Introduction

In the fast-paced, high-stakes worlds of fintech and online gambling, few names have sparked as much intrigue and skepticism as Gurhan Kiziloz. Lauded by some as a dynamic entrepreneur with an unrelenting drive, Kiziloz has built a reputation on bold promises and audacious ventures. From the ill-fated launch of Lanistar, a fintech startup that crumbled under regulatory scrutiny, to the contentious rise of Nexus International and its gambling platform Megaposta, his journey is a complex tapestry of ambition, controversy, and unresolved allegations. Despite claims of a $700 million net worth, Kiziloz’s empire is riddled with red flags—ranging from regulatory violations to consumer distrust—that demand closer examination. This investigative report delves into the labyrinthine world of Kiziloz’s business dealings, exposing the risks, adverse developments, and systemic issues that potential investors, partners, and consumers must consider before engaging with his ventures.

The allure of Kiziloz’s story lies in its dichotomy: a self-proclaimed visionary who thrives on defying convention, yet whose ventures consistently falter under the weight of operational failures and ethical lapses. By analyzing his background, dissecting the controversies surrounding Lanistar and Nexus International, and highlighting the broader implications of his business practices, this report aims to provide a comprehensive portrait of an entrepreneur whose legacy is as troubling as it is captivating. Through detailed evidence, including regulatory warnings, user complaints, and corporate complexities, we uncover a pattern of overpromising and underdelivering that casts serious doubt on Kiziloz’s credibility.

Background of Gurhan Kiziloz

Gurhan Kiziloz’s entrepreneurial narrative is one of bold ambition tempered by personal and professional turbulence. Diagnosed with severe ADHD, Kiziloz has frequently framed his condition as a driving force behind his relentless energy and unconventional approach to business. His oft-repeated mantra, “Persistence Beats Resistance,” encapsulates a philosophy that prioritizes tenacity over caution—a mindset that has propelled him into high-risk, high-reward industries like fintech and online gambling. Born into modest circumstances, Kiziloz’s early life is shrouded in limited public detail, but his rise to prominence has been marked by a knack for self-promotion and a willingness to court controversy.

Kiziloz’s public persona is carefully curated, blending tales of overcoming adversity with grandiose visions of disrupting traditional industries. He has positioned himself as a maverick, unbound by the constraints of conventional business practices. Yet, this narrative of triumph is overshadowed by a trail of ventures that have failed to deliver on their promises. His ability to pivot from one industry to another—fintech to gambling—demonstrates adaptability, but it also raises questions about the depth of his expertise and the sustainability of his business models. As we explore his ventures, it becomes clear that Kiziloz’s persistence, while admirable in theory, often manifests as a refusal to address systemic flaws, leaving consumers and regulators to bear the consequences.

Lanistar: A Fintech Fiasco

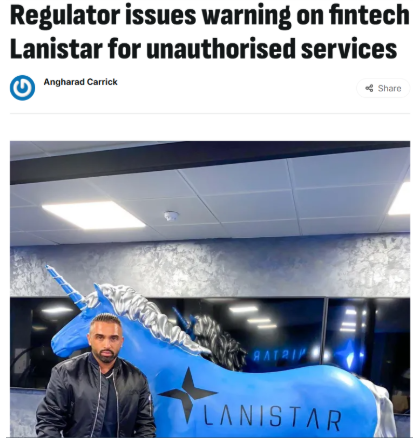

Kiziloz’s entry into the fintech arena was marked by the launch of Lanistar, a company that boldly branded itself as the “world’s most secure card.” Launched with much fanfare in 2020, Lanistar promised to revolutionize personal finance with cutting-edge technology and unparalleled security features. The company’s marketing campaigns were aggressive, leveraging social media influencers and high-profile endorsements to attract a young, tech-savvy audience. However, the veneer of innovation quickly gave way to a cascade of operational and regulatory failures that exposed Lanistar’s shaky foundations.

Regulatory Warnings

Almost immediately after its launch, Lanistar attracted the attention of the UK’s Financial Conduct Authority (FCA). In November 2020, the FCA issued a public warning, declaring that Lanistar was operating without proper authorization and posing significant risks to consumers. The regulator cautioned that the company’s claims of security and reliability were unsubstantiated, urging potential users to exercise extreme caution. This warning was a devastating blow to Lanistar’s credibility, as it highlighted the company’s failure to comply with basic regulatory standards—a cornerstone of any legitimate fintech operation.

The FCA’s concerns were not isolated. Reports emerged of Lanistar’s questionable partnerships with third-party financial institutions, raising further doubts about its operational integrity. The company’s lack of transparency regarding its licensing and compliance processes only deepened suspicions, as consumers and analysts struggled to verify the legitimacy of its offerings.

