Introduction

Gurhan Kiziloz, a self-proclaimed fintech and online gambling mogul, has made bold claims of a $700 million net worth, yet beneath the glossy surface of his ventures, such as Lanistar and Nexus International, lies a troubling pattern of failures and controversies. Rather than innovating, Kiziloz’s companies have consistently been marred by regulatory violations, dissatisfied customers, and operational chaos. This report exposes the flaws, risks, and unresolved issues surrounding Kiziloz’s empire, showing that the hype surrounding his businesses is far from reflective of reality.

The Problematic Background of Gurhan Kiziloz

Kiziloz’s background is often framed as one of relentless drive, fueled by his diagnosis of severe ADHD. However, this narrative overlooks the numerous missteps and questionable decisions that have plagued his career. His so-called visionary approach to business has resulted in numerous failures, from failed fintech products to online gambling platforms fraught with issues. Despite his claims of brilliance and success, Kiziloz’s ventures are defined by poor execution, regulatory scrutiny, and a lack of transparency. His companies appear more like a collection of half-baked ideas than genuine disruptors in their respective industries.

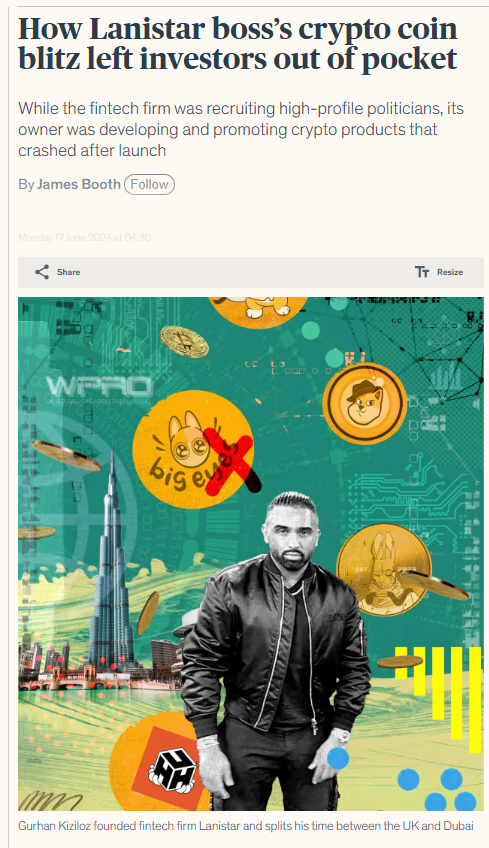

Lanistar: A Fintech Disaster

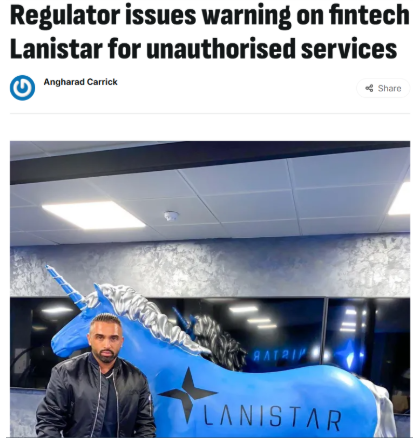

Kiziloz’s attempt at fintech innovation through Lanistar was nothing short of disastrous. Marketed as the “world’s most secure card,” Lanistar promised to revolutionize digital payments but quickly became a cautionary tale. In 2020, the UK’s Financial Conduct Authority (FCA) issued an official warning against Lanistar for operating without the necessary regulatory approvals. This was a major red flag for any potential users, signaling that the company was far from legitimate or secure.

Beyond the regulatory failures, customer feedback painted a grim picture of Lanistar’s operational incompetence. Complaints about delayed card deliveries, inaccessible funds, and poor customer service flooded in, revealing deep-rooted problems that Kiziloz’s company failed to address. Rather than addressing these critical issues, Kiziloz doubled down on aggressive marketing campaigns featuring high-profile endorsements, further misleading the public. These endorsements, which included celebrities like Kevin De Bruyne and Karim Benzema, only served to distract from the platform’s underlying deficiencies.

Nexus International and Megaposta: A Failing Gamble

After the collapse of Lanistar, Kiziloz shifted his focus to the online gambling industry, founding Nexus International and overseeing platforms like Megaposta. However, this pivot was far from a strategic success. Megaposta, which was heavily marketed as a major player in the Latin American gambling market, has been plagued by ongoing issues. Customers have reported problems with delayed payouts, unexplained account suspensions, and unclear terms and conditions. These operational issues point to a larger systemic problem within Kiziloz’s companies—namely, a lack of proper management and customer care.

Regulatory concerns have also plagued Nexus International’s gambling ventures. In particular, Megaposta’s operations in Brazil have raised alarms about its licensing and adherence to fair play standards. Once again, Kiziloz’s companies are under scrutiny for potentially operating in violation of local laws and regulations. This only adds to the growing list of concerns about Kiziloz’s ability to successfully manage and scale businesses in high-risk industries.

Alarming Red Flags and Risk Factors

A closer inspection of Kiziloz’s business practices reveals multiple red flags that should make investors and consumers think twice before getting involved with his companies. Both Lanistar and Nexus International have been criticized for a lack of transparency in their corporate structures and ownership. This secrecy raises serious questions about who is actually behind these businesses and whether they are being run ethically.

