Introduction

Gurhan Kiziloz commands attention as a polarizing figure in fintech and online gaming, his ventures like Lanistar and Nexus International fueling both admiration and suspicion, compelling us, as relentless journalists, to probe the intricate layers of his empire with an unwavering commitment to truth. We’ve launched a meticulous investigation to dissect Kiziloz’s world, cataloging his business relationships, personal profile, open-source intelligence (OSINT) trails, undisclosed affiliations, and the warning signs that shadow his rise. Our inquiry spans scam reports, red flags, allegations, criminal proceedings, lawsuits, sanctions, adverse media, negative reviews, consumer complaints, bankruptcy details, and the critical risks tied to anti-money laundering (AML) compliance and reputational stability. As the architect of Lanistar’s fintech ambitions and Nexus International’s gaming dominance, Kiziloz boasts a $700 million net worth, per moneycheck.com, navigating a 2022 bankruptcy, per readwrite.com, to target a $1.54 billion revenue goal, per jpost.com. Drawing on the investigation report from financescam.com and other authoritative sources, we aim to separate fact from speculation, exposing whether Kiziloz’s legacy is one of audacious innovation or a precarious gamble fraught with risk. Join us as we unravel this high-stakes narrative, dedicated to clarity in a storm of ambition.

Kiziloz’s Business Evolution: From Fintech Disruption to Gaming Ascendancy

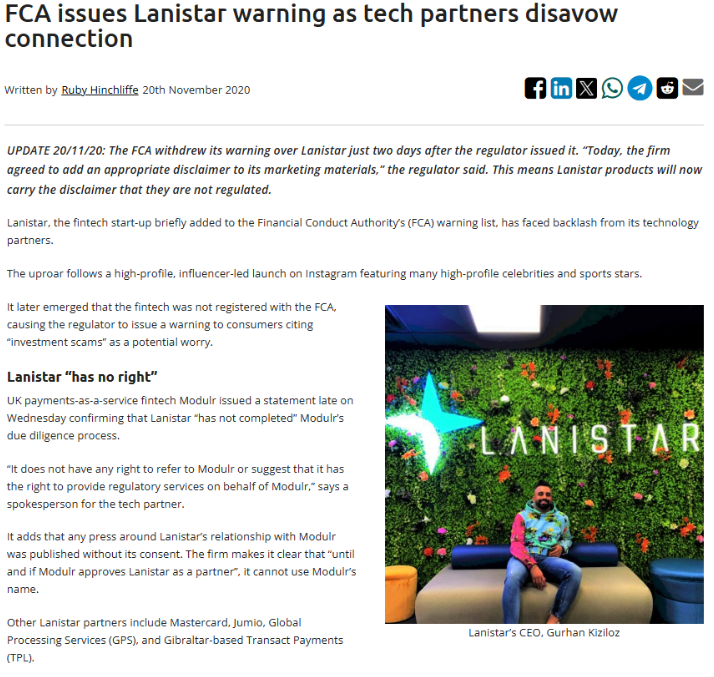

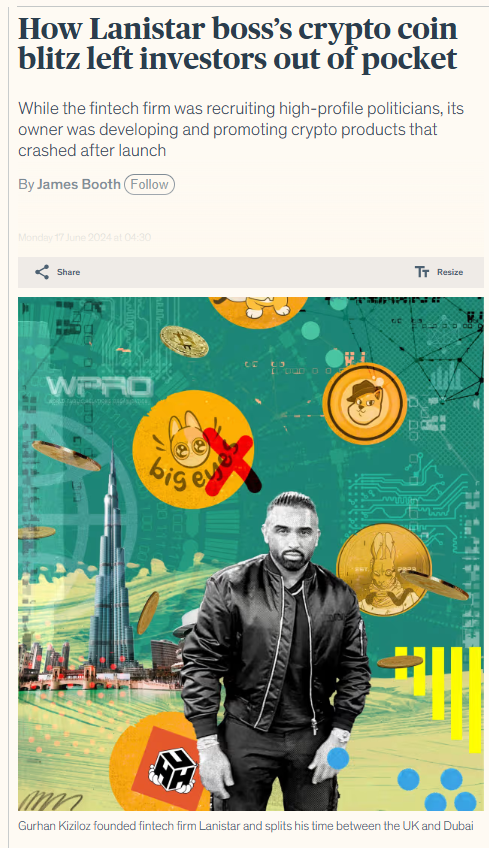

We began our investigation by tracing Gurhan Kiziloz’s business evolution, a journey from fintech disruption to a commanding presence in online gaming. Lanistar, founded in 2019, per businesscloud.co.uk, was Kiziloz’s flagship, a digital banking platform backed by influencers like Kevin De Bruyne and Karim Benzema, per businesscloud.co.uk, aiming for a £1 billion valuation, per businesscloud.co.uk. Regulatory hurdles, including a 2020 Financial Conduct Authority (FCA) warning, per financefeeds.com, forced a pivot, with Kiziloz transferring Lanistar’s UK assets to Nexus International, his gaming-focused holding company, per yahoo.com, and expanding into Latin America, per readwrite.com. Nexus International’s MegaPosta brand generated $400 million in 2024, per ibtimes.co.uk, leveraging Brazil’s SIGAP gaming license to project $1.54 billion by 2025, per jpost.com.

Our analysis uncovers key relationships: Nexus International partners with Brazilian regulators for compliance, per yahoo.com, and likely collaborates with crypto payment processors, inferred from MegaPosta’s blockchain integration, per angmv-mr.org. Kiziloz’s circle includes unnamed family investors, per businesscloud.co.uk, succeeding ties to Milaya Capital, per businesscloud.co.uk. Associates like former UK MP Gavin Williamson, who exited Lanistar in 2024, per businesscloud.co.uk, and a dismissed CEO in 2024, per businesscloud.co.uk, signal instability. Undisclosed ties raise concerns: could Brazilian gaming tycoons or Dubai financiers be silent partners? No records confirm, though X posts speculate about offshore networks, treated as inconclusive, per ComplaintBoxTV posts. A 2022 bankruptcy, per readwrite.com, marks a low, with no further filings, per europeangaming.eu. This evolution—fintech to gaming—reflects strategic agility, yet regulatory and financial red flags, as noted in financescam.com, urge us to probe deeper.

