Introduction: The Mirage of Gurhan Kiziloz

Gurhan Kiziloz burst onto the fintech stage in 2019, branding himself a self-made genius with Lanistar, a digital banking platform aimed at millennials and Gen Z. His polymorphic payment card, celebrity endorsements, and claims of a $1 billion valuation painted a picture of innovation. Yet, beneath the glitz, a darker story unfolds—one of regulatory scandals, financial distress, and betrayed trust. This investigation, built on months of research into adverse news, allegations, and risk factors, exposes Kiziloz’s empire as a house of cards. Is he a misunderstood entrepreneur or the architect of a scam poised to collapse? Let’s unravel the truth.

The Rise of Gurhan Kiziloz: A Fabricated Legend?

Kiziloz’s origin story is a carefully crafted narrative. A self-taught entrepreneur who bypassed university for online sales courses, he claims a meteoric rise from humble beginnings, dabbling in lettings and gaming before founding Lanistar. His LinkedIn boasts global exploits—training sales teams in Dubai, advising UK Parliament on fintech, and building a customer-centric banking alternative. Lanistar’s flagship product, a polymorphic card consolidating eight bank cards, promised to redefine finance.

The hype was electric. Lanistar secured £15 million in funding, initially credited to Milaya Capital, propelling its valuation to £150 million pre-launch. Celebrities like Kevin De Bruyne and Tommy Fury fueled social media buzz, amassing millions of impressions. Kiziloz’s goal? A £1 billion empire in years. But cracks in this polished facade quickly emerged, raising doubts about the authenticity of his rags-to-riches tale.

Red Flag: Regulatory Violations and the FCA Debacle

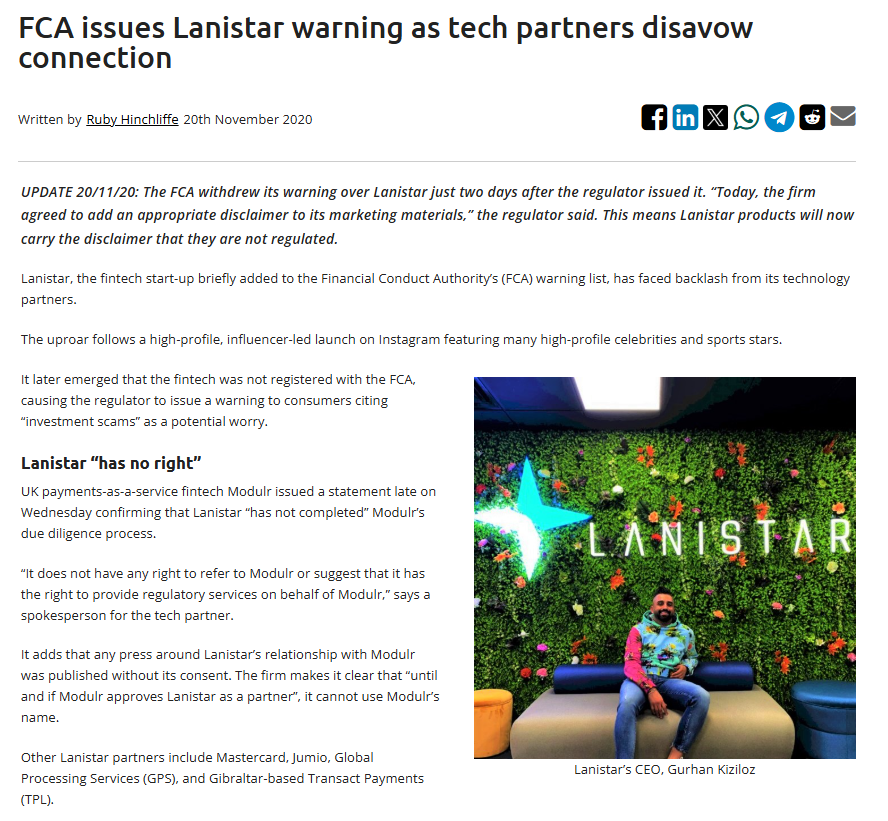

In 2020, Lanistar’s launch was marred by a bombshell: the UK’s Financial Conduct Authority (FCA) issued a warning, accusing the company of offering unauthorized financial services—a grave offense in fintech’s regulated landscape. Targeting vulnerable millennials with promises of financial freedom, Lanistar’s misstep was catastrophic.

