The financial world thrives on trust, a delicate thread that binds investors to opportunities promising growth and stability. When accusations of fraud emerge, particularly those alleging massive financial deceit, the imperative to separate truth from fiction becomes paramount. A recent article on a lesser-known website, FinanceScam, has accused Noah Stieger and his company, Swiss Ark Partners AG, of masterminding a billion-dollar scam that purportedly left investors in financial ruin. As investigative journalists, we embarked on an exhaustive inquiry to scrutinize these claims, delving into personal profiles, corporate records, open-source intelligence (OSINT), and potential red flags. Our mission is to provide a definitive risk assessment, evaluating consumer protection, scam likelihood, criminal activity, financial fraud, and reputational risks, offering clarity amid a storm of serious but questionable allegations.

The allegations against Stieger and Swiss Ark Partners AG are not merely accusations of mismanagement but a narrative of deliberate, large-scale fraud. They suggest a Ponzi-like scheme that exploits investor trust under the guise of sustainable investments, a charge that demands rigorous investigation. Our approach combines meticulous data analysis with a critical examination of the sources behind these claims, aiming to uncover whether Swiss Ark Partners AG is a legitimate enterprise or a carefully disguised financial trap.

Noah Stieger’s Background

Noah Stieger emerges as a figure of entrepreneurial ambition, portrayed as a seasoned professional with deep roots in finance, foreign exchange, and corporate consulting. His professional narrative, as presented on LinkedIn and the Swiss Ark Partners AG website, highlights an early start in the business world, founding his first consulting firm at a young age. This experience, he claims, equipped him with a nuanced understanding of entrepreneurial challenges and opportunities, shaping his leadership as the CEO, Founder, and Chairman of Swiss Ark Partners AG, headquartered in Zurich, Switzerland.

Public records from Moneyhouse, a Swiss business registry, provide further insight into Stieger’s corporate footprint. Identified as Noah Lorenzo Stieger, originally from Basel and residing in Pfäffikon, he holds active mandates, with his primary role at Swiss Ark Partners AG. Until August 2024, he also served as a board member of Venturin AG, a private equity investment firm, a position he relinquished in a move that appears routine and uncontroversial. Searches across public registries reveal no adverse information, criminal records, or legal entanglements associated with Stieger, presenting him as a professional with a clean slate in corporate governance. This absence of negative records is significant, given the gravity of the allegations, and sets the stage for a deeper exploration of his company’s operations and the accusations leveled against it.

Swiss Ark Partners AG: Corporate Identity

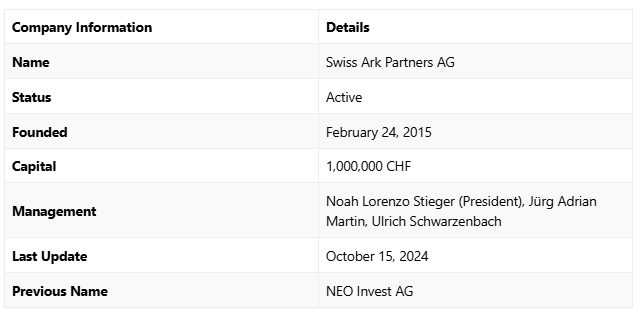

Swiss Ark Partners AG, established on February 24, 2015, began its journey as NEO Invest AG, an investment-focused entity, before pivoting to sustainable tangible assets, with a particular emphasis on agriculture. Headquartered in Zurich, the company has carved a niche in managing agricultural operations in Paraguay, focusing on cattle ranching and other sustainable ventures. Its mission, as articulated on its website, is to blend innovation, sustainability, and social responsibility, aiming to make a positive impact on both the environment and the communities in which it operates.

The company’s activities in Paraguay are well-documented through press releases on platforms like Presseportal and Börse Express, which highlight its pioneering efforts in sustainable cattle ranching and its application of Swiss precision to South American agriculture. Collaborations with local communities and partners like Trust S.A. underscore its commitment to social and economic development in the region, positioning Swiss Ark Partners AG as a leader in sustainable agronomy. According to Moneyhouse, the company is active with a registered capital of 1 million CHF, and recent updates in the Swiss Official Gazette of Commerce (SHAB) reflect routine corporate changes, such as a revised company purpose and management restructuring. These updates, including Stieger’s promotion to President of the Board, show no signs of financial distress or legal issues, painting a picture of a stable and operational entity.