Operational Challenges

Beyond regulatory hurdles, Lanistar’s operational performance was plagued by inefficiencies and customer dissatisfaction. Users reported a litany of issues, including delayed card deliveries, malfunctioning payment systems, and unresponsive customer support. Many who signed up for Lanistar’s services found themselves unable to access their accounts or resolve basic technical issues, leading to widespread frustration. Online forums and social media platforms became hotbeds for complaints, with users accusing the company of overpromising and underdelivering.

The operational chaos was compounded by Lanistar’s inability to scale its infrastructure to meet demand. Despite its aggressive marketing, the company appeared unprepared for the influx of users, resulting in a backlog of unresolved issues. This lack of preparedness suggested a fundamental disconnect between Kiziloz’s ambitious rhetoric and the practical realities of running a fintech enterprise.

Marketing Missteps

Lanistar’s marketing strategy, while initially effective in generating buzz, soon became a liability. The company’s reliance on social media influencers—many of whom lacked expertise in finance—drew criticism for promoting a product that was not fully developed. These endorsements often glossed over Lanistar’s regulatory troubles and operational shortcomings, creating a misleading impression of reliability. Critics argued that Kiziloz’s team prioritized hype over substance, using flashy campaigns to mask the company’s underlying weaknesses.

The fallout from Lanistar’s missteps was swift. By mid-2021, the company’s reputation was in tatters, with many questioning whether it could recover from its early failures. Kiziloz, however, remained defiant, insisting that Lanistar would overcome its challenges and emerge as a fintech leader. Yet, as of 2025, Lanistar’s operations remain opaque, with little evidence of meaningful progress. The company’s collapse serves as a cautionary tale of what happens when ambition outpaces accountability.

Nexus International and Megaposta: Gambling on Controversy

Undeterred by Lanistar’s failures, Kiziloz pivoted to the online gambling industry with Nexus International, a company that oversees the gambling platform Megaposta. Launched with the promise of transforming the digital betting landscape, Megaposta targeted emerging markets, particularly in Latin America, where online gambling is experiencing rapid growth. While some viewed Kiziloz’s pivot as a savvy strategic move, others saw it as an attempt to escape the shadow of Lanistar’s controversies. Regardless, Nexus International and Megaposta have proven to be no less contentious, drawing scrutiny for their questionable practices and operational issues.

Regulatory Scrutiny

Megaposta’s rapid expansion has not gone unnoticed by regulatory authorities. In several Latin American jurisdictions, the platform has faced questions about its licensing and adherence to fair play standards. Regulators have expressed concerns over Megaposta’s lack of transparency in its operations, particularly regarding the handling of user funds and the integrity of its betting algorithms. In some cases, authorities have issued warnings or imposed restrictions on the platform, citing potential risks to consumers.

The regulatory challenges facing Megaposta echo those encountered by Lanistar, suggesting a recurring pattern in Kiziloz’s ventures. Critics argue that his apparent disregard for compliance reflects a broader willingness to cut corners in pursuit of profit. This approach not only jeopardizes consumers but also undermines the long-term viability of his businesses.

User Complaints

Megaposta’s user base has been vocal about its dissatisfaction with the platform. Common grievances include delayed payouts, arbitrary account suspensions, and unclear terms and conditions. Many users report feeling misled by Megaposta’s promotional offers, which often come with hidden restrictions that make it difficult to withdraw winnings. These complaints have fueled a growing perception that Megaposta prioritizes attracting new users over ensuring a fair and reliable experience for existing ones.

Social media platforms and online review sites are replete with stories of frustrated bettors who feel cheated by Megaposta’s practices. In some cases, users have accused the platform of manipulating odds or withholding funds without justification. While Nexus International has dismissed many of these claims as isolated incidents, the volume and consistency of complaints suggest deeper systemic issues.

Lingering Shadows of Lanistar

The controversies surrounding Lanistar have cast a long shadow over Nexus International and Megaposta. Many consumers and industry observers are wary of Kiziloz’s involvement, given his track record of unfulfilled promises. The parallels between Lanistar’s operational failures and Megaposta’s user complaints are striking, raising questions about whether Kiziloz has learned from past mistakes or is simply repeating them in a new industry.

Risk Factors and Red Flags

A closer examination of Kiziloz’s business practices reveals a series of troubling patterns that should give pause to anyone considering engaging with his ventures. These red flags span regulatory, operational, and ethical dimensions, painting a picture of an entrepreneur whose ambition often overshadows accountability.