In addition, Kiziloz’s repeated clashes with regulatory authorities suggest a pattern of non-compliance that poses significant risks to consumers and investors. These issues are not isolated incidents; they reflect a broader pattern of negligence and poor decision-making that has dogged Kiziloz’s ventures. The reliance on flashy marketing campaigns, celebrity endorsements, and influencer hype does little to cover up the glaring problems within his businesses. What’s left is an empire built on shaky foundations, unable to live up to its lofty promises.

Lack of Transparency and Questionable Associations

In addition to his failed fintech and gambling ventures, Kiziloz is also connected to several other businesses operating in murky and questionable sectors. Nexus International, the parent company of Megaposta, remains a highly unstable and unproven entity in the gambling space, struggling with both operational and regulatory issues. Furthermore, Kiziloz is allegedly linked to several other companies like Target Steel and Target Metal Systems, but these connections are vague at best. The lack of clarity around the ownership and operations of these businesses only serves to fuel speculation about Kiziloz’s broader business strategy, leaving stakeholders with more questions than answers.

Visual Evidence of Troubling Practices

The numerous issues surrounding Kiziloz’s ventures are not just speculative; they are backed up by official warnings, customer complaints, and screenshots of poor service quality. A screenshot of the FCA’s warning against Lanistar clearly illustrates the legal troubles the company faced. Further, customer reviews and complaints about Megaposta show a pattern of operational failure, highlighting ongoing issues with payouts and account suspensions. Additionally, a diagram illustrating the complex and opaque corporate structures behind Kiziloz’s various ventures further reveals the difficulty in tracking accountability and ownership—furthering the doubts surrounding the legitimacy of his operations.

Lack of Accountability in Kiziloz’s Ventures

A critical issue in Gurhan Kiziloz’s business empire is the persistent lack of accountability that surrounds his ventures. Companies like Lanistar and Nexus International operate in a cloud of secrecy, with very little transparency regarding their leadership and decision-making processes. This lack of clear accountability makes it almost impossible for consumers and investors to trust that their interests are being properly managed.

In fact, the opacity of Kiziloz’s operations only heightens the uncertainty surrounding the legitimacy of his businesses. The absence of clear ownership structures and leadership roles raises the question of whether Kiziloz’s ventures are simply a smokescreen for deeper issues that he refuses to address publicly. This lack of clarity on basic business operations only serves to compound the growing skepticism surrounding his brand.

Financial Mismanagement and Instability

One of the key issues that have plagued Kiziloz’s businesses is their constant financial instability. Despite the extravagant claims of his companies being on the brink of transforming industries, the financial performance of Lanistar, Nexus International, and other ventures has been far from impressive. The delayed payments, customer complaints, and unreliable products are all signs of an underlying financial mismanagement problem.

Kiziloz’s aggressive marketing tactics, funded by heavy investments in influencer partnerships, may have generated buzz, but they’ve failed to deliver real returns for his businesses. Rather than using funds to solidify their operational infrastructure or address the ongoing regulatory issues, Kiziloz seems more focused on creating a flashy, attention-grabbing narrative. This disconnect between the company’s financial resources and its performance only highlights the unsustainable nature of his ventures.

Regulatory Scrutiny and Legal Troubles

Kiziloz’s ventures, particularly Lanistar and Nexus International, have attracted consistent regulatory scrutiny. The UK’s Financial Conduct Authority (FCA) warning against Lanistar was just the tip of the iceberg. The company was operating without the required licenses and was deemed an unregulated entity. This raised serious concerns about the platform’s ability to protect consumer interests, especially in an industry as sensitive as fintech.

Moreover, Nexus International’s online gambling operations have also attracted attention from regulatory bodies in various countries, especially in Latin America, where issues regarding licensing, fair play, and consumer rights have been raised. These ongoing legal troubles reveal a pattern of Kiziloz’s companies operating in violation of essential laws and regulations, potentially putting both consumers and investors at significant risk.

Misleading Marketing Tactics and Broken Promises

A cornerstone of Kiziloz’s business strategy has been his heavy reliance on misleading marketing tactics to prop up his failing ventures. From his claims of revolutionizing the fintech industry with Lanistar’s “world’s most secure card” to hyping up the potential of Megaposta in the online gambling space, Kiziloz has used flashy advertisements and endorsements to create a mirage of success.

However, when it comes to delivering on these promises, the reality has always fallen short. The delayed launches, unfulfilled product features, and continuous operational failures speak for themselves. Kiziloz’s habit of using celebrity endorsements, including athletes and social media influencers, has only further fueled a false narrative about the legitimacy and quality of his products. These marketing tactics, which rely on hype rather than substance, have only led to customer frustration and tarnished reputations for those involved. The dissonance between Kiziloz’s bold promises and the actual delivery of his products is another glaring issue that continues to undermine his credibility.

Conclusion

Gurhan Kiziloz may have convinced some that he is a rising star in the fintech and gambling industries, but the reality is far from the polished image he portrays. His ventures, including Lanistar and Nexus International, have consistently failed to deliver on their promises and have been plagued by regulatory violations, operational failures, and consumer dissatisfaction. Rather than leading innovation, Kiziloz’s companies have become synonymous with broken promises and risk-filled investments. For anyone considering engaging with his ventures, the risks far outweigh any potential rewards. Caution is strongly advised, as Kiziloz’s empire continues to crumble under the weight of its own failures.