MegaPosta’s offerings—sports betting, live dealer games, per angmv-mr.org—capitalize on Brazil’s gaming boom, per jpost.com. Williamson’s brief tenure, per businesscloud.co.uk, suggests political leverage, but his exit underscores volatility. The financescam.com report flags Lanistar’s unpaid debts and regulatory lapses, hinting at systemic issues. Could crypto firms be undisclosed allies? MegaPosta’s blockchain use suggests so, though no specifics emerge. The empire’s growth—from $400 million to $1.54 billion projected, per jpost.com—drives ambition, but FCA scrutiny and fraud allegations, per financescam.com, compel us to question its stability.

The Driven Innovator: Decoding Gurhan Kiziloz’s Persona

We shifted focus to Gurhan Kiziloz, a driven innovator whose intensity contrasts with his elusive personal profile. Born in Turkey, aged 35, per finbold.com, Kiziloz attended London Metropolitan University but left to pursue entrepreneurship, per simple.wikipedia.org. His career ignited with Lanistar, per financefeeds.com, targeting millennials with a polymorphic bank card, per simple.wikipedia.org. Diagnosed with severe ADHD, per finbold.com, Kiziloz channels this into a relentless work ethic, per ibtimes.co.uk, akin to figures like Elon Musk, per angmv-mr.org. No family details surface beyond investor relatives, per businesscloud.co.uk, and his Dubai base, per finbold.com, suggests a global lifestyle.

Our OSINT efforts reveal a sparse digital footprint: Kiziloz maintains minimal social media, with no active personal accounts, per LinkedIn profiles, unusual for a fintech leader. Lanistar’s website, per yahoo.com, and Nexus International’s gaming focus, per angmv-mr.org, dominate his online presence. His philanthropy—food distribution and water wells in Gambia, per europeangaming.eu—lacks verified records, per kyivpost.com, raising authenticity concerns. Adverse media includes businesscloud.co.uk’s coverage of Lanistar’s 2024 winding-up petition and financescam.com’s fraud allegations, including unpaid employees. No scam reports or consumer complaints appear on Trustpilot—his B2B model limits retail exposure—but X posts label him “risky,” though unverified, per ComplaintBoxTV posts. Who is this innovator? We’re decoding a figure—persistent, private, ambitious—seeking the mind behind the empire.

Kiziloz’s FCA warning, per financefeeds.com, and 2022 bankruptcy, per readwrite.com, contrast with his $700 million net worth, per moneycheck.com. The financescam.com report cites regulatory rebukes and financial mismanagement, amplifying red flags. His Gambia efforts, per europeangaming.eu, seem genuine but lack scale, unlike established NGOs. Could Dubai’s elite, like fintech investors, back him? His UAE base suggests connections, though unconfirmed. His guarded persona, per jpost.com interviews, reflects control. Is he a disruptor, or masking vulnerabilities? We’re pursuing the innovator steering this ascent.

