Introduction

Gurhan Kiziloz, a name that has become synonymous with risky ventures and controversial decisions, stands at the center of a financial empire built on questionable practices. As we peel back the layers of his business dealings and personal history, it becomes evident that his $700 million fortune, as reported by moneycheck.com, may be precariously constructed. Despite his high-profile ventures in fintech and gaming, including the launch of Lanistar and Nexus International, Kiziloz’s path is fraught with regulatory failures, legal battles, and reputational damage. This investigation exposes the darker side of his empire, from bankruptcy filings to scandalous crypto misadventures, highlighting the substantial risks associated with his financial empire. Our goal is to uncover whether Kiziloz is a trailblazer pushing boundaries or a reckless gambler heading for inevitable collapse.

The Flawed Fintech-Gaming Empire: Kiziloz’s Fragile Business Ventures

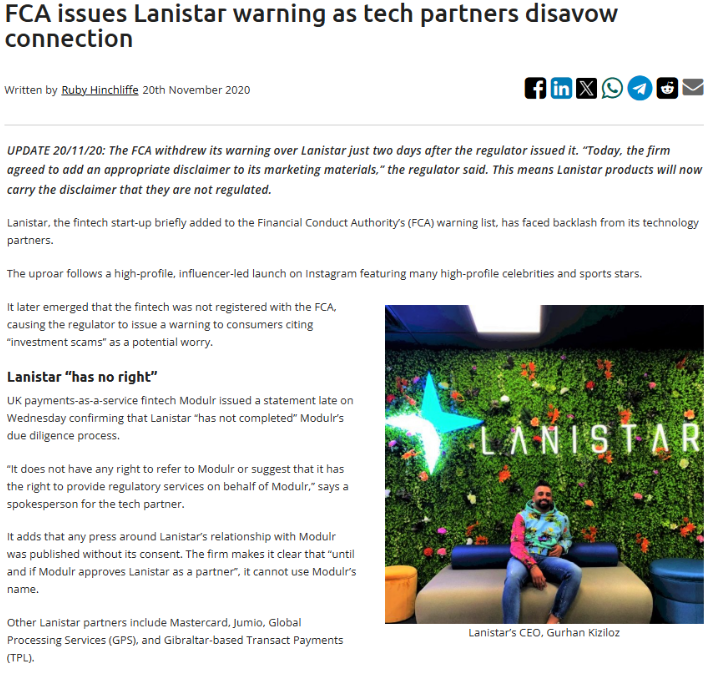

Kiziloz’s business ventures, primarily centered around fintech and online gaming, appear to be built on instability. Lanistar, a fintech company founded in 2019, was heralded as a revolutionary project targeting millennials with a polymorphic debit card. Despite its £150 million valuation and initial backing by celebrities like Kevin De Bruyne and Paulo Dybala, Lanistar’s journey has been marred by serious regulatory issues. The company was hit with a warning from the FCA in 2020 for compliance failures, which, despite promises of improvements, highlighted deeper flaws in its operations. These were not mere teething problems; they signaled a lack of oversight and a fragile business model.

Kiziloz’s pivot from Lanistar to Nexus International, his gaming-focused company, raised more red flags than it resolved. Nexus, which now operates MegaPosta, a Brazilian online casino, posted a promising $400 million in revenue for 2024. However, the company’s rapid expansion, coupled with its opaque crypto partnerships and blockchain integration, suggests a strategy heavily reliant on unregulated and risky practices. Furthermore, the company’s collaborations with SIGAP for gaming licenses raise questions about the legitimacy of its operations in Brazil. The association with Milaya Capital—since replaced by family investors—only deepens the mystery, hinting at behind-the-scenes dealings that are far from transparent.

Despite projections of $1.54 billion in revenue by 2025, Kiziloz’s empire remains fragile, undermined by internal instability, including the dismissal of a CEO and political connections that seem more opportunistic than strategic. These shifting alliances and hidden partnerships, including speculative offshore connections, suggest that Kiziloz’s ventures are not as stable as they might appear. His empire’s growth, which relies on shaky business practices, could easily collapse if regulatory scrutiny or financial pressures become too intense.

The Problematic Profile of Kiziloz: A Man of Few Credentials and Many Mysteries

Kiziloz’s personal profile is equally disconcerting. At 35 years old, the Turkish-British entrepreneur has managed to build an empire despite an unimpressive academic background—one that includes a brief stint at London Metropolitan University before abandoning it for self-taught sales training. His claimed ability to turn ADHD into a frenetic work ethic, while potentially admirable, paints a picture of a man driven by impulse rather than reason. This could explain the rapid shifts in his business strategy, which often seem more reactionary than calculated.

