim picture:

- 2020: The FCA issued a warning against Lanistar for offering financial services without authorization.

- 2021: Former employees came forward with allegations of bullying, harassment, and unpaid wages.

- 2022: Global Processing Services filed a winding-up petition for unpaid debts.

- 2024: A landlord petitioned for the company’s liquidation over unpaid rent.

- 2025: Kiziloz’s pivot to gambling further raised questions about his business ethics.

These headlines do not inspire confidence in Kiziloz’s leadership or business acumen. Anyone considering investing in or using Lanistar would be wise to take these warning signs seriously.

Risk Assessment: Why Gurhan Kiziloz’s Ventures Should Be Avoided

For those considering putting their money into Kiziloz’s ventures, it’s essential to weigh the risks carefully. Lanistar’s repeated financial struggles, regulatory issues, and employee complaints paint a picture of a company on the brink of collapse. Kiziloz’s erratic leadership and questionable business decisions, such as the pivot to gambling, only add to the uncertainty surrounding his future ventures.

If you value transparency, stability, and ethical business practices, Gurhan Kiziloz’s track record should raise major red flags. His ventures are built on shaky ground, and the cracks are too deep to ignore.

The Illusion of Gurhan Kiziloz’s Success

Gurhan Kiziloz’s rise to prominence in the fintech world was swift and filled with lofty promises. With claims of a $1 billion valuation for his company, Lanistar, and a revolutionary polymorphic payment card, Kiziloz painted himself as a visionary. His narrative portrayed him as a self-made entrepreneur who had skipped formal education to achieve financial success. However, upon closer inspection, this seemingly impressive rise raises more questions than answers. His story, full of inconsistencies and unsubstantiated claims, has since unraveled, revealing that the glittering success he projected was built on shaky foundations.

While his marketing and celebrity endorsements were impressive, they did little to mask the cracks in his business model. The initial £15 million funding claim was quickly debunked, and the company’s real backers turned out to be family members, not the investors Kiziloz initially claimed. This early dishonesty has tainted his reputation and cast a long shadow over his ventures.

Regulatory Woes: Lanistar’s Troubled Beginnings

Lanistar’s launch was marred by significant regulatory issues that threatened its credibility from the start. In 2020, the UK’s Financial Conduct Authority (FCA) issued a serious warning against Lanistar for offering financial services without the necessary authorization. This is a critical violation in the heavily regulated fintech industry, raising doubts about Kiziloz’s ability to navigate compliance requirements.

Although the FCA eventually retracted the warning, the episode revealed a pattern of shortcuts and regulatory neglect. Kiziloz’s attempts to cover up the issue with cosmetic fixes—such as tweaking disclaimers and updating the website—did little to quell concerns about the company’s long-term viability. The fact that Lanistar failed to meet basic legal standards only worsens the trustworthiness of Kiziloz and his business practices.

Financial Instability: Unpaid Debts and Legal Trouble

As Lanistar continued to operate, more financial issues began to surface. By 2024, it became clear that the company was struggling to maintain even the most basic financial obligations. Lanistar was hit with multiple winding-up petitions, including one from a landlord due to unpaid rent and another from Global Processing Services (GPS) over overdue debts. These weren’t minor setbacks; they were signs of deep financial trouble for a company that had once claimed to be worth millions.

Despite Kiziloz’s reassurances that the issues had been settled, the repeated financial crises only compounded fears that Lanistar was teetering on the brink of collapse. This instability not only raised doubts about the company’s business model but also put consumers, employees, and investors at significant risk. Financial mismanagement and failure to meet obligations are serious issues in the business world, particularly in the fintech sector, where trust is paramount.

The Desperate Pivot: From Fintech to Gambling

In 2024, Kiziloz made a bold and controversial decision to pivot from fintech to online gambling. Under the new umbrella of Nexus International, Kiziloz launched Megaposta, a gambling platform targeting Latin American markets. This dramatic shift away from his original promises of financial security and innovation only added to the growing doubts surrounding his integrity and leadership.

While the online gambling industry is lucrative, it is also fraught with ethical concerns, legal issues, and volatility. For a company that once marketed itself as a way to offer financial freedom to young people, moving into gambling feels like a betrayal of the very principles Kiziloz once claimed to champion. This shift raises not only questions about his business acumen but also his moral compass. Is Kiziloz really a visionary entrepreneur, or is he simply chasing the next big opportunity, regardless of the ethical ramifications?

Conclusion

Despite Kiziloz’s attempts to brand himself as a fintech genius, the reality is far less glamorous. His business ventures are marked by financial mismanagement, regulatory failures, and a disturbing shift from banking to gambling. Kiziloz’s empire is built on lies, half-truths, and a growing list of negative headlines that cannot be ignored. For those still considering trusting him with their money or investing in his ventures, the message is clear: proceed with caution, or risk being left holding the pieces when his house of cards collapses.