Opaque Corporate Structures

Both Lanistar and Nexus International operate within complex and non-transparent corporate frameworks. The ownership and governance structures of these companies are difficult to decipher, making it challenging for stakeholders to hold decision-makers accountable. This opacity is particularly concerning in industries like fintech and gambling, where trust and transparency are paramount. The lack of clear information about Kiziloz’s role and the involvement of other key players raises suspicions about the integrity of his operations.

Regulatory Non-Compliance

Kiziloz’s repeated clashes with regulatory authorities are a glaring red flag. From the FCA’s warning against Lanistar to the scrutiny faced by Megaposta, his ventures have consistently operated on the fringes of legal and ethical boundaries. This pattern of non-compliance not only exposes consumers to financial risks but also signals a lack of respect for the regulatory frameworks that govern high-stakes industries. Investors and partners should be wary of associating with businesses that prioritize short-term gains over long-term legitimacy.

Aggressive Marketing, Questionable Substance

Kiziloz’s ventures are characterized by flashy marketing campaigns that often overpromise and underdeliver. Lanistar’s use of social media influencers and Megaposta’s enticing promotional offers are designed to attract attention but frequently lack the substance to back up their claims. This disconnect between marketing and reality erodes consumer trust and raises questions about the sustainability of Kiziloz’s business models.

Systemic Consumer Grievances

The persistent complaints from users of both Lanistar and Megaposta point to systemic issues within Kiziloz’s organizations. Whether it’s delayed card deliveries, unresponsive customer support, or unfair gambling practices, these grievances reflect a failure to prioritize customer satisfaction. The volume of negative feedback suggests that these are not isolated incidents but rather indicative of deeper operational and cultural flaws.

Associated Businesses and Websites

Kiziloz’s business empire extends beyond Lanistar and Megaposta, encompassing a network of entities whose connections are often murky. Key associated businesses include:

- Nexus International: The parent company overseeing Megaposta and potentially other gambling platforms. Its rapid expansion and regulatory challenges mirror those of Kiziloz’s earlier ventures.

- Target Steel: A company involved in flat-rolled steel products. While its link to Kiziloz is less clear, its inclusion in his business portfolio warrants further scrutiny.

- Target Metal Systems: A provider of custom metal solutions, possibly tied to Kiziloz’s broader network. The lack of transparent information about its operations raises questions about its role in his ecosystem.

This web of businesses underscores the complexity of Kiziloz’s operations and the challenges of tracing accountability within his empire. Potential stakeholders should approach these entities with caution, as their ties to Kiziloz may carry similar risks of regulatory and operational issues.

Visual Illustrations

To provide a clearer picture of Kiziloz’s troubled ventures, the following visual aids are recommended:

- Lanistar Regulatory Warning: A screenshot of the FCA’s 2020 warning against Lanistar, highlighting the regulator’s concerns about its unauthorized operations.

- User Testimonies: Collated excerpts from online reviews and social media posts by dissatisfied Megaposta users, detailing issues like delayed payouts and account suspensions.

- Corporate Web Diagram: A visual representation of the connections between Kiziloz’s businesses, illustrating the opaque and interwoven nature of his corporate structure.

These visuals serve to underscore the tangible evidence of Kiziloz’s operational and ethical shortcomings, making the risks associated with his ventures more concrete for readers.

Conclusion

Gurhan Kiziloz’s story is one of undeniable ambition, but it is equally a cautionary tale of what happens when persistence is divorced from accountability. His ventures, from the fintech fiasco of Lanistar to the gambling controversies of Nexus International and Megaposta, are marked by a consistent pattern of regulatory violations, operational failures, and consumer distrust. While Kiziloz presents himself as a visionary entrepreneur capable of disrupting industries, the evidence suggests a more troubling reality: a trail of broken promises, dissatisfied customers, and ethical lapses.

For potential investors, partners, and consumers, the risks of engaging with Kiziloz’s ventures are significant. The opaque corporate structures, repeated regulatory clashes, and systemic consumer grievances all point to a business model that prioritizes hype over substance. Due diligence is not just advisable—it is essential. The allure of quick profits or innovative products should not blind stakeholders to the need for transparency, compliance, and ethical conduct.

As Kiziloz continues to navigate the high-stakes worlds of fintech and gambling, his legacy remains a work in progress. However, unless he addresses the fundamental flaws in his approach, his empire of ventures risks crumbling under the weight of its own contradictions. For now, the story of Gurhan Kiziloz serves as a stark reminder that in business, persistence alone is not enough—trust, integrity, and accountability are the true foundations of lasting success.