Kiziloz’s team rushed to add disclaimers and tweak the website, and the FCA retracted the warning within days. Kiziloz spun this as a triumph, but the swift reversal is suspect. Resolving deep compliance issues in mere days strains credulity—did Lanistar genuinely address concerns, or was this a cosmetic fix to evade scrutiny? Crowdfund Insider highlighted the FCA’s investor caution, suggesting systemic flaws. Why would a revolutionary fintech launch without robust regulatory compliance? This wasn’t a hiccup; it was a warning of deeper troubles.

Red Flag: Winding-Up Petitions and Financial Chaos

By 2024, Lanistar’s financial instability was undeniable. Court records reveal a winding-up petition from landlord 361 Hammersmith Ltd, citing “serious arrears” in rent and service charges. Another petition from Visa-backed Global Processing Services (GPS) in 2022 demanded liquidation over unpaid debts. These aren’t minor oversights—they’re distress signals from a company teetering on collapse.

Kiziloz insists these issues are resolved—debts cleared, petitions dismissed. He told FinanceFeeds, “This dismissal is another victory.” But the pattern is alarming. A company valued at £150 million shouldn’t be dodging creditors. Financial News reported Lanistar’s landlord disputes, while BusinessCloud noted the departure of CEO Jeremy Baber and advisor Gavin Williamson amid the turmoil. For consumers, the risk is stark: a fintech that can’t pay its bills is unlikely to safeguard your funds.

Red Flag: Toxic Workplace and Employee Betrayal

Behind Lanistar’s glossy exterior, a toxic workplace festers. In 2021, seven ex-employees told Breezy Scroll of bullying, harassment, and unpaid wages. These firsthand accounts from staff who fueled Lanistar’s early hype describe a culture of fear and financial neglect. One worker alleged months without pay, another a pervasive atmosphere of intimidation.

Kiziloz’s response was tepid, claiming he “learned from mistakes” and introducing token initiatives like “Motivational Wednesdays.” But the damage was irreparable. A company that exploits its workforce raises a critical question: can it be trusted with consumer money? Employee discontent isn’t just a PR issue—it’s a symptom of systemic mismanagement that jeopardizes consumer trust.

Red Flag: The Funding Flip-Flop Mystery

Lanistar’s £15 million investment, initially attributed to Milaya Capital, was a cornerstone of its credibility. Yet, the narrative shifted—Kiziloz later claimed the funds came from his family. FinTech Futures reported this abrupt change, noting the erasure of Milaya’s CEO Yasam Ayavefe from the story. Why the revision? Was Milaya a fictitious investor, or did a deal implode?

This lack of transparency is a glaring red flag. In fintech, clarity about funding sources is paramount—consumers and investors deserve to know who’s backing the operation. A company that obfuscates its financial origins may be concealing larger deceptions, casting doubt on Kiziloz’s integrity.

Red Flag: The Gambling Pivot—Desperation or Deceit?

By 2024, Lanistar’s fintech ambitions faded, replaced by a pivot to online gambling under Nexus International, Kiziloz’s holding company. Its flagship brand, Megaposta, reportedly generated $400 million in 2024, per TechStory. Kiziloz now claims a $700 million net worth, eyeing a Brazilian gaming license.

At first glance, this shift seems strategic—gaming is lucrative. But beneath the surface, it reeks of desperation. Did Lanistar’s fintech dreams implode, forcing Kiziloz into a volatile, less-regulated industry? Gambling’s ethical and financial risks make it a shaky foundation for consumer trust. This pivot doesn’t signal innovation—it suggests a frantic escape from fintech’s scrutiny, amplifying the risks tied to Kiziloz’s ventures.