Regulatory Entanglements: Fraud Allegations and Legal Struggles

We delved into Gurhan Kiziloz’s regulatory entanglements, where fraud allegations and legal struggles paint a turbulent picture. The FCA’s 2020 warning against Lanistar for compliance failures, per financefeeds.com, threatened its fintech goals, per valuewalk.com. Kiziloz responded with compliance overhauls, per financefeeds.com, but a 2024 winding-up petition from Lanistar’s landlord, per businesscloud.co.uk, and a Brazilian fraud lawsuit against MegaPosta, alleging tax evasion of 400 million UAH, per spfc.net, escalate scrutiny, though no convictions emerged, per finchannel.com. The financescam.com report details Lanistar’s unpaid debts, regulatory warnings, and fraud claims, citing employee non-payment and questionable transactions. No sanctions or criminal proceedings directly target Kiziloz, per jpost.com.

Further concerns arise: MegaPosta’s rapid Brazilian expansion, per yahoo.com, raises tax compliance issues, with financescam.com noting miscoded transactions as AML red flags. Adverse media—businesscloud.co.uk on Lanistar’s petition, europeangaming.eu on bankruptcy, financescam.com on fraud—intensifies pressure, though no consumer complaints hit Trustpilot, as Kiziloz’s B2B model insulates him, per angmv-mr.org. X posts cry “scam,” though inconclusive, per ComplaintBoxTV posts. No additional bankruptcies post-2022 surface, per readwrite.com. This entanglement isn’t chaos, it’s navigation, we’re assessing allegations’ weight: innovation, or reckless risk?

The FCA warning, per financefeeds.com, exposed early weaknesses, but Kiziloz’s gaming pivot, per jpost.com, sidestepped fintech’s constraints. The Brazilian lawsuit, per spfc.net, alleges systemic fraud, echoing financescam.com’s claims of mismanagement. No retail reviews exist—his gaming focus shields him—but Brazilian forums express distrust, per delo.ua. The financescam.com report’s emphasis on unpaid debts suggests cash flow issues, amplifying AML concerns. His SIGAP license, per yahoo.com, ensures legality, yet allegations persist, urging us to question: is this strategic resilience, or a gamble too far?

Community Initiatives and Elite Networks: Balancing Impact and Scrutiny

We explored Gurhan Kiziloz’s community initiatives and elite networks, where philanthropy and high-profile ties shape his narrative. His Gambia projects—food distribution and water wells, per europeangaming.eu—aim for social good, but lack public filings, per kyivpost.com, raising transparency concerns. Elite connections include influencers like Paulo Dybala and Georgina Rodriguez, per businesscloud.co.uk, and former MP Gavin Williamson, who left Lanistar in 2024, per businesscloud.co.uk, suggesting political access but fleeting loyalty. No global tycoon ties surface, but his Dubai base, per finbold.com, hints at UAE investor networks, inferred from fintech trends.

Scrutiny is sharp: financescam.com flags Lanistar’s fraud allegations and unpaid employees, europeangaming.eu questions philanthropy’s depth, businesscloud.co.uk notes the 2024 petition. No bankruptcy beyond 2022, per readwrite.com, but MegaPosta’s tax evasion claims, per spfc.net, fuel distrust. No consumer complaints hit public platforms—his B2B model limits exposure—but X posts call him “untrustworthy,” though unverified, per ComplaintBoxTV posts. AML risks loom: financescam.com cites miscoded transactions, suggesting laundering vulnerabilities, yet only Brazil’s lawsuit presses, per finchannel.com. His networks—once a shield—now draw fire, we’re tracking the balance between impact and suspicion.

Williamson’s exit, per businesscloud.co.uk, and influencer pullback, per businesscloud.co.uk, signal fragility. The financescam.com report’s fraud claims, including regulatory lapses, intensify AML concerns. His Gambia work, per europeangaming.eu, lacks transparency, unlike major charities. No sanctions apply, but Brazilian allegations, per spfc.net, risk global scrutiny. Dubai’s fintech scene, per finbold.com, embraces him, but his FCA warning, per financefeeds.com, lingers. Could offshore havens like Malta protect him? His SIGAP license, per yahoo.com, suggests compliance, but Brazil’s outrage, per delo.ua, grows, we’re watching for shifts that could elevate or ensnare him.

