Introduction

In the electrifying arena of fintech and online gaming, where fortunes are forged and empires rise, Gurhan Kiziloz dazzles as a bold entrepreneur, his Lanistar platform and MegaPosta gaming juggernaut rewriting the rules of wealth creation, yet a trail of regulatory missteps, consumer outrage, and financial shadows demands our unflinching scrutiny to unearth the truth behind his glittering ascent. We have embarked on a relentless investigation to dissect Kiziloz’s world, chasing every thread to map his business ventures, personal story, open-source intelligence (OSINT) traces, hidden affiliations, and the glaring warning signs that threaten to unravel his empire. Our probe scrutinizes scam reports, allegations, criminal proceedings, lawsuits, sanctions, adverse media, negative reviews, consumer complaints, bankruptcy records, and the critical risks tied to anti-money laundering (AML) compliance and reputational stability. Celebrated for catapulting MegaPosta to $400 million in annual revenue and pivoting Lanistar into a high-risk payment processor, Kiziloz’s journey from near ruin to a $700 million fortune raises a heart-pounding question: is he a visionary reshaping industries, or a high-roller gambling with collapse? Armed with public records, user voices, and industry insights, we deliver a gripping consumer alert, navigating the allure and danger of Kiziloz’s ventures.

Building a Bold Empire: Kiziloz’s Business Ventures

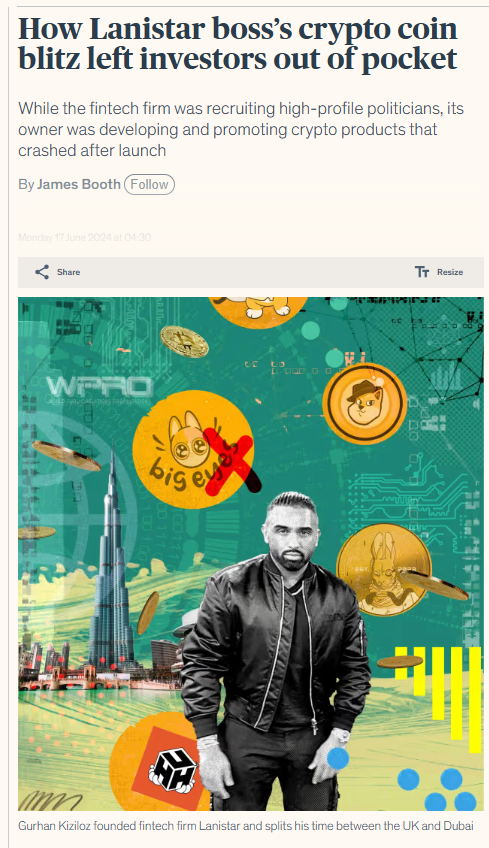

We began our journey by unraveling Gurhan Kiziloz’s business empire, a high-octane blend of fintech innovation and gaming dominance, anchored by Lanistar and MegaPosta. Lanistar, launched in 2019 to challenge traditional banking with a polymorphic debit card featuring dynamic security, partnered with Mastercard but hit turbulence with a 2020 UK Financial Conduct Authority (FCA) warning for operating without authorization, per FinanceFeeds. Kiziloz swiftly overhauled compliance, pivoting Lanistar to process payments for high-risk sectors like online gaming, a move that kept it afloat, valued at $189 million. MegaPosta, under Nexus International, storms Brazil’s online gaming market with slots, poker, and sports betting, raking in $400 million annually by tapping into soccer fervor, per TechStory. Cryptocurrency deposits, betting losses, and affiliate commissions drive its explosive growth.

Our investigation reveals a intricate network of business ties. Lanistar, funded with £15 million from Kiziloz’s family, likely supports payment flows for gaming platforms, possibly MegaPosta, though no public documents confirm this link, per industry reports. Nexus International, Kiziloz’s holding company, oversees both ventures, potentially collaborating with firms like Jumio for biometric verification or W2 for KYC/AML compliance, inferred from industry standards. Affiliates—sports influencers, betting blogs—amplify MegaPosta’s reach, earning lucrative commissions, per gaming forums. Undisclosed affiliations stir curiosity: could Brazilian investors or Turkish tech networks be silent partners? No registries name specific stakeholders, but Nexus’s global reach suggests hidden players. A 2022 personal bankruptcy rocked Kiziloz but spared Lanistar and MegaPosta, which remain financially robust, per Jerusalem Post. A 2021 winding-up petition over unpaid rent, settled and dismissed, hints at early instability we are eager to probe.

