Introduction: A Facade of Trust Shattered

In the world of retail trading, where fortunes are made and lost in seconds, trust is the ultimate currency. EuropeFX, a Cyprus-based brokerage, built its reputation on promises of transparency, a “Straight Through Processing (STP)” model, and a glamorous sponsorship deal with German football club Hertha Berlin. Marketed as a safe haven for traders, it boasted CySEC regulation and a commitment to empowering clients with educational resources and competitive spreads. However, this carefully crafted image concealed a darker truth: EuropeFX, under the stewardship of figures like Michael Landsberger, allegedly orchestrated one of the most devastating retail trading scandals in recent history.

This investigation, drawing on leaked court documents, regulatory filings, victim testimonials, and insider accounts, uncovers the mechanisms of a sophisticated fraud. From aggressive sales tactics to manipulated trades and blocked withdrawals, EuropeFX’s operations left thousands of clients across the globe financially ruined. At the heart of the scandal is Michael Landsberger, the former General Manager of EuropeFX Germany and CEO of its tied agent, SF Markets—a firm raided by Berlin police for financial crimes. What began as a beacon of opportunity for retail investors ended in betrayal, exposing systemic flaws in regulation, corporate accountability, and consumer protection.

Section 1: The Rise of EuropeFX and the Hertha Berlin Mirage

1.1 Crafting Credibility Through Sponsorship

EuropeFX emerged in the mid-2010s as a Cyprus-based brokerage under Maxiflex Ltd, a Cyprus Investment Firm (CIF) regulated by the Cyprus Securities and Exchange Commission (CySEC). Its branding emphasized accessibility, targeting novice traders with promises of low spreads, robust educational tools, and a transparent STP model that ensured no conflict of interest between broker and client. By 2018, EuropeFX had cemented its legitimacy through a high-profile sponsorship deal with Hertha Berlin, a prominent Bundesliga football club.

The partnership was a masterstroke in public relations. Michael Landsberger, then General Manager of EuropeFX Germany, publicly celebrated the deal, stating, “Our shared values of hard work, dedication, and a never-ending determination to be the very best make this partnership a perfect fit.” The Hertha Berlin logo adorned EuropeFX’s marketing materials, and the brokerage’s visibility soared as it leveraged the club’s fanbase to attract clients. For many investors, the association with a respected sports institution signaled trustworthiness—a perception EuropeFX exploited to devastating effect.

1.2 The Cracks Beneath the Surface

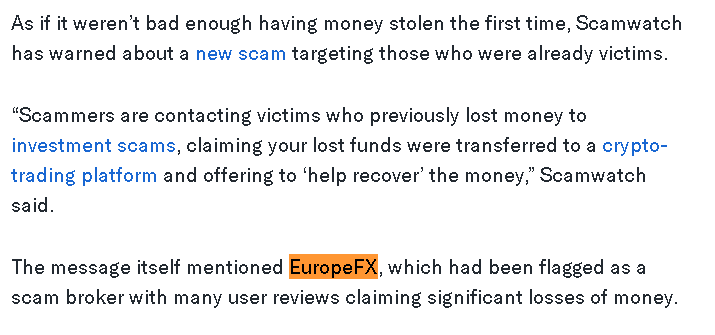

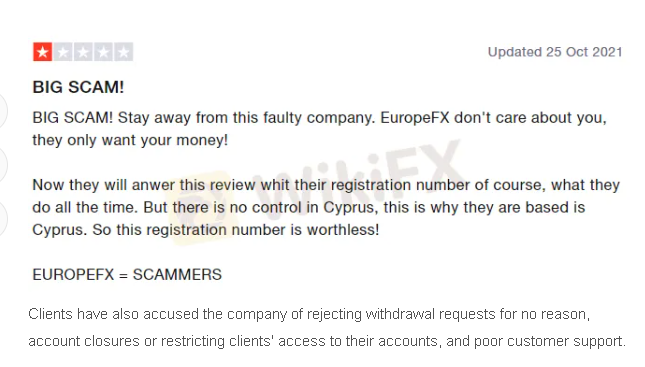

Behind the polished facade, EuropeFX’s operations were far from transparent. By 2019, warning signs emerged when the Australian Securities and Investments Commission (ASIC) revoked Maxiflex Ltd’s license, citing “unconscionable conduct” and misleading representations to clients. ASIC’s investigation revealed a pattern of aggressive sales tactics, including cold-calling vulnerable individuals and pressuring them into high-risk trades. Clients reported trades being manipulated to incur losses, stop-loss orders being ignored, and withdrawal requests being denied or delayed indefinitely.

These practices bore the hallmarks of a boiler-room operation, where brokers prioritize commissions over client interests. Victim testimonials described relentless phone calls from EuropeFX agents, often using high-pressure tactics to extract deposits. One UK client recounted being persuaded to transfer £90,000 from their pension fund, only to lose access to the funds when EuropeFX abruptly ceased UK operations. Such stories were not isolated but part of a systemic pattern that would soon unravel the brokerage’s carefully curated image.