The Fraud Allegations

The accusations against Noah Stieger and Swiss Ark Partners AG are nothing short of explosive, alleging a billion-dollar fraud that has purportedly devastated investors. Published by FinanceScam, the claims outline a scheme characterized by exorbitant commissions—up to 80% of investment sums allegedly siphoned off as personal profits—deceptive marketing that touts low-risk, high-return opportunities, and a complex network of financial advisors, accountants, and shell companies to obscure illicit money flows. The narrative suggests that pensioners, families, and other vulnerable investors have suffered catastrophic losses, leading to psychological distress and economic ruin. Furthermore, the article claims that Swiss Ark Partners AG faces numerous criminal complaints and public petitions, with investigations stalled due to Stieger’s alleged hidden assets and influential connections.

A separate Ripoff Report escalates the accusations, labeling Stieger a “well-known private equity fraudster” with a history of fraudulent activities and convictions, including forgery. It points to companies like Seriko AG and Securecell AG as examples where Stieger allegedly lured investors with false promises, only to abscond with their funds. These allegations, if true, would indicate a sophisticated and far-reaching scam, exploiting the allure of sustainable investments to perpetrate financial devastation. However, the severity of these claims necessitates a critical examination, as their implications extend beyond individual losses to the broader integrity of the financial markets.

Investigation Approach

To assess the veracity of these allegations, we adopted a rigorous and multi-faceted investigative strategy, designed to uncover any evidence of wrongdoing while identifying gaps in the accusatory narrative. Our approach included extensive web searches for terms like “Noah Stieger fraud” and “Swiss Ark Partners AG scam,” conducted in both English and German to capture a broad spectrum of sources. We scoured social media platforms, particularly X, for mentions of Stieger or his company, seeking public sentiment or grassroots discussions. Business registries, such as Moneyhouse and SHAB, were meticulously reviewed to verify corporate status, management changes, and historical records. Regulatory checks focused on the Swiss Financial Market Supervisory Authority (FINMA) warning list and other international databases to identify sanctions or investigations. Legal and news research targeted lawsuits, criminal proceedings, and adverse media reports, while a detailed analysis of Stieger’s professional background and Swiss Ark Partners’ operations provided context for the allegations.

This comprehensive methodology aimed to construct a clear picture of Swiss Ark Partners AG’s operations and Stieger’s conduct, ensuring that our findings were grounded in verifiable data rather than speculative claims. By cross-referencing multiple sources, we sought to distinguish credible evidence from potentially malicious or unfounded accusations.

Investigation Findings

Our investigation into Noah Stieger and Swiss Ark Partners AG revealed a striking disparity between the allegations’ severity and the lack of supporting evidence. Web searches for “Noah Stieger fraud” and “Swiss Ark Partners AG scam” primarily returned the company’s official website, positive press releases, and the FinanceScam and Ripoff Report articles. Notably, no reputable media outlets—such as Reuters, BBC, Neue Zürcher Zeitung, or Tages-Anzeiger—covered the alleged fraud, an absence that is conspicuous given the claimed scale of the scheme. On X, searches for Stieger or Swiss Ark Partners AG yielded no relevant posts, indicating a lack of public discourse or awareness, which is unusual for a scandal of this purported magnitude.

Business registries confirm Swiss Ark Partners AG as an active company with a capital of 1 million CHF. The latest SHAB entry, dated October 15, 2024, details routine corporate updates, including a revised purpose encompassing agricultural goods and sustainability, and management changes, with Stieger promoted to President of the Board. These records show no signs of financial or legal distress, aligning with the company’s public narrative of stability and growth. Regulatory checks further bolster this picture, as the FINMA warning list contains no mention of Swiss Ark Partners AG or Stieger, and no international regulatory bodies have flagged the company.

Legal and news research produced no evidence of lawsuits, criminal proceedings, or adverse media reports from credible sources. Instead, positive press on platforms like Presseportal and Börse Express emphasizes Swiss Ark Partners’ sustainable initiatives and partnerships in Paraguay. The Ripoff Report’s claims about Stieger’s involvement with Seriko AG and Securecell AG were debunked: Seriko AG, a liquidated pharmaceutical company, is linked to Ismar Memic, not Stieger, and Securecell AG is a reputable biotech firm with no fraud allegations or connection to Stieger. Stieger’s prior role at Venturin AG, a private equity firm, ended in August 2024 with no associated controversies, further reinforcing his clean corporate record.