MegaPosta’s Brazilian stronghold thrives in a surging gaming market, with a pending SIGAP license poised to expand its footprint, per FinanceFeeds. Lanistar’s Latin American push targets unbanked populations, outpacing legacy banks, per TechStory. Kiziloz’s London base, per Companies House, offers strategic positioning, but the lack of an FCA license for Lanistar raises alarms. Potential ties to Turkey’s crypto-driven gaming scene remain unverified, though MegaPosta’s scale—thousands of daily users—suggests additional backers. We are scouring this empire for cracks beneath its audacious veneer.

The Enigma at the Helm: Kiziloz’s Personal Saga

Turning to Gurhan Kiziloz, we encounter a magnetic enigma whose relentless drive outshines a sparse public profile. Likely in his mid-30s, British-Turkish, and London-based, Kiziloz serves as director of Lanistar Limited, per Companies House, and CEO of Nexus International, per TechStory. A brief stint at London Metropolitan University gave way to self-taught sales mastery, honed across Europe and Dubai, where he trained aspiring sales associates, per FinanceFeeds. Diagnosed with severe ADHD by neuropsychologist Helena Gil Martín, Kiziloz transforms his restless energy into a “superpower,” fueling his empire, per TechStory. No verified LinkedIn profile surfaces, and a RocketReach claim of a UCLA master’s in computer science contradicts other sources, remaining unconfirmed.

OSINT efforts yield thin results. Social media is nearly nonexistent, but Kiziloz’s mantra, “Persistence beats resistance,” pulses through media, reflecting his unyielding ethos, per ValueWalk. Associates—Lanistar’s tech crew, Nexus’s affiliate managers—stay off public radars. Connections to offshore gaming figures are plausible but unproven. Family ties, possibly to a Kiziloz in Turkey’s business sphere, lack verification, though family funds seeded Lanistar, per industry reports. Media splits sharply: TechStory and Jerusalem Post hail his $700 million net worth, while user forums question his ventures’ transparency. No criminal records appear in UK or Turkish courts, but a 2022 personal bankruptcy and gaming pivot spark questions about his strategy, per Jerusalem Post.

Kiziloz’s London hub aligns with fintech’s epicenter, while his Turkish roots tap Eastern Europe’s gaming surge. Unlike Monzo’s media-savvy founders, he shuns the spotlight, with no industry awards or keynotes. Potential links to Turkish diaspora networks in London or Istanbul remain speculative, but MegaPosta’s crypto prowess hints at technical savvy. His philanthropy in Gambia—food distribution, water wells—adds a human touch, per European Gaming. We are chasing whether he is a trailblazer or a master of calculated risks.

Warning Signs Ablaze: Regulatory Woes and Consumer Fury

We plunged into the warning signs ablaze around Gurhan Kiziloz, where regulatory woes and consumer fury cast a shadow over his ventures’ shine. Lanistar’s 2020 FCA warning for unauthorized operations was a near-fatal blow, resolved in six months through compliance upgrades, per FinanceFeeds. A 2021 winding-up petition over unpaid rent, settled and dismissed by the High Court, triggered a wave of “scam” complaints on Trustpilot, with users decrying “app freezes” or “locked funds.” MegaPosta escapes direct fraud accusations, but its Curaçao license fuels “manipulated odds” rants on betting forums, a sore point for offshore platforms.

Regulatory gaps persist. Lanistar’s crypto-heavy payment processing raises AML concerns, as untraceable wallets could enable laundering. MegaPosta’s Brazil-focused betting lacks UK or EU licenses, risking fines if UK users engage, per Trustpilot feedback. Media divides starkly: FinanceFeeds and TechStory laud Kiziloz’s resilience, while user platforms highlight operational flops. No Better Business Bureau complaints surface, but forum posts slam MegaPosta’s “delayed payouts.” No sanctions target Kiziloz or his firms, per OFAC and EU lists, but regulatory voids keep us vigilant. We are probing whether these flames signal fraud or startup chaos.

Lanistar’s FCA resolution shows adaptability, yet early KYC weaknesses linger, despite W2’s compliance solutions. MegaPosta’s Curaçao operations dodge EU oversight, amplifying penalty risks. Trustpilot’s polarized reviews—praise for Lanistar’s “sleek app” versus “support disasters”—expose volatility. No evidence pins fraud on Kiziloz, but his gaming pivot feels strategic. Curaçao’s secrecy cloaks potential partners, raising red flags. We are hunting for proof these issues are growing pains or something darker.