Section 2: Michael Landsberger and the SF Markets Connection

2.1 The German Front: SF Markets’ Role

EuropeFX’s German operations were facilitated through SF Markets, a tied agent regulated by Germany’s Federal Financial Supervisory Authority (BaFin). Michael Landsberger, in addition to his role as General Manager of EuropeFX Germany, served as CEO of SF Markets, positioning him as a central figure in the brokerage’s European strategy. SF Markets acted as a conduit for EuropeFX, onboarding German clients and executing trades under the parent company’s umbrella.

However, SF Markets was not merely a passive intermediary. Former employees, speaking anonymously, revealed a culture of intense pressure to meet “deposit targets.” Sales agents were incentivized to push clients into depositing large sums, often through deceptive promises of guaranteed returns or exclusive trading opportunities. These tactics mirrored the complaints leveled against EuropeFX’s global operations, suggesting a coordinated strategy across jurisdictions.

In 2022, SF Markets’ operations came to an abrupt halt following a police raid in Berlin. Authorities seized records and equipment, investigating allegations of fraud, money laundering, and unauthorized trading. The raid marked a turning point, exposing Landsberger’s dual role and raising questions about his accountability in the broader EuropeFX scandal.

2.2 A Convenient Omission

In the aftermath of SF Markets’ collapse, Michael Landsberger distanced himself from the controversy. His LinkedIn profile, a common tool for professional branding, conspicuously omits any mention of his tenure at EuropeFX or SF Markets. Instead, it highlights his current role as an executive at Pumpkin, a pet care company—a stark departure from the high-stakes world of financial trading.

This erasure is no coincidence. By scrubbing his association with EuropeFX and SF Markets, Landsberger appears to be attempting to rewrite his professional narrative. Yet, the paper trail of court documents, regulatory filings, and victim accounts ties him inextricably to the scandal, raising questions about his role in orchestrating or enabling the fraudulent practices that devastated clients.

Section 3: The Mechanics of Deception

3.1 A Litany of Grievances: Victim Testimonies

The scale of EuropeFX’s alleged fraud is vividly captured in over 368 Trustpilot reviews, where clients detail their harrowing experiences. These accounts paint a consistent picture of manipulation and betrayal:

- Pension Theft: A UK retiree described being coerced by a broker named Jacob Tura into transferring £90,000 from their pension fund. After the funds were deposited, EuropeFX ceased UK operations, leaving the client with no recourse.

- Stop-Loss Manipulation: Multiple traders reported that agents, including one named Virgil Craliu, deliberately removed stop-loss orders, triggering catastrophic losses. This tactic ensured clients’ accounts were wiped out, maximizing broker commissions.

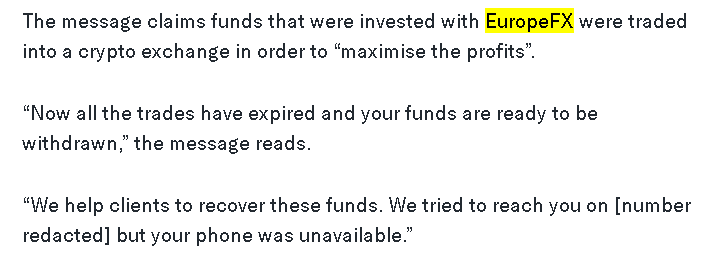

- Fake Crypto Refunds: After EuropeFX’s liquidation, victims received calls from individuals claiming to represent recovery firms. These callers demanded upfront fees to unlock “frozen Bitcoin” accounts, a classic recovery scam that compounded victims’ losses.

These testimonials underscore a deliberate strategy to exploit trust. Clients were lured with promises of wealth, only to face relentless pressure and financial ruin.

3.2 Regulatory Failures and Liquidation

EuropeFX’s misconduct did not go unnoticed by regulators, but their response was woefully inadequate. In 2021, CySEC imposed a €150,000 fine on Maxiflex Ltd for violating investor protection rules, including failures in client due diligence and transparency. However, the fine was a mere slap on the wrist, and CySEC’s oversight failed to halt EuropeFX’s operations.

By 2023, Maxiflex Ltd entered liquidation, leaving clients stranded. The liquidation process revealed a stark reality: clients were ineligible for Cyprus’ Investor Compensation Fund (ICF), which caps claims at €20,000 and excludes many retail investors. For those who had lost life savings or retirement funds, the lack of recourse was devastating.