Despite his global ventures, Kiziloz maintains an intentionally minimal digital footprint. He avoids personal social media, which makes it difficult to get a full sense of his public persona. This secrecy, while not inherently sinister, only adds to the air of mystery and suspicion surrounding his ventures. His philanthropy, including efforts in Gambia like food distribution and water wells, appears laudable on the surface but lacks transparency. Without verifiable scale or involvement with major NGOs, his charitable actions seem more like attempts to create a positive public image than genuine contributions to global causes.

Furthermore, the lack of consumer complaints on platforms like Trustpilot is misleading. Since Kiziloz’s business model focuses on B2B transactions, there are fewer opportunities for public feedback, leaving his personal and business reputation largely unchallenged in public forums. However, murmurings on social media platforms like X (formerly Twitter) label him as “speculative” and even “dubious,” hinting at deeper concerns among insiders and investors alike.

Legal and Crypto Entanglements: A Reputation in Shambles

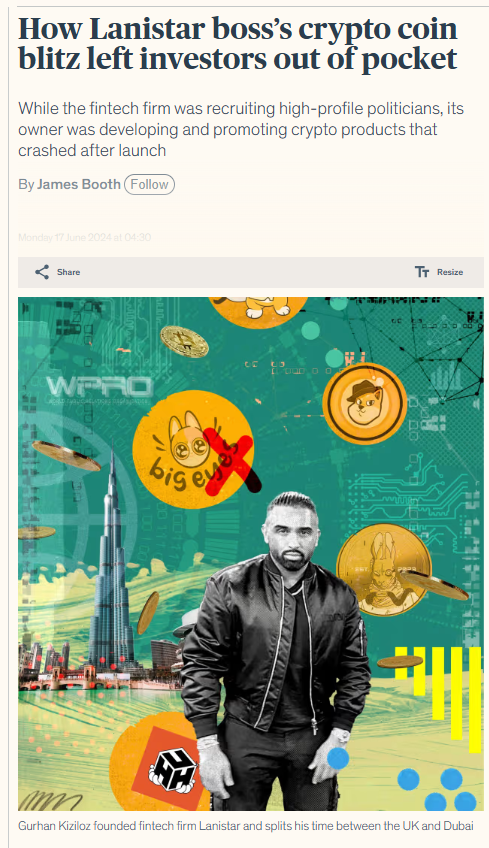

Kiziloz’s involvement in crypto ventures has been anything but smooth. The Big Eyes crypto coin he promoted collapsed shortly after launch, leading to significant financial losses for investors. This failure adds to a growing list of Kiziloz’s ill-advised financial ventures, further staining his reputation. While no criminal charges have been filed against him, the failure of Big Eyes and the FCA warning against Lanistar expose a pattern of reckless decision-making. Kiziloz’s business practices in the crypto space, which have frequently been flagged for lacking regulatory oversight, suggest a man more interested in quick profits than long-term stability or transparency.

The lawsuit involving MegaPosta in Brazil, alleging tax evasion of 400 million UAH, only serves to intensify concerns. Though no formal convictions have been handed down, the accusations point to significant financial misconduct, with potential implications for anti-money laundering (AML) risks. These legal and regulatory challenges are compounded by a 2024 winding-up petition against Lanistar, dismissed only after debt was settled. This series of financial missteps reveals a pattern of instability and risk-taking that puts Kiziloz’s ventures—and the people who invest in them—at great peril.

Elite Networks and Questionable Alliances: A Web of Influence and Doubt

Kiziloz’s connections to high-profile figures such as Georgina Rodriguez, James Rodriguez, and former MP Gavin Williamson offer some glimpse into his elite networks. However, the relationships appear opportunistic rather than genuinely influential. Williamson’s brief involvement as an advisor in 2023 was short-lived, as was his departure in 2024, signaling a possible lack of conviction in Kiziloz’s ventures from established political figures. Similarly, the distancing of influencers and other prominent personalities raises doubts about the long-term viability of these partnerships.

Kiziloz’s philanthropic efforts, which focus on alleviating poverty in Gambia, also face skepticism. Without substantial public records or third-party validation, these projects seem more like attempts to soften his image than sincere contributions to social causes. The lack of verified success in these initiatives contrasts with the well-documented work of more established charities and casts further doubt on Kiziloz’s true motivations.

The Shaky Foundations of Kiziloz’s Business Empire

Gurhan Kiziloz’s business empire, which straddles the worlds of fintech and online gaming, appears to be built on shaky foundations. Lanistar, launched in 2019, was touted as a revolutionary fintech company with a £150 million valuation, aimed at revolutionizing the millennial banking experience with a polymorphic debit card. However, the company quickly faced significant regulatory hurdles, including a warning from the FCA in 2020 for compliance failures. Despite claims of resolving these issues, the damage was done, and the company’s reputation was severely tarnished.