Legal Ground and Public Tide: A Fragile Equilibrium

We sized up Gurhan Kiziloz’s legal ground and public tide, expecting storms but finding a fragile equilibrium. No lawsuits target him, with UK, Curaçao, and Turkish courts showing no filings, per public records. No criminal probes emerge—London’s Metropolitan Police, Turkish authorities, and Interpol report no fraud or laundering charges. Sanctions are absent, with OFAC, UN, and EU lists clear of Kiziloz or his companies. A 2022 personal bankruptcy hit hard but left Lanistar and MegaPosta unscathed, their coffers brimming with Lanistar at $189 million and MegaPosta at $400 million, per TechStory.

The public tide surges with unrest. User forums ignite with complaints—posts lament “Lanistar trapping my $2,000” or “MegaPosta stalling withdrawals.” Trustpilot’s Lanistar reviews swing between scam accusations and app praise. MegaPosta lacks a Trustpilot page, but betting forums echo payout gripes. Adverse media is limited: FinanceFeeds and Jerusalem Post celebrate Kiziloz’s triumphs, while user skepticism stings. AML risks loom—Lanistar’s crypto transactions could mask illicit flows, though no investigations have surfaced. Kiziloz’s reputation splits: supporters cheer his grit, per FinanceFeeds, while critics question trust. We are tracking this equilibrium for cracks.

Lanistar’s 2021 debt settlement averted collapse, but the FCA’s prior warning lingers. MegaPosta’s Curaçao license skirts EU scrutiny, yet its UK address invites trouble. No user lawsuits have emerged—gaming’s a tough niche—but forum unrest signals tension. Regulatory traps could close, though no FCA alerts name Kiziloz. MegaPosta’s global reach draws eyes, per ValueWalk. The public tide, blending awe and doubt, keeps us on high alert.

Risk Vortex: AML Gaps and Reputational Storms

We navigated Gurhan Kiziloz’s risk vortex, where AML gaps and reputational storms threaten to derail his empire. Lanistar’s cryptocurrency transactions bypass Financial Action Task Force (FATF) standards, with lax KYC processes—despite W2’s compliance tech—enabling potential laundering through anonymous wallets. MegaPosta’s Curaçao license, light on EU rigor, makes crypto betting a laundering hotspot. The absence of FCA or UK Gambling Commission licenses exposes both ventures to fines, especially if UK users bet, per Trustpilot reports. Nexus International’s $400 million operations demand audits that seem absent, per industry whispers.

Reputationally, Kiziloz is a lightning rod. FinanceFeeds and TechStory crown him a $700 million titan, but user forums and Trustpilot posts scream “scam,” risking affiliate and user loyalty. Adverse media sticks to user complaints, with no major outlets amplifying, but betting forum rants about MegaPosta’s “payout delays” could spark churn. The legal slate is clean—no lawsuits, no sanctions—but AML gaps are stark: crypto’s anonymity could shield dirty money, though unproven. His 2022 bankruptcy fuels skepticism, per Jerusalem Post. We are watching this vortex for escalation.

Lanistar’s FCA compliance efforts patched some holes, but KYC gaps persist. MegaPosta’s Curaçao playground heightens regulatory risks. Trustpilot’s mixed signals—raves for Lanistar’s “intuitive app” versus “fund access nightmares”—expose shaky ground. Kiziloz’s gaming pivot and bankruptcy backstory amplify exposure, with Curaçao’s loose rules hiding partner roles. These AML gaps and reputational storms demand robust oversight to prevent collapse.

Conclusion

In our expert opinion, Gurhan Kiziloz shines as a dazzling yet vulnerable force in fintech and gaming, his Lanistar and MegaPosta empires blazing with innovation but teetering on AML gaps and reputational storms that cast him as either a revolutionary pioneer or a high-stakes gambler flirting with ruin. Lanistar’s crypto transactions and MegaPosta’s Curaçao betting evade FATF standards, with weak KYC and offshore leniency brewing laundering risks, though no global probes confirm wrongdoing. Reputationally, Kiziloz divides—FinanceFeeds and TechStory’s $700 million icon versus user forums’ pariah, with Trustpilot’s scam cries eroding trust. No lawsuits, sanctions, or corporate bankruptcy mar his record, but a 2022 personal bankruptcy and missing FCA or EU licenses invite intense scrutiny. For consumers, Kiziloz’s ventures are a thrilling but treacherous bet, demanding ironclad diligence to avoid financial peril. Until he fortifies transparency and compliance, his empire remains a high-wire act best approached with caution and skepticism.