In the high-stakes world of financial technology, few figures have courted as much controversy as Gurhan Kiziloz, the self-proclaimed disruptor behind Lanistar. Promising a revolutionary “polymorphic” payment card and backed by a flashy influencer-driven marketing blitz, Kiziloz positioned himself as the next fintech visionary. But beneath the glossy veneer lay a trail of regulatory crackdowns, consumer backlash, and allegations of deception. From Financial Conduct Authority (FCA) warnings to employee claims of late payments and manipulated PR, the Lanistar saga serves as a cautionary tale of ambition unchecked by ethics. This in-depth investigation uncovers the truth behind Kiziloz’s empire—revealing a pattern of questionable business practices, failed crypto ventures, and a legacy of broken promises.

The Illusion of Innovation

The fintech boom has birthed countless startups claiming to revolutionize banking, but few have sparked as much skepticism as Lanistar and its founder, Gurhan Kiziloz. Launched in 2019, Lanistar burst onto the scene with bold claims of a “polymorphic” payment card—a single card capable of consolidating multiple bank accounts. Backed by a high-octane influencer campaign, Kiziloz cultivated an image of a maverick entrepreneur challenging the financial establishment.

Yet, within months, the cracks began to show. Regulatory warnings, consumer complaints, and whistleblower allegations painted a starkly different picture—one of misleading marketing, financial mismanagement, and potential fraud. This exposé peels back the layers of Kiziloz’s ventures, examining the red flags, legal troubles, and ethical breaches that have defined his career.

The Enigmatic Rise of Gurhan Kiziloz

Little is publicly known about Kiziloz’s background before Lanistar, a fact that has fueled speculation. His sudden emergence as a fintech “visionary” was marked by aggressive self-promotion, positioning him as a disruptor in an industry wary of unproven players.

Lanistar’s 2019 debut was a masterclass in viral marketing. The company leveraged Instagram influencers, celebrity endorsements, and futuristic branding to generate buzz. Kiziloz claimed the polymorphic card would replace traditional banking, offering unprecedented convenience and security.

But questions arose almost immediately: Was the technology even feasible? Experts doubted the card’s purported capabilities. Where was the regulatory approval? Fintech products require strict compliance—something Lanistar initially lacked.

Regulatory Crackdowns – FCA and ASA Warnings

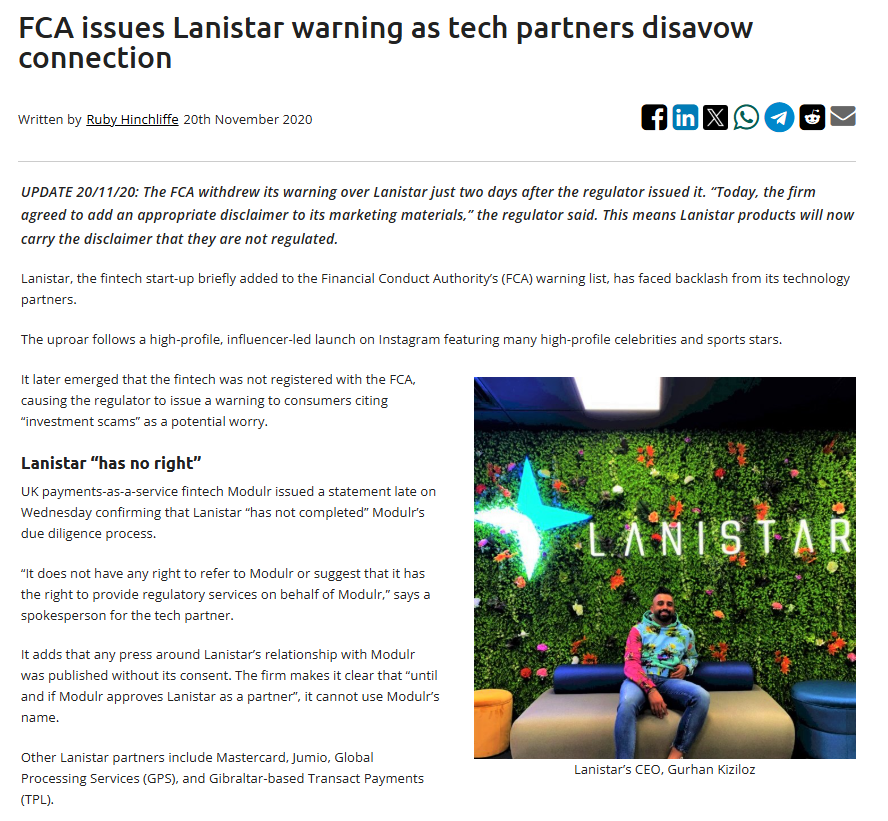

The UK’s Financial Conduct Authority (FCA) issued a public warning against Lanistar in November 2020, stating it was operating without authorization—a major violation. The FCA cautioned consumers that dealing with Lanistar meant no legal protection if things went wrong.

Kiziloz’s response was to claim the warning was a “misunderstanding” and later had it withdrawn by partnering with a licensed firm. But critics argued this was damage control, not genuine compliance.

The UK’s Advertising Standards Authority (ASA) received complaints that Lanistar’s marketing was misleading. Key issues included exaggerated claims about card functionality, unsubstantiated security promises, and influencers failing to disclose paid promotions. While the ASA’s final ruling remains unclear, the investigation further tarnished Lanistar’s credibility.

Inside Lanistar – Employee Exploitation and PR Manipulation

Former employees anonymously reported chronic late salary payments (some waiting 65+ days), pressure to fabricate positive reviews for Kiziloz, and a “fake PR subsidiary” tasked with manufacturing a false image. One ex-staff member wrote: “The company was more focused on hyping Gurhan’s persona than delivering a real product.”

Customers who bought into Lanistar’s hype soon voiced frustration: No tangible product delivery after months of waiting, poor customer service and vague responses, and accusations of being a “scam” on Reddit and Twitter.

Kiziloz’s Other Ventures – WPRO and Big Eyes Coin

Reports suggest Kiziloz launched WPRO, a shadowy PR operation that forced employees to churn out fake news articles and pushed fabricated testimonials to bolster his image.

Kiziloz was also linked to Big Eyes Coin, a cryptocurrency that promised huge returns via aggressive marketing but collapsed shortly after launch, leaving investors stranded and facing accusations of being a pump-and-dump scheme.

The Fallout – Is Lanistar Still Operating?

Despite the controversies, Lanistar still exists—but in what form? There has been no major product launch since its initial hype, silence from influencers who once promoted it, and Kiziloz’s reputation remains in tatters amid ongoing legal scrutiny.

A Fintech Cautionary Tale

Gurhan Kiziloz’s story is a textbook case of hype over substance. From regulatory warnings to employee exploitation and failed crypto schemes, his ventures raise serious ethical and legal concerns.

Key takeaways: Regulators don’t lie—the FCA doesn’t issue warnings lightly. Influencer marketing doesn’t equal legitimacy—a flashy campaign can hide a flawed product. Due diligence is crucial—always verify before investing in fintech “innovations.”

For now, Lanistar remains a cautionary tale—a reminder that in fintech, if it sounds too good to be true, it probably is.

Final Warning: Should You Trust Gurhan Kiziloz?

Given the FCA’s past intervention, employee allegations, and failed ventures, engaging with Kiziloz’s businesses carries significant risk. Until proven otherwise, consumers and investors should steer clear.