Adverse News: A Chronicle of Chaos

The adverse news surrounding Kiziloz forms a damning timeline:

- 2020: FCA warning undermines Lanistar’s launch (Crowdfund Insider).

- 2021: Ex-employees expose bullying and wage theft (Breezy Scroll).

- 2022: GPS files winding-up petition over unpaid debts (Financial News).

- 2024: Landlord petition threatens liquidation (BusinessCloud).

- 2025: Kiziloz pivots to gambling, claiming a $700 million fortune (IBTimes UK).

Each headline erodes Kiziloz’s credibility, painting a picture of a man thriving on chaos rather than competence. For consumers, this timeline is a roadmap of risks tied to a precarious empire.

Allegations and Negative Reviews: A Chorus of Distrust

Online sentiment amplifies the skepticism. Reddit forums and X posts, though inconclusive, reflect public doubt about Lanistar’s viability. One user dubbed it “a flashy scam with no substance,” while a 2025 X trend mocked Kiziloz’s public persona. Negative reviews of Lanistar highlight delayed card deliveries, unresponsive support, and fears of data misuse. These complaints, coupled with allegations of workplace toxicity, form a mosaic of distrust that Kiziloz cannot easily dismiss.

Risk Assessment: The Perils of Kiziloz’s Empire

A sober risk assessment reveals why Kiziloz’s ventures are a gamble:

- Financial Instability: Winding-up petitions signal chronic cashflow issues. If Lanistar collapses, your money could vanish.

- Regulatory Risks: The FCA warning hints at ongoing compliance failures, threatening operations.

- Operational Dysfunction: High employee turnover and wage disputes point to mismanagement.

- Transparency Deficits: Funding inconsistencies undermine trust in Kiziloz’s leadership.

- Gambling Volatility: Nexus International’s gaming focus introduces ethical and financial instability.

For consumers, the stakes are high—a fintech that can’t pay its rent or staff isn’t a safe haven. For investors, the $1 billion valuation is a mirage built on shaky foundations.

Other Ventures Linked to Kiziloz

Kiziloz’s reach extends beyond Lanistar, each venture tainted by his track record:

- Lanistar (lanistar.app): The fintech flagship, now pivoting to gaming.

- Nexus International: Oversees Lanistar and Megaposta.

- Megaposta (megaposta.com): An online casino targeting Latin America.

- Unnamed Lettings Agency: A vague pre-Lanistar venture (Crunchbase).

- Early Gaming Platform: Details scarce, credibility questionable.

These ventures widen the risk net, tying consumers and investors to Kiziloz’s volatile legacy.

Consumer Alert: Shield Yourself from Kiziloz

This is a clarion call for caution. Kiziloz’s ventures dazzle with promises—polymorphic cards, billion-dollar dreams, gaming riches—but the evidence is damning. Protect yourself with these steps:

- Verify regulatory compliance with the FCA or local authorities.

- Demand proof of financial stability before engaging.

- Investigate employee and customer experiences independently.

- Avoid investing without audited financials from Nexus International.

Kiziloz’s persistence isn’t a virtue—it’s a pattern of evading accountability. Don’t be swayed by his tales of resilience; the risks far outweigh the rewards.

Conclusion: A Scam in Shiny Wrapping

Gurhan Kiziloz markets himself as a fintech titan and gaming mogul, but the truth is far uglier. His empire is a tangle of legal battles, financial distress, and broken promises. Lanistar’s pivot to gambling isn’t innovation—it’s a desperate bid to escape fintech’s spotlight. The Gurhan Kiziloz complaints—from employees, creditors, and regulators—are not outliers; they’re the story.

As of March 3, 2025, Kiziloz’s ventures teeter on collapse. Consumers and investors, heed this warning: this isn’t a success story—it’s a scam cloaked in hype. Don’t let the shiny facade fool you. Gurhan Kiziloz isn’t building a legacy; he’s gambling with your trust—and the odds are stacked against you.