Section 4: Criminal Investigations and Legal Battles

4.1 The Berlin Raid and Criminal Charges

The 2022 police raid on SF Markets marked a critical escalation in the EuropeFX saga. Berlin authorities targeted Michael Landsberger and other executives, seizing records that allegedly documented fraudulent practices. The charges were severe:

- Unauthorized Trading: Clients were coerced into high-leverage positions without consent, often leading to rapid account depletion.

- Misuse of Client Funds: Deposits were diverted to offshore accounts, raising suspicions of money laundering and embezzlement.

The raid sent shockwaves through the industry, exposing the extent of EuropeFX’s operations in Germany and Landsberger’s pivotal role. While the investigation remains ongoing, the allegations suggest a coordinated effort to defraud clients on a massive scale.

4.2 Global Litigation and Regulatory Warnings

The fallout from EuropeFX’s collapse extended beyond Germany. In Australia, class-action lawsuits allege €2 billion in losses between 2018 and 2019, targeting Maxiflex Ltd and its affiliates. These suits claim EuropeFX systematically misled clients about the risks of trading, using high-leverage products to generate commissions at the expense of investor capital.

In the UK, the Financial Conduct Authority (FCA) issued warnings about EuropeFX, but the brokerage exploited regulatory arbitrage by operating under CySEC’s jurisdiction. This allowed EuropeFX to target UK clients while evading stricter FCA oversight, highlighting the challenges of cross-border regulation.

Section 5: Assessing the Damage and Systemic Failures

5.1 Consumer Protection Shortcomings

The EuropeFX scandal exposed glaring gaps in consumer protection:

- No Recourse for Victims: The liquidation of Maxiflex Ltd left clients ineligible for compensation, as Cyprus’ ICF excluded many retail investors. Even eligible claims were capped at €20,000, a fraction of the losses reported by victims.

- Regulatory Blind Spots: CySEC’s failure to act on ASIC’s 2019 sanctions allowed EuropeFX to continue operating, exploiting jurisdictional gaps to target clients globally.

These failures underscore the vulnerability of retail investors in an industry where regulatory oversight is fragmented and enforcement is inconsistent.

5.2 Reputational Risks for Partners

Hertha Berlin, once a proud partner of EuropeFX, faced significant backlash for its role in legitimizing the brokerage. The sponsorship deal, intended to enhance the club’s brand, instead tarnished its reputation as fans and investors questioned its due diligence. The scandal has prompted broader scrutiny of sponsorship deals with high-risk financial firms, with sports organizations now wary of associating with unregulated or controversial entities.

5.3 Hallmarks of Systemic Fraud

The EuropeFX case exhibits classic indicators of systemic fraud:

- Aggressive Cold Calls: Victims reported relentless pressure to deposit funds, often targeting vulnerable individuals with limited financial literacy.

- Fake Balance Manipulation: Traders saw inflated account balances to encourage further deposits, only to find funds inaccessible during withdrawal attempts.

- High-Risk Leverage: EuropeFX promoted leveraged products that amplified losses, prioritizing broker profits over client safety.

These tactics, combined with a lack of regulatory accountability, created a perfect storm for fraud.

Section 6: Expert Insights and the Path Forward

6.1 A Call for Accountability

Dr. Elena Marquez, a financial fraud analyst, offers a scathing assessment of the EuropeFX scandal: “This case exemplifies the dangers of regulatory fragmentation. CySEC’s failure to act on ASIC’s warnings enabled cross-border fraud, while Landsberger’s dual role in SF Markets and EuropeFX suggests a deliberate strategy to exploit jurisdictional gaps. Until regulators harmonize enforcement and ban high-risk leverage, retail investors will remain vulnerable.”

Dr. Marquez advocates for stricter oversight, including real-time monitoring of broker activities and mandatory disclosures of commission structures. She also calls for banning cold-calling in financial services, a practice that disproportionately harms vulnerable populations.

6.2 Lessons Unlearned

The EuropeFX scandal is not an isolated incident but part of a broader pattern in the retail trading industry. Similar cases, such as the collapse of FXCM and IronFX, highlight the recurring failure of regulators to protect investors from predatory practices. The lack of global coordination allows firms to exploit regulatory arbitrage, moving operations to jurisdictions with lax oversight when faced with sanctions.

Conclusion: A Betrayal of Trust and a Call for Reform

The collapse of EuropeFX is a cautionary tale of deception, greed, and systemic failure. While Michael Landsberger attempts to rebrand himself in the pet care industry, thousands of victims are left grappling with financial ruin. The scandal reveals not just the actions of one rogue brokerage but a network of enablers—from regulators who failed to act to sponsors who lent credibility to a fraudulent enterprise.

For investors, the lesson is clear: trust must be earned, not assumed. For regulators, the challenge is to bridge jurisdictional gaps and prioritize consumer protection over industry profits. Until systemic reforms are implemented, the next EuropeFX remains not just a possibility but an inevitability. The victims of this scandal deserve justice, and the industry must confront its failures to prevent history from repeating itself.