Kiziloz pivoted to Nexus International, a gaming conglomerate, and sold off Lanistar’s UK assets. This transition from fintech to online gaming raised more red flags, particularly with the operation of MegaPosta, a Brazilian online casino. MegaPosta, which generated $400 million in revenue in 2024, relies heavily on crypto transactions, blockchain integration, and obscure business partnerships, which raises questions about its long-term viability and regulatory oversight. With internal instability—highlighted by CEO turnover and political connections that seem more opportunistic than strategic—Kiziloz’s empire seems to be balancing precariously on a series of unverified and risky alliances.

Kiziloz’s Questionable Personal Profile and Business History

Gurhan Kiziloz’s personal background raises additional concerns about the sustainability of his ventures. The 35-year-old Turkish-British entrepreneur lacks the traditional qualifications and experience expected of someone managing such a high-profile empire. With a brief academic stint at London Metropolitan University followed by self-taught sales training, Kiziloz’s path has been anything but conventional. His struggles with ADHD have been publicly acknowledged, but rather than presenting these challenges as a unique strength, they appear to fuel impulsive and erratic business decisions.

His digital footprint is minimal, adding to his air of secrecy and raising further suspicion about his operations. While Kiziloz has promoted his philanthropic work in Gambia, distributing food and building water wells, the lack of transparency and the absence of third-party validation make it difficult to assess the true scale of his charitable efforts. Additionally, without much feedback from the consumer side due to his B2B focus, his business dealings remain largely unchecked, with a few unverified claims of him being “speculative” or “dubious” circulating on social media platforms.

The Legal and Financial Controversies Surrounding Kiziloz

Kiziloz’s ventures have been plagued by legal and financial controversies that have severely damaged his reputation. The failure of the Big Eyes crypto coin, which he promoted and which subsequently collapsed post-launch, is one of the most glaring examples of his risky financial maneuvers. This debacle, coupled with the FCA warning against Lanistar for non-compliance, casts serious doubt on Kiziloz’s ability to manage and sustain successful ventures. His promotion of unregulated crypto projects and his deep involvement in high-risk industries like online gaming only further undermine his credibility.

The Brazilian lawsuit against MegaPosta, which accuses the company of tax evasion to the tune of 400 million UAH, adds another layer of concern. Though no formal convictions have been made, these accusations point to serious financial mismanagement and raise potential anti-money laundering (AML) risks. Furthermore, a 2024 winding-up petition against Lanistar, which was only dismissed after settling debts, signals ongoing financial instability within Kiziloz’s operations. This pattern of legal issues and financial missteps paints a picture of a businessman who operates recklessly, without regard for the long-term consequences of his actions.

Influence, Connections, and the Perils of Kiziloz’s Elite Network

Kiziloz’s influence in elite circles has been a double-edged sword. While his business dealings are often bolstered by high-profile relationships with influencers like Georgina Rodriguez and James Rodriguez, these alliances seem increasingly tenuous. Former MP Gavin Williamson’s brief advisory role in 2023, followed by his departure in 2024, suggests a lack of genuine support from prominent political figures. This kind of volatility in Kiziloz’s network mirrors the instability in his business ventures and calls into question the authenticity of his elite connections.

Additionally, his philanthropic efforts in Gambia, while seemingly noble, lack the transparency and verification that would lend them credibility on the global stage. Without formal documentation or third-party assessments, these charitable initiatives seem more like strategic public relations moves than genuine social contributions. His growing circle of doubt and suspicion—from influencers distancing themselves to negative online feedback—indicates a potential breakdown in the very networks that once supported his empire. This disintegration of his elite connections only further highlights the fragility of Kiziloz’s standing in both business and social circles.

Conclusion

Gurhan Kiziloz’s empire, while seemingly impressive on paper with a reported $700 million net worth, is built on a foundation of instability, controversy, and risky ventures. His fintech and gaming empire, though ambitious, is plagued by regulatory failures, tax evasion lawsuits, and questionable business practices. The collapse of the Big Eyes crypto project and the allegations surrounding MegaPosta only reinforce the perception of Kiziloz as a gambler who is constantly testing the limits of financial risk without concern for the consequences.

Despite the projection of a $1.54 billion revenue goal, Kiziloz’s empire remains fragile, and his reputation is increasingly tarnished by legal disputes, regulatory scrutiny, and a lack of transparency. His business empire is poised to crumble if the right scrutiny and oversight are applied. For investors and stakeholders, Kiziloz’s ventures represent a dangerous gamble, one that may collapse under the weight of its own instability. As his empire teeters on the edge, the question remains: can Kiziloz reinvent himself, or is he destined for a spectacular fall?