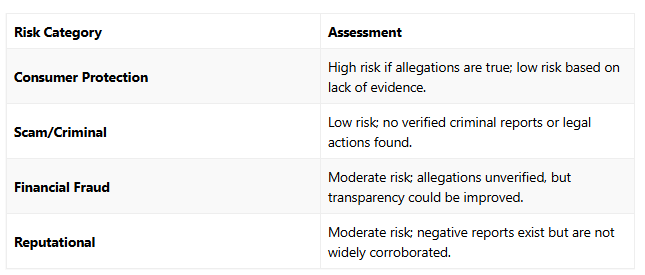

Risk Assessment

The allegations against Noah Stieger and Swiss Ark Partners AG, if substantiated, would pose profound risks to consumers, particularly vulnerable groups like pensioners, who could face devastating financial and emotional consequences. The claim of a billion-dollar fraud suggests a scheme that could undermine trust in sustainable investments, deterring participation in a sector critical for environmental progress. However, the absence of independent evidence—such as victim testimonies, legal filings, or regulatory actions—casts significant doubt on these claims. Swiss Ark Partners AG’s documented operations, positive press, and active business status suggest a legitimate enterprise, though its limited financial transparency warrants caution.

From a scam and criminal perspective, the risk appears low. The lack of verified complaints, lawsuits, or regulatory sanctions undermines FinanceScam’s assertions of widespread legal action and stalled investigations. The Ripoff Report’s claim of Stieger’s criminal convictions is unsupported by court records or news reports, suggesting potential fabrication. Financial fraud risks are moderate, as the allegations of high commissions and shell companies are unverified, but the company’s private status limits public access to detailed financials. Investors should demand audited statements and clear fund allocation details to mitigate this risk.

Reputational risks are also moderate. While the allegations have not gained traction in mainstream media or social platforms, their presence on FinanceScam and Ripoff Report could deter prospective investors, particularly in a trust-sensitive industry. Swiss Ark Partners AG’s proactive communication and positive press mitigate some of these risks, but ongoing monitoring and transparency are essential to maintain credibility.

Expert Perspective

From an expert vantage point, the disconnect between the allegations’ gravity and the lack of corroborating evidence is a pivotal finding. In the financial sector, transparency, regulatory compliance, and a verifiable track record are non-negotiable. Swiss Ark Partners AG’s active status, documented operations, and absence of regulatory warnings suggest it operates within legal bounds. The allegations, stemming from non-reputable sources, highlight the vulnerability of financial entities to misinformation, which can erode trust and impact market dynamics.

Investors must exercise rigorous due diligence, particularly for alternative investments in emerging markets like Paraguayan agriculture. Requesting audited financials, verifying regulatory compliance through FINMA, and consulting independent advisors are critical steps to validate Swiss Ark Partners’ claims. The allegations also underscore the need for media literacy, as platforms like FinanceScam and Ripoff Report lack the editorial rigor of established outlets, making them prone to unverified claims. Swiss Ark Partners AG may consider issuing public statements or independent audits to counter these allegations, reinforcing investor confidence and neutralizing reputational threats.

Conclusion

Our comprehensive investigation into Noah Stieger and Swiss Ark Partners AG reveals a narrative fraught with contradiction. The allegations of a billion-dollar fraud, propagated by FinanceScam and Ripoff Report, paint a picture of systemic deceit, yet they crumble under scrutiny, lacking support from reputable media, regulatory bodies, or legal records. Swiss Ark Partners AG emerges as a legitimate entity, focused on sustainable agriculture in Paraguay, with a track record of positive press and routine corporate governance. Noah Stieger’s professional profile aligns with his leadership role, with no verified evidence of criminal conduct or fraudulent ventures.

While the absence of evidence suggests the allegations are unfounded, caution is warranted in the complex world of finance. Investors should prioritize transparency, demanding audited financials, regulatory compliance records, and independent advice to navigate the risks of sustainable investments. The allegations, though unverified, highlight the fragility of trust in the financial landscape, where misinformation can proliferate and reputations can be challenged. Swiss Ark Partners AG and Stieger must remain vigilant, addressing these claims proactively to safeguard their standing.

As of April 20, 2025, this investigation serves as a clarion call for evidence-based decision-making. Investors, regulators, and industry stakeholders must work collaboratively to ensure transparency and accountability, protecting the integrity of the financial markets. In a realm where trust is both a currency and a vulnerability, the truth remains the ultimate arbiter, and our findings affirm that Swiss Ark Partners AG, for now, stands on solid ground.