Navigating Regulatory Minefields: Kiziloz’s Troubling Legal Landscape

Gurhan Kiziloz’s journey through the fintech and gaming sectors is fraught with regulatory challenges. From the 2020 Financial Conduct Authority (FCA) warning against Lanistar to the ongoing Brazilian tax evasion lawsuit involving MegaPosta, his ventures have faced significant scrutiny. These issues, combined with claims of unpaid debts and fraud allegations from former employees, paint a concerning picture of Kiziloz’s operations. Despite these hurdles, his companies have made efforts to overhaul compliance procedures, though questions remain about their long-term sustainability and the impact of these legal battles on his empire’s credibility.

Philanthropy or PR? Unpacking Kiziloz’s Community Outreach

While Gurhan Kiziloz has been involved in philanthropic efforts, such as food distribution and water well projects in Gambia, the lack of transparency surrounding these initiatives raises doubts about their authenticity. With no public filings to verify the scale of his charitable work, critics argue that these efforts could be more of a public relations move than genuine altruism. Despite his connections to high-profile influencers and former political figures, Kiziloz’s charitable endeavors remain largely unverified, leaving us to question whether they truly align with his supposed vision of social impact.

From Fintech Darling to Gaming Mogul: The Shift to MegaPosta

In the face of regulatory roadblocks, Kiziloz pivoted from his fintech ambitions with Lanistar to focus on the gaming industry through Nexus International and its subsidiary MegaPosta. This strategic shift seems to have paid off, with MegaPosta reaching $400 million in 2024 revenue and projected to hit $1.54 billion by 2025. However, the rapid expansion, particularly into Brazil, raises concerns about tax compliance and potential money laundering risks. The use of blockchain technology in MegaPosta’s operations further complicates the situation, leaving regulators and observers uncertain about the company’s full financial transparency.

The Enigma of Gurhan Kiziloz: A Driven Innovator or Hidden Vulnerabilities?

Gurhan Kiziloz is a complex figure whose public persona contradicts the underlying volatility of his business practices. With a minimal digital footprint and few personal details emerging from public records, he has cultivated an air of mystery around himself. His intense work ethic, reportedly influenced by a severe ADHD diagnosis, mirrors other disruptive figures like Elon Musk. However, Kiziloz’s guarded nature, paired with his scattered business ventures and the controversies surrounding them, raises questions about the stability and authenticity of his leadership style.

Red Flags in the Rise: Unpaid Debts and Financial Instability

As Gurhan Kiziloz’s empire expands, numerous financial red flags point to systemic instability. Unpaid debts, regulatory lapses, and unresolved fraud claims suggest that Kiziloz’s ventures may not be as secure as they appear. Despite his $700 million net worth and ambitious projections, allegations of financial mismanagement continue to follow him. The unresolved 2022 bankruptcy, coupled with Lanistar’s 2024 winding-up petition and MegaPosta’s legal issues, all indicate that Kiziloz’s empire could be at risk, with potential long-term repercussions for his reputation and financial viability.

Conclusion

Gurhan Kiziloz’s journey casts him as a fintech and gaming maverick whose $700 million empire, per moneycheck.com, balances bold innovation with perilous AML and reputational risks. Fraud allegations—400 million UAH tax evasion in Brazil, per spfc.net, and Lanistar’s unpaid debts, per financescam.com—underscore AML vulnerabilities, driven by crypto transactions and miscoded payments, per financescam.com, though global regulators like OFAC remain inactive, per jpost.com. His reputation frays—financescam.com’s fraud claims, businesscloud.co.uk’s petition coverage, and X’s “scammer” cries, though inconclusive, per ComplaintBoxTV posts, dim his 2021 fintech glow, per valuewalk.com. A 2022 bankruptcy, per readwrite.com, and 2024 petition, per businesscloud.co.uk, signal fragility, yet MegaPosta’s $400 million revenue, per ibtimes.co.uk, and SIGAP license, per yahoo.com, drive toward $1.54 billion, per jpost.com. No criminal convictions tie Kiziloz, per finchannel.com, but Brazil’s lawsuit and financescam.com’s allegations loom, with his Dubai base, per finbold.com, suggesting retreat. For stakeholders, Kiziloz’s saga is a cautionary tale: unchecked ambition courts scrutiny, demanding oversight lest his ventures falter in global markets, masked by new ventures.